A mixed lead-in from Wall Street and sinking commodity prices have combined to leave the ASX in a weak position this morning, with the benchmark working hard to be positive but falling 0.14% short by the time we broke for lunch.

I’ll get into that shortly, but first, there’s news from an aquarium in the United States that is sure to cause paralysing fear among swimmers and scientists alike.

According to staff at the Aquarium and Shark Lab by Team ECCO in Hendersonville, North Carolina, one of their resident stingrays – a temptress, seductively-named “Charlotte” – is pregnant.

Staff noticed something was amiss when Charlotte began to display signs growth in her belly. Concerned that she might have some kind of tumour, they ran her through a CT scanner and found to their surprise that she’s actually expecting a clutch of babies.

The issue is that Charlotte hasn’t been anywhere near another stingray for quite some time, leaving her handlers baffled as to how it has come to be that she’s clearly knocked up – considering that most of the usual signs of pregnancy (swollen ankles, increased breast size and a catastrophic desire to shop for everything all at once) were absent.

Staff had noticed that Charlotte was showing some signs of wear and tear in recent months, including bite marks on her outer edges – so staff methodically removed all of the other smaller fish from Charlotte’s enclosure.

That included a gang of three young sharks – including two 1-year-old white spot bamboo males – and it’s those horny teenaged sharks that are currently the leading theory on how Charlotte got preggers.

The theory goes that it was those sharks, deep in the grip of teenager-level hormonal activity, saw an opportunity to get their rocks off, and have been messing around with poor little Charlotte, and have somehow managed to successfully mate with her.

Charlotte is due to give birth “imminently”, leaving the research team to have a number of sleepless nights ahead of the arrival of whatever Lovecraftian horror is set to emerge from inside her.

The scans have at least ruled out the worst case scenario – Charlotte’s babies are pretty much stingray shaped, canning the utter horror of a new type of shark sporting a venomous spike at one end, and a mouthful of very pointy teeth up the other.

Which leaves us with the possibility that the world is on course to have a very bitey stingray to contend with – and because Steve Irwin remains stubbornly unavailable to help the world deal with it, I reckon it’s time to hit the panic button and move into a treehouse, hundreds of miles inland.

TO MARKETS

Local markets opened lower this morning, after Wall Street delivered a mixed bag on Friday night, leaving local shares moving along with the trends set in New York when things got cooking this morning.

The ASX 200 was doomed to lose value early – and it did – after commodity prices fell further overnight, leaving the unlikely trio of tin, silver and oil on the rise while pretty much everything else continued last week’s decline.

By lunchtime, the ASX 200 had an initial 35 point slump, recovered a bit but then started to waver again when the unmistakable waft of the tea-lady’s perfume permeated the markets shortly after 11:15am.

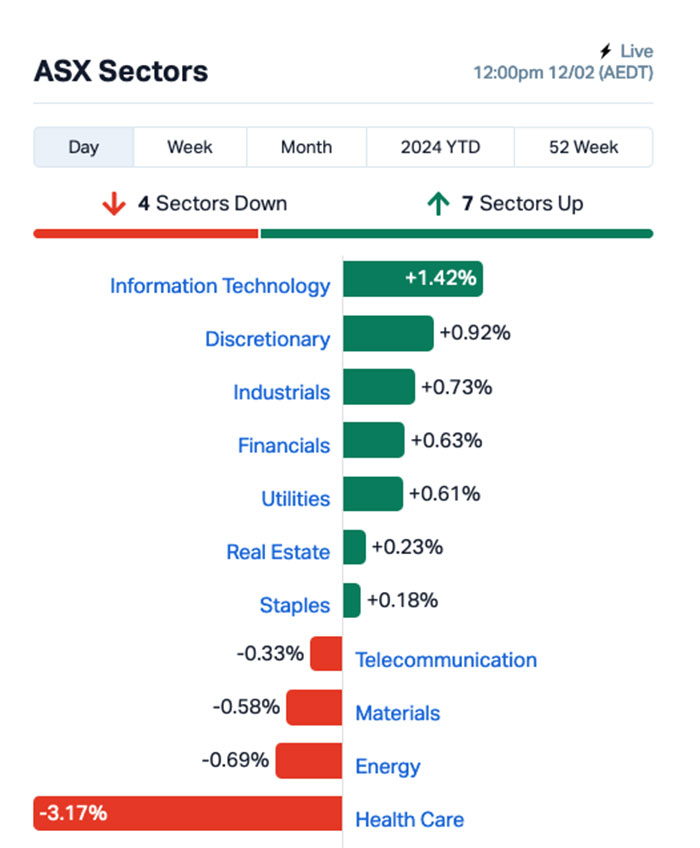

By midday, it had become apparent that the ASX 200 was unlikely to be firing on all cylinders today, despite a surge in tech stocks that (kind of) mirrored the Nasdaq’s performance on Friday.

