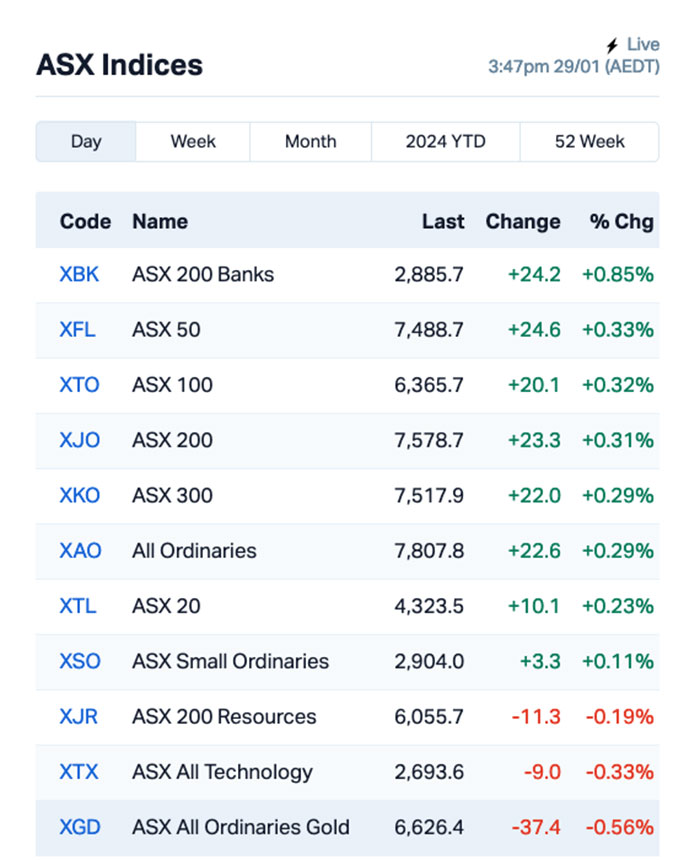

- ASX 200 ends the day up 0.30pc and that’s six on the trot for the benchmark.

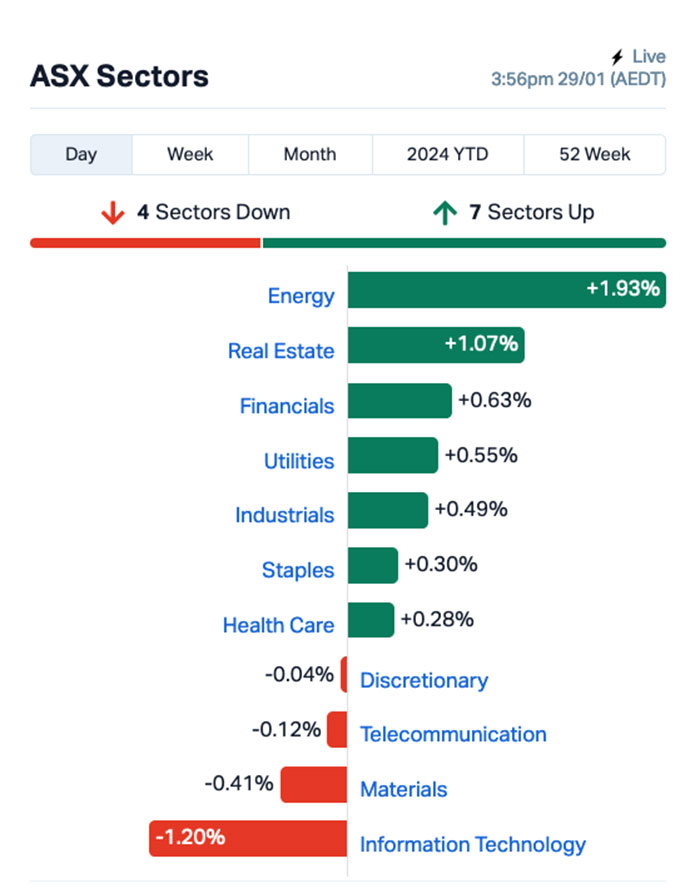

- Energy was the day’s big winner, while the InfoTech sector took a mild pummeling.

- Avira Resources took line honours, with Mako and Sacgasco in hot pursuit.

While it wasn’t exactly a bonanza or extravaganza or any other kind of -anza, really, the ASX 200 did manage to eke out a win on a day that looked like it was set to to turn bad, early on.

Pre-market, the ASX 200 Futures index was pointing marginally higher, and the market opened with 0.2% rush, but that eased as quick as it started, leaving the market to labour heavily as the day wore on.

At 4.15pm on 29 Jan, the S&P/ASX200 was ahead 23.0 points or 0.30% to 7,578.4

The big winner was the Energy sector, well out in front on +1.95% towards the end of play, as the highly variable commodities markets worked their magic on the hearts and minds of investors throughout the day.

