- AMEC commissioned report suggests IRA style ‘production tax credit’ could supercharge downstream battery metals processing in Australia

- Comes amid crisis over nickel and lithium mining curbs

- Miners say they need support to be competitive with overseas players

A West Australian mining embassy has flown in to Canberra in a bid to put subsidies for downstream processing under the eyes of the nation’s decision makers, putting forward a policy idea they say could ramp up domestic lithium hydroxide production over 8x by 2035.

Following the lead of the US Inflation Reduction Act and China’s support for critical minerals, which included US$29 billion of spending between 2009 and 2022 to turn it into the world’s biggest electric vehicle player, modelling commissioned by the Association of Mining and Exploration Companies says a 10% tax subsidy could significantly expand Australia’s role downstream in the EV supply chain.

It says the move could add $2.4b to Australia’s economy but cost $340m over the budget’s forward estimates to 2027-28 and $1.69b to 2035.

Additional investment would peak at $1.6b in 2028, underpinning a peak in construction jobs of 1800 a year later.

But the scale of the industry would be substantially larger, a Mandala Partners report says, estimating refined lithium production would be 8.4x higher with the tax break, nickel sulphate output 2.1x up, vanadium oxide 6.2x higher and separated rare earth oxides 1.6x bigger.

The investment could also spawn new industries in precursor, cathode and vanadium electrolyte production, the report claims.

The PTC has been a cause celebre for critical minerals players along with attempts to get international commodity exchanges and Western customers to recognise a ‘green premium’ for Australian nickel and other metals.

All up, AMEC’s modelling says the expansion of downstream processing could provide 4220 Aussie jobs by 2035.

Can Australia compete downstream?

The push comes as Australia faces serious questions about its capability to develop downstream processing technologies perfected in China.

Lithium hydroxide facilities owned by global lithium giants Albemarle and the JV of Tianqi and IGO (ASX:IGO), collectively the owners of WA’s creme de la creme lithium mine Greenbushes, were announced several years ago to much fanfare.

But production ramp up and product qualification at each has been so slow as to be almost comical.

Albemarle boss Kent Masters told the BMO conference this week the US major had flown in experts from China, where it already operates lithium refineries, to bring its Aussie team at the Kemerton plant near Bunbury up to speed.

The company announced a multi-billion dollar expansion of the initial 50,000tpa plant last year despite falling lithium prices which led to it pausing work on the last of four 25,000tpa trains in January.

The third train will still be built, but the plant’s product is yet to be qualified. WA will have its third stab at doing it right with SQM and Wesfarmers’ (ASX:WES) Covalent lithium refinery in Kwinana.

But there has been growing skepticism from Australian lithium executives about the fiscal logic of heading downstream.

Pilbara Minerals (ASX:PLS) has a small stake in a refinery in Korea with its customer POSCO, but it remains uncertain whether it will pursue a strategy of more substantial vertical integration with a strategic process to place 300,000t of spodumene concentrate from the expansion of its Pilgangoora mine to 1Mtpa.

It is developing a 3000tpa pilot plant to develop a novel midstream lithium phosphate product in partnership with electric calcining technologist Calix (ASX:CXL) which has been mooted as a potential best of both worlds development for the Aussie market.

Mineral Resources (ASX:MIN) MD and founder Chris Ellison, one of WA’s most influential businessmen, halted a $1 billion deal with Albemarle to head into refining in China last year and has grown increasingly dismissive of the economics of heading downstream.

He told analysts just last week it was a lost cause without government support, saying rates of return were in the single digits — most large cap miners look for an IRR above 15% to justify investing capital.

Ellison says he won’t go downstream without a ‘free carry’, but that organisations in Germany and the UK who have come to the table don’t have the track record to demonstrate they can deliver.

“I mean, everyone has this vision you make a lot of money in downstreaming. Let me tell you, right, really clearly; the ROIC on downstreaming, it’s single digit. And if anyone tells you out there they’re an expert on running these plants, call bullshit,” he said.

“I mean, we’ve got two very large plants in Western Australia that have never made a tonne of product. And I’m just not up for that.”

Nickel ripples

In tow with the AMEC caravan is Wyloo Metals CEO Luca Giacovazzi, whose ultimate boss Andrew Forrest delivered a screed on clean and dirty nickel to the National Press Club earlier this week. Executives from PLS, IGO and Tesla are also among the delegation, along with Queensland vanadium hopeful QEM Ltd’s (ASX:QEM) MD Gavin Loyden.

And while we have seen production curbs at a range of Aussie lithium mines including those owned by Core Lithium (ASX:CXO), MinRes’ Wodgina, Greenbushes and Arcadium’s (ASX:LTM) Mt Cattlin, it’s nickel where the concern most intensely lies.

A couple years ago IGO and Wyloo were touting their plans to develop a long-life nickel sulphate refinery in Kwinana to supply battery-grade nickel to the EV market.

But in around a month at the start of 2024 low prices caused by a glut of supply and technological advancements by Chinese backed Indonesian nickel producers has sent the industry to the wall.

Benchmark Minerals Intelligence estimates around 40,000t of nickel metal output curbs have already been announced by Australian nickel sulphide and laterite producers.

