- Gold prices sit oh so close to an all time high on the back of war and US Fed rate cut hopes

- Iron ore and uranium continue their strong runs with the nuclear fuel at an all time high

- Lithium eats a second straight month of +15% losses

In Up, Up, Down, Down we track the commodities that won and lost the market in November.

WINNERS

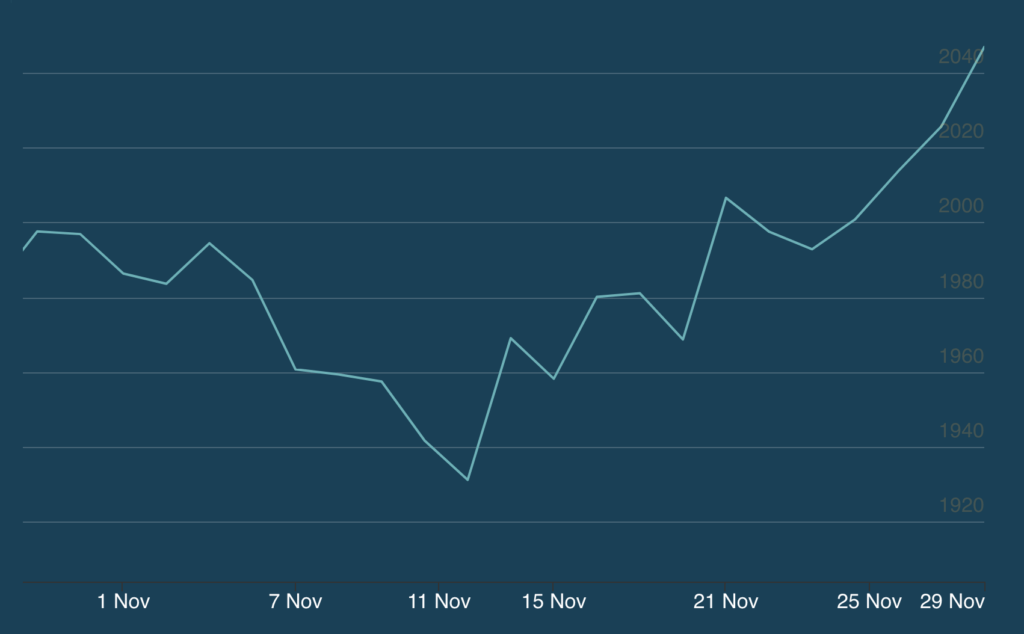

Gold

Price: US$2046.95/oz

% Change: +2.47%

Gold prices have spent November edging closer to their all time high of US$2075/oz, a run that has been followed by a lift in ASX gold equities, which are up over 6% in the past four weeks.

The catalyst initially was the outbreak of the Israel-Hamas conflict and the IDF’s subsequent bombardment of Gaza, sparked by a Hamas attack on October 7.

That drew massive safe haven demand in for the precious metal, a traditional store of wealth for the wealthy in times of discord and uncertainty.

That bump was maintained and supercharged by suggestions the US Fed could cut its fund rate as early as next year, following a month when the US dollar fell 3%, its largest drop in 12 months.

Aussie gold prices are trading a touch shy of $3100/oz, levels that should deliver margins to most producers of around $1000/oz, provided they’re unhedged.

IG Markets analyst Hebe Chan said the outlook for gold remained strong for 2024.

“Looking forward, the outlook for gold in 2024 is expected to remain positive, as the factors driving the growing appetite for the precious metal seem to stay intact,” Chen said.

“Furthermore, as gold is often seen as a reliable means of safeguarding wealth during challenging economic periods, the widely projected economic slowdown in 2024 should serve as an additional catalyst for gold to preserve its prime.”

The end of a brief ceasefire and continued hopes for Fed rate cuts next year subsequently sent gold futures to US$2071/oz on Friday, with the London Bullion Market Association’s prices to be closely watched on Monday.

UP

- CME Group’s Fedwatch Tool thinks there is a 100% probability of rates remaining the same (5.25-5.5%) at the next US Fed meeting in December, with a more than 40% chance of a cut at next year’s March meeting

- While the US dollar has weakened, exchange rates still have Aussie spot gold prices above $3000/oz

DOWN

- Safe haven demand eased with Israel and Hamas agreeing a temporary truce to enable the release of hostages and prisoners on each side … that’s now over.

