- Indonesia’s nickel quotas could have a domino effect on global markets

- Benchmark says short-term outlook hinges on expanded quotas

- ARL and AXN aim to grab place in market when deficit looms in 2028-29

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, and vanadium.

In the middle of 2024, the Indonesian government approved annual ore quotas of 240Mt out to 2026 in a move aimed at curbing illegal mining, improving environmental standards and ensuring responsible resource management amid concerns over premature resource depletions.

Now that quota has been cut to closer to 200Mt.

Benchmark Minerals Intelligence (BMI) notes this would leave domestic smelters reliant on imports from the neighbouring Philippines to fill this supply gap – a country Indonesia imported record levels of nickel ore from last year to sustain domestic refined output.

For context, that was a 24x increase between January and October compared to the entirety of 2023.

“Given the scale of the current estimated shortfall, it appears likely that there will be a cut to refined nickel production unless the quota is expanded from current levels,” BMI said.

Indonesia emerged as one of the world’s biggest producers of nickel after a 2020 ban on the export of raw nickel sent expansion of its domestic processing industry. But now this year’s quotas suggest the price may have fallen too far for even some of its own producers.

BMI says the short-term outlook for the nickel market hinges on the country shifting these mining quotas, known as RKAB.

Essentially, if Indonesia doesn’t shift the bar, they will not have enough nickel to meet domestic demand – and that will have a domino effect throughout the industry.

Nickel in surplus but not for long

Ardea Resources (ASX:ARL) managing director and CEO Andrew Penkethman says that because the nickel market is currently in surplus the Indonesian government is aiming to generate a higher margin from their nickel production – – and maximise the value for depleting their nickel resources.

“The ability for Indonesia to expand their rate of nickel production is starting to dwindle, the highest value lowest cost ore is being or has already been mined and the government is increasingly concerned by the rate of resource depletion,” he said.

“So, they’re looking at cutting their global supply which will have a big impact on the availability of nickel units for sale around the world.”

The nickel price is currently sitting between US$15,000/t and US$16,000/t, with a host of Australian mines including those owned by BHP closing last year, but Penkethman says there’s light at the end of the tunnel.

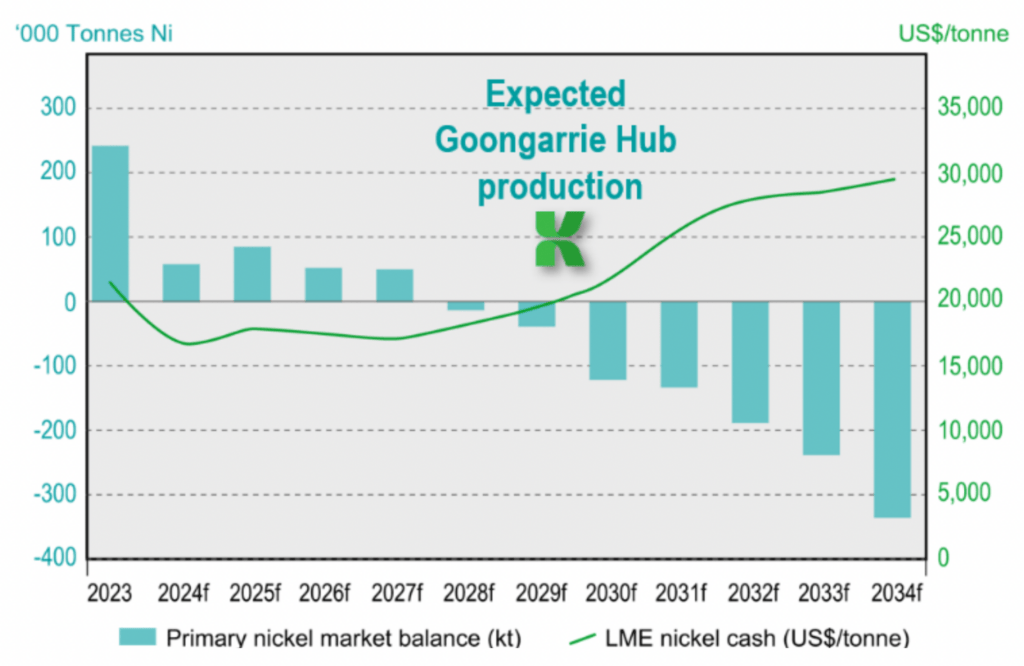

“Independent research from groups like Benchmark, WoodMac and Fastmarkets all highlight that nickel demand is only going to continue to increase through traditional uses like the stainless steel sector and in lithium-ion energy storage sector, and so the expectation is the nickel market will move back into deficit around 2028-2029 and we expect to see a strong nickel price response to that,” he said.

Ardea is hopeful its Kalgoorlie nickel project, where Japanese giants Sumitomo and Mitsubishi are conducting a feasibility study, expected to come online just as that deficit hits.

“We think our timing is really good, with our production currently earmarked for 2029 when the nickel market is expected to move back into deficit,” Penkethman said.

“But even based on current nickel prices we’ve already demonstrate with our July 2023 pre-feasibility study that we can be cost competitive.

“Our C1 operating cost, allowing for the cobalt by-product, was about US$6,000/t. I appreciate that the cobalt price has reduced since then but even on a nickel only basis, our C1 cost is about US$10,000/t – we’ll obviously update that as part of the current definitive feasibility study underway but it shows that we can be cost competitive with our global peers including Indonesia.”

