The ASX is tracking a little higher today, despite having the wind knocked out of its sails a little when Jim Chalmers delivered his Mid‑Year Economic and Fiscal Outlook (MYEFO) report, which briefly set the market tumbling mid-morning.

But it got better. Mostly.

I’ll get into the details shortly, but first some news out of the United States of America, the nation whose lawmakers have unwittingly set themselves up for a very un-merry Christmas.

The Iowa State Capitol is home to some pretty excitable representatives, who have found themselves backed into a pretty uncomfortable corner.

A portion of the building was set aside to allow for the display of Christmas decorations – a chance for the more religious members of the state legislature to promote their brand of Christianity to the masses, despite the concept flying very close to the whole “separation of church and state” bone that’s in the US Constitution.

When asked if that was open to any religiion, and not just Christianity, the state representatives hands were forced – they couldn’t, after all, claim that their decorations were okay, but those of any other religions weren’t.

So, in the spirit of inclusion, The Satanic Temple turned up and put their statue of Baphomet on full display – and everybody has lost their minds.

“It’s abhorrent to see something like a display like this. It’s a travesty, to see in our Capitol I don’t know why it’s allowed to be here,” Pastor Joel Tenney with Alpha Pneuma Ministries told local media.

Ho ho ho.

Iowa’s not alone in dealing with what is rapidly turning into a massive own goal.

The National Railroad Museum in Green Bay, Wisconsin, traditionally holds a similar exhibition each year, celebrating the festive decorations of different churches and faiths at this time of year.

The Satanic Temple has its own tree on display there this year, and local Republican Senator Mike Gallagher is not happy about it… no sir, not one little bit.

“It’s impossible to overstate how offensive this is to Christians. It would be, in quite a literal sense, the same thing as waving a Hamas flag inside of a synagogue,” he told Fox News, ruining pretty much any chance he has of ensuring that Satan will come down his chimney on Christmas Eve this year.

TO MARKETS

The ASX was rising at a modest – dare I say it, sedate – pace this morning after a lukewarm lead in from Wall Street overnight, while local investors picked away at a couple of fast movers when the doors came open and the rest of the market waited for Aussie Treasurer Jim Chalmers to deliver the Mid‑Year Economic and Fiscal Outlook.

Here’s a quick-glance look at which way the needle was moving for the benchmark this morning – see if you can spot the moment when Chalmers started flapping his gums.

Despite the optics, it wasn’t all bad news.

Real wages are stagnating, the cost of living keeps rising, global conflicts – particularly those in Gaza and Ukraine – are giving everyone the willies and China’s economy being backed up worse than an octogenarian with a prune allergy…

But, Chalmers did point out that “there are substantial risks to the economic outlook” … which is also pretty bad.

I have no doubt that someone a lot smarter than me will be along shortly to provide some much better insight into what the Mid‑Year Economic and Fiscal Outlook actually means – it’s well beyond my “I dropped out of Year 9 Economics because my teacher hit me with a cricket bat” education level to digest and regurgitate it in full this morning.

So – let’s settle on “Chalmers momentarily tanked the benchmark, but it got better” and leave it at that.

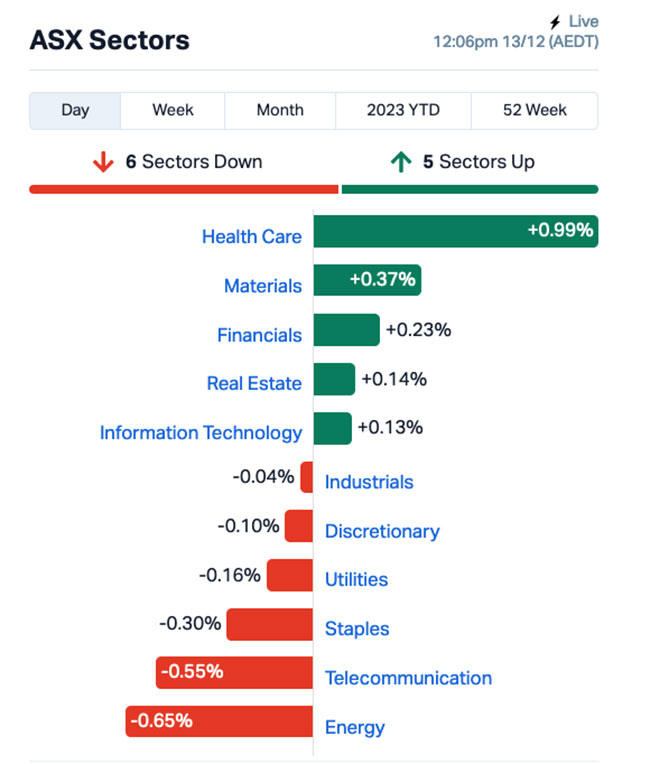

Looking at the sectors, Health Care is out in front – no doubt the proposed Sigma merger to allow Chemist Warehouse to stealth its way onto the ASX has a lot to do with that this morning – and Materials is doing pretty well, thanks to a couple of days of solid exploration results.