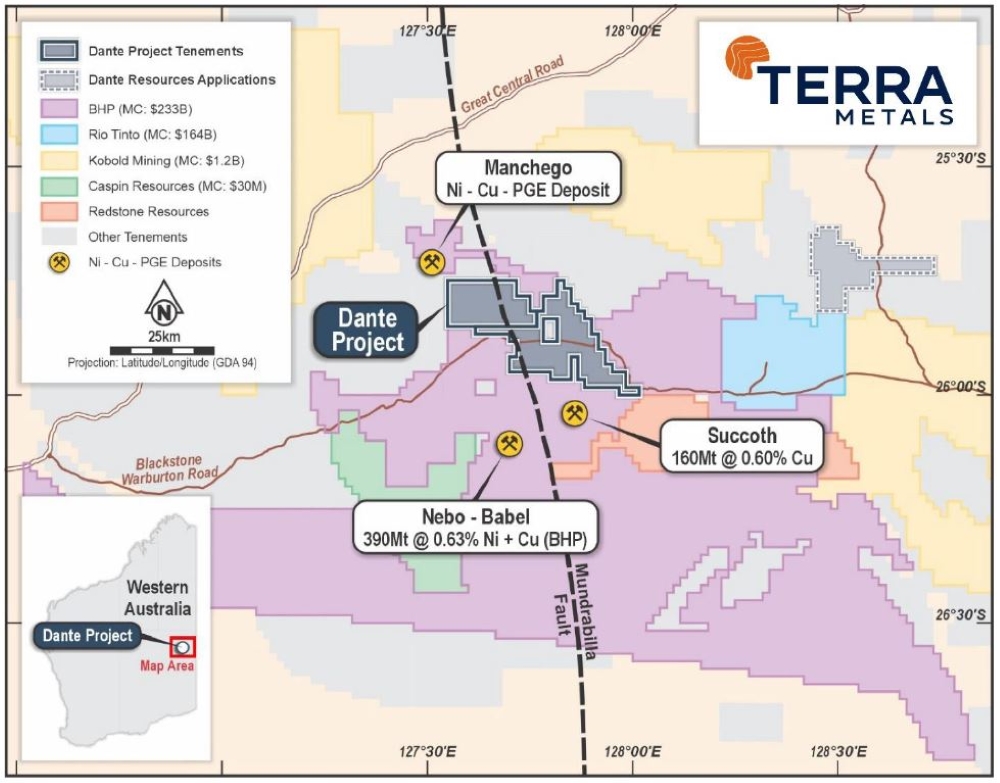

BHP (ASX:BHP) is reviewing whether to put its integrated 80,000tpa Nickel West business on ice as well after writing down its value to negative US$300m.

That prompted the feds to place nickel on the critical minerals list, opening up the commodity to a $4 billion loan and grants facility, while the WA Government has offered a 50% royalty holiday for 18 months (to be repaid once prices return to higher levels).

Mandala’s report says global interventions in industrial policy rose 46-fold between 2010 and 2022, with the PTC intended to make Aussie producers competitive with companies operating under IRA legislation in the USA.

Aurelia looks to turn a corner

It was a tough day for straggling half year reporters coming into the end of the season, with red across the board.

Aurelia Metals (ASX:AMI) at least limited losses from its New South Wales gold and base metals mines after the closure last year of the high cost Hera mine.

It’s aim is to get into stoping at the new Federation mine by the September quarter, after generating an underlying net loss after tax of $1.8m and statutory net loss after tax of $2m in H1 FY24.

That was an improvement on its $29.5m statutory net loss in H1 last year, with its underlying EBITDA rising 153% to $31m and margin up from 8% to 22%.

The miner had $108.7m in the bank at December 31, banking a tax refund of $17.8m in January. MD Bryan Quinn said it had $160m in liquidity to pursue growth plans in the Cobar Region.

“It is pleasing to see progress against our strategy and vision, with some solid business results underpinned by improvement plans and growth projects, all contributing to a stronger first half financial performance,” he said.

“We remain focussed on lifting operating efficiencies, tightly manage our balance sheet and capital allocation across our portfolio to drive down costs, grow margin and deliver value for shareholders, but recognise we still have much to achieve on this journey.

“We have a significant opportunity to grow our business in the Cobar Region, supported by a strong outlook in base metals.”

Quinn said growth programs were funded from cashflow through the first half of the year to support AMI’s balance sheet.

There were fewer bright spots for overseas miners SSR Mining (ASX:SSR) and Sierra Rutile (ASX:SRX).

SSR shares fell 7.3% after the gold miner delivered over US$338m of impairments following the collapse of a heap leach pad at its Copler mine in Turkiye, which has left nine workers still unaccounted for.

More impairments and a large remediation liability is likely to come as the first quarter unfolds.

At Sierra Rutile, the mineral sands mines swung from a $75.6m profit to a $20.7m loss in 2023 on lower prices, higher costs and lower sales from its Area 1 mine in Sierra Leone.

But a bigger concern is the news Area 1 would be shut from March 11 this year amid a dispute with the country’s government over plans to remove tax concessions for the mine.

SRX shares were unchanged today but are down 32% year to date and almost 80% since being hived off from Iluka Resources (ASX:ILU) in 2022.

Financial results reporters this morning

The post Ground Breakers: Miners want Canberra’s help to compete in critical minerals. Is it worth it? appeared first on Stockhead.