Ultimately, he says we need security and diversity of nickel supply.

“Alternate sources of supply have to come online, and there’s no better jurisdiction than Australia, and with our project just north of Kalgoorlie we are perfectly positioned to develop Australia’s next large-scale, long-life, low-cost nickel-cobalt operation,” Penkethman said.

More supply chain diversity needed

Alliance Nickel (ASX:AXN) CEO and managing director Paul Kopejtka said Indonesia’s cuts could lead to a more balance global nickel market “potentially benefiting future producers like Alliance Nickel through improved pricing and increased demand for non-Indonesian nickel sulphate sources.”

“Some analysts believe prices could jump to US$20,000 per tonne by mid-2025 should supply constraints be introduced by Indonesia in that time,” he said.

“However, nickel price recovery will depend on a multitude of factors such as disciplined supply management, continued demand growth and customers trending towards more sustainably sourced nickel.”

Like Ardea, Alliance is optimistic about the long-term growth in nickel demand, underpinned by the global transition to electric vehicles, growth in renewable energy technologies and robust industrial demand – particularly from stainless steel production.

And Kopejtka says its NiWest project has the long-term sustainability and cost competitive advantages to secure a slice of the market.

“The project DFS released by Alliance Nickel last year underscores our competitive advantage, with the project firmly positioned in the first cost quartile for All-In Sustaining Cost (AISC) compared to domestic and international peers,” he said.

“This highlights industry-leading production efficiency of high purity battery-grade material from one of the largest, highest grade nickel laterite resources in Australia, cost resilience and long-term sustainability of NiWest, which is anticipated to have a 35-year life of mine.

“Alliance Nickel’s binding offtake agreement with Stellantis provides stable demand for NiWest products, positioning us favourably in the market.”

Nickel Industries (ASX:NIC), an ASX listed company that has become one of the largest nickel miners in the world by pursuing aggressive expansions in Indonesia, told analysts yesterday it remained confident of receiving upgraded RKAB permits for its Hengjaya mine and future permits for its Sampala project, which it believes can be developed for around US$50m, supplying ore to its four existing nickel pig iron plants and a new HPAL development.

MD Justin Werner suggested some local companies had fallen foul of regulatory requirements for updated feasibility studies and environmental management plans as Indonesia cracks down on environmentally unsound mining practices.

NIC sold 32,120t of nickel in metal from its RKEF lines in the December quarter and 2099t from its 10% share of a HPAL plant, generating underlying EBITDA of US$42m and US$14.7m respectively despite weak nickel prices.

Battery Metals Winners and Losers

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese and vanadium is performing >>>

| Security | Description | Last | %Wk | %Mth | %SixMth | %Yr | MktCap |

|---|---|---|---|---|---|---|---|

| XTC | XTC Lithium Limited | 0.2 | 19900% | 19900% | 19900% | 19900% | $17,528,272 |

| AQD | Ausquest Limited | 0.04 | 471% | 344% | 244% | 244% | $46,327,323 |

| AX8 | Accelerate Resources | 0.013 | 63% | 100% | 30% | -50% | $8,082,801 |

| ASO | Aston Minerals Ltd | 0.014 | 56% | 56% | 56% | -18% | $18,130,900 |

| LML | Lincoln Minerals | 0.006 | 50% | 20% | 20% | 0% | $10,281,298 |

| EVR | Ev Resources Ltd | 0.0035 | 40% | 17% | -24% | -62% | $7,250,013 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 33% | 0% | -60% | $1,929,431 |

