Mining companies must improve their metal price forecasting to reduce mine failures and increase long-term returns for investors, according to a new study.

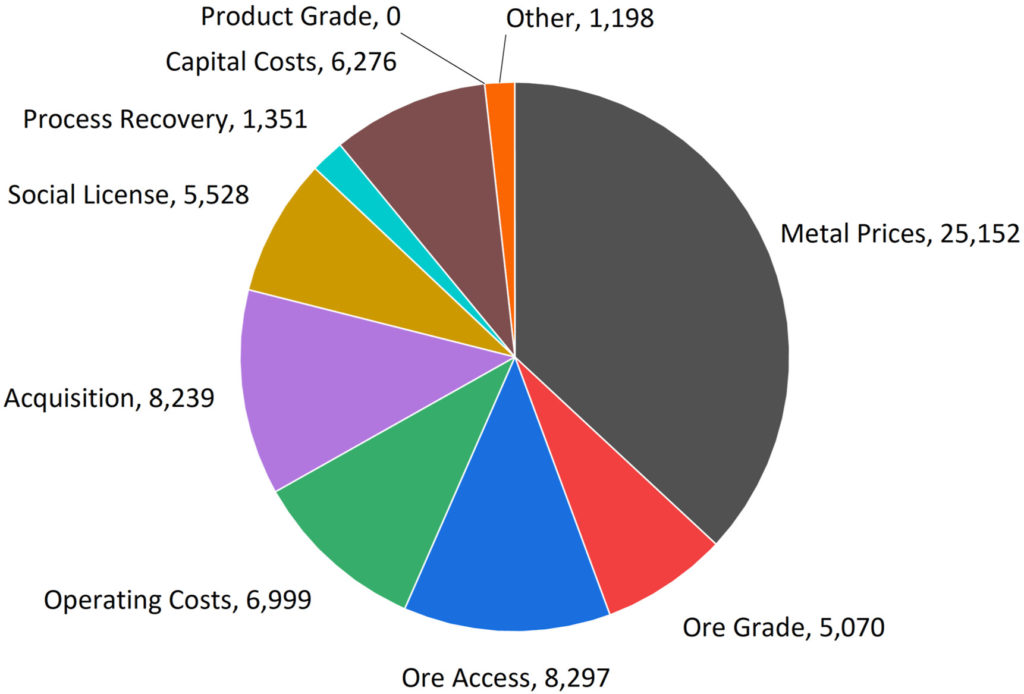

Tumbling metal prices account for more than half all of impairment charges, declared when fixed assets fall below market values, the study of 105 TSX-listed mining companies found. They incurred C$68 billion in charges from 2002 to 2015. Using unfamiliar technology and locating in developing countries also contributed, data show.

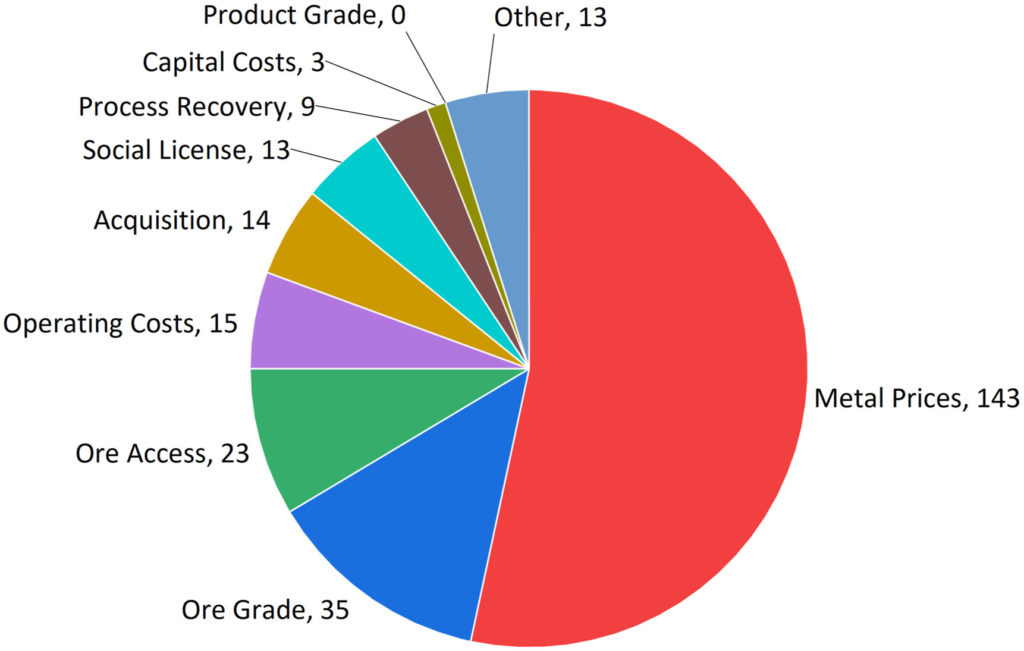

Metal price drops accounted for 143 of 268 cases and C$25.2 billion in impairment charges, according to the study published last month in Resources Policy, an international journal on mineral rules and economics with editors in the United States, Australia and China. The research appears appropriate at a time when nickel and lithium prices have crashed from 2022 highs as gold has set new records.

“While impairments have been shown to be a common occurrence across mining companies, they also are a major contributor to the industry’s low average returns,” said the authors led by Andrew Gillis of Edmonton-based Aurora Hydrogen.

“The degree of impairments is higher at mines in developing countries and at mines where the geographic location and mining processes are new to the company operating the mine,” said the authors, which included John Steen and W. Scott Dunbar of the Department of Mining Engineering at the University of British Columbia in Vancouver, and Andrew von Nordenflycht of the Beedie School of Business at Simon Fraser University in Burnaby, B.C.

Get lucky

Forecasting by its nature is uncertain. But some firms get lucky and only face a few impairments, while others get unlucky and suffer many or large impairments, the authors said. Their targeted years of research coincided with the rise of the commodity super-cycle 20 years ago followed by the financial crisis and declining metals prices from 2012.

The group recommended mining companies should improve their forecasting of mineral reserves, capital costs, production costs and commodity prices, which all impact future cash flows. It noted how C-suites might blame falling metal prices for impairments because other slips in capital or operating costs could be directly attributed to their own forecasting. The flip side is that rising metal prices can hide some other forecasting errors. And forecasting in foreign lands is simply more difficult, the authors said.

“Higher impairments in developing countries stem from lower information availability about market conditions and/or more volatile local market prices and conditions,” the authors said. “The sources of uncertainty are just greater, making forecasts harder and forecast errors easier, even for experienced forecasters.”

In the end, the researchers recommended more studies on forecasting. They could try to pinpoint the root causes of forecasting errors through personal interviews with project participants, detailed comparisons of feasibility studies and actual outcomes as well as assessing their methods of error prevention.

“Asset impairments have been identified as a primary determinant of long-term shareholder returns across Canadian mining firms,” the authors said. “Our findings suggest looking more closely into price forecasting procedures at mining companies to see if certain techniques or circumstances lead to more or fewer price-driven impairments.”

I loved as much as youll receive carried out right here The sketch is tasteful your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike

This post was exactly what I needed to read today Your words have provided me with much-needed clarity and reassurance

RBwXWCkUl