- Gold turns in a second month of massive gains as bullion prices hit fresh record

- Copper up, nickel down, lithium sideways as battery metals deliver mixed signals

- Iron ore and uranium down for the second month straight. Panic stations yet?

WINNERS

Gold

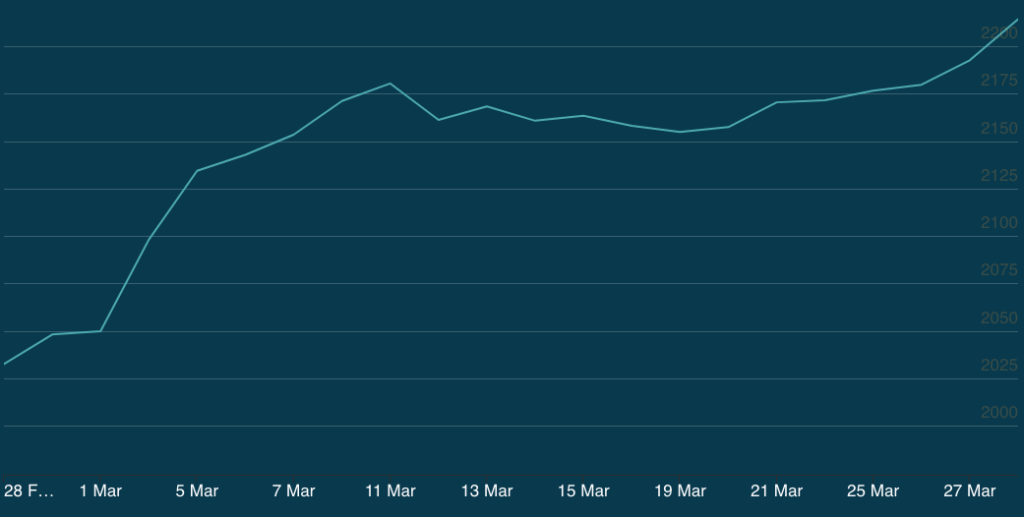

Price: US$2214.35/oz

% Change: +8.1%

Inflamed by war and hopes that interest rates are about to be cut, gold is responding to crises by reverting to type and that means record high prices for the metal that prays off your misery.

Bullion hit US$2214/oz at the end of last month with few signs the rally is about to end, as futures peaked over US$2250/oz yesterday.

That came after the US Fed chair Jerome Powell said inflation data in the States fell in line with what it wants to see. The US Fed has guided three rate cuts this year to bring rates down from long term highs of 5.25-5.5%.

“As a reminder, gold prices tend to move inversely with interest rates. When interest rates fall, gold becomes relatively more attractive compared with fixed income assets such as bonds, which offer weaker returns in a lower interest rate environment. Or put differently, lower interest rates reduce the opportunity cost of holding gold,” City Index head of market research Matt Weller said.

“Looking ahead, markets will be keying in on Friday’s highly-anticipated Non-Farm Payrolls (NFP) report to see if it confirms a soft landing in the US jobs market. Traders and economists are expecting the report to show about 205K net new jobs were created in March after an initial estimate of 275K in February.”

Silver prices also rose close to 10%.

UP

- An attack on an Iranian embassy in Syria by Israeli warplanes has again heightened fears of a spillover in conflict in the Middle East. Safe haven demand for gold has been elevated since Hamas’ October 7 attack which led to Israel’s bombardment of Gaza.

- China’s central bank continues to bolster its gold reserves, adding more gold bars for 16 straight months leading up to the end of February.

DOWN

- After a sharp rise in gold prices, markets could be overheated if the rate cut cycle starts slower than expected.

- Investment demand from the financial community is lagging that of central banks and bar and coin investors, with ETF holdings sitting at four year lows in March.

- Copper traders think prices are going to rise, with LME copper in its biggest contango since 1994.

- India has emerged as a destination for copper miners as Adani opened the first stage of a US$1.2b smelter in Gujarat.

