Local markets are tracking slightly higher this morning, with the benchmark hovering around +0.13% at midday but looking like it’s in the mood to firm up quite nicely after a bruising two hours for most of the market since the doors were flung open at 10am.

The market got off to bumpy start ahead of the release of the RBA’s minutes from its most recent luncheon-fest, which really didn’t contain many surprises once it dropped mid-morning.

The highlight was an amusing portion of the note that suggests that perhaps… just perhaps… the RBA has a flair for dramatic understatement when it comes to giving reasons for its decisions.

“Members noted growing signs of a mindset among businesses that any cost increases could be passed onto consumers,” the RBA statement said.

Members no doubt also noted that the sky is blue, water is wet and England is s..t at cricket.

“In this environment, members assessed that tightening monetary policy at this meeting would help to mitigate the risk of an unwelcome rise in inflation expectations,” the note continued, giving Australians some optimism in the face of the egregious price gouging that has seen corporate profits hitting record levels, while the plebs bleed by the gallon from our wounded hip pockets.

… but anyway, in far cheerier news, the operators of a Colorado funeral home have reportedly been arrested after authorities found dead bodies on the premises.

Obviously, you’d expect that there would be corpses around the place if it’s a funeral home, but the issue for authorities was the number of dead folks they found: 189.

Which is, by any reasonable measure, too many.

The business, Return to Nature Funeral Home, is located in Penrose, a small town about 160km south of Denver, Colorado, and promised its customers either your bog-standard cremations, or the option of enviro-friendly “green” burials, without the use of embalming fluids.

The first inkling that something was awry were reports to police of an awful smell emanating from the premises in early October.

Officials contacted the owner, who told them everything was fine, and that any odours coming from the building were due to his hobby of amateur taxidermy – which set more than a few sets of Spidey Sense a-tingling among investigators.

Police moved in and found nearly 200 dead people in various stages of decomposition stinking the place up – and the business owners nowhere to be seen.

The business owner, reported as Jon Hallford, and his wife have since been arrested on charges of abuse of a corpse, money laundering and forgery, after police caught up with them nearly 1100km away in Muskogee, Oklahoma.

TO MARKETS

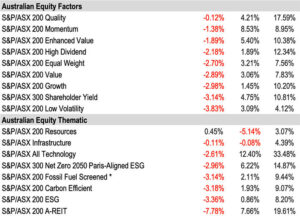

As mentioned, at midday today the ASX 200 benchmark was at +0.13%. That’s notable, because it’s exactly where the hugely influential Financials sector was sitting, too – right on +0.13%.

The rest of the market was a bit of a shambles – Materials was way out in front of the pack, and the rest of the pack was well into the red to varying degrees.

Real Estate and Energy had posted modest drops, but Utilities was deep into negative territory.

Interestingly, the local InfoTech sector has also had a rough morning, down close to 1.0% despite most of the gains from Wall Street that usually buoy local sentiment quite nicely came from the US tech sector.

I’ll explain that in a minute or two – but first, a quick look at the top end of town to see who’s making waves.

It should come as no surprise, given the shape of the sector results this morning, that the Big Dollar winners this morning are the usual rogue’s gallery of lithium players.

Pilbara Minerals (ASX:PLS) is leading the Aussie digger charge today, up 3.5%, Allkem (ASX:AKE) is not far behind on +2.8% and Mineral Resources (ASX:MIN) is up 2.5% – all on no particular news, but part of a pattern of investor buy-in for lithium on the local market.

Leading the losses among the big kids is Origin Energy (ASX:ORG) , down 2.3% this morning, and AGL Energy (ASX:AGL) is also feeling the pinch this morning, losing 1.3%.

Interestingly, though, kiwi energy concern Mercury NZ (ASX:MCY) has bucked the energy-sapping trend, and was at one stage the Large Cap leader this morning, but has since retreated to a more modest 2% gain for the day thus far.

NOT THE ASX

In New York, the S&P 500 rose by +0.74%, the blue chips Dow Jones index was up by +0.58%, and the tech-heavy Nasdaq climbed by +1.13%.

The banner headline news from the session was both Nvidia and Microsoft hitting all time highs, with Nvidia breaking through the US$500 per share barrier to close at $504, ahead of a crucial earnings report tonight (our time).

All eyes are on any sort of guidance that the Nvidia report contains, as the company quite famously plays its cards close to its chest when it comes to forecasting results.

Plus, there are some possibly quite considerable headwinds brewing for Nvidia, too – the heavy restrictions on being able to sell into the Chinese market are most likely yet to be felt in terms of the company’s bottom line, and direct competitor AMD’s game of catch-up appears to be getting stronger by the day.

Meanwhile, Microsoft – one of Nvidia’s major customers in the AI space – scored big overnight, in the wake of a terrible chain of events at AI giant OpenAI.