| TAR | Taruga Minerals | 0.012 | 33% | 20% | 50% | 50% | $8,472,321 |

| AOA | Ausmon Resorces | 0.002 | 33% | 0% | 0% | -33% | $2,179,455 |

| G88 | Golden Mile Res Ltd | 0.009 | 29% | -10% | -10% | -40% | $4,466,006 |

| EMN | Euromanganese | 0.041 | 28% | 32% | -34% | -55% | $8,401,560 |

| AXN | Alliance Nickel Ltd | 0.04 | 25% | 3% | 5% | 33% | $29,033,585 |

| AKN | Auking Mining Ltd | 0.005 | 25% | 0% | -71% | -86% | $2,573,894 |

| TMX | Terrain Minerals | 0.005 | 25% | 67% | 25% | 0% | $7,242,782 |

| TOR | Torque Met | 0.072 | 24% | 44% | -47% | -63% | $17,476,475 |

| AZI | Altamin Limited | 0.027 | 23% | 8% | -10% | -42% | $15,511,578 |

| CLA | Celsius Resource Ltd | 0.011 | 22% | 10% | -8% | 0% | $26,692,385 |

| IG6 | Internationalgraphit | 0.068 | 21% | 39% | -24% | -48% | $13,161,966 |

| MRD | Mount Ridley Mines | 0.003 | 20% | 0% | -70% | -80% | $2,335,467 |

| ENV | Enova Mining Limited | 0.006 | 20% | 0% | -40% | -71% | $5,909,576 |

| LNR | Lanthanein Resources | 0.003 | 20% | 0% | -25% | -54% | $7,330,908 |

| LNR | Lanthanein Resources | 0.003 | 20% | 0% | -25% | -54% | $7,330,908 |

| GL1 | Globallith | 0.215 | 19% | 16% | -16% | -59% | $57,581,067 |

| SMX | Strata Minerals | 0.038 | 19% | 90% | 46% | -7% | $7,250,976 |

| VRC | Volt Resources Ltd | 0.0035 | 17% | 17% | -30% | -42% | $15,428,838 |

| VHM | Vhmlimited | 0.35 | 17% | -17% | -22% | -40% | $72,514,199 |

| TMB | Tambourahmetals | 0.029 | 16% | 26% | -41% | -66% | $2,985,931 |

| GW1 | Greenwing Resources | 0.04 | 14% | 18% | 0% | -58% | $9,626,059 |

| ASL | Andean Silver | 1.085 | 13% | 32% | 50% | 393% | $168,300,180 |

| SBR | Sabre Resources | 0.009 | 13% | -10% | -36% | -67% | $3,536,657 |

| ESR | Estrella Res Ltd | 0.028 | 12% | 33% | 460% | 460% | $53,229,079 |

| PFE | Pantera Lithium | 0.019 | 12% | 6% | -31% | -65% | $9,001,890 |

| BSX | Blackstone Ltd | 0.029 | 12% | 0% | -22% | -53% | $17,254,913 |

| EMH | European Metals Hldg | 0.155 | 11% | -14% | -39% | -48% | $32,153,929 |

| ARL | Ardea Resources Ltd | 0.38 | 10% | 17% | -16% | 4% | $75,879,508 |

| FLG | Flagship Min Ltd | 0.047 | 9% | -13% | -48% | -71% | $9,568,928 |

| DRE | Dreadnought Resources Ltd | 0.012 | 9% | 9% | -43% | -45% | $45,213,600 |