- It’s hard to find copper exposure on the ASX, with many of the major players suffering the same supply issues that have impacted overseas miners. Most notably 29Metals (ASX:29M) crumbled on news its Capricorn mine had been shut for the second time in 12 months due to flooding.

- The World Bank has forecast China’s growth to hit just 4.5%, short of its 5% GDP growth target.

- China and India lifted thermal coal imports to record levels in March.

- A heatwave in the coming months in the northern hemisphere could stir increased demand for coal imports.

- Weak rebar prices and steel PMIs in China are weighing on met coal prices.

- Australia’s Department of Industry, Science and Resources thinks met coal exports globally peaked at 349Mt last year, projecting a slow decline at 0.8% a year across the next five years. Australia’s are projected to peak at 181Mt in 2026 before falling to 174Mt by 2029. That would still be up on the 151Mt exported in a weather affected 2023.

- Chinese auto giant BYD increased electric vehicle sales by 36% and plug-in hybrid sales by 56% YoY in a massive return to form in March. Its sales were up 14% in the first quarter to 624,000, coming after a 62% lift across 2023.

- Pilbara Minerals inked a deal with China’s Ganfeng to run a year long feasibility study on a new refinery to be based outside of China in the hope of supplying IRA compliant lithium chemicals.

- The recent lift in spodumene prices will likely delay any production curbs from the large producers, pushing back the timing of market deficits.

- China’s largest lithium miners Tianqi and Ganfeng have given no indication they plan to curb production despite falling prices.

- Some nickel stocks are still pressing ahead with production plans. Nickel Industries (ASX:NIC) hit a 2024 high yesterday after announcing it had doubled its interest in the Excelsior HPAL plant in Indonesia to 27.5%. Pacific Nickel Mines (ASX:PNM) meanwhile completed the first DSO shipment to Glencore from its Kolosori project in the Solomon Islands.

- Benchmark Mineral Intelligence launched a price index which will track prices for producers said to have higher ESG standards on its sustainability measurements

- The Indonesian Minister responsible for the nickel sector, Septian Seto, told the Financial Times the country would continue to expand nickel production to meet the needs of EV makers. He predicts long term prices between US$18,000-19,000/t.

- BHP has reportedly been cutting contractors at its Kalgoorlie nickel smelter and West Musgrave nickel project as it decides whether to place its nickel assets in care and maintenance

- Goldman Sachs has set a US$55 price target on Cameco, the west’s largest uranium producer, predicting that yellowcake will average US$95/lb long term over the next seven years. The PT is 27% upside.

- Miners at the recent Future Facing Commodities Conference in Singapore tipped the current bull run would take uranium prices to new highs of between US$150-200/lb.

- Debate in Australia continues to focus on the ban on uranium in WA and nuclear power at a national level, with few new developments on the cards.

- Rio Tinto subsidiary Energy Resources of Australia (ASX:ERA) drew the ire of traditional owners by applying to extend the lease of the Jabiluka uranium project, which the Mirarr People have said they will never consent to. The company says the renewal is essential to ensure an agreement that includes veto rights for the Mirarr remains in place.

- Iron ore is beginning to reach the breakeven point for marginal producers, when prices often plateau.

- Despite projecting prices to fall the latest outlook from Canberra’s Office of the Chief Economist suggest iron ore production will still grow in Australia, rising from 893Mt last year to 983Mt by 2028.

- China’s steel industry PMI hit a 10 month low of 44.2 in March. Anything below 50 is a contraction in market activity.

- Rio and BHP’s shipments charged more than 20% each in the last week of March, with a combined 17% lift in exports by Aussie and Brazilian producers suggesting supply is on the rise.

- Government support is beginning to flow in the West, notably in the US and Australia, to incentivise non-Chinese producers.

- There’s competitive tension to help get new producers online, with China’s BTR Materials Corp confirming a 9.9% stake in ASX-listed Tanzanian developer Evolution Energy Minerals (ASX:EV1).

- The Shanghai Metals Market says buyers are continuing to push for lower NdPr prices despite recent falls.

- China Northern Rare Earth has maintained listing prices for its products in April despite margin pressure that cut its profits by 60% in 2023.

