Local markets were primed for a rise this morning, with the ASX 200 Futures index pointing 0.5% higher, thanks to a tremendous effort by Wall Street to warm up the crowd overnight.

The market arrived at midday right on schedule, the needle pointing to +0.54% on the heels of a smashing rally by InfoTech stocks this morning – which is, as I write this, apparently in the process of coming off the boil. So how the afternoon is likely to play out is anyone’s guess at this stage.

I’ll get into the finer points of all that shortly, but first, we’re only a couple of weeks away from the unending horrors of Valentine’s Day, a bona fide Hallmark holiday that has brought romance into the lives of literally dozens of people over the years, and heartbreaking levels of stress and angst to the other billions.

For people in a relationship, those who think they’re in a relationship when they’re not, and other assorted creeps and weirdos, it’s a day for showering your special someone with shockingly overpriced flowers, diabetes-inducing chocolate treats and – if you’re feeling extra bold – the kind of lacy underwear commonly seen on recently-arrested prostitutes in mid-80s TV cop dramas.

But for people who are recent returnees to the dating scene, it’s a day when thoughts invariably turn to an ex-partner, and all of the associated joys that come with a prolonged bout of introspective howling, with an hour or two of ugly-crying in the shower if you’re lucky.

However, if you’re at the stage of being an ex where there’s still just a gigantic, numb hole in your life, tinged red around the rim with the urge to “get even”, then there’s an animal shelter in New Jersey, USA, that has precisely the kind of Valentine’s gift you’re looking for.

For the low, low price of just $50, staff at the shelter will name one of the feral cats that has wound up in their care after your ex-partner, and then cut off its balls (or whip out its lady parts, depending on what flavour cat it is).

… more accurately, they’ll neuter the animal, which is something they do to the animals that wind up at the shelter anyway, so that those unfortunate beasts don’t get their frisk on with other feline felons in similar circumstances, and end up making a lot more feral kitties in the process.

The Homeward Bound Pet Adoption Center in South Jersey operates what it calls a “trap-neuter-return program”, which it says is a “vital component of feral cat population control as it breaks the breeding cycle and stops the birth of unwanted cats in our community”.

So, if you’ve ever fancied getting some thoroughly misplaced revenge on your ex by putting a small animal through an entirely unnecessary, and very invasive, medical procedure, here’s your chance to show them just how much you care.

TO MARKETS

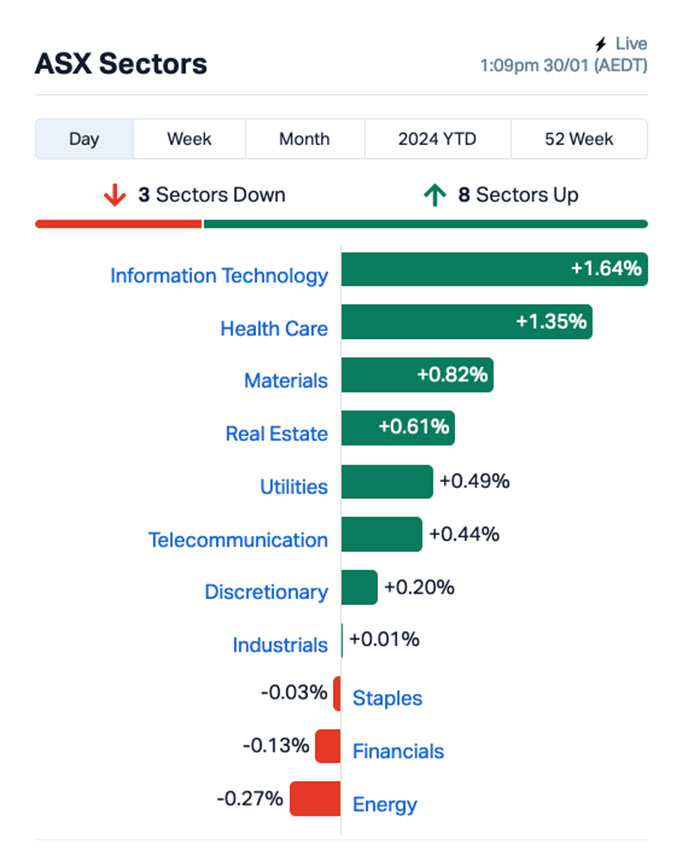

A quick look at the sectors to see what’s making waves today shows the local InfoTech sector enjoying something of a return to recent form, out in front of the market with thanks to a bit of heavy lifting from a large capper with a supersized gain this morning.

