Power Nickel (TSXV: PNPN; US-OTC: PNPNF) increased its ownership of the Nisk project in Canada’s Quebec province to 80% from Critical Elements Lithium (CRE: TSXV) and reported new drill results from a polymetallic zone.

The filing of a resource estimate in November qualified Power Nickel for 30% more in the project to conclude the earn-in agreement, the company said on Wednesday. New assays from the Lion zone have buoyed the project with strong copper, platinum and palladium mineralization, CEO Terry Lynch said in a release.

Shares in Power Nickel have soared nearly 60% since it reported the first Lion drill results on April 15. They were up 4% on Wednesday to C41¢ apiece, valuing the company at C$65.6 million ($47.8m).

“We have a real sentiment of having found a large prolific area hosting different styles of multi-elements mineralization, each being a smaller part of a much larger system,” Lynch said. “We look forward to ramping up our efforts throughout ’24 and ’25 as we seek to bring these targets to a production decision.”

Drill hole PN-24-047 cut 14.4 metres grading of 0.59 gram gold per tonne, 69.14 grams silver, 8.17% copper, 6.25 grams palladium, 8.44 grams platinum and 0.58% nickel, the company said.

The hole included 4.7 metres at 0.85 gram gold, 91 grams silver, 11.66% copper, 8.42 grams palladium, 6.69 grams platinum, and 0.46% nickel; and 3 metres at 0.95 gram gold, 167.46 grams silver, 17.33% copper, 13.04 grams palladium, 29.24 grams platinum and 1.77% nickel.