- High prices could threaten jewellery and retail demand in major markets India and China.

Gold miners share prices today:

Uranium (Numerco)

Price: US$80.75/lb

% Change: +8.39%

Uranium prices are at a roughly 15-year high. You read that right.

And like Donna Summer, the bulls in the yard are singing at the top of their lungs that this time they know it’s for real.

“Nobody is going to build a uranium mine now at US$75/lb, so the incentivisation for greenfield projects is not there yet,” Deep Yellow (ASX:DYL) managing director and uranium industry veteran John Borshoff said at the RIU Resurgence Conference in Perth last month.

“Is it going to be US$90/lb or US$100/lb? Let’s see what happens when the utilities get off their arses and say, ‘look, I know what it was like in the good old days’, throwaway the rear vision mirrors and look forward to how they’re going to get greenfields projects on this planet because that’s the only way we’re going to meet this incredible growth in the nuclear fleet.

“Everyone has to come to grips with the hard decisions that have to be made to get new projects on the ground.”

Around 160Mlb of uranium oxide has been contracted in 2023 so far, on track to double the amount sold to utilities on long term contracts in 2022.

That suggests a genuine shortage for power plants at a time when pressure is coming on the industry to increase its share of the power grid globally to displace fossil fuel burning sources of baseload power like coal and gas.

Terra Capital’s Jeremy Bond told Stockhead he saw uranium going beyond its 2007 highs of US$149/lb in the new bull market.

““In Australia, we don’t see it because we’re just anti-nuclear. But China I think needs to do nine reactors a year for the next 10 years or something,” he said.

“There’s 450 reactors globally now. And they’re looking to build 90 over the next 10 years.

“We think the long term story is real, the short term story is real — as in there’s a physical squeeze in the market at the moment.

“So you’ve got a short term story in a spot market squeeze and then a long term story and I just think the adoption nuclear is going to become more mainstream.”

UP

- Uranium contracting is at its highest level since the Fukushima disaster in 2011

- With inflation, experts think higher prices will be necessary to incentivise new producers

DOWN

- Large uranium miners like Kazatomprom and Cameco will see the uptick in prices as an opportunity to bring idled supply onto the market. BHP could also dramatically increase production from its Olympic Dam mine if it signs off on a big expansion of its South Australian copper business.

- The world’s first commercial small modular reactor build has conked out after developer NuScale failed to subscribe enough cornerstone customers to back the construction of a plant in Idaho Falls in the USA

Uranium share prices today:

Iron ore (SGX Futures)

Price: US$129.75/t

% Change: +8.81%

The surprising strength of iron ore in the face of a weak Chinese economy and even more parlous property sector has energised investment bank analysts to ratchet up their price predictions for both 2023 and 2024.

In mid-November Goldman Sachs lifted its projection for 2023 to US$117/t, picking up its 2024 forecast by 22% to US$110/t.

That followed similarly bullish projections from JPMorgan and UBS, and now the commercial Australian banks are getting on board as well.

ANZ’s Daniel Hynes and Soni Kumari lifted their short term target to US$110/t last week, with 2024 prices expected to float above US$100/t.

They say lower than expected supply is behind the strength in iron ore.

“We believe the market is too early in assuming property sector demand for

steel will recover in 2024, a situation that would severely tighten the market,” they said.

“Nevertheless, we expect the market to remain tight for the foreseeable future.

“Inventories are low and restocking is likely, which should provide some strong

support to prices.”

That’s great for Australian producers, the top handful of which (BHP, Rio and FMG) produce each tonne of iron ore at a cost of around US$20/t. That will deliver dividends this year even a massive run up in decarbonisation capex, and in Andrew Forrest’s case green energy projects, can’t erase.

UP

- Iron ore supply growth has faded, plunging the market into a potential 40Mt deficit in 2023, according to ANZ.

- There are around 102Mt of iron ore in portside stocks, around a quarter lower than what’s normally seen at this time of the year.

DOWN

- Property investment in China has fallen over over two years straight, hurting a key source of domestic steel and iron ore demand.

- The Chinese Communist Party’s powerful National Development and Reform Commission is investigating speculation and hoarding in iron ore markets in an attempt to bring down prices.