But… Energy is the issue – the sector is once again on the receiving end of a profoundly enthusiastic kicking, after oil prices slid quite markedly overnight, thanks to oversupply concerns and China’s statuesque economic outlook.

NOT THE ASX

Local markets were set to open flat this morning, after a session on Wall Street overnight that left the S&P 500 up by +0.38%, the blue chips Dow Jones index up by +0.43% and the tech-heavy Nasdaq up as well, by +0.60%.

US investors weren’t really in a spending mood, it seems, after fresh data showed that while the US inflation rate slipped to 3.1% in November from 3.2% the previous month, the closely watched Core Inflation (sme thing, but without counting food and energy costs) rose 0.3% in the same period.

The wider reasoning suggests that these are the sort of numbers that will shore up intellectual support for the US Fed to start taking chainsaw to interest rates sometime in the 2nd quarter of 2024.

However, Earlybird Eddy Sunarto reports that one expert has warned that investors should not be overconfident the Fed will cut rates soon.

“Inflation remains sticky. The Fed will not want to take the risk of pivoting on policy too soon by cutting rates,” said Nigel Green of deVere Group.

“We believe that the data is still not strong enough for the central bank of the world’s largest economy to commit to reversing its most aggressive tightening campaign in decades – yet the markets seem ready to confidently and heavily price-in rate cuts.”

In US stock news, Alphabet fell -0.66% after Google lost a monopoly case to Fortnite maker, Epic Games.

Epic Games sued Google in 2020, accusing it of unlawfully making its app store dominant over rivals, and now jurors in San Francisco agreed with Epic and found that the search giant had operated an illegal monopoly.

Speaking after the verdict, Google affairs and public policy VP Wilson White said the company plans to appeal the verdict and that “the trial made clear that we compete fiercely with Apple and its App Store, as well as app stores on Android devices and gaming consoles.”

A spokesperson for Epic responded by saying “skill issue”, and teabagging Google’s legal team until he was booted from the server.

Computer maker HP Inc fell -0.43% after Berkshire Hathaway cut its holding in the stock by half. Berkshire had held 5.2% of HP on November 30.

In Asian market news, Japan’s Nikkei is up 0.63%, Hong Kong’s Hang Seng is down 0.38% and Shanghai markets are currently flat, but that will almost definitely change.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 13 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SIG | Sigma Health Ltd | 1.065 | 43% | 47,811,205 | $810,346,458 |

| AOA | Ausmon Resources | 0.004 | 33% | 500,000 | $3,020,998 |

| ENT | Enterprise Metals | 0.004 | 33% | 1,000,000 | $2,398,413 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 3,815,840 | $11,677,324 |

| ASR | Asra Minerals Ltd | 0.009 | 29% | 2,060,591 | $11,402,970 |

| LBT | LBT Innovations | 0.014 | 27% | 506,000 | $13,820,998 |

| KNB | Koonenberry Gold | 0.042 | 24% | 494,324 | $4,071,469 |

| CNJ | Conico Ltd | 0.006 | 20% | 160,539 | $7,850,475 |

| IPB | IPB Petroleum Ltd | 0.012 | 20% | 2,588,214 | $5,651,224 |

| NYR | Nyrada Inc. | 0.026 | 18% | 8,166 | $3,432,191 |

| AW1 | American West Metals | 0.135 | 17% | 1,643,470 | $42,750,556 |

| BAT | Battery Minerals Ltd | 0.07 | 17% | 740,956 | $8,061,870 |

| LML | Lincoln Minerals | 0.007 | 17% | 175,000 | $10,224,272 |

| RIL | Redivium Limited | 0.007 | 17% | 92,138 | $16,385,129 |

| ATS | Australis Oil & Gas | 0.015 | 15% | 910,249 | $16,469,252 |

| AYT | Austin Metals Ltd | 0.008 | 14% | 97,910 | $7,111,123 |

| NES | Nelson Resources | 0.004 | 14% | 700,000 | $2,147,580 |

| SWP | Swoop Holdings Ltd | 0.25 | 14% | 194,721 | $45,805,966 |

| CKA | Cokal Ltd | 0.135 | 13% | 1,078,777 | $129,473,878 |

| BCT | Bluechiip Limited | 0.018 | 13% | 332,853 | $12,593,409 |

| OSL | Oncosil Medical | 0.009 | 13% | 135,000 | $15,796,329 |

| RNT | Rent.Com.Au | 0.018 | 13% | 404,710 | $8,442,256 |

| RR1 | Reach Resources Ltd | 0.0045 | 13% | 4,007,246 | $12,841,188 |

| TEM | Tempest Minerals | 0.009 | 13% | 221,606 | $4,091,068 |

| HFR | Highfield Resources | 0.325 | 12% | 50,067 | $113,733,283 |

Leading the market today is Healthcare large capper Sigma Healthcare, which has gone flying this morning on news of a multi-billion dollar merger being put together to allow retail behemoth Chemist Warehouse to backdoor list on the ASX.