However, the Energy sector is off the boil again today, leaving that sector all on its lonesome on the wrong side of the ledger for the session so far.

There are a couple of Large Caps waaaay up the top of the winner’s list today, generating some super-chunky quantities of value for shareholders with some very big moves for companies of their size.

The major winner this morning is Megaport, which is flirting with busting through $2 billion in market cap thanks to an enormous 26.4% hike in the first hour of trade today.

News that the company’s revenue for the quarter was $48.6 million (up $2.1 million or 5% compared to 1Q FY24) and generated positive Net Cash Flow of $6.9 million in 2Q FY24 (up $1.3m or 23% compared to 1Q FY24, and up $18m compared to 2Q FY23) was enough to light a fire under the collective backside of investors today.

The rush of interest sent Megaport soaring from $9.88 to more than $12.60 per share in minutes.

It’s not the first time Megaport has seen a surge like this – a look back at the company’s performance graph shows that it’s had similar, but not quite as dramatic, spikes several times in the past 12 months.

The other big winner this morning is Nickel Industries, which has spiked more than 18% this morning on news of a share buy-back up to US$100 million, which the company expects will be conducted over a 12-month period.

Elsewhere, all the economic talk is doom and gloom about how hard it is to find a rental property, which is old news to just about everyone, including the several hundred people who turned up a few weeks ago to troop through the apartment next door to mine, after the former tenants were evicted because their baby looked at the landlady funny, or something.

NOT THE ASX

Wall Street turned on the charm overnight, delivering a positive round of results for the major indices that left the Dow Jones up +0.59%, the tech-heavy Nasdaq up by +1.12% and the all-conquering S&P 500 bagging another record high, up +0.76%. On the Fed Reserve front, the penny-counters responsible for setting monetary policy in the US have gathered to natter about nickels and dimes for the first time this year, with a result from the meeting due to land on Thursday.

It’ll be largely academic, though – the US market, freshly burnt by a premature rush on rumours of a rate cut as early as March, seems to have settled on a May date for the Fed’s next bold move.

So, barring something completely unexpected, the chances of a surprise from this month’s meeting are slim to none.

“Keep your expectations in check because we are not on the cusp of the Fed cutting rates,” said Greg McBride, Bankrate’s chief analyst.

“Even when they do, those cuts will likely be modest compared to the increases seen over the past couple of years.”

Earlybird Eddy Sunarto reports that Bond yields have fallen ahead of the meeting, with the benchmark 10-year treasury yield sliding by 8 basis points.

To stocks, Tesla shares surged 4% on dip buying after the fall last week caused by the downbeat production outlook for 2024.

Warner Bros Discovery fell -1.2% after Wells Fargo downgraded the stock from Overweight to Equal Weight, citing “risky earnings setup”.

In Asia, the talk of the town is still (unsurprisingly) doomed property developer Evergrande, which has had last drinks called by a Hong Kong court yesterday, leaving the company with no choice but to liquidate under the weight of US$300 billion in liabilities.

However, Evergrande chief executive Shawn Siu has very bravely shown his face, to reassure customers that homes that are currently in the process of being built will be completed.

“The worry is hundreds of thousands of Chinese families not getting the flat they thought they were going to live in,” he said, possibly missing the actual worry, which is a US$300 billion black hole that looks set to consume everything in its path.

Shanghai markets are down 0.61%, and Hong Kong markets are down 1.32% in early trade.

Meanwhile in Japan, the Nikkei is up 0.51% this morning, which is hugely surprising considering the nation is currently reeling from what can only be described as a culinary mugging by pizza chain Domino’s.

The company recently launched a whimsical “Cheese Volcano” pizza, which – as the name suggests – is a pizza with a crude mountain full of molten cheese in the middle, which – as the description suggests – is completely and irreversibly gross.

The ASX-listed company recently blamed a disastrous 31.2% single-day crash on (among other things) the chain’s inability to gain traction among Japanese consumers.

