Local markets are doin’ their thang this morning, footloose and fancy free because yesterday, Wall Street was closed for Presidents’ Day – which means we don’t have any adults around to tell us what to do.

That has, evidently, led to some confusion for the ASX, which can’t decide between sinking or floating today, so as we roll into lunch, things are pretty much at break-even.

The ASX 200 benchmark is flattish at -0.07%, on the wrong side of things because of an early 31 point -0.4% slide, but it’s getting better. Slowly.

I’ll get into the details there shortly, but first, some big news from the World of Sneakers and massively overpaid sporting professionals, after Nike became the latest in a shockingly long list of profitable companies to slash its workforce because they’re just not profitable enough.

News of the lay-ups – sorry, lay offs – actually landed a few days ago, but I’ve only just noticed the bewildering efforts by Nike CEO John Donahoe to stick his finger in every dyke he can find, in an effort to make the sackings look like anything other than what they really are.

Speaking at the announcement that the shoe manufacturer to the stars is cutting 1,500 jobs from its payroll, Donahoe uttered the following statement, completely without a shred of irony, about the company’s recent performance.

“We are not currently performing at our best, and I ultimately hold myself and my leadership team accountable,” Donahoe said.

I will very happily bet a pair of Donald Trump’s pathetically awful high-tops that neither he, nor any of his leadership team, are on the list of people losing their jobs.

Which means that Donahoe’s take on “holding himself accountable” is by sacking a bunch of faceless drones, and clearing a chunk of change from the wrong side of the company balance sheet, to prop up the bottom line for next time Nike has to submit a spreadsheet to keep Wall Street in the loop.

Here’s the rub.

In the quarter to November 2023, Nike dropped US$1.198 billion on stock buybacks.

In FY23, Donahoe’s personal remuneration ran to a total of US$32,789,885 – the base salary was a meagre US$1.5 million, the rest of it was stock awards (US$13,220,455), option awards (US$7,247,371) and Non-Equity Incentive Plan Compensation ($6,770,000), with another wearingly non-specific “other compensation” running at a cool US$4,052,059.

That was, according to The American Federation of Labor and Congress of Industrial Organizations, only 975 times as much as the median Nike worker’s salary for that year.

Now, don’t get me wrong – I’m all for people making money when they can, there’s nothing wrong with investing wisely and working hard and earning a fair pay packet and all that other stuff.

But, really… there’s a guy in charge making nearly 1,000 times what the average worker makes at the company, calling the shots when it’s transparently obvious that a huge chunk of his pay packet is undoubtedly linked to the company’s base performance, and its stock price.

And he spent $1.2 billion in three months buying back stock to juice the price up, and covered his arse – sorry, “held himself and his leadership team fully accountable” by sacking 1,500 people to get the headcount down.

Donahoe also said that slashing the headcount would “reignite our growth” – and I reckon he’d be right, because that’s precisely the sort of talk that ends with large, unruly torch-wielding mobs at the castle gates.

There’s a lesson in there somewhere… not sure where, but that could be the reason why a certain former US President is suddenly getting into the sneaker racket as well.

I’ll leave this here… my grumpy old lefty roots are showing.

TO MARKETS

The ASX is chugging along this morning, whistling a modestly engaging tune and flirting ominously with the idea of going higher than 0.00%.

At the time of writing this, the needle’s on -0.09%, and if you don’t believe me, here’s a photo I took of it just now.

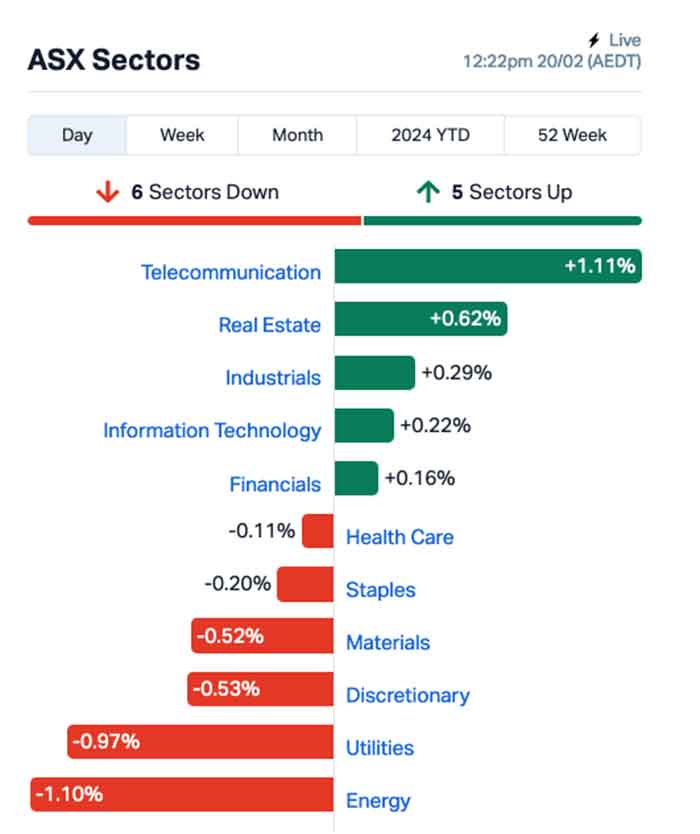

Looking at the sectors, it’s the Telcos out in front of the barricades on +1.11%, a move that I bet nobody saw coming this morning.

