Anglo American will review its assets after a 94% plunge in annual profit and writedowns at its diamond and nickel operations, the company said on Thursday.

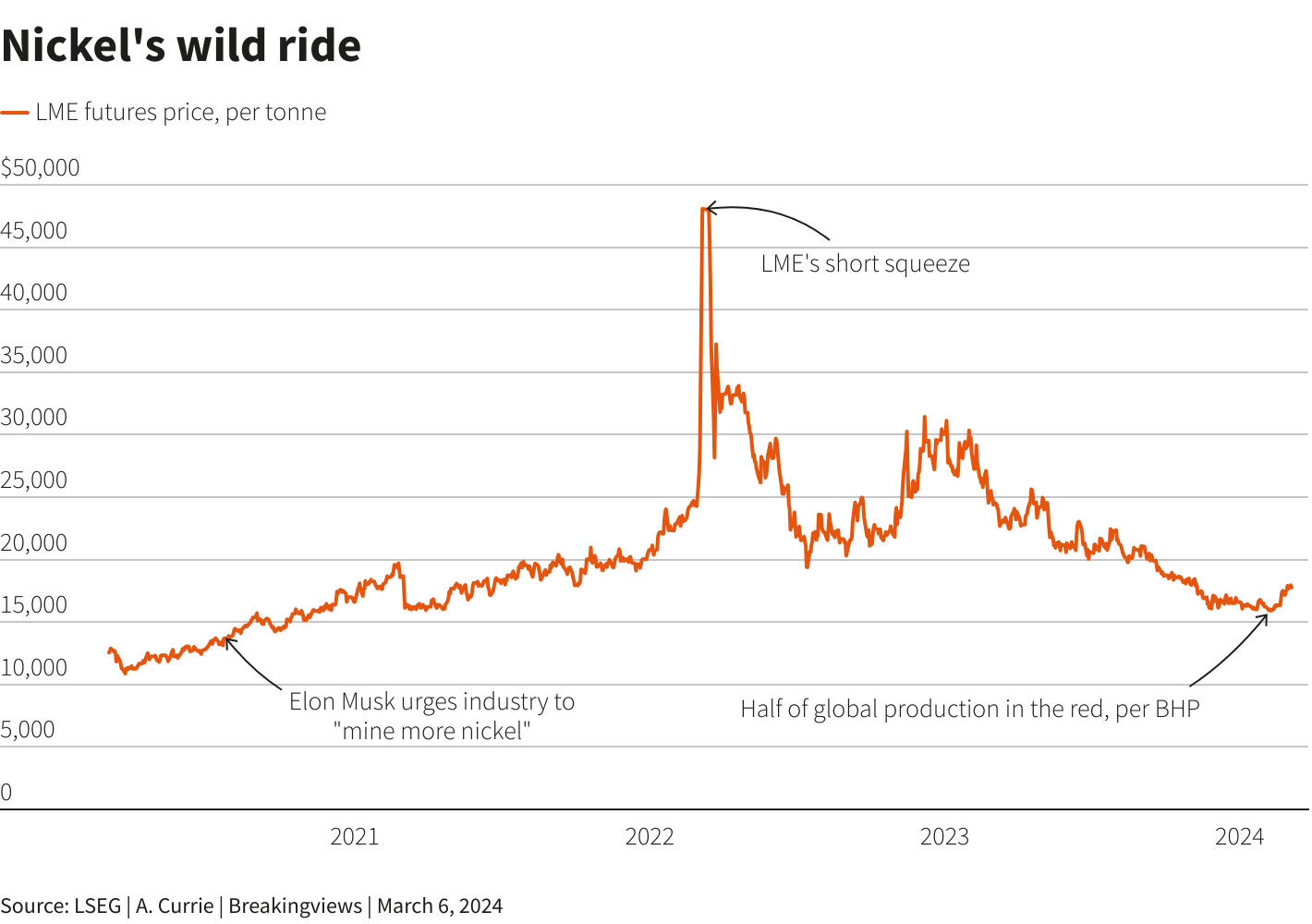

The miner announced a $1.6 billion impairment charge on its De Beers diamond business owing to faltering demand and a $500 million impairment on its Barro Alto nickel mine as prices are hit by slowing demand from the electric vehicle sector.

“We are now in a process of systematically going through all of our assets in a review just to assess their role in the portfolio, their success in the portfolio, and absolutely nothing is off the table,” CEO Duncan Wanblad told reporters.

The review is expected to take about a year, he said.

Anglo’s shares were up 3.3% by 1530 GMT.

The London-listed miner’s 2023 profit attributable to shareholders fell to $283 million from $4.5 billion a year earlier. The company declared a full-year dividend of $0.96 per share, down from $1.98.

Net debt swelled to $10.6 billion from $6.9 billion, slightly below the $10.93 billion expected by analysts.

Anglo, which also produces copper, platinum group metals (PGMs), iron ore and steelmaking coal, is not new to asset overhauls when commodity markets hit rock bottom. A decade ago, when its shares dived 75% on investor concerns over spiralling debt, the miner was poised to sell assets and cut jobs until the plans were abandoned thanks to a recovery in metal prices.

Both its South African unit Kumba Iron Ore and Anglo American Platinum this week announced plans to cut more than 4,000 jobs and review agreements with 780 contractors.

Portfolio burdens

Wanblad said “the two assets that are dragging the portfolio today are the PGMs and diamonds businesses,” adding that more action will be taken if platinum prices continue to decline.

Sales of rough diamonds at the company’s De Beers unit fell in 2023 as an economic slowdown curbed appetite for luxury items in major consumers China and the United States.

“Diamond inventories stand at around $2 billion, which is high by the standards of the past decade…It is higher than we want it to be,” De Beers CEO Al Cook told Reuters.

“What we’ll be doing over the course of the next year is… reducing purchases and production,” he said, adding that he expects a gradual pick-up in demand later in the year.

De Beers aims to reduce sustainable overheads by $100 million via job cuts and the sale of non-core parts of the business to improve cashflow.

It has already suspended the Chidliak project and Gahcho Kue underground project in Canada.

“We continue to think that the asset (De Beers) should be disposed – a sale to a luxury business could be sensible, but we remain sceptical as to whether this would be at the $7.6 billion carrying value that Anglo includes in its valuation,” Berenberg analysts said.

Anglo had already announced $1.8 billion of spending cuts by 2026 after logging a $1.7 billion writedown on its project to produce fertiliser nutrients in Britain. The company is in talks with potential partners over options including the sale of a stake in the project.

(By Clara Denina and Felix Njini; Editing by Miral Fahmy, David Goodman and Kirsten Donovan)