| KNI | Kunikolimited | 0.18 | 9% | -5% | -5% | -20% | $15,618,468 |

| RVT | Richmond Vanadium | 0.18 | 9% | -16% | -40% | -45% | $38,820,833 |

| MLX | Metals X Limited | 0.49 | 9% | 20% | 14% | 72% | $425,467,938 |

| RAS | Ragusa Minerals Ltd | 0.013 | 8% | 30% | -24% | -58% | $1,853,784 |

| TKM | Trek Metals Ltd | 0.026 | 8% | 0% | -10% | -35% | $13,523,194 |

| SLM | Solismineralsltd | 0.07 | 8% | -1% | -42% | -42% | $4,942,581 |

| TLG | Talga Group Ltd | 0.505 | 7% | 15% | 19% | -19% | $223,318,847 |

| ABX | ABX Group Limited | 0.044 | 7% | 7% | -12% | -39% | $11,012,911 |

| PAT | Patriot Lithium | 0.047 | 7% | 4% | 4% | -64% | $5,435,972 |

| NWC | New World Resources | 0.018 | 6% | 0% | -28% | -51% | $51,125,071 |

| EG1 | Evergreenlithium | 0.09 | 6% | 50% | 67% | -18% | $4,892,010 |

| DYM | Dynamicmetalslimited | 0.29 | 5% | 4% | 66% | 93% | $13,960,725 |

| STK | Strickland Metals | 0.08 | 5% | -6% | -9% | -20% | $176,593,179 |

| NTU | Northern Min Ltd | 0.02 | 5% | -5% | -33% | -23% | $170,123,281 |

| PGM | Platina Resources | 0.02 | 5% | 5% | -26% | 5% | $12,463,607 |

| BUX | Buxton Resources Ltd | 0.04 | 5% | -2% | -49% | -72% | $8,891,299 |

| GCM | Green Critical Min | 0.021 | 5% | 91% | 600% | 200% | $40,410,369 |

| WIN | WIN Metals | 0.021 | 5% | 24% | -9% | -74% | $11,551,220 |

| LIN | Lindian Resources | 0.105 | 5% | 31% | -9% | -28% | $126,821,446 |

| EV1 | Evolutionenergy | 0.021 | 5% | -7% | -34% | -84% | $7,615,660 |

| ASN | Anson Resources Ltd | 0.064 | 5% | 10% | -47% | -33% | $85,848,499 |

| MAN | Mandrake Res Ltd | 0.022 | 5% | -4% | -15% | -46% | $13,799,718 |

| MTM | MTM Critical Metals | 0.235 | 4% | 2% | 683% | 213% | $109,999,899 |

| 1MC | Morella Corporation | 0.024 | 4% | -17% | -44% | -81% | $7,596,107 |

| DVP | Develop Global Ltd | 2.46 | 4% | 10% | 21% | 1% | $638,273,289 |

| BMM | Bayanminingandmin | 0.052 | 4% | 4% | -24% | -42% | $4,474,107 |

| KAI | Kairos Minerals Ltd | 0.0135 | 4% | 13% | 69% | -10% | $34,201,858 |

| SRI | Sipa Resources Ltd | 0.014 | 4% | 8% | -26% | -30% | $3,988,364 |

| WMG | Western Mines | 0.14 | 4% | -7% | -43% | -26% | $12,649,468 |

| OCN | Oceanalithiumlimited | 0.028 | 4% | 8% | -19% | -55% | $3,712,402 |

| PGD | Peregrine Gold | 0.15 | 3% | 43% | -27% | -48% | $10,181,763 |

| AR3 | Austrare | 0.092 | 3% | -8% | 18% | -26% | $14,627,055 |

| EGR | Ecograf Limited | 0.093 | 3% | 4% | -11% | -31% | $42,234,259 |

| IDA | Indiana Resources | 0.067 | 3% | 10% | 54% | 50% | $43,063,075 |

| BCA | Black Canyon Limited | 0.067 | 3% | 2% | -12% | -36% | $7,107,630 |

| ICL | Iceni Gold | 0.072 | 3% | 7% | 14% | 73% | $22,167,754 |

| A8G | Australasian Metals | 0.077 | 3% | -1% | -9% | -38% | $4,399,619 |

| ZNC | Zenith Minerals Ltd | 0.043 | 2% | 5% | -14% | -70% | $17,519,981 |

| GBR | Greatbould Resources | 0.047 | 2% | 9% | -6% | -19% | $35,677,716 |

| LLI | Loyal Lithium Ltd | 0.097 | 2% | -14% | -22% | -55% | $9,771,107 |

| PSC | Prospect Res Ltd | 0.099 | 2% | 8% | -21% | 25% | $55,457,204 |

| ARU | Arafura Rare Earths | 0.1325 | 2% | 10% | -24% | 10% | $332,684,373 |

| ATM | Aneka Tambang | 0.9 | 1% | 0% | -13% | -23% | $1,173,284 |

| BM8 | Battery Age Minerals | 0.097 | 1% | -12% | -25% | -41% | $10,017,592 |

| LTM | Arcadium Lithium PLC | 9.2 | 1% | 11% | 80% | 20% | $2,281,252,136 |

| CAE | Cannindah Resources | 0.04 | 0% | 0% | -25% | -50% | $29,123,198 |

| COB | Cobalt Blue Ltd | 0.065 | 0% | -3% | -16% | -60% | $27,511,818 |

| LPD | Lepidico Ltd | 0.002 | 0% | 0% | 0% | -58% | $17,178,371 |

| CZN | Corazon Ltd | 0.002 | 0% | 0% | -60% | -85% | $2,369,145 |

| FRS | Forrestaniaresources | 0.01 | 0% | -29% | -66% | -66% | $2,439,635 |

| FGR | First Graphene Ltd | 0.055 | 0% | 90% | 8% | -2% | $37,799,433 |

| NH3 | Nh3Cleanenergyltd | 0.019 | 0% | 0% | 46% | 58% | $9,892,886 |

| MNS | Magnis Energy Tech | 0.042 | 0% | 0% | 0% | 0% | $50,378,922 |

| PLL | Piedmont Lithium Inc | 0.135 | 0% | -10% | -16% | -48% | $87,746,092 |

