Indian conglomerate Vedanta (NSE: VEDL) announced on Friday it was splitting its business into six listed companies as part of a broader restructuring plan to get better valuations.

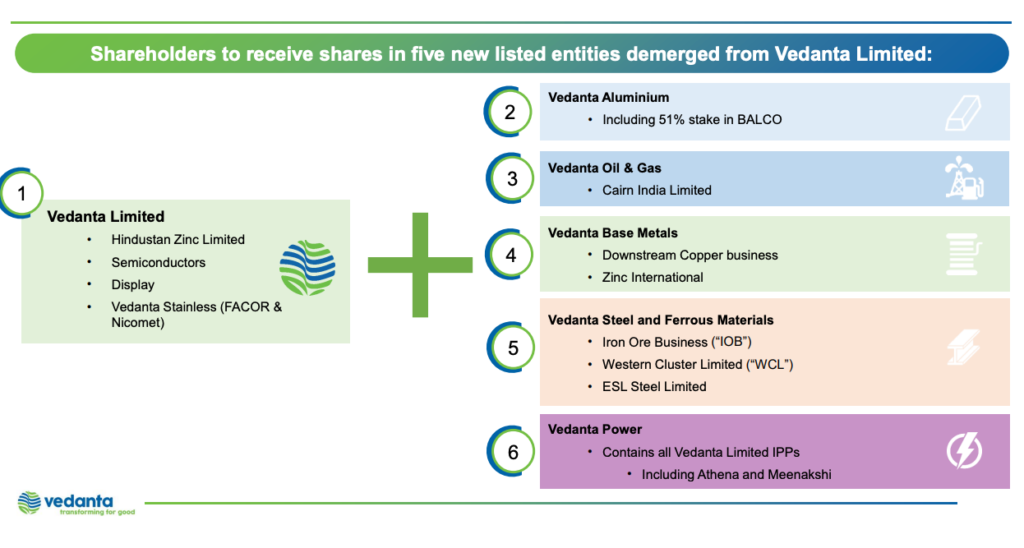

The company, owned by billionaire Anil Agarwal, is creating Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Steel and Ferrous Materials, Vedanta Base Metals, and Vedanta Ltd.

Current investors will get one share in each of the five newly listed entities, for every one share they hold in the presently listed company,which has a market capitalization of $10 billion.

The move is aimed at simplifying Vedanta’s corporate structure with sector-focused independent businesses and provides opportunity to global investors, including sovereign wealth funds, retail investors and strategic investors.

“By demerging our business units, we believe that will unlock value and potential for faster growth in each vertical,” chairman Agarwal said in the statement.

“While they all come under the larger umbrella of natural resources, each has its own market, demand and supply trends, and potential to deploy technology to raise productivity,” he added.

The move will need shareholder and other regulatory approvals and the process is expected to be completed in fiscal year 2025.

Vedanta Resources, the UK-based parent of Vedanta Ltd, has been struggling to raise funds due to rating downgrades and concerns about meeting its debt obligations.

The firm, whose debt load stands at $7.7 billion, attempted to reduce it by getting Hindustan Zinc, a unit of Vedanta Ltd, to buy some of the parent group’s zinc assets in a $2.98 billion deal.

The move was thwarted by the Indian government, which owns nearly 30% stake in Hindustan Zinc.