- Nickel prices continue to trend down on increased Indo production, weak EV/stainless steel demand, and substitution of nickel in batteries

- Nickel matte production from Indonesia could disrupt ‘nickel sulphide is for batteries’ thematic

- Indo-focused Nickel Industries (ASX:NIC) talking to as many as 20 EV makers about battery nickel supply

- Today inked first direct matte sales to Western customers via sales contract with Glencore

Nickel sulphide stocks are battling on multiple fronts as Indonesian matte production, weaker-than predicted EV demand, and the substitution of nickel in batteries take their toll on prices.

The nickel story used to be simple.

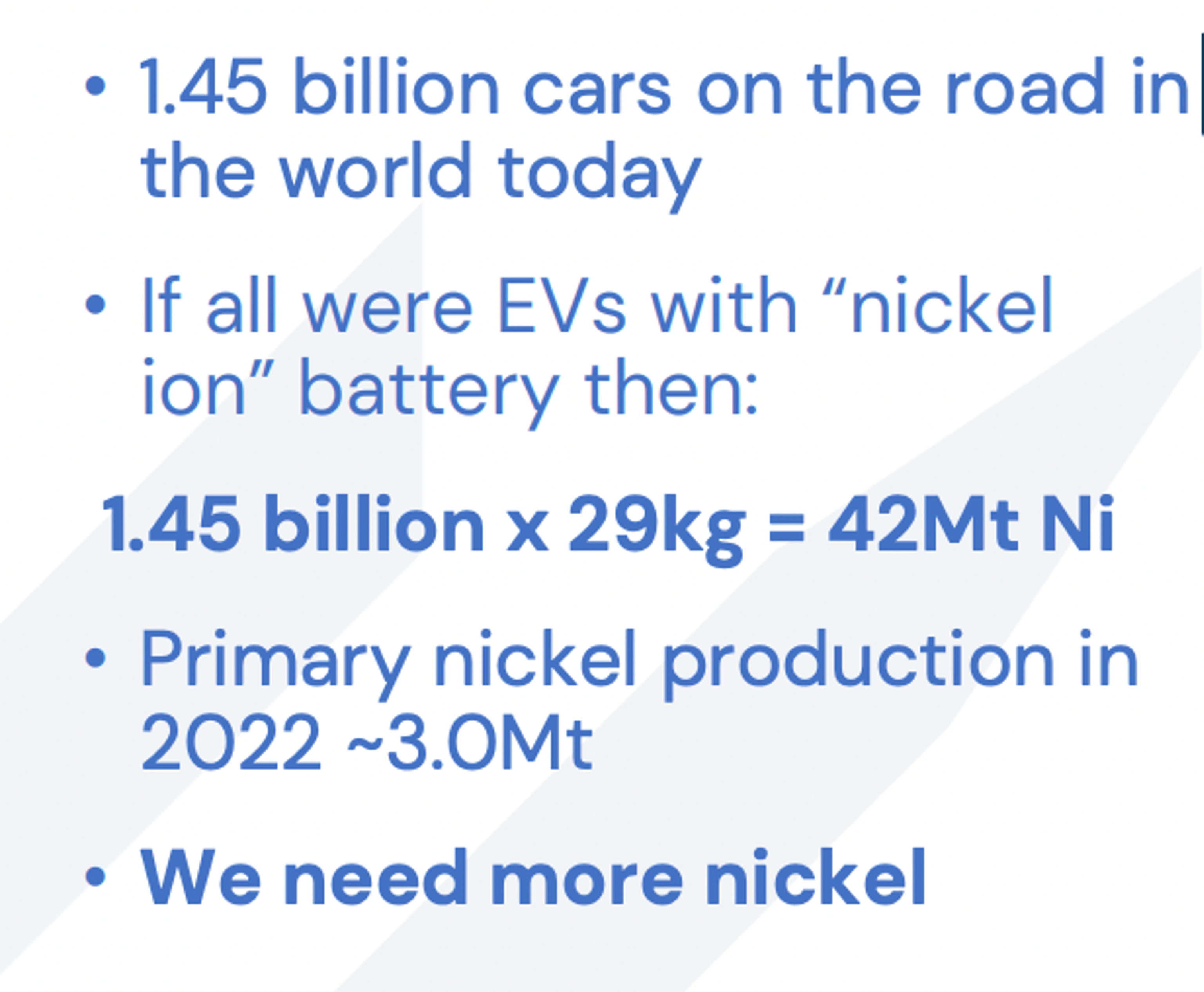

Stainless steel consumes ~70% of the world’s nickel, mostly Class 2 from laterites. But the big growth opportunity is battery quality sulphide nickel (Class 1), which the world will soon have an acute shortage of, the experts said.