If you were wondering why that might have been the case, behold the answer to your question.

All the almost-but-not-quite-palatable flavours you’d expect from a Domino’s pizza, married to a dish that’s about as visually appealing as a skate park accident – it makes -31.2% sound like Domino’s actually got let off lightly.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| EMU | EMU NL | 0.0015 | 50% | 5,504,907 | $2,024,771 |

| PRX | Prodigy Gold NL | 0.004 | 33% | 908,947 | $5,253,323 |

| DCL | Domacom Limited | 0.013 | 30% | 23,000 | $4,355,018 |

| AXN | Alliance Nickel Ltd | 0.039 | 30% | 287,755 | $21,775,188 |

| MP1 | Megaport Limited | 12.44 | 27% | 2,010,491 | $1,556,240,642 |

| ATH | Alterity Therapeutics | 0.005 | 25% | 39,855,667 | $15,245,305 |

| IEC | Intra Energy Corp | 0.0025 | 25% | 1,000,000 | $3,321,563 |

| NAE | New Age Exploration | 0.005 | 25% | 250,000 | $7,175,596 |

| RLC | Reedy Lagoon Corp. | 0.005 | 25% | 99,252 | $2,478,163 |

| CCX | City Chic Collective | 0.53 | 22% | 2,660,625 | $100,885,237 |

| NIC | Nickel Industries | 0.73 | 22% | 18,719,546 | $2,571,485,928 |

| AD1 | AD1 Holdings Limited | 0.006 | 20% | 972,612 | $4,493,242 |

| CRB | Carbine Resources | 0.006 | 20% | 124,969 | $2,758,689 |

| ECT | Env Clean Tech Ltd | 0.006 | 20% | 59,067 | $14,321,552 |

| LPD | Lepidico Ltd | 0.006 | 20% | 1,993,681 | $38,191,540 |

| OMX | Orange Minerals | 0.024 | 20% | 121,574 | $1,715,003 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 400,000 | $65,333,512 |

| Z2U | Zoom2U Technologies | 0.065 | 18% | 197,440 | $10,658,226 |

| E33 | East 33 Limited | 0.021 | 17% | 20,618 | $9,667,597 |

| AQD | Ausquest Limited | 0.014 | 17% | 2,039,299 | $9,901,791 |

| ASP | Aspermont Limited | 0.007 | 17% | 1,145,100 | $14,632,582 |

| CCO | The Calmer Co International | 0.007 | 17% | 1,584,135 | $5,144,971 |

| EMT | Emetals Limited | 0.007 | 17% | 170,000 | $5,100,000 |

| HLX | Helix Resources | 0.0035 | 17% | 62,262 | $6,969,438 |

| NAG | Nagambie Resources | 0.028 | 17% | 18,214 | $19,056,905 |

Up top for the Small Caps on Tuesday morning was City Chic Collective (ASX:CCX), with a 23% gain on news that the company has weathered a difficult six months that saw cost-cutting, inventory clearing and a headcount reduction result in a dip in revenue to ~$53.8 million for it’s Australia/New Zealand sector, down 32% on PCP.

Similarly, revenue fell to ~$52.0 million – down 26% in PCP – for its Americas division, but despite how that looks, it’s actually good news for the company.

The result is in line with the strategic decisions the company has made in an effort to get the business back on track, with inventory expected to be approximately $39.5 million at the end of H1 FY24, down 27% from July when the company was massively overstocked and struggling.

Similarly, a happy news story from LiveHire (ASX:LVH) helped it to a prize-winning gain in early trade, with the company reporting Q2 positive Net Operating Cashflow of $0.8m, and clearly very grateful for the $1.4 million R&D refund that pushed it into positive territory.