| BKT | Black Rock Mining | 0.034 | 0% | -8% | -45% | -46% | $42,569,652 |

| GLN | Galan Lithium Ltd | 0.12 | 0% | -11% | -15% | -77% | $97,152,160 |

| ADV | Ardiden Ltd | 0.14 | 0% | 4% | 4% | -13% | $8,439,863 |

| AAJ | Aruma Resources Ltd | 0.009 | 0% | -18% | -36% | -57% | $1,998,524 |

| IXR | Ionic Rare Earths | 0.006 | 0% | -14% | -33% | -70% | $31,430,570 |

| CWX | Carawine Resources | 0.105 | 0% | 5% | 15% | 0% | $24,793,172 |

| TKL | Traka Resources | 0.001 | 0% | 0% | -33% | -50% | $2,125,790 |

| PRL | Province Resources | 0.041 | 0% | 0% | 0% | 0% | $48,441,219 |

| IPT | Impact Minerals | 0.011 | 0% | 5% | -35% | -15% | $33,653,771 |

| ARN | Aldoro Resources | 0.3 | 0% | -13% | 257% | 186% | $48,021,529 |

| JRV | Jervois Global Ltd | 0.011 | 0% | -8% | -35% | -62% | $29,730,402 |

| POS | Poseidon Nick Ltd | 0.004 | 0% | -11% | 9% | -45% | $16,815,567 |

| AUZ | Australian Mines Ltd | 0.012 | 0% | 26% | 33% | 20% | $16,082,889 |

| ALY | Alchemy Resource Ltd | 0.007 | 0% | 0% | 0% | -13% | $8,246,534 |

| LEL | Lithenergy | 0.37 | 0% | 0% | 3% | -14% | $41,440,581 |

| RMX | Red Mount Min Ltd | 0.008 | 0% | -20% | -47% | -70% | $3,719,662 |

| REE | Rarex Limited | 0.009 | 0% | 13% | -36% | -57% | $7,207,613 |

| MRC | Mineral Commodities | 0.026 | 0% | 0% | 0% | 0% | $25,596,288 |

| PUR | Pursuit Minerals | 0.082 | 0% | -22% | -45% | -73% | $6,687,951 |

| LEG | Legend Mining | 0.01 | 0% | -17% | -17% | -29% | $29,094,772 |

| MOH | Moho Resources | 0.005 | 0% | 25% | -17% | -44% | $3,582,373 |

| AML | Aeon Metals Ltd. | 0.005 | 0% | 0% | 0% | -44% | $5,482,003 |

| WKT | Walkabout Resources | 0.095 | 0% | 0% | -10% | -21% | $63,769,838 |

| CNJ | Conico Ltd | 0.009 | 0% | -10% | -10% | -78% | $2,374,873 |

| BOA | BOA Resources Ltd | 0.022 | 0% | 10% | 10% | -24% | $2,713,763 |

| MRR | Minrex Resources Ltd | 0.008 | 0% | 0% | -11% | -43% | $8,678,940 |

| AM7 | Arcadia Minerals | 0.02 | 0% | 5% | -39% | -71% | $2,347,669 |

| GSM | Golden State Mining | 0.008 | 0% | 0% | -27% | -38% | $2,234,965 |

| IMI | Infinitymining | 0.011 | 0% | 0% | 22% | -90% | $4,631,174 |

| TEM | Tempest Minerals | 0.005 | 0% | 25% | -38% | -35% | $3,172,649 |

| EMC | Everest Metals Corp | 0.14 | 0% | 4% | 17% | 84% | $31,329,737 |

| OB1 | Orbminco Limited | 0.0015 | 0% | -25% | -50% | -70% | $4,333,180 |

| KOR | Korab Resources | 0.008 | 0% | 0% | 0% | -47% | $2,936,400 |

| CMX | Chemxmaterials | 0.026 | 0% | 0% | -42% | -66% | $3,354,580 |

| FRB | Firebird Metals | 0.099 | 0% | -10% | -18% | -14% | $14,093,779 |

| JMS | Jupiter Mines. | 0.145 | 0% | 0% | -45% | -17% | $284,351,055 |

| LRS | Latin Resources Ltd | 0.165 | 0% | 9% | 16% | 5% | $477,661,711 |

| CRR | Critical Resources | 0.005 | 0% | -17% | -29% | -64% | $13,375,798 |

| ENT | Enterprise Metals | 0.003 | 0% | -25% | -25% | -25% | $3,534,952 |

| SCN | Scorpion Minerals | 0.02 | 0% | 43% | 18% | -29% | $9,008,036 |

| RR1 | Reach Resources Ltd | 0.007 | 0% | 0% | -36% | -49% | $6,121,019 |

| PNT | Panthermetalsltd | 0.009 | 0% | -25% | -64% | -74% | $2,233,537 |

| AVW | Avira Resources Ltd | 0.001 | 0% | 0% | 0% | -50% | $2,938,790 |

| CAI | Calidus Resources | 0.115 | 0% | 0% | 0% | -44% | $93,678,206 |

| RGL | Riversgold | 0.003 | 0% | -25% | -40% | -68% | $5,051,138 |

| THR | Thor Energy PLC | 0.011 | 0% | -8% | -35% | -71% | $2,991,281 |

| CLZ | Classic Min Ltd | 0.001 | 0% | 0% | 0% | -98% | $1,544,026 |

| CRI | Criticalim | 0.017 | 0% | 42% | -6% | 113% | $48,392,075 |

| VTM | Victory Metals Ltd | 0.38 | 0% | -6% | 12% | 65% | $40,688,518 |

| M2R | Miramar | 0.004 | 0% | 14% | -43% | -82% | $1,587,293 |

| RR1 | Reach Resources Ltd | 0.007 | 0% | 0% | -36% | -49% | $6,121,019 |

| GRL | Godolphin Resources | 0.014 | 0% | 0% | -7% | -67% | $5,027,381 |

| DM1 | Desert Metals | 0.022 | 0% | -4% | -12% | -27% | $6,150,791 |

| M24 | Mamba Exploration | 0.017 | 0% | 42% | 55% | -69% | $3,994,274 |