Of particular note was a 1.0% climb for crude oil prices overnight that lit a bit of a fire under the sector, which outpaced the next-best Real Estate sector that could only manage about 0.95% through the session.

The millstone around the market’s neck was very much InfoTech shaped today, following Wall Street’s lead on Friday that saw the tech-heavy Nasdaq flounder to a -0.36% dribble, ahead of several massive earnings reports from the likes of Apple, Alphabet, Amazon, Meta, and Microsoft this week.

The overarching narrative out of Wall Street, however, was that bond yields in the US have risen again, which is a sure sign that the bets on a rate cut in March are now well and truly consigned to the dustbin, with the rate cut canaries now piling in on a far more likely move by the Fed in May.

That said, all eyes will be on which way American investors decide to send their money over the coming days, as the US Fed is due to meet later this week – which means the market’s game of trying to pre-empt any Fed moves will be in full swing when New York gets a-rockin’ later tonight.

Here’s what Fox News reckons is likely to happen when Wall Street opens later.

Locally, up the big end of town, financial services mob Infratil was the best of the Large Caps, banking a ~4% rise for reasons known only to whoever decided to spend up big on the company’s stock today.

Likewise, finance company GQG Partners also enjoyed a solid 4%er today, part of a broader rise among financial stocks led by the Banking sector, which averaged a market-leading 0.77% climb for the XBK All Ords Banks index.

The big news in Asian markets came from a court decision in Hong Kong today that property giant Evergrande will pretty much definitely be liquidated, with a provisional liquidator and then an official liquidator set to be named to try to sort out the horrendous mess left behind by the beleaguered property developer.

Who knew that getting yourself into a US$300 billion liability crisis could be a bad thing?

There is a glimmer of hope for creditors, though. The ABC is reporting that “a new debt restructuring plan to offshore creditors holding $US23 billion of debt in Evergrande if they determined the company had enough assets or if a white knight investor appeared”.

Seems unlikely, though – the level of self-loathing it would take to burden yourself with such an enormous problem would pretty much preclude anyone with a functional sense of their place in the universe from wanting to step in to try to save such an obviously damaged brand.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.002 | 100% | 504,303 | $2,133,790 |

| DCX | Discovex Res Ltd | 0.002 | 100% | 401,000 | $3,302,568 |

| MKG | Mako Gold | 0.013 | 44% | 55,333,806 | $5,961,685 |

| DXN | DXN Limited | 0.002 | 33% | 4,406,826 | $3,230,010 |

| SGC | Sacgasco Ltd | 0.013 | 30% | 7,561,503 | $7,796,871 |

| VMS | Venture Minerals | 0.009 | 29% | 8,561,959 | $15,470,091 |

| AI1 | Adisyn Ltd | 0.024 | 26% | 249,400 | $3,067,542 |

| BWF | Blackwall Limited | 0.555 | 26% | 87,308 | $75,670,129 |

| NES | Nelson Resources | 0.005 | 25% | 1,000,091 | $2,454,377 |

| 1AI | Algorae Pharma | 0.011 | 22% | 912,140 | $14,951,162 |

| BFC | Beston Global Ltd | 0.011 | 22% | 100,521 | $17,973,422 |

| AQD | Ausquest Limited | 0.012 | 20% | 1,272,468 | $8,251,492 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 966,084 | $8,796,859 |

| HOR | Horseshoe Metals Ltd | 0.006 | 20% | 628,680 | $3,232,393 |

| NRX | Noronex Limited | 0.012 | 20% | 3,296,604 | $3,783,018 |

| SIT | Site Group International | 0.003 | 20% | 3,051,262 | $6,506,226 |

| AWJ | Auric Mining | 0.115 | 20% | 569,848 | $12,562,521 |

| ARN | Aldoro Resources | 0.105 | 19% | 64,800 | $11,846,889 |

| PAR | Paradigm Biopharmaceuticals | 0.41 | 19% | 1,466,885 | $120,953,265 |

| BEO | Beonic Ltd | 0.032 | 19% | 100,962 | $11,461,363 |

| GSM | Golden State Mining | 0.013 | 18% | 353,020 | $3,073,077 |

| FND | Findi Limited | 1.56 | 18% | 722,546 | $64,661,618 |

| PPY | Papyrus Australia | 0.02 | 18% | 201,400 | $8,375,774 |

| 1AG | Alterra Limited | 0.007 | 17% | 355,200 | $4,992,883 |

| AVE | Avecho Biotech Ltd | 0.0035 | 17% | 220,000 | $9,507,891 |

Avira Resources (ASX:AVW) was nominally on top of the winner’s list early, boasting a 100% jump to $0.002 per share, as local investors took a low-cost punt on the company’s recently-completed Phase 2 drill program at the Puolalaki Ni-Cu-Co-Au project.

Copper prices are in the midst of a little boom at the moment, gold prices are holding above US$2,000 an ounce and it’s probably best we don’t talk about cobalt – but three outta four ain’t bad, and Avira’s got assay results due to market in the coming weeks.