Iron ore miners share prices today:

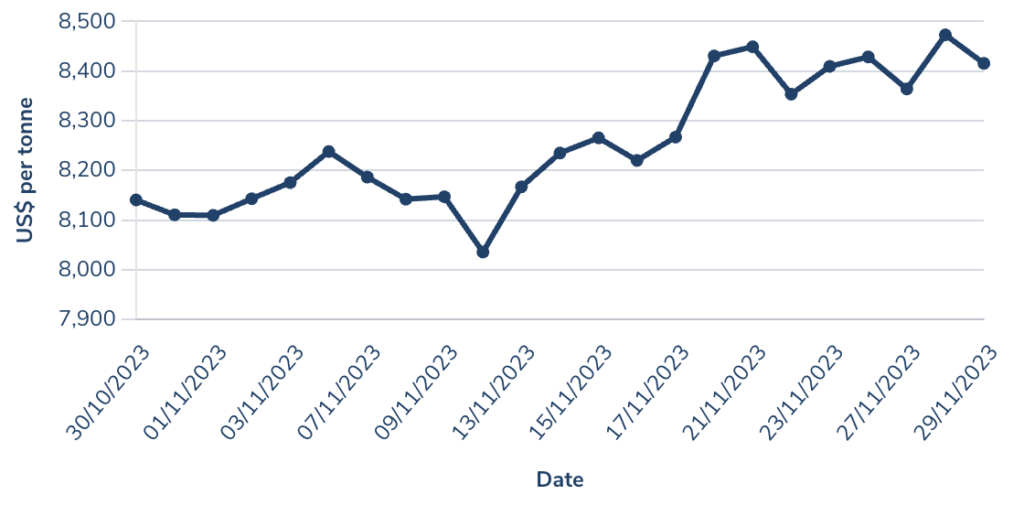

Copper

Price: US$8415.50/t

% Change: +3.75%

Copper finally caught a break this month, with prices rising amid the threat of supply disruptions from South and Central America.

Most notable was the news that Canada’s First Quantum Minerals could face the loss of its Cobre Panama operations, after the High Court of Panama ruled an agreement with the government to extend mining there was unconstitutional.

That mine is a tidy 1.5% of global supply, while MMG’s Las Bambas mine in Peru has also faced strikes.

Copper has been a balanced market this year, though long term expectations are that it will fall into big deficits from the latter part of this decade as green demand rises and miners struggle to expand operations or develop new ones unless prices rise substantially.

Chinese refiners, who have built up capacity substantially in recent years, agreed to the first fall in processing fees in three years on the back of a misbalance between the supply of copper concentrate and refining capacity.

UP

- First Quantum could face the closure of the Cobre Panama mine, responsible for 1.5% of global copper supply

- Citi lifted copper forecasts from US$7500/t to US$8600/t for 2024

DOWN

- Chinese PMI of 49.2 for October shows the manufacturing sector in China continues to struggle

- Copper prices have been heavily in contango, meaning futures are fetching higher prices than metal for immediate delivery — a sign of weak demand

Copper miners share prices today:

Coal (Newcastle 6000 kcal)

Price: US$133.50/t

% Change: +8.1%

Thermal coal prices finally recovered slightly, posting a baby bounce back from year long lows in the low US$120/t range.

Those prices remain solid by historical standards, but are an issue for high cost producers, with most coal miners in recent times feeling the effect of logistics bottlenecks that have — ironically — also driven up prices.

Coking coal prices remain very strong, fetching well over US$300/t for top grade steelmaking coal.

That’s come off the back of continued issues with ramping up supplies out of Queensland, while China could put its foot down in the coking coal province of Shanxi after over 100 industrial deaths this year.

On the equities front, met coal miners continued to show their investment wares as Stanmore (ASX:SMR) announced a first dividend since the purchase of BHP’s Poitrel and South Walker Creek mines in 2022 but disappointed on guidance.

Whitehaven (ASX:WHC) clocked a win in a Takeovers Panel dispute over an activist investor protesting its $6.4 billion purchase of BHP’s Daunia and Blackwater met coal mines.

On the thermal coal front Australian Pacific Coal (ASX:AQC) looks to be pushing ahead with plans to develop its Dartbrook coal mine in the Hunter Valley despite the lower coal prices, raising US$60m from European trader Vitol to restart the mine for the first time in 18 years.