Gold miners share prices today:

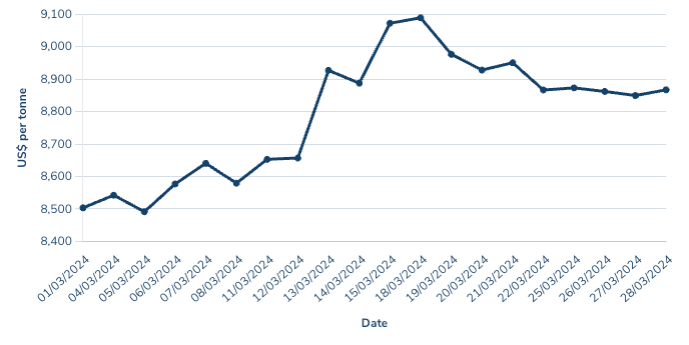

Copper

Price: US$8448.50/t

% Change: +4.95%

A plunge in treatment and refining charges at under utilised and underfed Chinese smelters sent the sector into a crisis of its own making which drew an agreement to curb production from the mainland’s major refiners.

That saw copper prices spring to life after supply cuts in Latin America saw a previously well supplied market thrust into deficit at the end of last year.

It has fundies and brokers insisting prices have to climb higher to satisfy hardcore demand forecasts expected to hit as the energy transition — which will be copper intensive in any form — really unfolds.

In our latest Ten Bagger column, Lowell Resources Fund CIO John Forwood said based on the prices needed for recently completed mines and expansions to reach an IRR of 15%, a minimum of US$4.75/lb would be needed incentivise new sources of production.

Copper price forecasters have a history of getting a little over exuberant — Bank of America suggested US$20,000/t by 2024 was within the realm of possibility when prices hit record highs in 2021. But there are plenty of reasons to be bullish.

UP

DOWN

Copper miners share prices today:

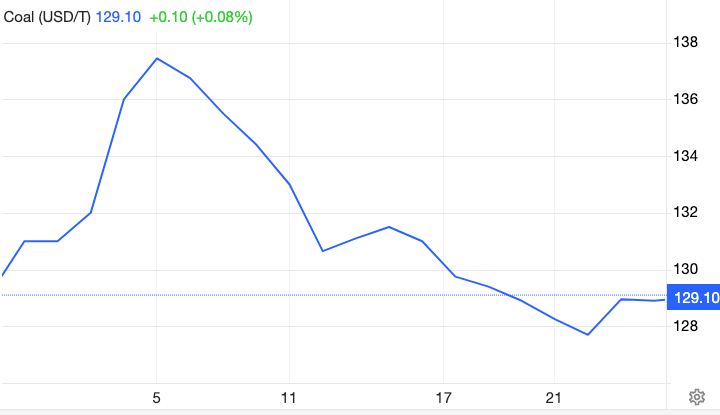

Coal (Newcastle 6000 kcal)

Price: US$133/t

% Change: +2.7%

Coal continued its indifferent start to 2024, with high operating costs and the Baltimore bridge collapse, which closed one of the US’ largest coal export hubs, putting a floor under prices.

But upside has been limited, with successive mild northern winters keeping demand spikes in check as gas stores do the job for power utilities in Europe.

Coking coal prices have been hammered, though still command a rich premium compared to thermal, down from over US$300/t earlier this year to US$235/t yesterday.

That did little to harm Whitehaven Coal (ASX:WHC), which believes it can get 70% of its earnings from coking coal after officially acquiring BHP’s Daunia and Blackwater mines in a deal worth up to $6.4 billion yesterday.

UP

DOWN

Coal miners share prices today:

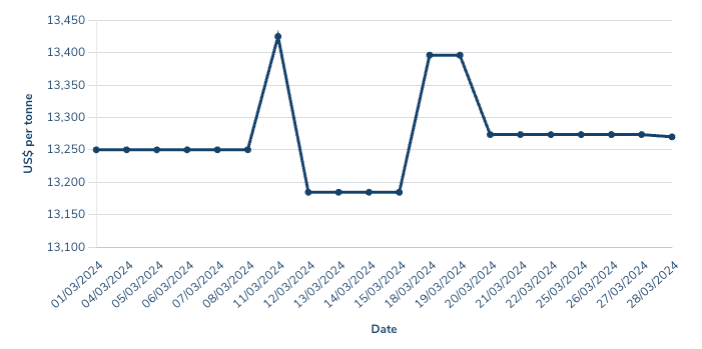

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$13,270/t

% Change: +0.02%

Are there bright spots emerging for white gold?