The actual news from Sigma this morning was only tangentially related to that merger, as it was all about the completion of a fully underwritten 1 for 1.85 pro-rata accelerated non-renounceable entitlement offer to raise approximately $400 million.

Sigma CEO Vikesh Ramsunder said that the offer had been well-supported, and that Sigma plans to use the funds raised on increased working capital requirements and progress business growth initiatives, including relaunching Sigma’s Amcal and Discount Drug Store brands and expanding the company’s “private and exclusive label” product range.

Ramsunder also said that, in the event the proposed merger does go ahead, “some of the net proceeds from the Entitlement Offer may instead be used to partially fund the cash consideration by Sigma under the Proposed Merger”. So there’s that.

In second place today is small explorer Koonenberry Gold, which is celebrating a win this morning with an announcement featuring two words investors love to read: “visible gold”.

Drilling at the company’s the Bellagio gold prospect has hit widespread quartz veins below the weathered zone, containing visible gold down dip from the Koonenberry’s previously reported intercept of 10m @ 1.61g/t Au, which – just so we’re clear – did not have any visible gold.

“Below the strongly weathered zone, quartz veins are associated with sericite-silica hydrothermal alteration and trace arsenopyrite over a +125m wide zone,” KNB says.

“This is significant as sericite-silica alteration is a common feature of many orogenic gold systems” – orogenic referring to the crumple zone that makes mountain ranges when two tectonic plates collide.

I looked it up, so that you didn’t have to.

And the third stock worth a mention in the winner’s list for today is American West, which is on the rise after revealing that it is sitting on the only known domestic indium resource in the United States.

Indium is one of those rare critical minerals that most people have never heard of, but without which they wouldn’t be able to play Candy Crush or send shockingly lewd Tinder messages to each other, as it’s a pretty important element in the manufacture of things like mobile phones and emojis.

AW1’s indium resource isn’t just unique in terms of its geological placement, but also pretty big – the company is reporting a JORC compliant resource of some 23.8Moz of indium at the site, nestled cheek-by-jowl with an equally impressive total of 119Koz of gold, 1.3Mt zinc, 49Kt copper and 10Moz silver.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 4 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.001 | -50% | 110,232 | $6,590,311 |

| AVW | Avira Resources Ltd | 0.001 | -33% | 529,000 | $3,200,685 |

| VPR | Volt Power Group | 0.001 | -33% | 1,117 | $16,074,312 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 1,750,000 | $3,671,126 |

| KPO | Kalina Power Limited | 0.003 | -25% | 125,129 | $7,623,685 |

| MSG | Mcs Services Limited | 0.015 | -25% | 150,000 | $3,961,993 |

| NNL | Nordic Nickel | 0.13 | -24% | 16,666 | $9,938,201 |

| WEC | White Energy Company | 0.034 | -21% | 2,397,781 | $2,941,466 |

| 8CO | 8Common Limited | 0.051 | -20% | 30,000 | $14,342,074 |

| AUH | Austchina Holdings | 0.004 | -20% | 24,090 | $10,389,418 |

| TMG | Trigg Minerals Ltd | 0.009 | -18% | 30,000 | $4,122,318 |

| KGD | Kula Gold Limited | 0.015 | -17% | 3,651,208 | $7,548,584 |

| RCR | Rincon | 0.03 | -17% | 4,471,494 | $6,395,864 |

| IVX | Invion Ltd | 0.005 | -17% | 5,002 | $38,529,793 |

| SGC | Sacgasco Ltd | 0.01 | -17% | 701,981 | $9,282,993 |

| IVR | Investigator Resources | 0.039 | -15% | 3,592,581 | $66,109,821 |

| AAP | Australian Agricultural Projects | 0.017 | -15% | 27,551 | $6,101,990 |

| PAT | Patriot Lithium | 0.175 | -15% | 66,239 | $14,046,012 |

| CCZ | Castillo Copper Ltd | 0.006 | -14% | 2,334 | $9,096,537 |

| FHS | Freehill Mining Ltd. | 0.003 | -14% | 11 | $9,974,421 |

| HOR | Horseshoe Metals Ltd | 0.006 | -14% | 986,894 | $4,504,351 |

| MTB | Mount Burgess Mining | 0.003 | -14% | 16,591 | $3,656,847 |

| OPN | Oppenneg | 0.006 | -14% | 1,067,059 | $7,904,257 |

| PXX | Polarx Limited | 0.006 | -14% | 1,404,599 | $11,477,317 |

| R8R | Regener8 Resources NL | 0.125 | -14% | 25,372 | $3,720,156 |

The post ASX Small Caps Lunch Wrap: Whose Christmas celebrations took a very dark turn this week? appeared first on Stockhead.