| CDT | Castle Minerals | 0.002 | 0% | 0% | -43% | -71% | $3,793,628 |

| DLI | Delta Lithium | 0.17 | 0% | 3% | -28% | -39% | $121,812,105 |

| CY5 | Cygnus Metals Ltd | 0.14 | 0% | 40% | 122% | 106% | $118,764,751 |

| PBL | Parabellumresources | 0.055 | 0% | 2% | 45% | -15% | $3,426,500 |

| OM1 | Omnia Metals Group | 0.078 | 0% | 0% | 0% | 0% | $4,550,568 |

| LLL | Leolithiumlimited | 0.332997 | 0% | 0% | 0% | 0% | $401,057,170 |

| SRN | Surefire Rescs NL | 0.004 | 0% | 14% | -50% | -60% | $9,665,231 |

| WSR | Westar Resources | 0.009 | 0% | 29% | 13% | -47% | $3,588,523 |

| LU7 | Lithium Universe Ltd | 0.009 | 0% | 13% | -35% | -59% | $7,073,817 |

| MHC | Manhattan Corp Ltd | 0.024 | 0% | 26% | -4% | -52% | $5,637,574 |

| ANX | Anax Metals Ltd | 0.01 | 0% | -9% | -60% | -52% | $8,764,517 |

| FIN | FIN Resources Ltd | 0.004 | 0% | -20% | -43% | -75% | $2,597,075 |

| LM1 | Leeuwin Metals Ltd | 0.12 | 0% | -14% | 43% | 14% | $5,622,201 |

| LCY | Legacy Iron Ore | 0.009 | 0% | 0% | -45% | -45% | $87,858,383 |

| ASR | Asra Minerals Ltd | 0.003 | 0% | 0% | -50% | -50% | $6,937,890 |

| KM1 | Kalimetalslimited | 0.12 | 0% | 0% | -20% | -77% | $9,219,315 |

| KNG | Kingsland Minerals | 0.12 | 0% | -17% | -35% | -53% | $8,344,505 |

| BHP | BHP Group Limited | 39.41 | -1% | -1% | -6% | -16% | $198,541,753,486 |

| CTM | Centaurus Metals Ltd | 0.395 | -1% | 10% | 8% | 32% | $198,680,485 |

| NMT | Neometals Ltd | 0.078 | -1% | 8% | 11% | -48% | $60,015,157 |

| QEM | QEM Limited | 0.069 | -1% | 33% | -50% | -62% | $12,976,691 |

| OMH | OM Holdings Limited | 0.34 | -1% | -6% | -23% | -29% | $260,527,312 |

| HAS | Hastings Tech Met | 0.32 | -2% | -3% | 5% | -43% | $58,043,563 |

| ARR | American Rare Earths | 0.285 | -2% | 2% | 12% | 119% | $141,798,524 |

| RNU | Renascor Res Ltd | 0.057 | -2% | -8% | -35% | -30% | $144,895,833 |

| ITM | Itech Minerals Ltd | 0.052 | -2% | 0% | -27% | -37% | $8,883,440 |

| GED | Golden Deeps | 0.0225 | -2% | -17% | -34% | -39% | $3,409,253 |

| MLS | Metals Australia | 0.0225 | -2% | 2% | 13% | -32% | $16,396,189 |

| LRV | Larvottoresources | 0.635 | -2% | 26% | 452% | 807% | $261,809,716 |

| LKE | Lake Resources | 0.04 | -2% | -5% | 8% | -56% | $71,222,166 |

| PLS | Pilbara Min Ltd | 2.35 | -2% | 7% | -20% | -35% | $7,109,284,933 |

| RAG | Ragnar Metals Ltd | 0.0195 | -3% | 3% | 8% | -11% | $9,242,727 |

| KZR | Kalamazoo Resources | 0.075 | -3% | -3% | 9% | -21% | $15,416,722 |

| PNN | Power Minerals Ltd | 0.09 | -3% | -3% | -5% | -42% | $10,246,939 |

| BNR | Bulletin Res Ltd | 0.036 | -3% | -8% | -28% | -57% | $10,570,080 |

| FTL | Firetail Resources | 0.07 | -3% | -11% | -13% | 23% | $23,206,958 |

| LTR | Liontown Resources | 0.685 | -3% | 25% | -28% | -28% | $1,637,961,240 |

| NVA | Nova Minerals Ltd | 0.335 | -3% | -3% | 139% | -8% | $103,032,773 |

| AVL | Aust Vanadium Ltd | 0.0145 | -3% | 4% | -3% | -26% | $120,885,213 |

| GAL | Galileo Mining Ltd | 0.145 | -3% | 21% | -19% | -31% | $28,655,614 |

| PTR | Petratherm Ltd | 0.435 | -3% | 50% | 2459% | 1640% | $132,954,533 |

| AGY | Argosy Minerals Ltd | 0.028 | -3% | -3% | -36% | -72% | $40,765,786 |

| SUM | Summitminerals | 0.125 | -4% | 0% | -38% | 76% | $10,890,999 |

| ASM | Ausstratmaterials | 0.475 | -4% | -3% | -26% | -53% | $86,126,827 |

| LOT | Lotus Resources Ltd | 0.235 | -4% | 24% | -10% | -30% | $531,596,687 |

| KOB | Kobaresourceslimited | 0.07 | -4% | -8% | -53% | -50% | $11,099,313 |

| WC8 | Wildcat Resources | 0.23 | -4% | -12% | -4% | -42% | $321,385,107 |

| L1M | Lightning Minerals | 0.091 | -4% | 23% | 32% | -4% | $7,749,624 |

| AZL | Arizona Lithium Ltd | 0.011 | -4% | -15% | -39% | -50% | $50,179,960 |

| DEV | Devex Resources Ltd | 0.086 | -4% | -4% | -66% | -66% | $37,985,398 |

| CHR | Charger Metals | 0.064 | -4% | -2% | 5% | -49% | $4,954,896 |

| GRE | Greentechmetals | 0.064 | -4% | -9% | -47% | -74% | $7,625,688 |

| VMC | Venus Metals Cor Ltd | 0.063 | -5% | -7% | -24% | -34% | $12,356,107 |