Prices for lithium chemicals have barely moved in the past two months, but spodumene has strengthened somewhat, with auction sales by Pilbara Minerals (ASX:PLS) and Albemarle that implied spot 6% Li2O concentrate prices of US$1200/t giving WA’s hard rock miners a shot in the arm.

That saw Fastmarkets lift its spot prices in recent weeks from US$850/t to US$1100/t.

Not every one is positive on the impact of the auctions, which have set pricing that threatens to eat into converter margins in China.

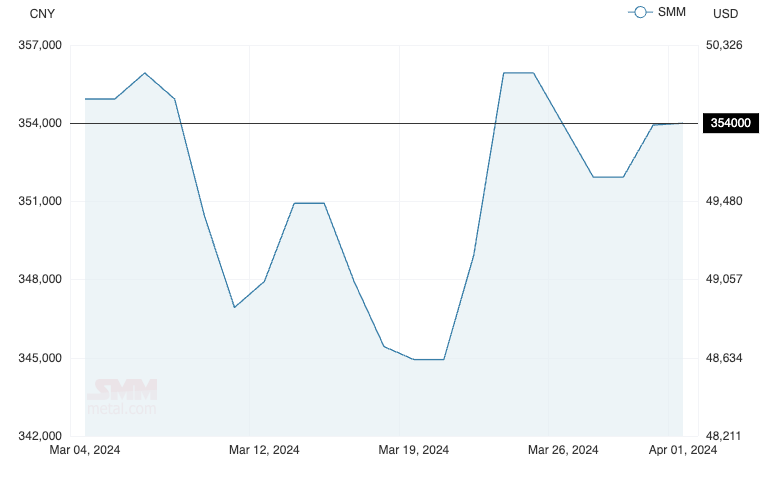

The Shanghai Metals Market warned the auction sales — Mineral Resources (ASX:MIN) is reportedly planning one of its own — could foster price volatility.

“According to SMM’s research, companies are less willing to receive spodumene concentrate at this price, especially after the lithium carbonate price dropped this week. Some participants in this bidding told SMM that considering the final price point of the bidding, they may not participate in similar spodumene bidding activities again in the future,” the SMM said.

“Looking ahead, overseas companies are interested in normalising such lithium mine tender activities. This will continue to amplify the volatility of the prices.

“Furthermore, the involvement of non-lithium salt production-related enterprises in lithium mine price discovery may change the lag effect between lithium ore and lithium salt prices.

“However, the production enterprises without stable sources of lithium ore are still the ones ultimately severely affected. Additionally, this year, there are still expectations of oversupply and capacity reduction in the upstream of the lithium battery industry, putting considerable pressure on the operation and survival of some small and medium-sized smelters.”

Lithium carbonate futures have also been rising in recent days.

At mkt close today (15:00 China time), average #lithium carbonate futures prices increased by 4.36% exceeding the average LC spot price by CNY7,787, resulting once again in increasing contango for the 2nd consecutive day. Mkt sentiment is back but it's anyone's guess for how long pic.twitter.com/qZpbbRFHID

— Juan Carlos Zuleta (@jczuleta) April 1, 2024

UP

DOWN

Lithium stocks prices today:

LOSERS

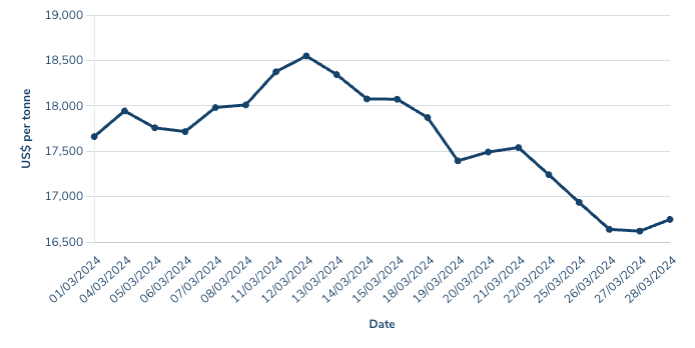

Nickel

Price: US$16,749/t

% Change: -4.84%

The positivity building in nickel that saw prices rebound in the direction of US$18,500/t early last month was snuffed out by the end of March as weak demand indicators in China that hurt other base metals combined with the well-publicised oversupply issues to knock it back down to US$16,750/t.

Can prices stay there? BHP, which says it needs to see prices of US$20,000/t to breakeven at its Nickel West business in West Australia, thinks we’ll be oversupplied thanks to the rise of Indonesian production until the 2030s.

Not everyone is so sure the rise of Indonesia can keep prices as low as they have been through the early months of the year and late 2023.

In a note last week ANZ’s Daniel Hynes and Soni Kumari said they see the oversupply scenario lasting for ‘two to three years’ and that a tighter market is not out of the question. It follows suggestions from Macquarie that the expected hefty surplus projected by bodies like the International Nickel Study Group (239,000t in 2024) may actually be tighter than that thanks to strong stainless steel production in China and slow approvals from Indonesian authorities amid a national election.

“The recent collapse in prices has made more than half the industry sub-economic. Producers responded rapidly, with up to 100kt of capacity likely to close this year,” ANZ’s commodity strategists said.

“New Indonesian projects face Environmental Social and Governance (ESG) issues, such as poor safety, delays in getting government permits and issues with environmental impact that may delay delivery.

“We see the most likely scenario being an oversupplied nickel market over the next two to three years, but a tighter market is not out of the question. The latter possibility would provide some support to prices. We think USD16,000/t is unsustainable over the medium term, and look for a bounce in coming months. We have a 12-month price target of USD18,000/t.”

UP

DOWN

Nickel miners share price today:

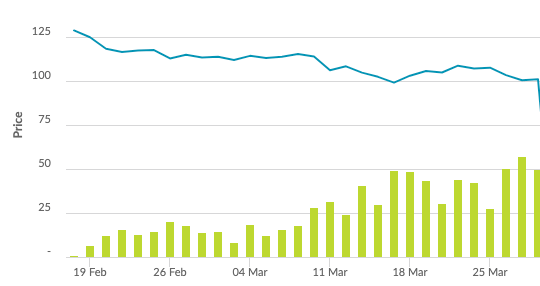

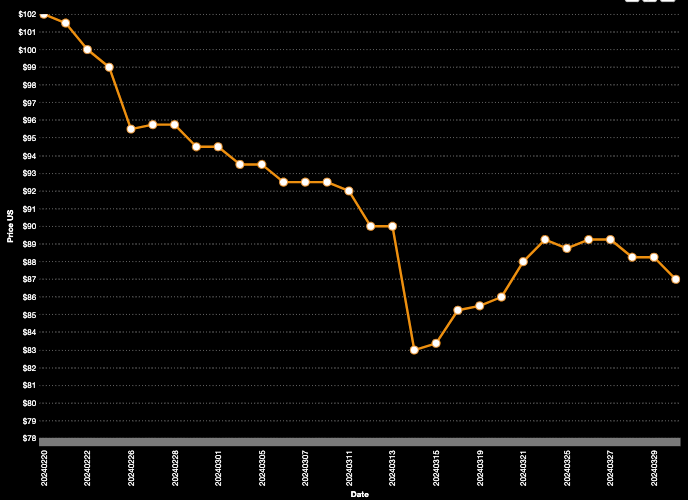

Uranium (Numerco)

Price: US$87/lb

% Change: -7.94%

Uranium spot prices fell for the second month in a row, with six weeks of declines seeing prices drop from 16 year highs of US$107/lb seen in January.