A solid drop for Health Care stocks has really weighted heavilty this morning, with the culprit readily identifiable. CSL, a major health sector player, dropped some really bad news on the market this morning, after its big play into the global heart attack market stumbled at the third hurdle.

CSL (ASX:CSL) reported that its Phase 3 AEGIS-II trial evaluating the efficacy and safety of heart attack drug CSL112 “did not meet its primary efficacy endpoint of MACE – major adverse cardiovascular events – reduction at 90 days”.

CSL did also point out that there were “no major safety or tolerability concerns with CSL112”, so the issue is that the drug simply doesn’t do what it was meant to do.

The market has taken the news hard – it’s kinda rare for such a large company to have a drug trial fall apart at this stage of proceedings – and CSL is down close to 5.0%, joining Respiri (ASX:RSH) (-12.5%) and Cynata Therapeutics (ASX:CYP) (-10.5%) on the table of big losses for the sector today.

The rest of the sectors look like this:

Materials and Energy are facing mild sell-offs this morning thanks to variability in commodities over the weekend, which saw most of the majors – with the exception of crude, tin and silver – falling in price again.

NOT THE ASX

Friday night saw Wall Street unable to decide between the chicken and the fish, and so finished the session with a weird hybrid of wins and losses.

The banner headline was that the S&P 500 rose by +0.57% and closed above the 5,000 mark for the very first time at 5,026.

The tech-heavy Nasdaq partied along to celebrate, lifting by +1.25% to its highest level since November 2021 – but the Dow, clearly jealous because its younger siblings are hogging the limelight, sulked in its room and lost 0.14%.

Nvidia extended its ascent after Reuters reported that the company was “building a new business unit focused on designing bespoke chips for cloud computing firms and others, including advanced artificial intelligence processors”.

Earnings season continues and PepsiCo shares slipped by -3.55% after sales missed analysts’ estimates amid price hikes.

Biotech stock Moderna fell -6.7% after analysts at UBS and TD Cowen said GSK and Pfizer had shown better results for the efficacy of their experimental respiratory syncytial virus (RSV) vaccine than Moderna.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 12 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GCR | Golden Cross | 0.003 | 50% | 6,232 | $2,194,512 |