Delivery platform Zoom2u Technologies (ASX:Z2U) has also delivered a quarterly this morning, showing that group revenue for Q2 FY24 is at $1.6 million, 37% higher on PCP, which was good enough news to get investors in behind a climb of around 18% through the morning.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 30 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| MKL | Mighty Kingdom Ltd | 0.008 | -33% | 2,970,240 | $5,711,085 |

| WEC | White Energy Company | 0.034 | -32% | 10,164 | $5,661,767 |

| AMT | Allegra Medical | 0.031 | -30% | 167,741 | $5,262,885 |

| VRC | Volt Resources Ltd | 0.005 | -29% | 23,490,126 | $28,910,747 |

| KOR | Korab Resources | 0.011 | -27% | 1,694,520 | $5,505,750 |

| BNL | Blue Star Helium Ltd | 0.017 | -26% | 28,502,056 | $44,672,101 |

| ADD | Adavale Resource Ltd | 0.006 | -25% | 4,035,488 | $6,489,377 |

| AUG | Augustus Minerals | 0.06 | -25% | 377,012 | $6,729,600 |

| CZN | Corazon Ltd | 0.01 | -23% | 543,626 | $8,002,773 |

| PVW | PVW Res Ltd | 0.044 | -23% | 47,046 | $5,780,072 |

| RMI | Resource Mining Corp | 0.024 | -23% | 127,006 | $17,432,782 |

| KNB | Koonenberry Gold | 0.048 | -20% | 66,347 | $7,184,945 |

| 1MC | Morella Corporation | 0.004 | -20% | 603,387 | $30,893,997 |

| CHK | Cohiba Minerals | 0.002 | -20% | 8,229,167 | $6,325,575 |

| M4M | Macro Metals Limited | 0.002 | -20% | 812,500 | $6,167,694 |

| NES | Nelson Resources | 0.004 | -20% | 2,250,000 | $3,067,972 |

| PUA | Peak Minerals Ltd | 0.002 | -20% | 900,000 | $2,603,442 |

| ME1DA | Melodiol Global Health | 0.018 | -18% | 1,036,952 | $5,201,706 |

| R8R | Regener8 Resources NL | 0.125 | -17% | 150,000 | $3,848,438 |

| LRL | Labyrinth Resources | 0.005 | -17% | 31,750 | $7,125,262 |

| RR1 | Reach Resources Ltd | 0.0025 | -17% | 2,342,835 | $9,630,891 |

| STM | Sunstone Metals Ltd | 0.01 | -17% | 2,017,237 | $41,852,819 |

| TSL | Titanium Sands Ltd | 0.01 | -17% | 2,279,743 | $23,924,763 |

| ICR | Intelicare Holdings | 0.016 | -16% | 25,000 | $4,461,665 |

| 1AG | Alterra Limited | 0.006 | -14% | 70,000 | $5,825,030 |

ICYMI – AM Edition

Greenvale Energy (ASX:GRV) has advised the market that it has entered into a conditional term sheet for the sale of its 20% shareholding in Knox Resources, the 100% owner of the Georgina Basin Project in the Northern Territory, to Astute Metals.

BPM Minerals (ASX:BPM) has kicked off a 10,000m drilling program along strike of Capricorn Metals’ (ASX:CMM) 3.24Moz Mt Gibson Gold Project, just 500m from Capricorn’s recent intersection of 16m @ 17.16g/t from 32m.

Adavale Resources (ASX:ADD) has landed some new funding, receiving commitments to raise $1.5 million through a private placement priced at $0.007 per share from new and existing professional and sophisticated investors, following a successful push from leading Melbourne boutique broker, Peak Asset Management.

Meanwhile, the board of Venture Minerals (ASX:VMS) would like everyone to know that it has engaged Argonaut PCF as advisor on the Riley Iron Ore Mine to undertake a strategic review of the asset.

Blue Star Helium (ASX:BNL) is continuing its run of happy news, alerting the market that the BBB #33 helium well at the high-grade Voyager helium development in Las Animas County in Colorado has been drilled to the targeted total depth of 935 feet.

Locksley Resources (ASX:LKY) has wrapped up follow-up sampling for high-grade REEs in the anomalous catchment areas within the North Block Claim in its Mojave Project, CA – with assay results expected in Q1 2024.

And last but not least, Paradigm Biopharmaceuticals (ASX:PAR) has managed to snag not one, but two influential podium presentations at the upcoming 2024 ORS Annual Meeting in California, and the 2024 OARSI World Congress on Osteoarthritis in Vienna, Austria – which, in case you were wondering, is quite a coup.

The post ASX Small Caps Lunch Wrap: Who’s come up with a brutal way to get back at your ex on Valentine’s Day? appeared first on Stockhead.