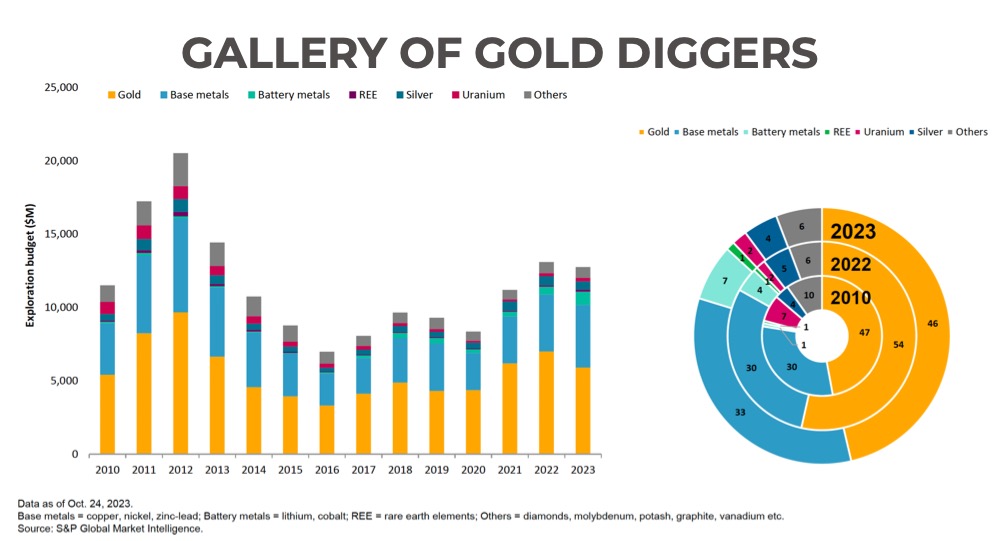

New study shows a $1.1 billion drop in gold exploration budgets this year as juniors struggle to raise capital, but the precious metal still accounts for 46% of the total.

According to a new study by S&P Global Market Intelligence, overall mining exploration budgets fell this year for the first time since 2020, dropping 3% to $12.8 billion at the 2,235 companies that allocated funds to find or expand deposits.

Gold budgets, which historically have been driven more by the junior mining sector than any other metal or mineral, dropped by 16% or $1.1 billion year-on-year to just under $6 billion, representing 46% of the global total.

That’s down from 54% in 2022 amid higher spending on lithium, nickel and other battery metals, a surge in spending on uranium and rare earths and an uptick for copper.

But the dominant role gold plays in exploration – and therefore the industry’s future remains clear from the fact that the combined money flowing into green energy transition metals (or future facing commodities as some majors like to label them) was not enough to offset the decline in gold.

Gold exploration budgets, like most mined commodities, peaked in 2012 when the precious metal accounted for nearly half the more than $20 billion spent.

Gold juniors represent 38% of the allocation to exploration this year and reduced spending by the sector was responsible for the bulk of the overall reduction in budgets.

It also follows the years-long trend in the gold sector identified by S&P Global where exploration has shifted to minesites and away from grassroots exploration.

The top region for gold exploration thanks in no small part to its vibrant junior sector, Canada, saw a roughly $400 million drop in budgets. Only in Asia Pacific did allocated resources increase compared to 2022 although not by much and from a low base.

Junior jaundice

The pullback among gold explorers represents a significant drop compared to last year when the sector spent more than the majors searching for the precious metal.