| ARR | American Rare Earths | 0.2275 | 42% | 6,386,800 | $71,427,728 |

| IPB | IPB Petroleum Ltd | 0.012 | 33% | 2,200,000 | $5,086,102 |

| REE | Rarex Limited | 0.021 | 31% | 2,333,781 | $10,934,185 |

| FTC | Fintech Chain Ltd | 0.014 | 27% | 5,000 | $7,158,465 |

| DOU | Douugh Limited | 0.005 | 25% | 263,000 | $4,328,276 |

| IEC | Intra Energy Corp | 0.0025 | 25% | 10,000,000 | $3,381,563 |

| SI6 | SI6 Metals Limited | 0.005 | 25% | 8,298,097 | $7,975,438 |

| MEM | Memphasys Ltd | 0.011 | 22% | 1,091,660 | $12,094,729 |

| M4M | Macro Metals Limited | 0.003 | 20% | 468,000 | $6,167,694 |

| AD8 | Audinate Group Ltd | 18.98 | 18% | 407,174 | $1,332,234,641 |

| VTI | Vision Tech Inc | 0.245 | 17% | 407 | $11,147,430 |

| 1AG | Alterra Limited | 0.007 | 17% | 2,804 | $4,992,883 |

| ASR | Asra Minerals Ltd | 0.007 | 17% | 142,857 | $9,818,974 |

| EMT | Emetals Limited | 0.007 | 17% | 71,576 | $5,100,000 |

| VAL | Valor Resources Ltd | 0.0035 | 17% | 1,429 | $12,661,004 |

| RFA | Rare Foods Australia | 0.046 | 15% | 427 | $8,197,973 |

| MNB | Minbos Resources Ltd | 0.095 | 14% | 642,115 | $65,672,651 |

| BMG | BMG Resources Ltd | 0.016 | 14% | 9,855,440 | $8,873,160 |

| OSL | Oncosil Medical | 0.008 | 14% | 1,035,000 | $13,821,788 |

| PAB | Patrys Limited | 0.008 | 14% | 16,916 | $14,402,131 |

| TOY | Toys R Us | 0.008 | 14% | 1,309,063 | $6,877,245 |

| VR1 | Vection Technologies | 0.032 | 14% | 5,757,572 | $31,544,491 |

| FRB | Firebird Metals | 0.12 | 14% | 56,750 | $14,947,947 |

| AZL | Arizona Lithium Ltd | 0.024 | 14% | 15,511,277 | $79,515,346 |

American Rare Earths (ASX:ARR) was way out in front of the game on Monday morning, despite not having any news for the ASX today – possibly on the heels of Friday’s investor presentation, and late news that chairman Ken Traub has been replaced by non-executive director Richard Hudson. Traub is set to remain on the board as a non-executive director.

But that seems kinda unlikely, given that 99.9% of the time, shuffling of the board is roundly ignored by investors, especially in the absence of any really juicy gossip.

Appen (ASX:APX) was climbing this morning, on news that the company has finalised details of additional measures to mitigate the impact of the loss of a material customer contract.

On 22 January, Appen was dealt a major blow when Google told the company that it would no longer require its services, bringing work between the two companies to a halt on or before 19 March 2024 – a huge blow for Appen, as Google’s contract was worth $82.8 million at a gross margin of 26% in In FY23.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 12 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.001 | -33% | 5 | $2,931,174 |

| RR1 | Reach Resources Ltd | 0.002 | -33% | 415,184 | $9,630,891 |

| WML | Woomera Mining Ltd | 0.004 | -33% | 53,037,767 | $7,308,834 |

| YPB | YPB Group Ltd | 0.002 | -33% | 1,580,602 | $2,371,384 |

| BNL | Blue Star Helium Ltd | 0.012 | -29% | 17,654,272 | $33,018,510 |

| BLG | Bluglass Limited | 0.034 | -26% | 9,770,086 | $71,267,113 |

| APL | Associate Global | 0.12 | -25% | 10,000 | $9,038,788 |

| PHX | Pharmx Technologies | 0.029 | -22% | 4,565,146 | $22,144,751 |

| CCO | The Calmer Co Int | 0.004 | -20% | 3,695,161 | $4,287,476 |

| NVQ | Noviqtech Limited | 0.002 | -20% | 2,453 | $3,273,613 |

| TSL | Titanium Sands Ltd | 0.009 | -18% | 343,414 | $21,931,032 |

| TIG | Tigers Realm Coal | 0.005 | -17% | 293,073 | $78,400,214 |

| CUS | Coppersearchlimited | 0.1 | -15% | 288,870 | $10,843,535 |

| BCT | Bluechiip Limited | 0.006 | -14% | 486,666 | $5,567,617 |

| FGL | Frugl Group Limited | 0.006 | -14% | 1,802,400 | $7,291,817 |

| KPO | Kalina Power Limited | 0.006 | -14% | 2,307,070 | $15,470,896 |

| MCL | Mighty Craft Ltd | 0.013 | -13% | 36,612 | $5,476,982 |

| UNT | Unith Ltd | 0.013 | -13% | 2,477,696 | $13,510,713 |

| SM1 | Synlait Milk Ltd | 0.695 | -13% | 154,715 | $173,772,420 |

| TNY | Tinybeans Group Ltd | 0.14 | -13% | 2,400 | $13,501,974 |

| FRX | Flexiroam Limited | 0.021 | -13% | 767,892 | $15,854,573 |

| M2M | Mtmalcolmminesnl | 0.021 | -13% | 113,200 | $2,816,244 |

| WCN | White Cliff Min Ltd | 0.015 | -12% | 15,239,418 | $22,709,609 |

| ABE | Ausbondexchange | 0.04 | -11% | 111,085 | $5,070,065 |

| FTL | Firetail Resources | 0.04 | -11% | 8,546 | $6,700,750 |

ICYMI – AM Edition

Oceana Lithium (ASX:OCN) has informed the market that Non-Executive Chairman Mr Jerome Vitale and Non-Executive Director Mr Simon Mottram have both resigned as directors with immediate effect, citing a desire to focus on their other business commitments.

Blue Star Helium (ASX:BNL) says that testing at its BBB #33 well in Nevada resulted in gas to surface flow containing approximately 3.0% helium, 92.4% nitrogen and 4.6% carbon dioxide, with the helium concentration gradually increasing over the life of the test and showing signs of ‘cleaning up’ at the end of the test.

The post ASX Small Caps Lunch Wrap: Is the world ready for a terrifying hybrid stingray shark? appeared first on Stockhead.