- Rising costs are putting pressure on miners to keep going in the face of middling prices: ANZ

- Mine closures in nickel, lithium, copper could put floor under prices, but don’t expect a quick rise

- Materials close up 1.26% in solid Friday

Egg prices became a totem of the cost of living pressures being felt by Aussie battlers at the checkout, lifting 10.4% on the year to November in 2023.

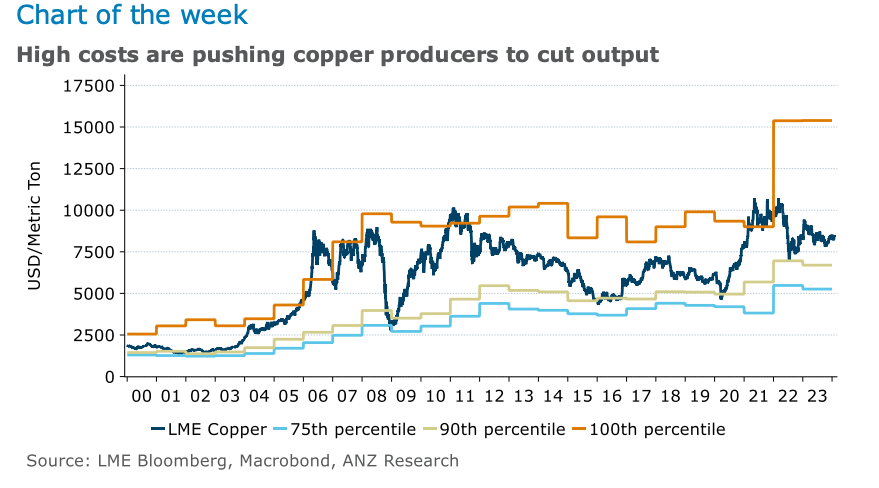

If you think that’s bad, some miners have been doing it even tougher, seeing costs lift as much as 40% in 2023 according to some number-crunching from ANZ’s commodity strategists Daniel Hynes and Soni Kumari.

OK, so maybe you won’t feel so bad for the multi-nationals forced to trim the fat at nickel, copper and lithium mines around the world.

While this is a sort of supply response — see any of our reporting on the downturn in nickel and lithium prices and their impact on Australian operations– ANZ’s boffins reckon its impact on prices will be more of stablisation than revival.

“Last year, inflation hit the mining industry, lifting costs by up to 40%. This came amid a slump in prices as tighter monetary policies and a lacklustre economic recovery in China weighed on demand,” they wrote in a note yesterday.

“The industry has reacted swiftly, with producers in copper, nickel and lithium cutting output, mothballing

operations and suspending new projects.

“With an uncertain economic backdrop, they are unlikely to trigger a rally in prices. However, we do see them providing a floor for prices.

“We expect more to come. Prices for metals, including nickel and lithium, remain well below the highest cost producers. Moreover, climate change policies could exacerbate the cutbacks as countries double down on efforts to reduce emissions. This is likely to impact steel and aluminium, two of the most energy-intensive industries.”

This chart is instructive, showing just how far spending from the top percentile copper producers has gotten out of hand. It’s like an escaped bull at a rodeo, blind with rage, which has shaken off its handlers and pierced its fallen rider through the gut.

How could falling output support prices?

