Local markets are down this morning. We’re not sure why, but your mum and I reckon it could just be normal teenage angst – or it’s possible that the market’s being bullied at school. Either that, or those meanies over on Wall Street have had a rough night again.

I’ll sit it down shortly to have a chat, see if I can find out what’s going on.

In the meantime, let’s head to Botswana, where the government is teeing up a protest with a fairly large difference.

Recently, Germany’s Environment Minister Steffi Lemke announced plans to ban the importation of hunting trophies, stopping the practice of idiots with guns heading overseas to shoot large things and bring bits of them back to show their friends how small their pee-pees are.

Which, pretty much any way you slice it, makes sense – except if you’re the President of Botswana, a country for whom trophy hunting is Big Biznus.

Botswana’s President Mokgweetsi Masisi has raised some concerns that a ban on trophy hunting could hurt his country’s economy in more ways than one.

Obviously, the loss of tourism dollars and hunting fees is likely to be a little rough – but Masisi has also raised the spectre of a much larger problem… elephant overpopulation.

Conservation efforts to save the long-nosed beastie in Botswana from poachers has been, apparently, wildly successful – so much so that any effort to reduce government sanctioned blasting of these creatures with high powered rifles will leave Botswana with a critical oversupply.

So, in an answer to Lemke’s proposal, Masisi says he has 20,000 elephants to give to Germany – and he’s being pretty insistent about it.

“Due to the overpopulation, 8,000 elephants have already been given to neighbouring Angola. Mozambique has yet to collect its quota,” says German news outlet Bild.

“And that is exactly how we would like to offer such a gift to the Federal Republic of Germany,” said Masisi, adding rather ominously: “We won’t take no for an answer.”

Germany, clearly, doesn’t have the infrastructure to deal with the sudden arrival of 20,000 elephants – and I strongly doubt that elephants who already call Germany home are likely to be happy about the idea of massive numbers of African migrant elephants turning up and stealing all the elephant jobs.

The scourge of unemployed elephants has already wreaked havoc in several African nations, with wild gangs of elephants roaming the streets of the savannah plains, knocking over trees and chasing tourists in Jeeps.

Germany has yet to respond to Botswana’s presidential decree, but it’s a safe bet that the phrase “lol, no” will feature prominently in any official reply.

TO MARKETS

The ASX is lower this morning, partially because Wall Street screwed the pooch last night while we were all asleep, leaving the S&P 500 down by -0.72%, while the blue chips Dow Jones index was down by -1%, and the tech-heavy Nasdaq slumped by -0.95%.

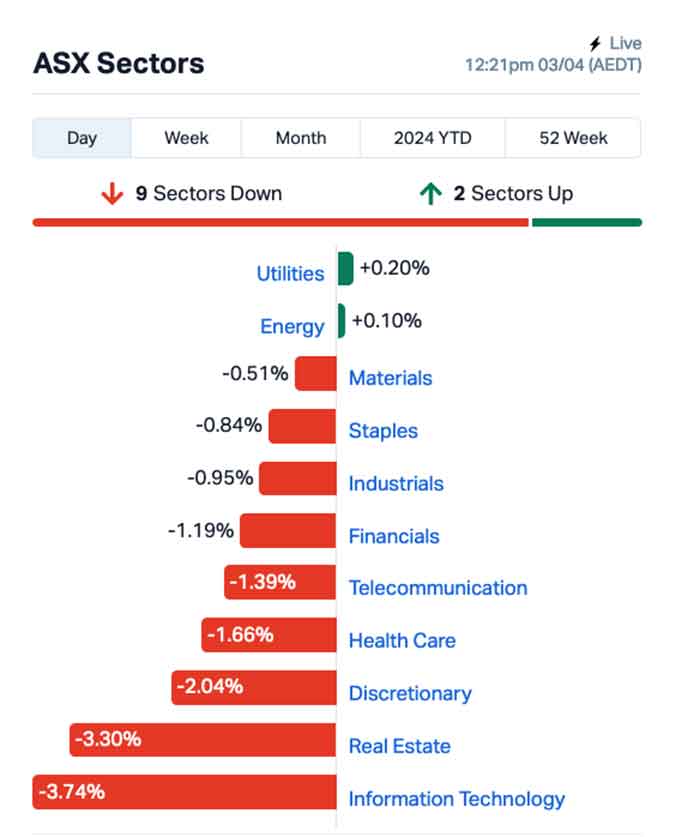

That’s led to a broad sell-off among tech stocks on Aussie markets this morning, which has pushed the sector down close to -3.9% so far this morning. Which is, now that I’m looking at it, actually pretty bad.