Carbon neutral

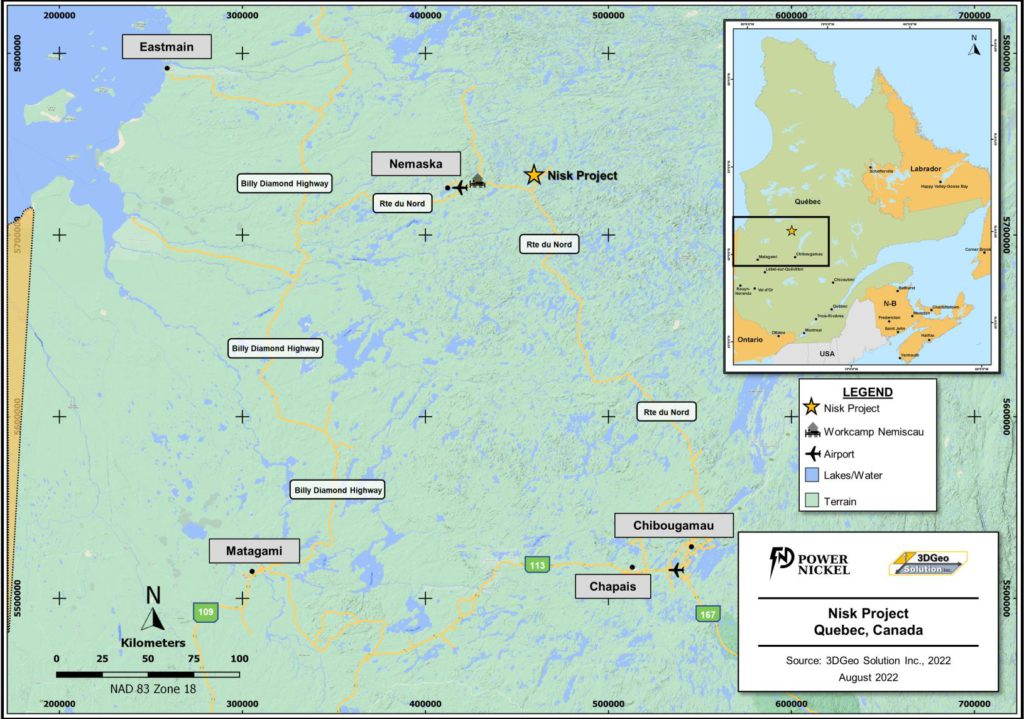

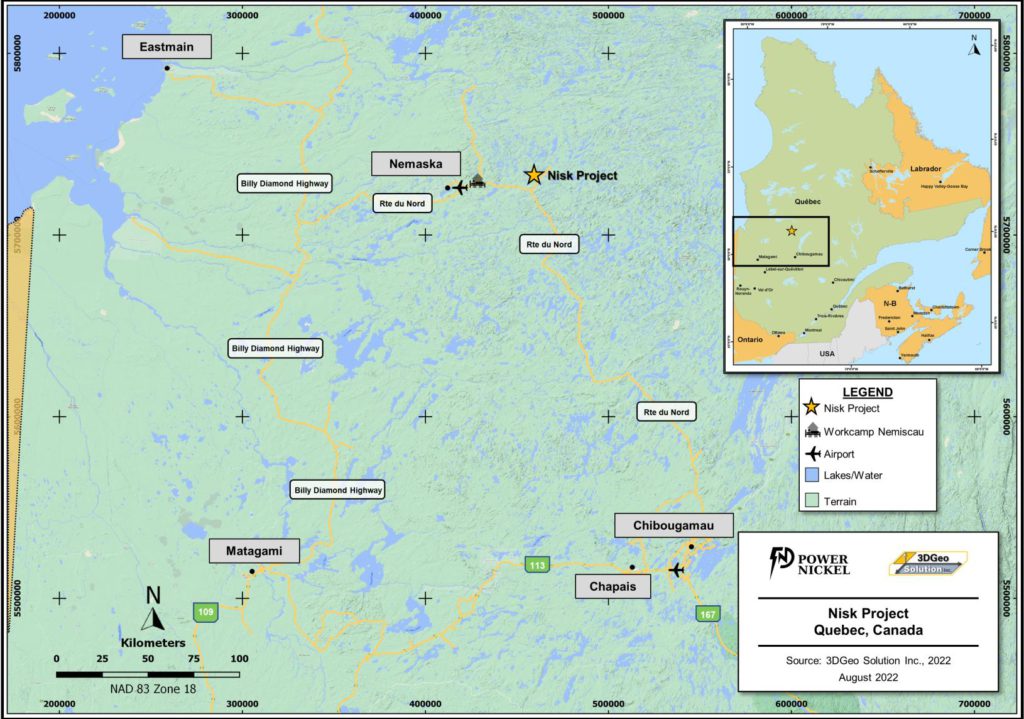

Power Nickel entered the project in 2021. It plans to develop Nisk, in Quebec’s James Bay region, as Canada’s first carbon neutral nickel mine by using carbon capture and hydroelectric power. Provincial and federal tax breaks cover half of exploration costs as the company works towards a feasibility study in this year’s third quarter.

Lynch is in negotiations to sell a 10% stake of the company for a 10% offtake from Nisk. A deal is planned by the end of June. Major shareholders include the Lynch family with 20%, Critical Elements at 10%, and the Stern family at 10%.

Inco, now a part of Vale (NYSE: VALE), discovered nickel on the site in 1962. Golden Goose Resources produced a historical resource for Nisk in 2008 of 2 million measured and indicated tonnes and 783,000 inferred tonnes. Critical Elements Lithium bought the site in 2014, but little work was done.

Nisk holds 4.9 million indicated tonnes underground grading 0.78% nickel, 0.05% cobalt, 0.42% copper, 0.78 gram palladium per tonne for 38,300 tonnes nickel, 2,400 tonnes cobalt, 20,500 tonnes copper and 123,100 tonnes palladium, according to Power Nickel’s filing.

Open pit resources total 519,000 indicated tonnes at 0.63% nickel, 0.04% cobalt, 0.3% copper and 0.56 gram palladium for 3,300 tonnes nickel, 200 tonnes cobalt, 1,600 tonnes copper and 9,400 tonnes palladium, the filing shows.

‘Spectacular hole’

Also reported on Wednesday, Lion drill hole PN-24-051 returned 11.4 metres grading 0.24 gram gold, 13.95 grams silver, 2.51% copper, 3.2 grams palladium, 19.59 grams platinum and 0.18% nickel. It included 2.6 metres at 0.4 gram gold, 41.18 grams silver, 8.09% copper, 8.37 grams palladium, 84.75 grams platinum and 0.54% nickel; and 4.9 metres at 0.23 gram gold, 7.53 grams silver, 1.32% copper, 2.47 grams palladium, 0.53 gram platinum and 0.12% nickel.

“Many of these results were checked twice as they were well over normal detection limits,” Lynch said. “Hole 51 doesn’t look that thick but as the assays showed, it was a spectacular hole.”

The company has partnered with Australia-based Fleet Space Technologies to use ambient noise tomography to explore for nickel. The technology uses satellites and hand-held devices to capture background vibrations and develop 3-D images of the subsurface down to 2 km in depth.

Fleet claims the process is 10 times more sensitive than nodal geophones, instruments that measure underground vibrations.