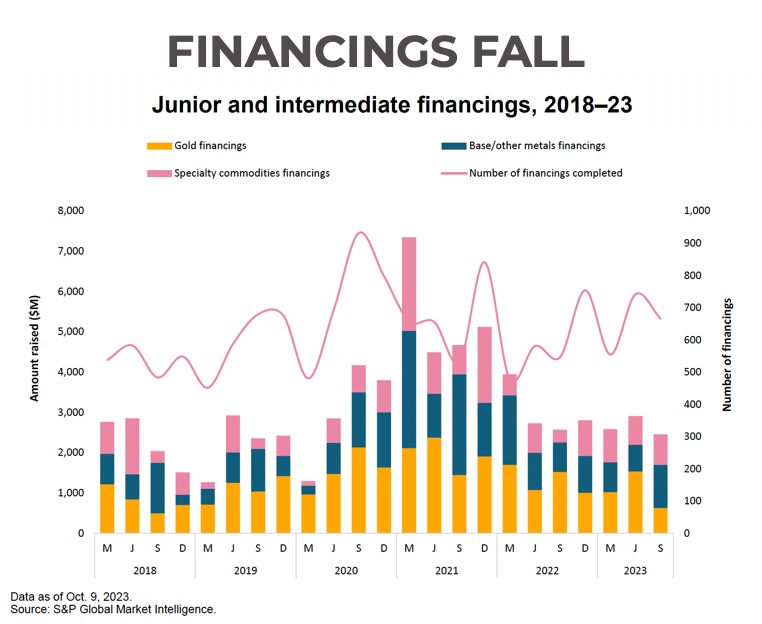

It is an indication of the difficulty junior exploration companies have had over the last year or so of tapping markets for new funding.

On a quarterly basis, gold financing for junior and mid-size mining companies was the lowest in Q3 since the September quarter of 2018.

Overall financing, excluding majors at $8 billion year-to-date was the lowest since 2019 and less than half raised over the same period last year.

Like with exploration budgets, the overall decline in financings came despite mining companies involved in specialty commodities managing to raise 46% more in the year to end-September than the same period last year.

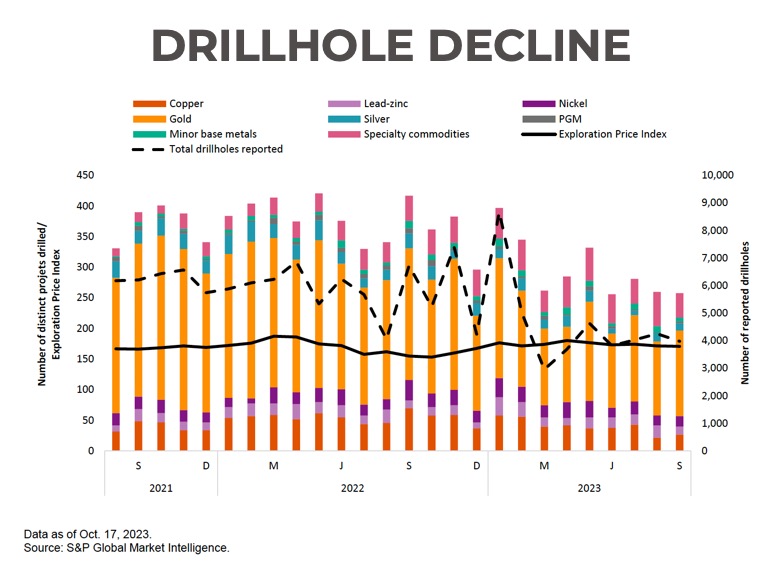

Overall the 41,086 holes drilled around the world from January to mid-Oct 2023 in search of non-ferrous metals and minerals represent a 23% decline compared to last year.

Gold drilling is down by 36% over the same period. With the gold price back in touch with $2,000 an on geopolitical safe have demand and the weakness across base and battery metals, it’s not inconceivable that gold’s share of exploration budgets top 50% again soon.

Basic base metals

Base metal budgets increased to 33% of the total, led by a $327 million increase in spending on copper, the metal at the centre of the energy transition, and a significant $117 million jump in outlays to find or expand nickel deposits.

The bulk of nickel exploration funds are directed at Canada where budgets for the stainless steel alloy and battery metal are now approaching $300 million.

“You’d have to go back to 2006/2007 to find a year in which the collective base metals attracted more money for exploration than gold,” says Kevin Murphy, research director metals and mining S&P Global Commodity Insights.

Copper in 2023 represents less than a quarter of mining exploration spending despite a double digit gain from 2022 to $3.12 billion, mostly by major miners and not juniors.

Murphy says copper exploration lagged behind other metals when it came to the shift of exploration to minesites, but this year despite growing budgets overall grassroots exploration for copper declined compared to 2022.

