Industrial metals are all trading below levels seen this time last year and while nickel’s rout has been grabbing headlines, copper’s bad start to the year after a disappointing 2023 points to broader weakness.

China consumes more than half the world’s metals and an even greater proportion of iron ore and battery raw materials – and gloom about the country’s economic prospects amid a property and stock market crisis have only added to bearish mining sentiment.

In a new trading desk note Marcus Garvey, head of Macquarie commodities strategy based in Singapore, and a team of analysts have identified the first green shoots for the sector (and 34 charts to back it up):

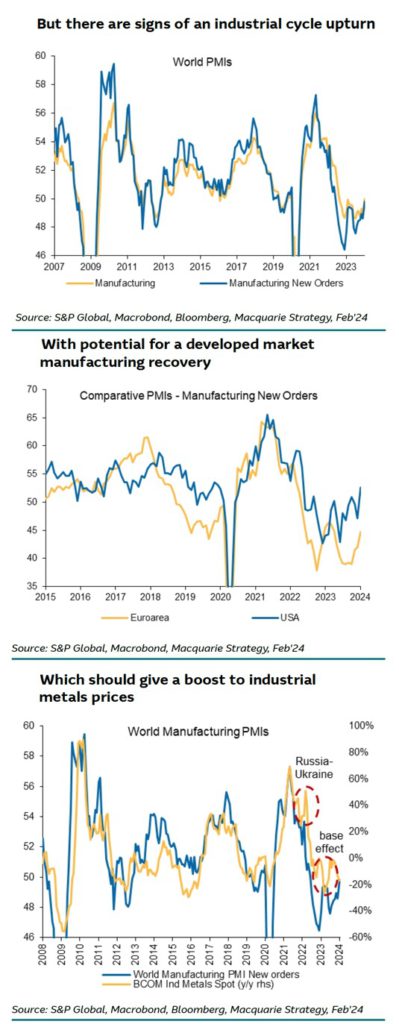

“January’s full set of PMIs (World manufacturing new orders up 1.2pp to 49.8) looks like a potential turning point for the global industrial cycle, with bullish implications for industrial commodities demand.”

Expectations of a smaller reduction in US interest rates this year than previously anticipated have supported the dollar and put metal prices under pressure which usually move in the opposite direction.

Nevertheless, says Macquarie: “Commodity prices have a far more consistent relationship with global growth than with FX.”

The investment bank also points to US goods demand which it says “increasingly looks to be reaccelerating,” and from a higher base. Macquarie also sees the potential of a developed market manufacturing recovery and a restocking cycle in Europe.”

And while China has so far held off on broad based economic stimulus, fixed asset investment in infrastructure, led by renewables, and certain sectors including autos (particularly electric cars) have shown notable strength.

“Ultimately, if commodity prices are lifted by a pick-up in global industrial production, the implications for goods inflation may become self-inhibiting, by reducing the scope for further central bank easing.

“But that is an ex-post problem, not an ex-ante one, suggesting to us that dips should now be bought.

“Selectively at least, in those markets where fundamentals are already relatively tight or have the potential to tighten quickly. Especially if positioning gets short.”