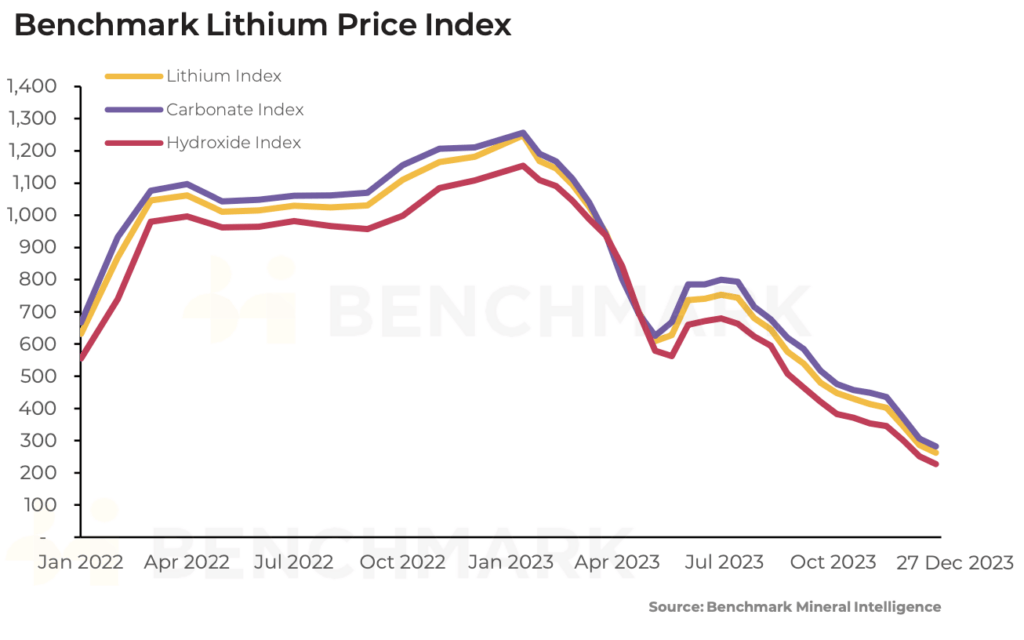

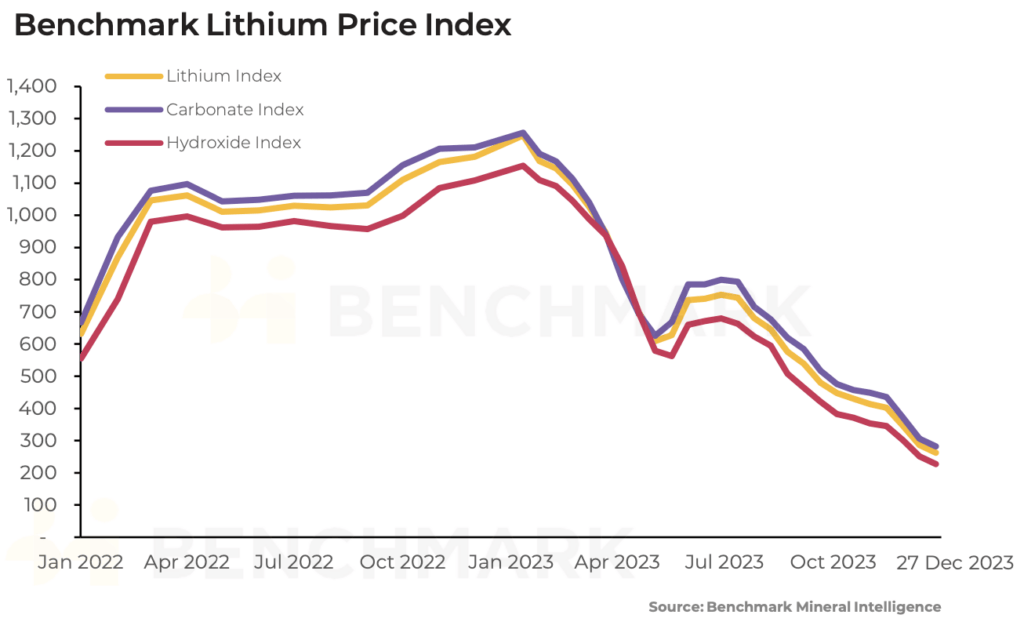

- Lithium prices have tumbled around 80% this year

- Benchmark’s latest price assessment suggests early 2024 may still be challenging for lithium prices

- Materials sector falls on light final trading day of 2023

OK, so lithium prices are back in the toilet, with our first ‘tighten the belt’ moment of 2024 coming with Core Lithium’s (ASX:CXO) decision to reduce spending at its Finniss mine in the NT last week.

