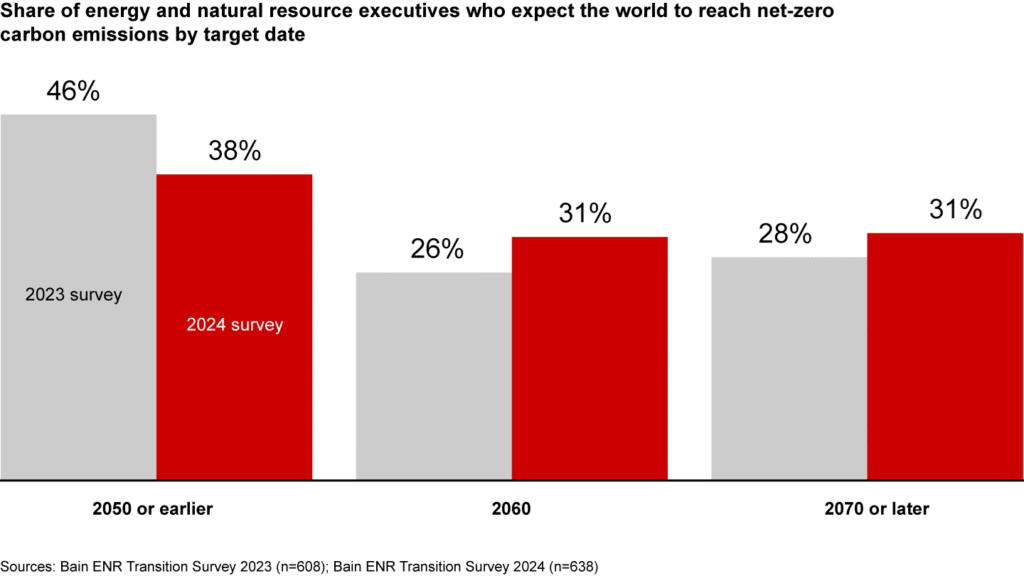

A growing number of industry executives expect the world to reach net zero by 2060 or later—with 62% sharing this sentiment in 2024 versus 54% in 2023, Bain & Company’s fourth annual Energy & Natural Resource Executive Survey shows.

According to the study, confidence in the world’s ability to achieve net zero by 2050 seems to be eroding as it becomes more difficult to ensure adequate investment returns and progress diverges in a fragmenting world. This view is consistent across most regions and is most strongly held among people working in the oil and gas sector.

Bain & Company surveyed over 600 industry executives in mining, oil and gas, utilities, chemicals and agribusinesses across the globe to better understand their views on the energy transition, new technologies, and investment opportunities, and where they see the greatest challenges for decarbonization.

“This year’s survey found that energy and natural resource companies have not dampened ambitions for their transition-oriented growth businesses. However, customers’ willingness to pay is a growing issue, as is the ability to generate adequate return on investment (ROI) in energy transition-oriented projects. As a result, companies are focusing on projects with a viable ROI path,” said Joe Scalise, head of Bain & Company’s energy and natural resource practice. “The longer the executives are at the front lines of the energy transition, the more sober they are getting about the transition’s practical realities.”

The survey points out that executives in the Middle East (61%), Asia-Pacific (55%), and Latin America (51%) are feeling more optimistic about the prospects of their transition-oriented growth such as renewables, hydrogen, bio-based products, and lithium and other transition commodities that will contribute to their company’s valuation and profits by 2030. Hence, they are maintaining or increasing green investments. Only 4%, 12% and 10%, respectively, of executives from the three regions expressed less optimism, while the remainder showed no significant change.

The survey revealed a more balanced picture in Europe where 30% of executives revealed more optimism vs. 27% who were less optimistic about their new energy growth business areas contributing to the bottom line.

In North America, 29% of executives were more positive compared to 17% who were less positive on their transition-related growth areas.

Returns to scale-up

“Like last year, executives say the greatest obstacle to scaling up their transition-oriented businesses is finding enough customers willing to pay higher prices (or having equivalent policy support) to create sufficient return on investment,” the report states. “In fact, the share of executives identifying this as a very significant roadblock jumped 14 percentage points from 2023 to 2024, to 70% of executives.”

The experts behind the study note that the direct impact of higher interest rates on the cost of transition projects is likely shaping executives’ perspective on the challenges associated with customer willingness to pay.

Bain has found that higher rates put upward pressure on the effective cost of low-carbon projects and a 500-basis-point increase in the cost of capital can increase the total annual revenue required to finance a project by as much as 50%.

Trendy North America

The survey presents North America as an emerging leader for green investments as 79% of all executives view it as an attractive region for energy transition investments. The next most attractive region is Europe at 65%.

Australia and New Zealand come in as second runner-ups at 43%.

Even as increasing government subsidies make some regions, such as North America, more attractive for investment, executives have growing concerns about policy stability.

The US Inflation Reduction Act is a major factor in North America’s investment attractiveness, but factors such as the availability of relatively low-cost natural gas feedstock also influenced the result.

“However, while almost two-thirds of US executives surveyed agree that the IRA’s subsidies target the right areas, less than one-quarter believe that the policy regime will remain stable over the next five to 10 years,” the dossier states. “Furthermore, 42% of US executives think the IRA’s subsidies are unclear and that the rules are not easy to follow.”

About 70% of executives worldwide say that reducing policy uncertainty would very significantly improve their ability to scale up transition-oriented businesses.

lv8re5