Appian Capital Advisory LLP announced on Monday that it has committed a $230 million financing package to miner and battery metals producer US Strategic Metals (USSM).

According to Appian, the initial funding consists of a $120 million secured term loan facility, along with a $70 million secured royalty financing arrangement and warrants.

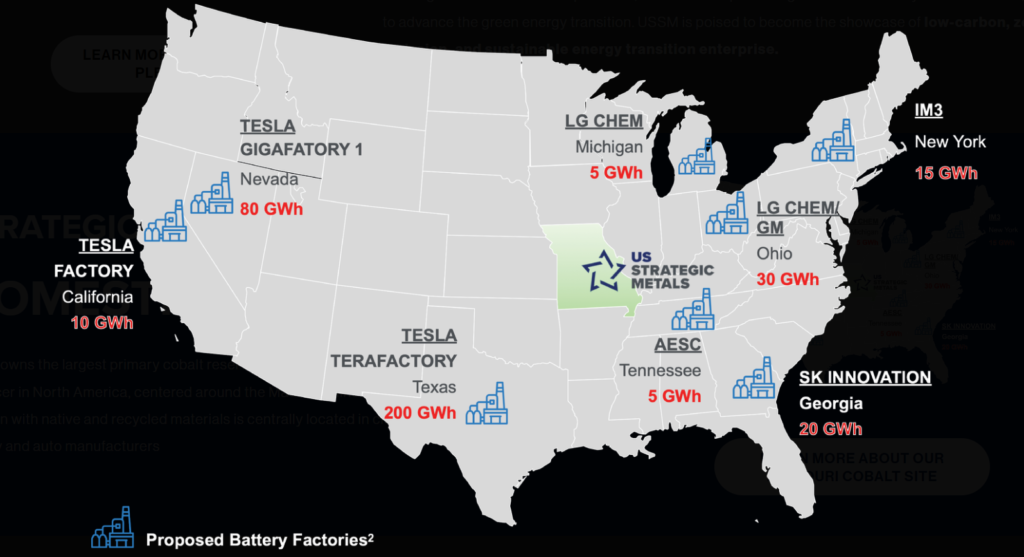

With the transaction, USSM has reached nearly $500 million in funding and commitments for the development of its cobalt-nickel mine and the construction of its hydrometallurgical battery metals recycling facility based in Fredericktown, Missouri.

USSM’s processing operations will be supplied with concentrates produced at its mine and black mass produced from lithium-ion battery production scrap and end-of-life lithium-ion batteries.

“The transaction positions USSM to become the first significant fully-integrated recycler and producer of battery metals for the electric vehicle supply chain in the United States,” Appian said in a press release.

According to USSM, the Fredericktown recycling site has all major permits in place, with commercialization de-risked through a pilot plant that has been operating since 2020. It is targeting commissioning in late 2024.

The company, formerly known as Missouri Cobalt, has invested over $250 million in capital to date from investors and industry participants, including Glencore.

Read More: US miners miss out on tax credit granted to processors