Nickel exploration budgets are also being spent on minesites with more than half of the $732 million budgeted this year aimed at replenishing reserves and extending mine lives. Majors carry out 54% of global nickel exploration, a rising share.

Lithium is the new old gold

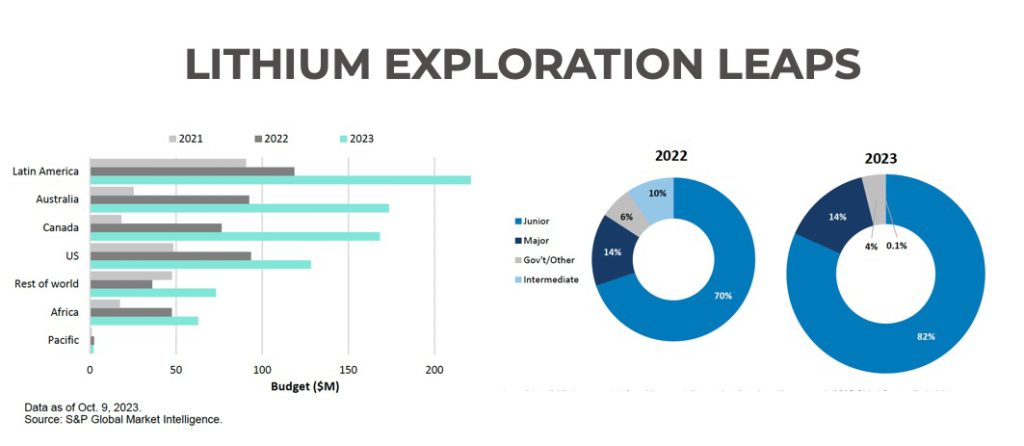

Lithium exploration budgets almost doubled this year after doing the same in 2022. In total $830 million was allocated to finding and expanding lithium resources in 2023, the third most explored non-ferrous commodity.

“Lithium is a young commodity for both exploration and development and it reflects this in a lot of different ways,” says Murphy.

The sector is entirely dominated by juniors at the moment with 82% of the exploration work carried out by smaller companies. “Whenever there’s a lot of interest in a commodity, the juniors tend to follow suit.”

The undeveloped nature of the lithium mining industry also shows up in the stages of development with grassroots, late stage exploration and feasibility making up the vast majority of field work being carried out.

A not insignificant portion of exploration for lithium is being carried out by governments which at 4% works out to more than $30 million from public coffers.

Large budget increases were seen all over the world led by Latin America and specifically Argentina, which hosts the largest undeveloped resources of the battery metal.

Australia produces half the world’s lithium currently and it’s the second most funded region for exploration followed by Canada, where budgets have doubled year on year to in excess of $160 million.

Exploration in the US also jumped substantially – the country is home to the second largest undeveloped resource of lithium globally.

Murphy expects lithium budgets to grow “although it’s tough to say just how much, simply because a lot of this is going towards late stage and feasibility work”:

“And of course, once a feasibility study gets completed, that’s a very large expenditure that falls away. There is the potential that we could see a small dip in lithium in the coming years.”

Also impacting future funding of lithium exploration is a precipitous and unrelenting slide in prices for the metal, now around $20,000 a tonne, from a peak north of $80,000 in November last year.

Uranium upsurge, REE ramp up

S&P Global now tracks 121 active projects grouped under what it calls specialty commodities and includes lithium, cobalt, graphite, rare earth, uranium and others, a near six-fold increase from two years ago.

Platinum group metals and diamond exploration has been on a downtrend for about two decades, according to the research company and until recently that was also true for uranium.

However a rebound in spot prices for the nuclear fuel – now trading at its highest in more than a decade after scaling $70 a pound last month – saw a more than $35 million bump in exploration budgets in 2023.

There’s growing realisation, even among environmental groups, that the move away from fossil fuels is too heavy a lift for unreliable wind and solar energy alone.

Rare earths, also expected to play an important part in the green energy transition due to extensive use in electric motors and wind turbines, received a massive bump in funding for exploration in 2023 given the industry’s overall size – just shy of $50 million more than last year.