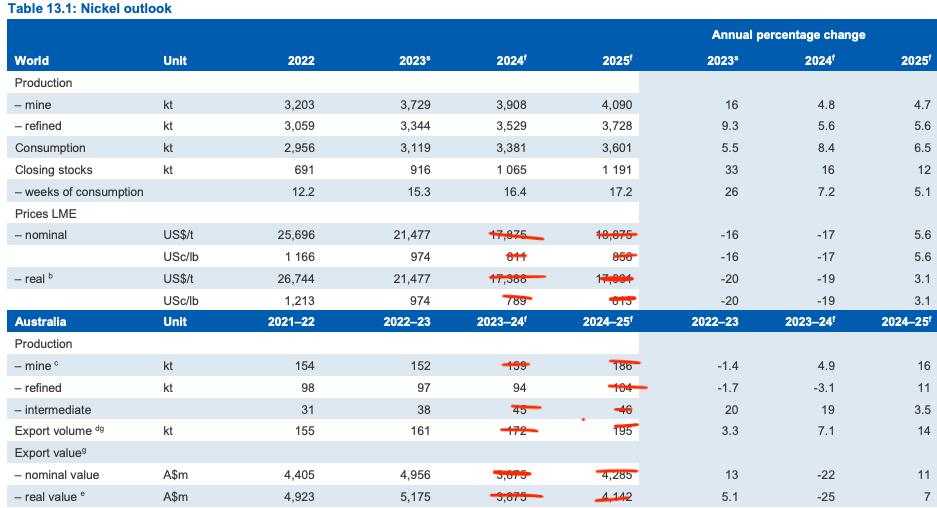

As much as 90,000t of nickel metal production will be lost from higher cost jurisdictions China and Australia as Indonesia dominates the market with its cheaper, larger scale exports.

But as much as 100,000t of nickel metal and 100,000t of raw ore exports from New Caledonia could be under threat due to low prices, high production costs and potential social unrest, Hynes and Kumari also said.

“The nickel industry’s response to recent price falls has also been relatively swift. Prices for LME grade nickel have fallen well below the industry’s cost support levels, leaving many producers to contemplate cutting or shutting operations,” they wrote.

“We calculate over 90kt of nickel production will be lost in 2024 due to mine closures in China and Australia. The latest to announce a closure was First Quantum’s

Ravensthorpe mine in Western Australia. BHP announced in recent weeks it is reviewing its nickel operations in the same state.

“In New Caledonia, Eramet has withdrawn funding from its Doniambo power station, Glencore from Koniambo Nickel and Trafigura from Prony Resources, leaving the plants

dependant on government support.

“If all close, the market will lose around 100kt per year of nickel, which in itself could boost sentiment around nickel prices. The risk of social unrest from the resultant layoffs could impact other operations, in

particular the 100k per year of nickel-in-ore exports to China, Korea and Japan.”

Among ANZ’s other commodity calls, they see limited impact on pricing until long-term contracts end, and predict environmetnal considerations will lead China to bring steel output to below 1Bt in 2024.

A 15% drop year on year in December and weak profit margins wasn’t enough to prevent China’s steel sector growing production for the first time since 2020, albeit marginally to 1.019Bt.

In copper, Hynes and Kumari say cost increases have seen prices hover to a level just above the 90th percentile.

Typically prices rise once 10% of the industry is losing money, ANZ says. Other factors, including mine supply issues in Latin America and an explosion in Chinese smelter bids are impacting the supply-demand balance.

“Tightness in the copper concentrate market will be exacerbated by the expansion of smelting and refining capacity in China. India will add 500kt of smelting capacity, which is likely to lift prices for concentrate while reducing treatment charges. This could shrink profit margins for smelters, increasing risks for refined copper producers,” Hynes and Kumari said.

“Demand for copper from builders of green energy infrastructure is expected to grow by 4% y/y to 27mt in 2024. So copper’s market balance looks tight and could easily flip into deficit.”

Goldman Sachs last month predicted prices would rise to US$10,000/t within 12 months on the back of supply disruptions from the closure of First Quantum’s 350,000tpa Cobre Panama mine and a more than 200,000tpa reduction in Anglo American’s copper guidance for 2024.

“Mine production disruptions have been relatively minimal over the past year, with just 200,000t of annual production impacted, but the risk of disruptions is rising,” Hynes and Kumari said.

“Given the expectation of growth from new projects in 2023, the scope for industry to miss its own guidance on project execution or experience slower ramp-ups is more than in recent years.”

And on the market

The ASX materials sector finally cut through the doom and gloom of the battery metals space today, finishing the week on a 1.26% Friday gain as of 4.10pm AEDT.

The big iron ore miners contributed despite falling prices for the commodity in China, while falling a US dollar gave gold prices a boost, taking Northern Star (ASX:NST) up more than 4%.

Uranium miners dominated the mid-tier gainers after spot prices returned to 16 year highs of US$106/lb.

That was prompted by concerns from Kazatomprom that sulphuric acid prices and supply shortages would impact output both this year and next for the world’s top uranium producer.

Boss Energy (ASX:BOE) notably closed at an all time high of $6.11.

Monstars share prices today

The post Monsters of Rock: And you thought the price of eggs was bad, some miners saw costs lift up to 40% in 2023 appeared first on Stockhead.