OpenAI is in major trouble, after the board ousted CEO Sam Altman on Friday due to “unspecified issues with his communications”, according to CNBC.

It took Microsoft less than 48 hours to woo Altman on board to head up a new, largely independent AI R&D effort at Microsoft, which is stunningly fast movement on Microsoft’s part.

Almost too fast, now that I think about it.

OpenAI’s board immediately came under heavy criticism when news of Altman’s ousting broke – and almost the entirety of the team at OpenAI has taken the opportunity to grasp the handle of the knife in OpenAI’s back and give it a mighty twist.

At the time of writing, more than 660 of the 770 employees at OpenAI have signed an open letter to the board, which basically says “you guys are idiots and need to leave – if you don’t, we’re going with Sam to Microsoft”.

It’s a teetering catastrophe for OpenAI, which is currently being steered by the co-founder of streaming service Twitch, Emmett Shear, in an interim CEO role while the drama unfolds.

In US stock news, Boeing rallied almost 5% after Deutsche Bank upgraded the shares following the acceleration of new jet deliveries.

Giant pharmaceutical firm Bayer AG dropped the most in its history, down -18% last night after aborting a large late-stage trial testing a new anti-clotting drug.

Bristol-Myers Squibb also slumped 4% after saying the US FDA delayed a decision on the expanded use of its blood cancer treatment.

Many thanks to Earlybird Eddy Sunarto for his stellar reporting on what’s happened while the rest of us were fast asleep.

In Japan, the Nikkei is down just 0.09% on news that Japan’s “Weak Men’s Centre” has called for a “men only” train car to be introduced to the nation’s commute.

Currently, there are women-only train cars designated on a number of major train lines in Japan, in a bid to combat the national sport of Chikan, in which sex pests grope unsuspecting women on trains for cheap sexual thrills.

The Weak Men’s Centre is a very-real, actual government-backed organisation, put together to raise awareness that men are sometimes the victims of sexual assault by women, which is fair enough at a basic level.

But it’s not doing itself any favours with the name – especially since the call for a “men only” rail carriage is itself so weak, that it specifically states that it’ll be okay for women to ride in the carriage as well.

In China, Shanghai markets are up 0.6% and in Hong Kong, the Hang Seng is up 1.24% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 21 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ROO | Roots Sustainable | 0.007 | 75% | 13,076,870 | $642,410 |

| PR1 | Pure Resources | 0.275 | 62% | 14,166,695 | $4,360,502 |

| AMD | Arrow Minerals | 0.0015 | 50% | 8,708,968 | $3,023,765 |

| AYT | Austin Metals Ltd | 0.008 | 33% | 902,783 | $6,095,248 |

| TCG | Turaco Gold Limited | 0.09 | 29% | 5,816,046 | $35,190,167 |

| CUF | Cufe Ltd | 0.014 | 27% | 2,668,755 | $12,607,236 |

| TG1 | Techgen Metals Ltd | 0.083 | 26% | 7,420,568 | $5,093,107 |

| CBY | Canterbury Resources | 0.03 | 25% | 241,666 | $3,468,565 |

| DTR | Dateline Resources | 0.0125 | 25% | 777,023 | $13,129,455 |

| CC9 | Chariot Corporation | 0.52 | 24% | 887,679 | $30,799,259 |

| CDD | Cardno Limited | 0.345 | 23% | 53,721 | $10,936,986 |

| GHY | Gold Hydrogen | 0.84 | 23% | 705,199 | $38,992,271 |

| BVR | Bella Vista Resources | 0.12 | 22% | 8,837 | $4,727,367 |

| AMM | Armada Metals | 0.034 | 21% | 349,836 | $4,831,906 |

| EPM | Eclipse Metals | 0.009 | 20% | 739,272 | $15,328,532 |

| FGH | Foresta Group | 0.012 | 20% | 349,666 | $22,395,028 |

| FHS | Freehill Mining Ltd. | 0.003 | 20% | 200,000 | $7,112,003 |

| WNR | Wingara Ag Ltd | 0.024 | 20% | 231,666 | $3,510,850 |

| JRV | Jervois Global Ltd | 0.044 | 19% | 15,291,145 | $99,993,265 |

| RHK | Red Hawk Mining Ltd | 0.585 | 18% | 3,487 | $83,580,046 |

| CVV | Caravel Minerals Ltd | 0.21 | 17% | 895,313 | $94,370,364 |

| CCO | The Calmer Co Int | 0.007 | 17% | 6,373,114 | $4,902,716 |

| BML | Boab Metals Ltd | 0.145 | 16% | 359,340 | $21,807,846 |

| CCA | Change Financial Ltd | 0.06 | 15% | 100,000 | $32,638,392 |

| IMU | Imugene Limited | 0.1025 | 15% | 75,223,286 | $637,682,762 |

Roots Sustainable Agricultural Technologies (ASX:ROO) is leading the Small Caps pack this morning, currently up around 75% on news that it has successfully completed an equipment delivery via air shipping from Israel to the United Arab Emirates, to major agriculture client Silal Food and Technology.