| MEK | Meeka Metals Limited | 0.105 | -5% | 36% | 156% | 192% | $273,528,012 |

| WA1 | Wa1Resourcesltd | 13.17 | -5% | 1% | -14% | 25% | $880,305,088 |

| WCN | White Cliff Min Ltd | 0.019 | -5% | 15% | 19% | 19% | $36,013,944 |

| 1AE | Auroraenergymetals | 0.057 | -5% | 27% | -5% | -58% | $10,206,633 |

| KFM | Kingfisher Mining | 0.035 | -5% | -13% | -46% | -70% | $1,880,025 |

| IPX | Iperionx Limited | 3.92 | -6% | -30% | 78% | 125% | $1,244,434,217 |

| SGQ | St George Min Ltd | 0.0255 | -6% | 2% | -23% | -9% | $30,963,511 |

| BC8 | Black Cat Syndicate | 0.665 | -6% | 8% | 87% | 177% | $403,927,253 |

| CNB | Carnaby Resource Ltd | 0.33 | -6% | -7% | -34% | -50% | $71,998,721 |

| QPM | QPM Energy Limited | 0.065 | -6% | 18% | 76% | 63% | $189,095,680 |

| LIT | Livium Ltd | 0.016 | -6% | -6% | -27% | -41% | $21,440,175 |

| LMG | Latrobe Magnesium | 0.016 | -6% | -24% | -62% | -72% | $37,576,598 |

| MIN | Mineral Resources. | 34.24 | -6% | 0% | -37% | -43% | $7,123,799,395 |

| JLL | Jindalee Lithium Ltd | 0.21 | -7% | 0% | -24% | -78% | $15,454,288 |

| RXL | Rox Resources | 0.21 | -7% | 6% | 45% | 32% | $127,655,503 |

| PEK | Peak Rare Earths Ltd | 0.14 | -7% | 27% | -36% | -42% | $47,475,774 |

| PEK | Peak Rare Earths Ltd | 0.14 | -7% | 27% | -36% | -42% | $47,475,774 |

| S32 | South32 Limited | 3.32 | -7% | -2% | 10% | -1% | $14,862,297,923 |

| INF | Infinity Lithium | 0.027 | -7% | 0% | -48% | -70% | $12,489,987 |

| IGO | IGO Limited | 4.97 | -7% | 2% | -12% | -35% | $3,899,929,237 |

| NIC | Nickel Industries | 0.79 | -7% | -7% | -2% | 32% | $3,431,847,904 |

| PVW | PVW Res Ltd | 0.013 | -7% | -7% | -48% | -77% | $2,585,762 |

| SRZ | Stellar Resources | 0.013 | -7% | -13% | -32% | 86% | $27,036,757 |

| FBM | Future Battery | 0.025 | -7% | 47% | 4% | -56% | $16,633,898 |

| MQR | Marquee Resource Ltd | 0.012 | -8% | -25% | 9% | -41% | $5,825,766 |

| NVX | Novonix Limited | 0.5625 | -8% | -19% | -22% | -8% | $365,352,572 |

| FG1 | Flynngold | 0.023 | -8% | -12% | -4% | -55% | $6,010,279 |

| WR1 | Winsome Resources | 0.46 | -8% | 2% | -23% | -20% | $102,067,410 |

| LYC | Lynas Rare Earths | 6.235 | -8% | -4% | 0% | 5% | $5,907,418,929 |

| MEI | Meteoric Resources | 0.079 | -8% | -12% | -21% | -62% | $181,926,160 |

| SYA | Sayona Mining Ltd | 0.022 | -8% | -19% | -29% | -44% | $253,952,512 |

| ODE | Odessa Minerals Ltd | 0.0055 | -8% | -21% | 83% | -21% | $9,597,195 |

| HAW | Hawthorn Resources | 0.042 | -9% | 2% | -41% | -53% | $14,070,656 |

| AS2 | Askarimetalslimited | 0.01 | -9% | -9% | -73% | -92% | $2,646,846 |

| KTA | Krakatoa Resources | 0.01 | -9% | 11% | -9% | -47% | $5,901,340 |

| LPM | Lithium Plus | 0.077 | -9% | -8% | -30% | -67% | $10,228,680 |

| NC1 | Nicoresourceslimited | 0.086 | -9% | -5% | -34% | -64% | $9,412,749 |

| ILU | Iluka Resources | 4.48 | -9% | -11% | -25% | -38% | $1,948,534,474 |

| VR8 | Vanadium Resources | 0.028 | -10% | -7% | -44% | -33% | $15,753,506 |

| A11 | Atlantic Lithium | 0.23 | -10% | -19% | -38% | -39% | $159,423,882 |

| SYR | Syrah Resources | 0.225 | -10% | 25% | -17% | -49% | $238,025,106 |

| DTM | Dart Mining NL | 0.009 | -10% | -10% | -51% | -30% | $5,681,528 |

| KGD | Kula Gold Limited | 0.0045 | -10% | -21% | -57% | -40% | $2,894,454 |

| SYR | Syrah Resources | 0.225 | -10% | 25% | -17% | -49% | $238,025,106 |

| CMO | Cosmometalslimited | 0.017 | -11% | -23% | -66% | -70% | $2,226,879 |

| REC | Rechargemetals | 0.017 | -11% | 0% | -45% | -78% | $4,360,329 |

| MHK | Metalhawk. | 0.295 | -11% | 5% | 490% | 181% | $34,615,976 |

| GT1 | Greentechnology | 0.058 | -11% | -4% | 0% | -63% | $23,325,126 |

| CHN | Chalice Mining Ltd | 1.0875 | -11% | -3% | 2% | 8% | $431,819,735 |

| EVG | Evion Group NL | 0.024 | -11% | -4% | 14% | -25% | $8,327,116 |

| RBX | Resource B | 0.031 | -11% | -14% | -23% | -59% | $3,570,719 |

| PMT | Patriotbatterymetals | 0.3275 | -11% | -23% | -37% | -59% | $191,644,750 |