This is not of extreme concern to producers and exploration hopefuls, most of whom have pegged incentive prices at around US$75/lb. It’s worth noting that U3O8 was trading for less than US$18/lb around six years ago.

But UxC Consulting’s Jonathan Hinze reckons the recent price pullback has seen the market hit a new bottom. Spot yellowcake recently rebounded from US$83/lb to US$87/lb.

“The fundamentals are still strong, with increased demand and supply that hasn’t fully responded,” he told Bloomberg.

UP

DOWN

Uranium share prices today:

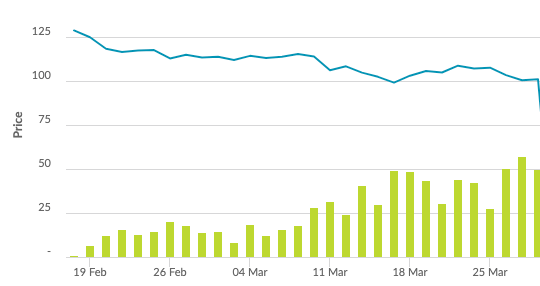

Iron ore (SGX Futures)

Price: US$101.04/t

% Change: -12.28%

After hitting strong levels of more than US$140/t late last year, iron ore has suffered three rough months, sliding back towards US$100/t.

This is around where many analysts think price support is, even if the difficulties being faced by China’s debt-ridden property barons suggests demand could slide further. Port stockpiles in China have also reverted from long term lows in late 2023 to more than year long highs by the end of March (144.3Mt) in a major inventory build that could dull demand ahead of peak steel season.

The rationale of analysts at ANZ, Commbank and more is that much of the swing supply in iron ore at the moment is coming from small marginal players and domestic Chinese magnetite producers who are under pressure at between US$90-100/t.

Iron ore hit a ten month low of ~US$96/t on April 1 before recovering. That’s no biggie for the majors or the vast bulk of the iron ore producers in the Australian market.

There are a handful who will struggle at these levels though, with private producer Gold Valley calling on the State Government to provide royalty relief despite accepting its operation is ‘high risk’.

The WA Government stepped in to provide limited royalty relief for MinRes after brokering the sale of Cliffs’ Koolyanobbing mine to the Chris Ellison led company several years ago in a bid to salvage stevedoring jobs at Esperance Port.

UP

DOWN

Iron ore miners share prices today:

Rare Earths (NdPr Oxide)

Price: US$49.90/kg

% Change: -2.35%

Lastly to a commodity that can’t catch a break, with rare earths remaining at depressed levels for pretty much all of 2024 so far.

That price is even worse for producers, given it includes Chinese taxes.

But there is a beacon of light out there, and it is the long-term approach Western governments are taking to support the diversification of the industry outside China.

Notably, Canberra has tipped $840 million into Arafura Rare Earths’ (ASX:ARU) Nolans project in the Northern Territory, long mooted as an alternative source of supply of the metals key to the magnets used in EV motors, aviation, defence and wind turbines.

That will include loans from the Northern Australia Infastructure Facility, Export Finance Australia and Critical Minerals Facility as well as $30m in grants.

Many in the industry have called current prices unsustainable. Established Australian producer Lynas (ASX:LYC) has been stockpiling uncontracted product since last year to wait out the storm, while American Rare Earths (ASX:ARR) said in a scoping study on its Halleck Creek project in Wyoming that China Northern Rare Earths — one of the world’s biggest miners — was producing at cost at recent prices.

ARR said the US project would still carry an IRR of 12% at current spot prices and a 10% discount rate.

DOWN

Rare Earths share prices today:

OTHER METALS

Prices correct as of March 28, 2024.

Silver: US$24.54/oz (+9.85%)

Tin: US$27,451/t (+3.37%)

Zinc: US$2439/t (+1.01%)

Cobalt $US28,550/t (0%)

Aluminium: $2337/t (+6.69%)

Lead: US$2055/t (-1.34%)

Graphite (Fastmarkets flake) US$490/t (-6.49%)

The post Up, Up, Down, Down: Gold wins the commodities game in March as bullion prices continue to level up appeared first on Stockhead.