That’s mostly down to big players like Seek, REA Group and CAR Group pushing through 1.5-2.0% gains this morning, all of which is happening without the benefit of them announcing anything to the market.

The Resources mob are busily handing back a lot of yesterday’s gains, with Energy and Utilities leading the race to the bottom.

A chunk of that action is coming via BHP (ASX:BHP), which dropped a bombshell this morning that seems to have rattled the windows quite a bit.

The Big Australian told the market this morning that its profits had slumped – and by slumped, I think they meant “have been poleaxed into a vegetative state”.

BHP says that its half-year profit dropped 86% to $1.4 billion despite its revenue rising 6% to $41.6 billion – but, most of that drop is due to “adjustments relating to Nickel West, West Musgrave and Samarco offsetting an otherwise solid operational performance and overall healthy commodity prices”.

Elsewhere, Suncorp Group (ASX:SUN) shares are up, and Australia and New Zealand Banking Group (ASX:ANZ) shares are down, on news that the Federal Court has given its green light to the $4.9 billion takeover of the former’s banking division by the latter.

It’s still not a done deal, though – the ACCC has noted the court’s decision, but hasn’t (as yet) indicated if it will appeal, plus the federal treasurer has to okay it as well.

NOT THE ASX

Wall Street had a holiday yesterday, so there’s nowt to report on from there. But luckily for us, Earlybird Eddy had a squiz at a bit of Euro action, and brought us news that Europe’s benchmark stock index, the STOXX 600, hit a two-year high, led by healthcare stocks.

That’s on the heels of that index notching its fourth consecutive weekly gain on Friday.

Britain, however, remains in recession. lol.

London-listed AstraZeneca rose by +3% after the pharma company said its Tagrisso drug shows ‘highly impactful’ results in a lung cancer trial, while the Paris-listed Forvia, the world’s seventh-largest automotive supplier, slumped by -13% after announcing that it will cut 10,000 jobs to better compete in the EV transition.

Commodity prices meanwhile were mostly lower overnight on concerns about China’s outlook – which is getting grimmer by the minute, thanks to that country’s property market tanking.

Overnight, iron ore shed -3%, copper dropped -1%, and crude prices eased by -0.5% as markets zeroed in on just how bad things in China have become.

For what it’s worth, markets there are singing roughly the same tune. Shanghai markets are down 0.56%, while both the Hang Seng and Japan’s Nikkei are following the ASX’s lead and hovering near zero for the morning so far.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 20 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| W2V | Way2Vatltd | 0.031 | 55% | 47,281,376 | $13,032,169 |