| S2R | S2 Resources | 0.069 | -12% | 3% | -40% | -49% | $31,247,202 |

| CXO | Core Lithium | 0.088 | -12% | 2% | -6% | -54% | $190,728,383 |

| TVN | Tivan Limited | 0.11 | -12% | 0% | 96% | 93% | $216,223,271 |

| TON | Triton Min Ltd | 0.007 | -13% | -22% | -30% | -63% | $10,978,721 |

| SLZ | Sultan Resources Ltd | 0.007 | -13% | 0% | 0% | -53% | $1,620,289 |

| EMS | Eastern Metals | 0.013 | -13% | -13% | -57% | -64% | $1,477,791 |

| NWM | Norwest Minerals | 0.013 | -13% | -19% | -48% | -46% | $6,306,554 |

| WC1 | Westcobarmetals | 0.019 | -14% | 19% | -36% | -65% | $3,166,423 |

| AXE | Archer Materials | 0.4 | -14% | -23% | 33% | 25% | $101,938,805 |

| CTN | Catalina Resources | 0.003 | -14% | 0% | 0% | 0% | $3,948,786 |

| STM | Sunstone Metals Ltd | 0.006 | -14% | -14% | -33% | -50% | $30,900,022 |

| RON | Roninresourcesltd | 0.175 | -15% | -8% | 46% | 25% | $7,065,627 |

| EFE | Eastern Resources | 0.027 | -16% | -4% | -46% | -61% | $3,404,429 |

| ADD | Adavale Resource Ltd | 0.0025 | -17% | 0% | -38% | -69% | $3,852,080 |

| HRE | Heavy Rare Earths | 0.025 | -17% | -17% | -16% | -47% | $5,200,847 |

| VUL | Vulcan Energy | 4.73 | -17% | -15% | 11% | 119% | $1,057,413,625 |

| E25 | Element 25 Ltd | 0.28 | -18% | 10% | 33% | -11% | $60,475,910 |

| INR | Ioneer Ltd | 0.1725 | -18% | 8% | 28% | 57% | $412,242,690 |

| OD6 | Od6Metalsltd | 0.056 | -19% | 24% | 37% | -63% | $8,081,410 |

| LSR | Lodestar Minerals | 0.012 | -20% | -20% | -40% | -75% | $2,710,638 |

| EMT | Emetals Limited | 0.004 | -20% | -20% | 0% | -33% | $3,400,000 |

| SRL | Sunrise | 0.265 | -22% | 15% | -35% | -34% | $23,459,149 |

| EUR | European Lithium Ltd | 0.058 | -24% | 49% | 23% | -31% | $89,601,251 |

| QXR | Qx Resources Limited | 0.003 | -25% | -25% | -57% | -82% | $3,930,234 |

| PVT | Pivotal Metals Ltd | 0.006 | -25% | -25% | -68% | -68% | $5,443,355 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 0% | -40% | -70% | $1,509,861 |

| ETM | Energy Transition | 0.065 | -26% | 91% | 195% | 71% | $102,049,773 |

| BUR | Burleyminerals | 0.058 | -30% | -21% | -54% | -42% | $9,022,257 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 0% | -43% | -50% | $1,553,413 |

| VML | Vital Metals Limited | 0.002 | -33% | 0% | -33% | -60% | $11,790,134 |

| RIL | Redivium Limited | 0.0025 | -38% | -38% | 100% | -33% | $8,505,889 |

Weekly Small Cap Standouts

After several months of researching antimony markets, EVR has reached an agreement to acquire 70% of an operating JV over the Los Lirios antimony mine in Oaxaca, Mexico.

The project consists of four licences covering 1652ha (16.52km2), three open pits, and several underground workings on a 7km trend that date back several generations.

EVR managing director Hugh Callaghan said the company has been intrigued by antimony for some time.

“It has many deep and flexible markets with mature technologies and minimal risk of substitution,” he said.

“The depletion of Chinese resources and consequent suspension of exports comes after decades of minimal exploration for antimony and closure of most mines outside of China.

“We are satisfied that antimony has the characteristics of a real, and sustainable market, and we are equally convinced that low-cost jurisdictions with skills for mining on a relatively small scale, such as in Mexico, are essential.”

EVR has commenced due diligence and planning for an exploration program.

By the end of March, EVR plans to begin the search for a suitable plant location, and proceed to a program of sampling and trenching, with a view to defining drill targets at Los Lirios.

The rare earths explorer has wrapped up a $1.5m placement to fund the development of its CODA lithium project in Brazil, and Charley Creek alluvial minerals sands project in the NT – with a specific focus on metallurgical test work and engineering.

In the latter half of 2024, exploration drilling at CODA North identified mineralisation with an expansive area extent of over 10 sqkm starting from surface in many locations and extending to depths of 70 metres.

Notably, this mineralisation is ‘free-dig’ weathered saprolites with consistent zones of high-grade REE, scandium and titanium.

This funding will allow continued metallurgical work investigating methods of metal extraction and within six months, a process flow design and project concept.

The company will also continue field exploration of its Lithium Valley (also Minas Gerais, Brazil) tenements and geochemical sampling.

The post High Voltage: Indonickel production quotas an ingredient in the cocktail for a price rebound appeared first on Stockhead.