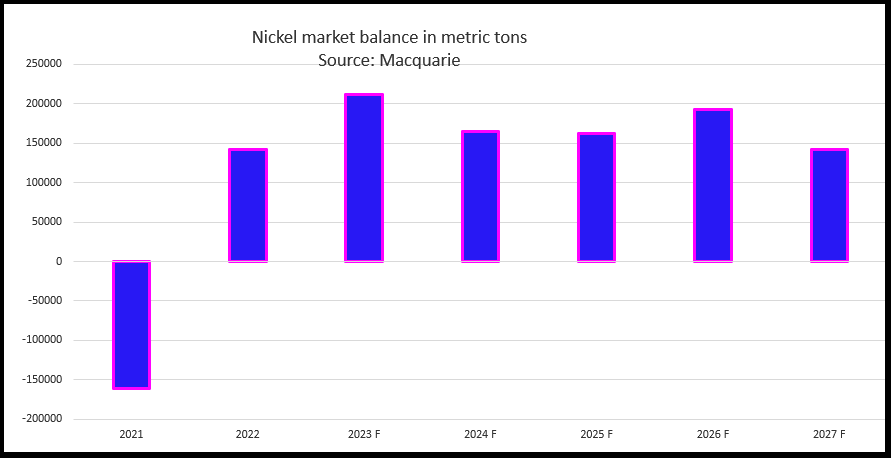

Sizeable output cuts will help shore up nickel prices, which are likely to have reached a bottom after a year-long slide, but tighter supplies are not expected to eliminate surpluses.

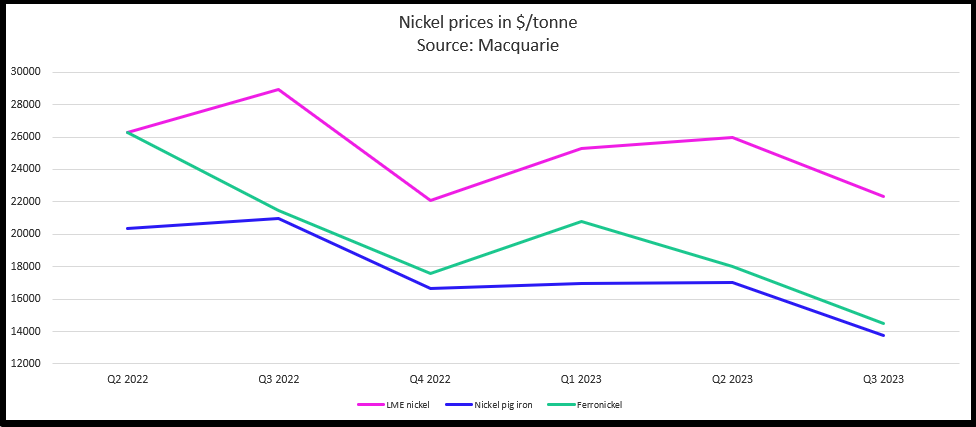

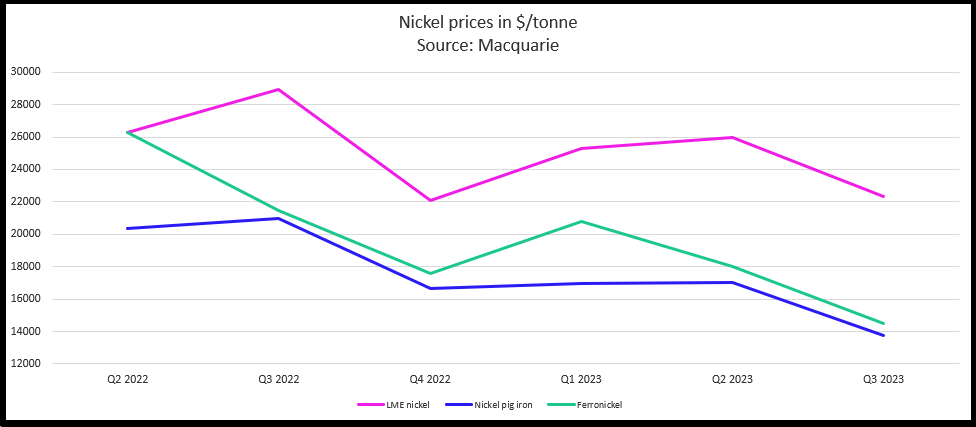

Specifically, the cutbacks have affected nickel pig iron (NPI) and ferronickel, both used to make stainless steel, where prices at around $14,000 a metric ton have dropped more than 15% since the third quarter of 2022.

On the London Metal Exchange (LME), nickel prices trading below $18,000 a ton have plunged 45% since December, but as yet production cuts of LME grade material have not been seen.