UP

- Coking coal prices rose amid a potential safety crackdown in China’s Shanxi Province

- Growing Indian steel production and consumption could drive demand for Australian met coal higher

DOWN

- Lower oil and gas prices are hurting demand for thermal coal as a switching fuel

- New Hope Group said there was low demand for uncontracted coal in the current market

Coal miners share prices today:

LOSERS

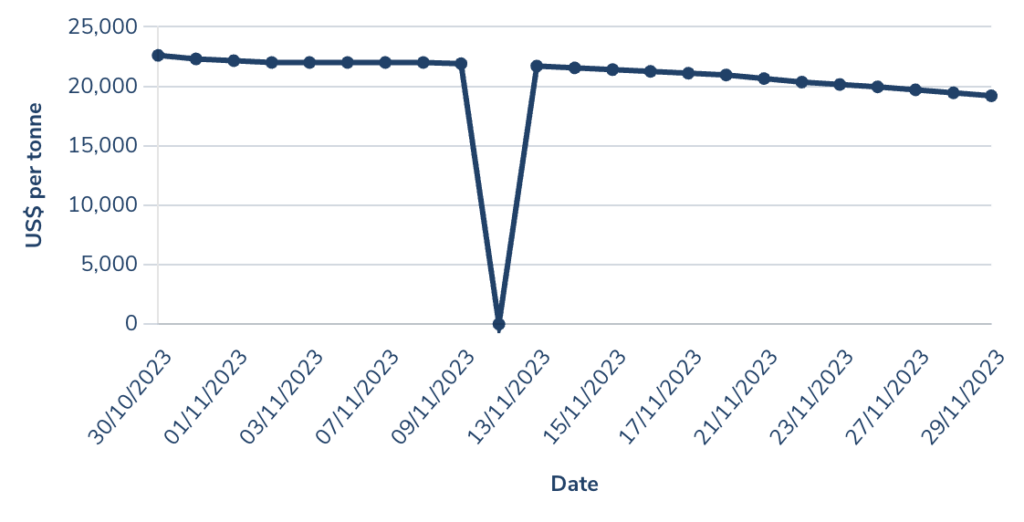

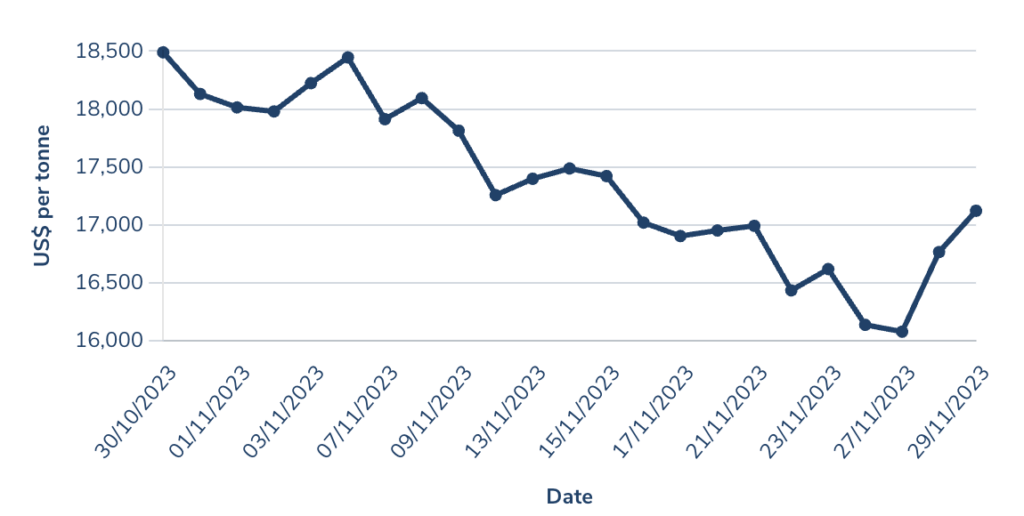

Lithium (Fastmarkets Hydroxide CIF China, Japan and Korea)

Price: US$19,200/t

% Change: -15.04%

Lithium suffered its second 15% fall in a row as EV sales growth rates lagged behind a rise in supply, especially of high cost conversion and lepidolite capacity in China.

Prices for lithium chemicals in China and North Asia slid below US$20,000/t, while spodumene concentrate sold by West Australian miners fell to US$1590/t, with analysts including Shanghai Metals Market and Goldman Sachs tipping a fall below US$1400/t next year.