The bleeding has been trending deeper into the claret since the doors opened on the ASX this morning – I’ll let this handy picture tell the story, so I don’t have to write 1,000 words.

Clever? Yes. Lazy? Also yes.

That’s left the sector outlook in a bit of a red mess:

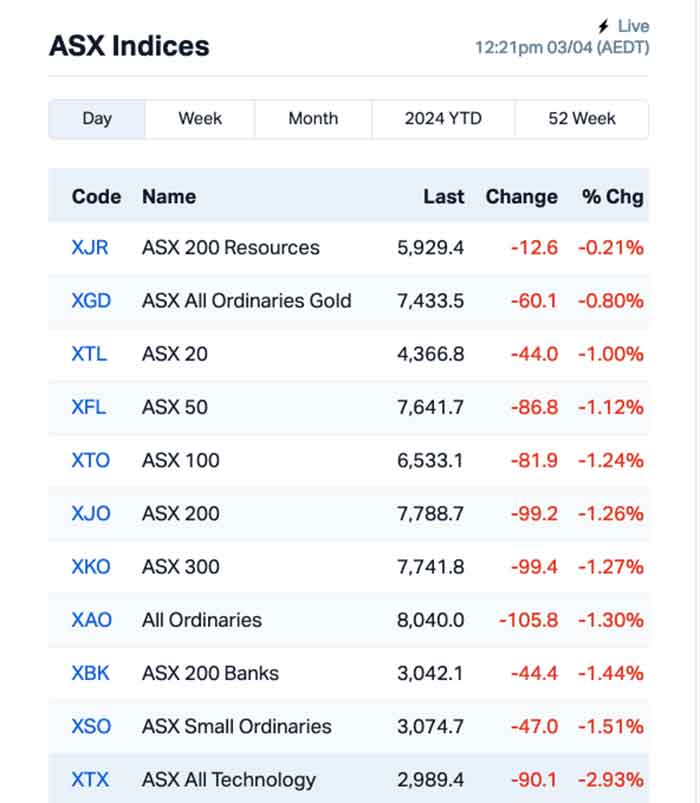

In fact, it’s only the XGD All Ords Gold Index and, to a lesser extent, a slice of the Resources sector performing well – and that was only happening because gold hit another record high overnight, briefly touching US$2,280.58 an ounce before a teacher saw them and they both got detention.

(Please Note: In the 20 minutes it took me to look that up, go get a coffee, take a leak and come back to write it, the goldies have since slid into negative territory… things are moving quick this morning, very little of it in the right direction. Much like my toilet break.)

There are some happy highlights – up the tubby end of town, $2.2 billion Ramelius Resources (ASX:RMS) is up more than +10% this morning after hitting record gold production of ~87,000oz – and free cash flow of $125.3m – in the March quarter… a result that “obliterated guidance of 70,000 – 77,500oz”.

And West African Resources (ASX:WAF) was continuing its recent run of gains this morning, up another +5.1% on the back of a well-timed 2023 sustainability report that had lots of funky numbers in it, like “226,823 oz Annual gold production” and “$661 million Annual revenue” and other things that tend to make investors happy.

NOT THE ASX

Wall Street stumbled last night, on the back of what Earlybird Eddy Sunarto describes as “good news is bad news” trade, as recent solid economic readings have spurred speculation the Fed could hold rates higher for longer.

Stocks on the move last night include Tesla, which fell almost -5% after reporting Q1 vehicle deliveries of 386,810, a drop of 8.5% from the same quarter last year. This was Tesla’s first YoY decline since 2020.

Tesla explained the drop in a statement: “The decline in volumes was partially due to the early phase of the production ramp of the updated Model 3 at our Fremont [California] factory and factory shutdowns.”

US healthcare insurers tumbled, led by the largest US health insurer UnitedHealth, after the Biden government said it will hold the increase in premiums of private Medicare plans at the same rate in 2025 as for 2024.

The truly terrifying news is that somebody, somewhere has decided once again to give Jerome “The Angel of Economic Death” Powell access to a microphone again.