| AVW | Avira Resources Ltd | 0.0015 | 50% | 150,285 | $2,133,790 |

| PKD | Parkd Ltd | 0.029 | 38% | 283,084 | $2,184,292 |

| 1MC | Morella Corporation | 0.004 | 33% | 4,131,601 | $18,536,398 |

| BP8 | BPH Global Ltd | 0.002 | 33% | 167,999 | $2,931,174 |

| EXL | Elixinol Wellness | 0.008 | 33% | 1,098,087 | $3,797,230 |

| AHK | Ark Mines Limited | 0.2 | 33% | 105,902 | $8,316,962 |

| BVS | Bravura Solution Ltd | 1.2275 | 28% | 3,728,961 | $430,419,842 |

| PL3 | Patagonia Lithium | 0.165 | 27% | 103,149 | $6,386,705 |

| TOY | Toys R Us | 0.0125 | 25% | 18,535,628 | $9,824,635 |

| FFG | Fatfish Group | 0.03 | 20% | 9,161,227 | $34,755,992 |

| CHK | Cohiba Minerals | 0.003 | 20% | 10,822,357 | $6,325,575 |

| WCN | White Cliff Minerals | 0.0165 | 18% | 4,389,885 | $18,702,031 |

| BFC | Beston Global Ltd | 0.007 | 17% | 3,654,391 | $11,982,281 |

| EVR | Ev Resources Ltd | 0.014 | 17% | 986,364 | $13,855,060 |

| HLX | Helix Resources | 0.0035 | 17% | 12,504,607 | $6,969,438 |

| NET | Netlinkz Limited | 0.0035 | 17% | 289,500 | $11,635,345 |

| NRZ | Neurizer Ltd | 0.007 | 17% | 350,311 | $8,483,465 |

| ZEO | Zeotech Limited | 0.029 | 16% | 350,088 | $43,335,577 |

| EVZ | EVZ Limited | 0.22 | 16% | 45,900 | $23,007,464 |

| 1CG | One Click Group Ltd | 0.008 | 14% | 336,965 | $4,817,252 |

| ALY | Alchemy Resource Ltd | 0.008 | 14% | 100,000 | $8,246,534 |

| OSL | Oncosil Medical | 0.008 | 14% | 154,000 | $13,821,788 |

| BRX | Belararox | 0.29 | 14% | 44,052 | $18,090,725 |

| MMS | McMillan Shakespeare | 19.75 | 13% | 462,327 | $1,215,270,769 |

Out in front on Tuesday morning was Way2VAT (ASX:W2V), stretching its two-day run into a third consecutive winner, up 55% before lunch on Friday’s news that it has launched a new AI-driven automatic auditing system.

Parkd (ASX:PKD) has been given the go-ahead to proceed with Stage 2 of the design and construction contract with John Hughes Automotive Group, for construction of a multi-level car storage facility to support its VW service centre in Victoria Park, Perth.

The project value of Stage 2 works is $4.3 million “under terms and conditions that are industry standard for a contract of this nature”, with contract claims due to kick off in March of this year.

Elixinol Wellness (ASX:EXL) was rising on news that it’s set to sell its non-core investment – a minority stake in Altmed Pets – to Altmed Pets, for US$1.5 million in cash… $100,000 up front, the rest later.

Bravura Solutions (ASX:BVS) was trading higher on happy 1HFY24 results including a gross revenue bump of 7.4% to $124 million, putting the company on an EBITDA of $7.9 million, which is $11.5 million better than the previous year.

Toys R Us (ASX:TOY) was up on news that the company has completed a private placement of 84,615,385 new fully paid ordinary shares in the Company at an offer price of $0.0065 raising $550,000 (roughly three Lego sets and a Summer Sun House Barbie doll) before costs.

And Cohiba Minerals (ASX:CHK) was also up on news of a placement, announcing that the company has raised $850,000 from professional and sophisticated investors, which will see the company issue 708,333,333 fully paid ordinary shares at $0.0012 a pop.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 20 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.001 | -50% | 357,981 | $3,267,458 |

| TKL | Traka Resources | 0.0015 | -25% | 250,000 | $3,501,317 |

| SGR | The Star Entertainment Group | 0.4425 | -21% | 74,350,511 | $1,606,461,291 |

| HUM | Humm Group Limited | 0.55 | -21% | 3,394,703 | $353,184,666 |

| CNJ | Conico Ltd | 0.002 | -20% | 400,000 | $3,925,237 |

| PRX | Prodigy Gold NL | 0.004 | -20% | 286,102 | $8,755,539 |

| PUA | Peak Minerals Ltd | 0.002 | -20% | 413,156 | $2,603,442 |

| PUR | Pursuit Minerals | 0.004 | -20% | 150,188 | $14,719,857 |

| ROG | Red Sky Energy | 0.004 | -20% | 305,000 | $27,111,136 |

| VML | Vital Metals Limited | 0.004 | -20% | 852 | $29,475,335 |

| FTC | Fintech Chain Ltd | 0.015 | -17% | 48,964 | $11,713,853 |

| ADD | Adavale Resource Ltd | 0.005 | -17% | 78,500 | $6,067,033 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 3,915 | $17,185,862 |

| LNR | Lanthanein Resources | 0.005 | -17% | 133,340 | $7,738,871 |

| LRL | Labyrinth Resources | 0.005 | -17% | 226,200 | $7,125,262 |

| TX3 | Trinex Minerals Ltd | 0.005 | -17% | 324,784 | $8,922,148 |

| YOJ | Yojee Limited | 0.042 | -16% | 4,668 | $8,485,231 |

| VN8 | Vonex Limited. | 0.017 | -15% | 11,346 | $7,236,572 |

| KNB | Koonenberry Gold | 0.03 | -14% | 259,239 | $4,191,218 |

| LML | Lincoln Minerals | 0.006 | -14% | 3,711,657 | $11,928,317 |

| LDR | Lode Resources | 0.069 | -14% | 526,673 | $8,542,732 |

| NC6 | Nanollose Limited | 0.026 | -13% | 10,000 | $5,160,191 |

| ODY | Odyssey Gold Ltd | 0.02 | -13% | 556,500 | $20,674,036 |

| POS | Poseidon Nick Ltd | 0.007 | -13% | 2,738,087 | $29,708,278 |

ICYMI – AM Edition

White Cliff Minerals (ASX:WCN) has announced the appointment of Troy Whittaker as executive director of the company, bringing with him over 20 years of commercial, feasibility and construction experience, having held senior positions with major international mining companies such as Fortescue Metals Group & Anglo-American UK.

The post ASX Small Caps News Wrap: Who’s taking full responsibility by firing 1500 people this week? appeared first on Stockhead.