Next best was Mako Gold (ASX:MKG), up 33% early in the wake of a due diligence update from the company about its flagship Napié Gold Project, where the company has been beavering away with a low-cost geological mapping and rock chip sampling at the Tchaga Nor target.

Mako boss Peter Ledwidge says the company is focusing its efforts on the western greenstone granite contact at Tchaga North and on new structural trends at the site, while progressing due diligence on a proposed “accretive transaction” with Goldridge, with negotiations there expected to recommence shortly.

The alarmingly-named Sacgasco (ASX:SGC) pumped its way into third place early, up 30% on news that three directors have bought into the company a little deeper, snapping up half a million shares each for a smidge over $4,500.

Adisyn (ASX:AI1) – the company formerly known as DC Two – banked a handsome climb in the afternoon off the back of a positive quarterly, and BlackWall (ASX:BWF) is up modestly after releasing an amended Appendix 4G and Governance Statement to the market late last week.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| SRX | Sierra Rutile | 0.062 | -52% | 13,383,137 | $55,150,738 |

| OMX | Orangeminerals | 0.02 | -38% | 421,008 | $2,744,006 |

| BUR | Burleyminerals | 0.1 | -26% | 205,576 | $13,945,062 |

| HLX | Helix Resources | 0.003 | -25% | 8,505,359 | $9,292,583 |

| CZN | Corazon Ltd | 0.01 | -23% | 1,517,924 | $8,002,773 |

| DCL | Domacom Limited | 0.01 | -23% | 400,000 | $5,661,523 |

| ESK | Etherstack PLC | 0.255 | -23% | 54,163 | $43,555,711 |

| CXL | Calix Limited | 1.8225 | -22% | 1,931,856 | $424,490,524 |

| LV1 | Live Verdure Ltd | 0.37 | -21% | 18,725 | $56,022,381 |

| SRJ | SRJ Technologies | 0.08 | -20% | 12,496 | $15,118,171 |

| IEC | Intra Energy Corp | 0.002 | -20% | 10,550,000 | $4,151,954 |

| KGD | Kula Gold Limited | 0.008 | -20% | 11,136,179 | $4,193,658 |

| PRX | Prodigy Gold NL | 0.004 | -20% | 3,456,292 | $8,755,539 |

| NGY | Nuenergy Gas Ltd | 0.022 | -19% | 252,905 | $39,985,798 |

| SPQ | Superior Resources | 0.0115 | -18% | 12,313,674 | $28,017,086 |

| GOR | Gold Road Res Ltd | 1.405 | -18% | 13,322,179 | $1,848,854,120 |

| LLI | Loyal Lithium Ltd | 0.21 | -18% | 998,159 | $21,238,266 |

| ALV | Alvomin | 0.14 | -18% | 149,296 | $15,832,153 |

| AXN | Alliance Nickel Ltd | 0.03 | -17% | 404,690 | $26,130,226 |

| FFG | Fatfish Group | 0.03 | -17% | 29,986,344 | $50,048,629 |

| PTR | Petratherm Ltd | 0.025 | -17% | 327,695 | $6,742,534 |

| AUZ | Australian Mines Ltd | 0.01 | -17% | 20,582,420 | $11,340,592 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 3,197,716 | $17,185,862 |

| IBG | Ironbark Zinc Ltd | 0.005 | -17% | 230,580 | $9,563,236 |

| KNM | Kneomedia Limited | 0.0025 | -17% | 151,224 | $4,599,814 |

TRADING HALTS

Arovella Therapeutics (ASX:ALA) – pending the release of an announcement regarding a licensing agreement.

European Lithium (ASX:EUR) – pending an announcement in connection with an update on a NASDAQ merger transaction and the timing of the special meeting of Sizzle shareholders.

Haranga Resources (ASX:HAR) – pending the company examining whether a cleansing prospectus should be issued or whether, in the circumstances, it should seek order from the Court in relation to its inadvertent failure to lodge a Cleansing Notice in relation to shares issued by the Company on or about 7 December 2023, within 5 business days of the issue of the shares. Due to an oversight, a Cleansing Notice for this issue was not lodged within the required timeframe for the share issue.

Galan Lithium (ASX:GLN) – pending the release of an announcement in respect of a capital raise.

Harvest Technology Group (ASX:HTG) – pending an announcement in relation to a capital raising.

Venus Metals (ASX:VMC) – pending an announcement to the market regarding update on the Youanmi Lithium Project.

Manuka Resources (ASX:MKR) – to allow the company the time necessary to secure commitments from sophisticated and professional investors in relation to a proposed capital raising.

Amaero International (ASX:3DA) – pending an announcement by the company or the commencement of trading on Wednesday, 31 January 2024, whichever is earlier.

The post CLOSING BELL: ASX 200 banks sixth straight win after Energy stocks drive investors mildly bananas appeared first on Stockhead.