Ol’ Pow-Pow, as Taylor Swift fans have taken to calling the scrofulous old rogue, is due to speak to the masses on Wednesday US time – and my prediction is that he will say stuff like “interest rates”, “inflation”, “please be patient” and “too soon”, cratering Wall Street in a matter of minutes when he does.

Asian markets are sliding into the sea this morning. Coastal communities in Queensland and NSW are advised to be on the lookout for rogue tranches of waterlogged companies, and are asked to not touch anything they find, but call authorities and wait for instructions.

Shanghai markets are down -0.17%, Hong Kong’s Hang Seng is down -0.65% and Japan’s usually effervescent and highly refreshing Nikkei is down -1.05% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 03 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ACR | Acrux Limited | 0.081 | 72% | $22,044,791 | $13,663,692.23 |

| PEC | Perpetual Res Ltd | 0.0105 | 50% | $21,064,940 | $4,480,205.94 |

| SIH | Sihayo Gold Limited | 0.0015 | 50% | $910,553 | $12,204,256.18 |

| LNU | Linius Tech Limited | 0.002 | 33% | $4,180,772 | $7,795,111.07 |

| RNE | Renu Energy Ltd | 0.009 | 29% | $493,965 | $4,724,771.35 |

| C7A | Clara Resources | 0.015 | 25% | $231,615 | $2,268,468.46 |

| AOA | Ausmon Resorces | 0.0025 | 25% | $1,000,000 | $2,117,998.69 |

| AS1 | Asara Resources Ltd | 0.01 | 25% | $1,003,975 | $7,057,402.80 |

| MCT | Metalicity Limited | 0.0025 | 25% | $1,274,963 | $8,970,107.59 |

| VML | Vital Metals Limited | 0.005 | 25% | $50,000 | $23,580,267.80 |

| NVO | Novo Resources Corp | 0.16 | 23% | $46,205 | $11,408,088.77 |

| PNM | Pacific Nickel Mines | 0.032 | 23% | $971,753 | $10,874,580.73 |

| JBY | James Bay Minerals | 0.25 | 22% | $353,237 | $6,651,225.00 |

| 5EA | 5E Advanced | 0.26 | 21% | $1,142,673 | $69,453,583.45 |

| KAM | K2 Asset Mgmt Hldgs | 0.06 | 20% | $1,258 | $12,054,259.80 |

| HHR | Hartshead Resources | 0.006 | 20% | $834,682 | $14,043,410.64 |

| LNR | Lanthanein Resources | 0.003 | 20% | $1,121,685 | $4,887,272.26 |

| SIT | Site Group Int Ltd | 0.003 | 20% | $660,000 | $6,506,225.54 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | $63,675 | $3,563,346.44 |

| RFT | Rectifier Technologies | 0.019 | 19% | $2,034,291 | $22,111,743.15 |

| AYA | Artrya | 0.38 | 17% | $75,000 | $25,560,922.73 |

| FOS | FOS Capital Ltd | 0.21 | 17% | $110,000 | $9,685,105.02 |

| 1MC | Morella Corporation | 0.0035 | 17% | $205,898 | $18,536,398.28 |

| 88E | 88 Energy Ltd | 0.007 | 17% | $263,478,771 | $150,744,375.40 |

| ARD | Argent Minerals | 0.014 | 17% | $5,883,195 | $15,501,108.02 |

Acrux (ASX:ACR) and its partner TruPharma today announced the launch of a generic of Dapsone 5% Gel, which is a prescription medicine used to treat acne vulgaris – a form of pimples that makes teenagers look gross and say terribly rude things to each other online, if my high school Latin skills haven’t let me down.

The market in the US for this product is estimated to be worth around US$15 million a year – a large enough market to push Acrux up a staggering 74.4% by lunchtime.

Pacific Nickel Mines (ASX:PNM) was also rising this morning, ostensibly off the back of recent news that its March shipment of nickel was “completed as anticipated”.

It’s not the most exciting news in the world, clearly, but… it was still newsy enough to help propel PNM into positive territory, with the share price rising just shy of +27% on Wednesday morning.

James Bay Minerals’ (ASX:JBY) expanding footprint in Quebec was continuing to help expand its share price this morning – it was up a tidy +26.8% by lunchtime.

And lastly, Clara Resources Australia (ASX:C7A) got a Please Explain from the ASX on 26 March 2024 about its recent announcement of a scoping study for its Ashford coking coal project in NSW, and has responded today.

