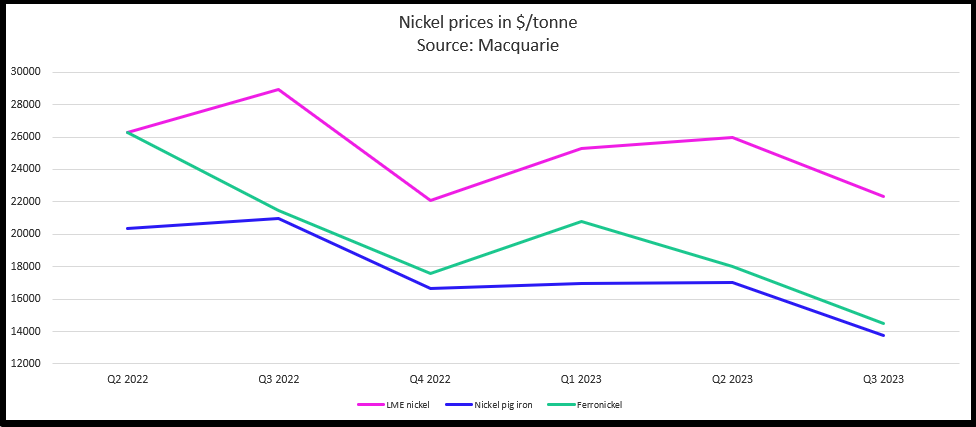

Nickel extended a year-long slump as rising Indonesian supplies help create a glut, while other base metals declined on reduced bets that the Federal Reserve will cut interest rates next month.

Prices of nickel on the London Metal Exchange have almost halved over the past year, prompting miners outside of Indonesia to close operations. Risk appetite for that metal and other industrial commodities fell further on Monday after Fed Chair Jerome Powell said policymakers will likely wait beyond March before cutting interest rates.

As Indonesian supply of the key battery metal continues to crank up, the market is expected to remain in a surplus for the rest of the decade, pushing prices down further, according to BloombergNEF analyst Allan Ray Restauro. He didn’t expect the closure of non-Indonesian mines to have a significant immediate impact on prices, as those assets represented less than 2% of global capacity so far.

Nickel fell 0.4% to $16,170 a ton on the LME as of 12:07 p.m. in Shanghai. Copper and aluminum also declined. Iron ore rose 1.4% to $127.80 a ton in Singapore following a 6.5% drop in the previous week, its steepest since April.