The weakness in lithium prices has come about despite strong long term demand forecasts from miners and industry analysts with EV sales projected to rise well beyond the pace at which mining companies can identify and develop new resources.

There have been complaints from some quarters of the industry that limited spot sales and paper trading — most of the market consists of product sold by miners to refiners under long term contracts — have knocked down prices.

At the same time, bears Goldman Sachs estimate a surplus of lithium carbonate equivalent tonnes of 29,000t in 2023 will blow out to 202,000t as brine producers in Chile and China, Aussie spodumene producers and African miners expand operations.

The saving grace for miners could be the cost curve. High cost non-integrated spodumene converters and many Chinese lepidolite producers are believed to be lossmaking at current prices.

“They’re below reinvestment economics. As we’ve said many times our concern would be towards the end of the decade that there needs to be sufficient amount of capacity to serve the EV market,” Albemarle’s president of energy storage Eric Norris said on an analyst call early last month.

“Here we are operating at a relatively healthy supply-demand utilisation with prices where they are so it’s very difficult to explain … but obviously we’re well positioned with our with our cost position and our go to market strategy to weather that storm.

“It’s just it’s going to be challenging for the industry at these levels.”

UP

- Lithium prices may be weak but junior lithium equities continue to see gains from M&A and rushes around new discoveries (cf. Azure, Wildcat, TG Metals)

- Prices could bottom well above previous cyclical lows amid inflation and the entry of high cost operators

DOWN

- Sodium ion could emerge as a cheaper technology to challenge the dominance of lithium battery chemistries in EVs

- “Growing pains” from western carmakers shifting to EV production could slow the pace of the industry’s expansion

Lithium stocks prices today:

Rare Earths (NdPr Oxide)

Price: US$67.94/kg

% Change: -4.66%

Rare earths prices have remained in a holding pattern, sitting around levels that prompted major non-Chinese producer Lynas (ASX:LYC) to stockpile non-contracted material a few months ago.

Prices rose as high as US$175/kg early last year for NdPr or neodymium-praseodymium, the high value magnet light rare earths which make up almost 30% of a standard permanent magnet — a key material in electric vehicle motors and wind turbines.

They averaged over US$120/kg in 2022 but have sagged badly in 2023 as higher quotas from the dominant producer China have run up against ho-hum demand in the spluttering Chinese economy.

Lynas boss Amanda Lacaze told investors at her AGM last week the company, which is waiting final approvals for gas infrastructure to confirm a commissioning date for its $730 million cracking and leaching plant in Kalgoorlie, would love to receive offtake from new market participants to build the supply chain outside China.

But none is forthcoming yet, with prices and rising finance costs an impediment to new operations chasing capital.

It is coming … slowly. Iluka Resources (ASX:ILU) is building a refinery at Eneabba in WA to process old mineral sands waste containing rich deposits of rare earths previously unfashionable to process and sell.

Northern Minerals (ASX:NTU) has an agreement to sell material from its Browns Range project near the WA-NT border to Iluka, but is currently embroiled in a dispute over share trading by a major Chinese investor.

Gina Rinehart backed Arafura (ASX:ARU) and Andrew Forrest supported Hastings Technology Metals (ASX:HAS) are among the other more advanced local hopefuls, while there are a number of companies aiming to open mineral sands and rare earths deposits in Victoria’s Murray Basin if they don’t run foul of long-standing regional farmers.

Peak Rare Earths (ASX:PEK) meanwhile last week revealed it had brought costs down for its Ngualla Rare Earths project in Tanzania, though it is planning to sell all its concentrate to major Chinese producer and 19.8% shareholder Shenghe Resources in a plan it thinks will help speed its entry to the market.

UP

- NdPr demand has risen 45% since 2019, leading ASX-listed explorer Lynas told investors at its AGM last week.

- Brazilian rare earths companies hoping to follow the success of Meteoric Resources (ASX:MEI) and its high grade Caldeira rare earths discovery are seeing strong support from the market, with Gina Rinehart backed Brazilian Rare Earths reportedly chasing $50 million in an upcoming IPO.

DOWN

- While demand is up strongly in recent years, a weak Chinese economic outlook has seen it stagnate in 2023

- China’s rare earth production quota is up 14% year on year, keeping a lid on prices until demand lifts again.