The response is thorough, to say the least – 22 pages long, lots of details about what’s included and, importantly, what hasn’t been included in the scoping study – and, at first glance, it all seems in order.

Clara also released a two-pager explaining a key element of questions from the ASX around coal price forecasting, saying: “Advisory Partners have advised that the coal price does not change the overall fairness and reasonable opinions and therefore has no impact on the outcome of the [Independent Expert Report] IER.”

So… that’s apparently that, and Clara’s up +25% following the clarification.

ASX SMALL CAP LAGGARDS

Here are the least-best performing ASX small cap stocks for 03 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 10,204 | $11,649,361 |

| CNJ | Conico Ltd | 0.0015 | -25% | 200,000 | $3,610,190 |

| EDE | Eden Inv Ltd | 0.0015 | -25% | 609,545 | $7,356,542 |

| HCD | Hydrocarbon Dynamic | 0.003 | -25% | 13,056 | $3,234,329 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | 441,219 | $12,394,892 |

| RMX | Red Mount Min Ltd | 0.0015 | -25% | 179,441 | $5,347,152 |

| FFF | Forbidden Foods | 0.012 | -20% | 26,519 | $3,027,908 |

| VEN | Vintage Energy | 0.012 | -20% | 2,436,338 | $13,048,441 |

| IRX | Inhalerx Limited | 0.04 | -20% | 25,000 | $9,488,348 |

| RDS | Redstone Resources | 0.004 | -20% | 376,102 | $4,626,892 |

| RIL | Redivium Limited | 0.004 | -20% | 1,002,013 | $13,654,274 |

| PLC | Premier1 Lithium Ltd | 0.021 | -19% | 397,000 | $4,538,926 |

| FRS | Forrestania Resources | 0.013 | -19% | 1,502,674 | $2,588,572 |

| CAE | Cannindah Resources | 0.049 | -18% | 142,908 | $34,684,797 |

| BXN | Bioxyne Ltd | 0.009 | -18% | 2,989,459 | $20,918,099 |

| UVA | Uvrelimited | 0.1 | -17% | 10,000 | $3,971,787 |

| EPM | Eclipse Metals | 0.005 | -17% | 200,000 | $13,257,933 |

| ICG | Inca Minerals Ltd | 0.005 | -17% | 954,500 | $4,828,433 |

| MOH | Moho Resources | 0.005 | -17% | 1,098,036 | $3,235,069 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 1,917,144 | $6,259,695 |

| VRC | Volt Resources Ltd | 0.005 | -17% | 424 | $24,780,640 |

| AL3 | AML3D | 0.06 | -14% | 271,573 | $16,488,760 |

| AN1 | Anagenics Limited | 0.012 | -14% | 33,421 | $5,867,860 |

| IS3 | I Synergy Group Ltd | 0.006 | -14% | 1,551,890 | $2,128,563 |

| PUA | Peak Minerals Ltd | 0.003 | -14% | 753,286 | $3,644,818 |

ICYMI – AM EDITION

Kingsland Minerals (ASX:KNG) has more than doubled the size of a high-grade lithium anomaly at its Lake Johnston project to 50km2. This follows soil sampling returning grades of up to >200ppm Li2O.

Lithium Energy (ASX:LEL) and Novonix (ASX:NVX) are spinning off their Queensland graphite assets into Axon Graphite, a vertically integrated mine to battery anode material manufacturing company that will list on the ASX.

Many Peaks Minerals (ASX:MPK) has tapped investors for a $2m placement to fund drilling at the exciting Ferké and Odienné projects in the world class Birimian greenstone belt in Coté d’Ivoire.

At Stockhead, we tell it like it is. While Kingsland Minerals and Many Peaks Minerals and possibly some others I mentioned somewhere are Stockhead advertisers, they did not sponsor this article. No one does… because I’m a maverick. A rogue force, highly unpredictable and capable of just about anything. You’d have to be nuts to put your name on stories like this. Utterly crazy. But that’s me, baby… completely mad, without a care in the world. An unstoppable force of nature, who’s not scared of anyone, or anything. Except maybe crocodiles, and some spiders. Not all of them, though. Just a couple of them. But they didn’t sponsor this article, either, because they’re spiders and spiders don’t have any money.

The post ASX Small Caps Lunch Wrap: Who’s sizing up the ultimate white elephant this week? appeared first on Stockhead.