Sulphide nickel was ideal for batteries, while laterite used in steel was not. This put Aussie sulphide explorers and miners in an enviable spot.

To make battery grade nickel and cobalt from laterite ore was tough, with High Pressure Acid Leach (HPAL) the incumbent process. HPAL is expensive to build and difficult to get right.

But the Chinese have a history of processing innovation.

In the 2000s, the Middle Kingdom developed something called nickel pig iron (NPI) which remains the cheap way to get nickel into stainless steel.

This low-cost substitute flooded the market and flattened a red-hot nickel price:

It was uneconomic to move NPI into battery-grade chemicals until recently, when Indonesian laterite producers, which supplied half the world’s nickel last year, and their Chinese backers made a breakthrough.

Enter nickel matte, an intermediate product based on nickel concentrate typically containing a metal content of 70-75%.

Matte can be converted into battery grade nickel sulphate.

Australia’s largest listed nickel producer, Indo-focused Nickel Industries (ASX:NIC) now says it is talking to as many as 20 EV makers about battery nickel supply.

Nickel Industries sold 34,263t of nickel metal in the September quarter, most of it in the form of nickel pig iron for stainless steel.

But it also produced 5285t of nickel matte.

Today, it inked a maiden nickel matte sales contract with Glencore for an initial six-month term; the company’s first direct sales to Western customers.

“We are delighted to have entered into this initial nickel matte sales contract with Glencore with this contract signalling a maturing of our nickel matte business and an important diversification of our customer base into Western markets closely linked with the global EV supply chain,” NIC managing director Justin Werner says.

“Very pleasingly we have seen strong interest from global battery and EV makers for our matte product and welcome this first contract with Glencore as we continue to broaden our customer base.”

There’s another problem: weak downstream demand

Nickel’s two main uses, nickel-cobalt-manganese (NCM) batteries and stainless steel, have seen weaker than expected demand in Q4 2023, weighing on both chemical and metal prices, according to pricing agency Benchmark Mineral Intelligence.

Despite Chinese NCM production showing growth of 5.5% in August, September, and October 2023 compared to same time period in 2022, this pales in comparison to the 149% growth during the same time between 2021 and 2022.

The weak increase in NCM output is further exacerbated by significant expansions in Chinese lithium iron phosphate chemistry (LFP) battery capacity, which has seen a y-o-y increase of 38.9% as EV manufacturers in China select LFP batteries for their new models.

LFP is cheaper than NCA or NCM cells, mainly because they don’t require nickel or cobalt.

They also have much longer useful lifetimes, though this is offset by lower energy densities. Perfect for entry level EVs, as it turns out.

Their popularity has put a dent in sulphide nickel companies’ ‘back of the envelope’ nickel forecasts, like this one from Poseidon Nickel (ASX:POS):

The ‘Big Australian’ is still a big believer

BHP still maintains its Nickel West sulphide division will deliver battery nickel with lower carbon intensity than Indonesian nickel laterites.

It also says sulphide nickel would sit at the low end of the cost curve and remains the most sustainable nickel produced for EVs.

“Our ambition is to continue to grow our nickel position,” BHP chair Ken Mackenzie said at the recent annual meeting of shareholders.

“Now in the case of Indonesia, it does have significant nickel reserves and we’ve seen a big rise of late in nickel production out of Indonesia, but the Indonesian reserves are typically laterite ore rather than what we have, which is sulphide ore in Western Australia, which is used for batteries.

“So to convert Indonesian ores into battery-grade materials requires significantly more processing and energy, and as a result of that has significantly greater carbon footprint.”

The post Ground Breakers: Is the battery nickel story in strife? appeared first on Stockhead.