Rare Earths share prices today:

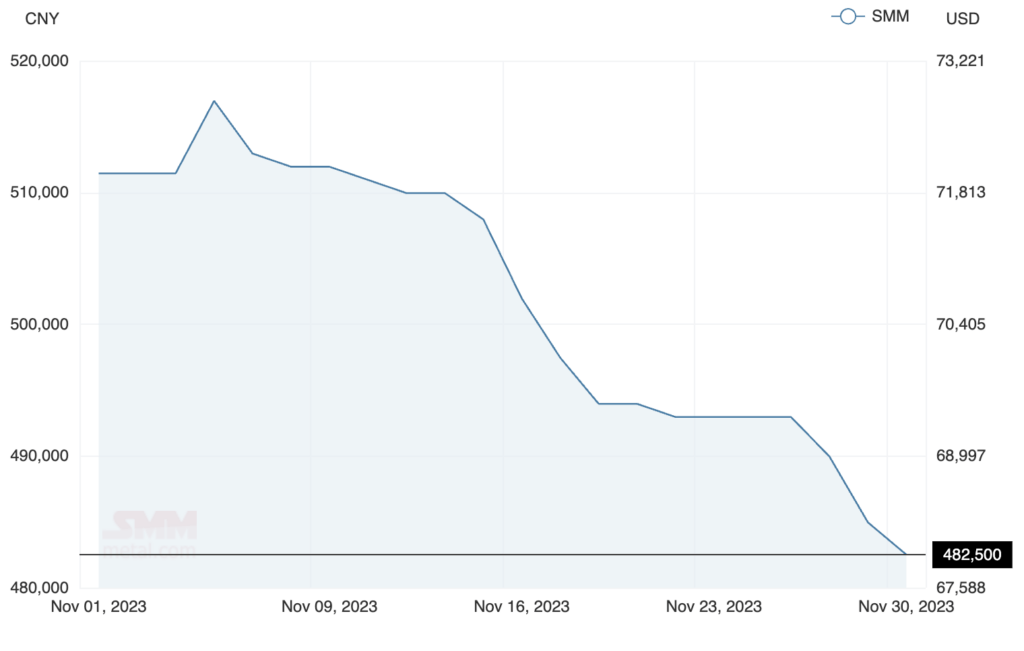

Nickel

Price: US$17,122/t

% Change: -5.56%

Nickel was one of the most volatile metals on the market in November, as fears of a surge in supply sent prices down to two year lows, halved from prices of over US$30,000/t seen at the start of 2023.

But short covering, a win for the LME in a court case over suspending and cancelling nickel trades in early 2022 and news Indonesian nickel would not be regarded as compliant for IRA purposes in America gave a bit of steam to the commodity late in November.

Indeed, prices ran up over US$1000/t in just two trading sessions to salvage some of the battery metal’s losses.

Lower prices hit miners hard, with Panoramic Resources (ASX:PAN) initiating the dreaded ‘strategic review’ over its high cost Savannah nickel operations in WA’s Kimberley.

IGO (ASX:IGO) meanwhile shuttered the Flying Fox nickel mine, part of the Forrestania project it picked up in a disastrous takeover of Western Areas.

Investors are awaiting news of the final costs and plan around the supposed jewel in that now heavily criticised acquisition — the Cosmos nickel mine.

The deal, which cost $1.3 billion, saw a writedown of almost $1 billion in IGO’s 2023 accounts which prompted angry questions from investors at its AGM last month.

UP

- Indonesian nickel will likely not be compliant for US carmakers seeking tax incentives in the Inflation Reduction Act

- Nickel use in batteries is forecast to grow next year, while stainless steel production is expected to recover from the second half of 2023 on after falling 0.9% in the first half, according to the International Nickel Study Group

DOWN

- The INSG forecasts the nickel market’s surplus will rise from 223,000t this year to 239,000t next year

- Indonesia could expand its market share from 55% to 70% in the next five years

Nickel miners share price today:

OTHER METALS

Prices correct as of November 30, 2023.

Silver

Price: US$25.25/oz

%: +9.07%

Tin

Price: US$23,501/t

%: -2.4%

Zinc

Price: US$2501/t

%: +2.94%

Cobalt*

Price: US$32,495/t

%: +0.04%

Aluminium

Price: US$2214/t

%: -1.67%

Lead

Price: US$2147/t

%: +2.97%

The post Up, Up, Down, Down: Gold, iron ore and uranium smash battery metals as old faithfuls capture the limelight appeared first on Stockhead.