Roots says the ag-tech it has supplied is set to be installed this week, enabling the demonstration of the “application of Root Zone Temperature optimisation technology as part of its berry farming operations at the COP28 global conference at Expo City, Dubai in early December”.

In second place on the ladder, Pure Resources (ASX:PR1) has jumped 62% on news of some decent lithium finds in mica at the company’s Järkvissle project in Sweden, with the standout report of field testing returning analysis up to 11.69% from one sample.

That is, clearly, astonishingly high – and it should be noted that the resting was performed using a LIBS system in the field.

LIBS, short for Laser Induced Breakdown Spectroscopy, is an off-the-shelf, often portable analysis technique that uses spot readings of super-heated samples to determine the chemical composition of the material being tested.

It is similar in many ways to portable XRF readings, in that the accuracy of the sampling method is the subject of some pretty fierce debate.

Third on the list (with news to report) is Turaco Gold (ASX:TCG) which mysteriously started flying off the shelves on 14 November for no apparent reason at all, before going into a trading halt on 17 November ahead of today’s announcement.

Turns out that Turaco is set to acquire a 70% interest in the Afema Gold Project in southeast Cote d’Ivoire, which boasts a granted mining permit covering 227km2, supported by an executed mining convention.

The project “covers the extensions and confluence of the two world-class Ghanian gold belts being the Sefwi-Bibiani (Ahafo, Bibiani, Chirano deposits) and the Asankrangwa (Essase, Obotan deposits) gold belts”, according to Turaco’s announcement.

Prior exploratory drilling at the site has returned some promising intercepts, including 25m @ 4.44g/t from 112m, and 58m @ 1.30g/t from 58m.

Turns out those lucky enough to have been speculating last week may well have been on the money after all.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 21 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Global Health | 0.002 | -33% | 16,380,970 | $12,477,689.75 |

| RNE | Renu Energy Ltd | 0.017 | -23% | 3,628,326 | $9,844,759.76 |

| CHK | Cohiba Minerals | 0.002 | -20% | 3,000,000 | $5,533,110.46 |

| TOY | Toys R Us | 0.013 | -19% | 3,342,431 | $15,719,416.08 |

| AUH | Austchina Holdings | 0.0025 | -17% | 100,000 | $6,233,650.91 |

| LRL | Labyrinth Resources | 0.005 | -17% | 393,120 | $7,125,262.21 |

| MEL | Metgasco Ltd | 0.01 | -17% | 1,342,775 | $12,766,640.94 |

| ID8 | Identitii Limited | 0.021 | -16% | 336,695 | $10,680,950.35 |

| CBL | Control Bionics | 0.041 | -15% | 30,400 | $4,915,628.06 |

| ADR | Adherium Ltd | 0.003 | -14% | 2,125,000 | $17,505,578.39 |

| CCZ | Castillo Copper Ltd | 0.006 | -14% | 122,000 | $9,096,537.49 |

| IBG | Ironbark Zinc Ltd | 0.006 | -14% | 50,000 | $10,267,489.83 |

| ION | Iondrive Limited | 0.012 | -14% | 1,000,000 | $6,807,993.91 |

| SGF | SG Fleet Group Ltd | 2.23 | -13% | 32,208,043 | $878,901,244.40 |

| AI1 | Adisyn Ltd | 0.02 | -13% | 36,200 | $3,215,109.81 |

| HNR | Hannans Ltd | 0.007 | -13% | 3,067,064 | $21,846,838.47 |

| MZZ | Matador Mining Ltd | 0.042 | -13% | 170,044 | $18,924,927.89 |

| LDR | Lode Resources | 0.079 | -12% | 366,757 | $9,610,573.05 |

| HFR | Highfield Resources | 0.33 | -12% | 185,689 | $147,068,899.88 |

| CPO | Culpeo Minerals | 0.031 | -11% | 2,450,774 | $4,079,682.67 |

| AVH | Avita Medical | 3.41 | -11% | 436,746 | $230,364,499.20 |

| NIS | Nickel Search | 0.12 | -11% | 10,557,848 | $24,157,627.38 |

| DTI | DTI Group Ltd | 0.016 | -11% | 24,345 | $8,073,925.45 |

| OSL | Oncosil Medical | 0.008 | -11% | 94,000 | $17,782,570.19 |

| SRZ | Stellar Resources | 0.008 | -11% | 69,777 | $9,883,678.18 |

The post ASX Small Caps Lunch Wrap: Whose house full of rancid corpses got them in serious trouble this week? appeared first on Stockhead.