Macquarie analyst Jim Lennon estimates more than 100,000 tons nickel production, mostly ferronickel, has been cut so far.

“Using an LME price of $18,000, we estimate nearly one-third of the industry is cash flow negative,” Lennon said, adding further cuts were likely, particularly in Chinese NPI output.

“A fall in LME prices to below $15,000 would push another 35-40% of the industry into loss making territory, suggesting considerable support for prices well above $15,000 and probably in the $17,000-18,000 range.”

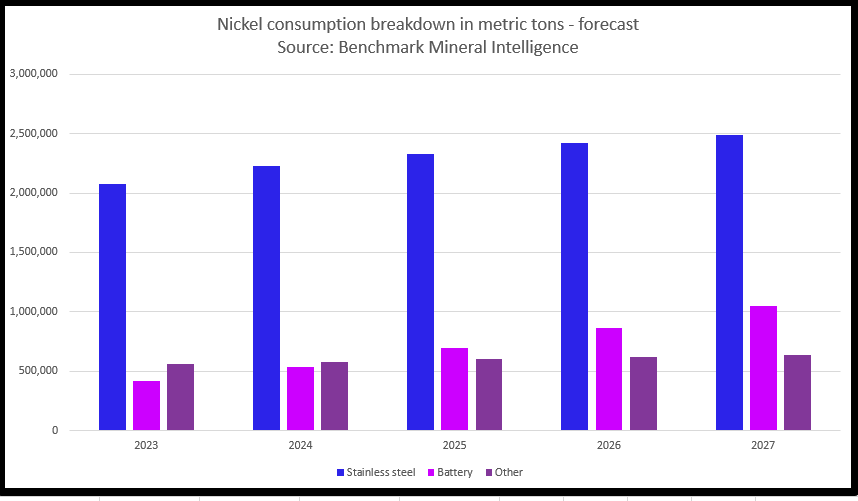

The average forecast in a recent Reuters survey was for a nickel market surplus of 200,000 tons this year and 205,000 tons in 2024. Global supplies are forecast to total around 3.3 million tons this year.

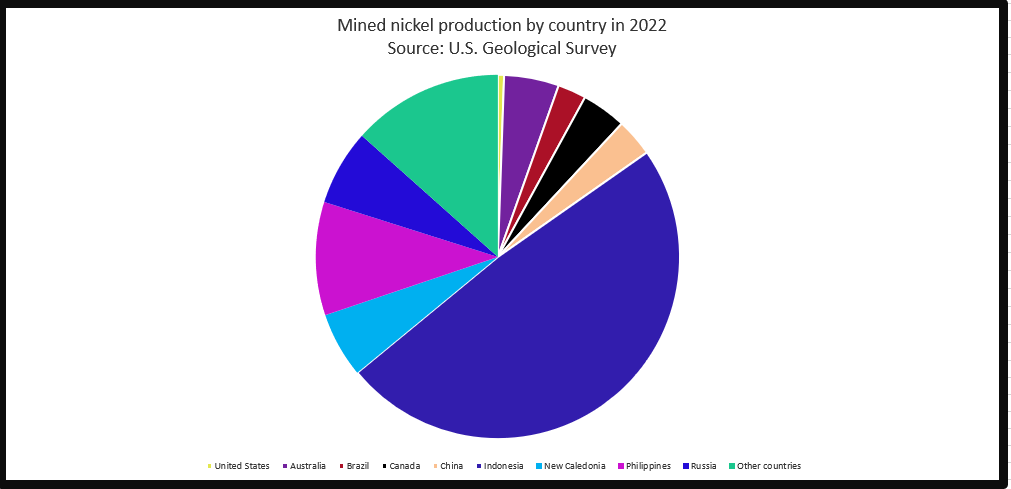

Surpluses are due to falling stainless steel production, weaker than expected demand from manufacturers of electric vehicle batteries and mounting supplies from top producer Indonesia, which accounts for nearly half of global mined production.

“With such a huge global dependency on supply from the country there is a risk this emboldens Indonesia to exercise its dominant position to behave like a de-facto swing producer,” Citi analysts said in a note.

“This risk increases in a lower price environment. Indonesian nickel supply also faces risks more broadly from ore grade depletion, regulatory actions, and pressure to address ESG issues.”

Indonesia earlier this year revoked more than 2,000 mining permits for various minerals including nickel, in an attempt to tighten governance in the sector.

Sources say the Indonesian government could attempt to help buttress nickel prices by trying to limit nickel ore shipments with higher export taxes.

(By Pratima Desai; Editing by Emelia Sithole-Matarise)