But historically, lithium price drops have been a bit like the Melbourne Demons tanking for draft picks.

As prices for both lithium carbonate and hydroxide chemicals and spodumene concentrate feedstocks crumble, supply comes off line and decisions to expand operations get waylaid.

When that happens and demand eventually pops, we get a situation where supply has to play sudden catch up, sending prices up the wazoo.

Like the Melbourne Demons you’ll burn brightly, win a premiership with your sudden riches, maybe go a bit overboard, get scuttled out of the finals in straight sets a couple of times and tank again preparing for the next time the sun shines.

So far cycles in lithium prices have been faster than an AFL premiership cycle.

After bottoming out in 2018 and 2020, prices soared to unimaginable highs of over US$80,000/t for chemicals and US$8000/t in 2022 as EV sales surged ahead of growth in lithium supply.

They’ve been in freefall already this year, with Benchmark Mineral Intelligence seeing lithium carbonate prices fall 68.4% YTD to US$18,750/t and 6% Li2O spodumene concentrate FOB Australia down 79.7% to US$1300/t.

And if investors were hoping for some sort of Christmas rally they’ll be disappointed, with the Benchmark Lithium Price Index down another 8.4% over the past fortnight.

So, how quickly can they bounce back and the cycle repeat?

Producers resisting further declines

Benchmark says market participants are expecting a depressed price environment to continue into 2024.

But lithium producers pushing on their margins are now beginning to fight back.

“Lithium producers begin to resist price declines, with contacts reporting deliveries have been refused on volumes with significant discounts to prevailing spot market prices,” BMI said.

There is now a bit of wrangling going on, especially between lithium carbonate producers and cathode and cell manufacturers as to where prices for chemicals will bottom out in the key China market.

“Lithium producers reported to Benchmark that they anticipate prices to stabilise around RMB 100,000/tonne, whereas cathode and cell manufacturers cited expectations that the price would drop below RMB 80,000/tonne,” BMI’s analysts say.

“In the wider seaborne Asia market, lithium chemicals spot prices fell by 3.1% for carbonate to reach an average of $15,750/tonne (CIF Asia).

“Contract prices in the region fell by 2.5% to reach an average of $19,500/tonne, as sellers offered discounts on spot prices for deliveries under longer term agreements.”

January will likely be a weak demand period as well, with Benchmark saying a number of cathode manufacturers plan to suspend production in mid-January for as long as a month around Spring Festival.

While its spodumene prices remained unchanged due to low trading information over Xmas, Benchmark said discussions around spot material sales remained below US$1000/t.

Some supply of lithium carbonate and hydroxide does appear to have been taken out of the market, with a big drop in lithium carbonate supply estimated by BMI in December.

At the same time NEV production rose in China in November by 8.6% month on month, with combined battery and hybrid EV production eclipsing 1 million units.

China produced 8.43m new energy vehicles in the first 11 months of 2023, up 34.5% on a year earlier.

At the same time, producers and big time investors in the Aussie resources market remain bullish on the long term outlook for lithium.

Chile’s SQM and Gina Rinehart have come back with a joint $1.7b bid at $3.70 a share for pre-resource explorer Azure Minerals (ASX:AZS), owner of the potentially world class Andover discovery in WA’s rich Pilbara lithium district.

Allkem chairman Peter Coleman, whose company will begin a new life as international lithium producer Arcadium Lithium (ASX:LTM) next year told investors at a scheme meeting to approve the merger with America’s Livent last week that there were early signs of a bottom.

“You’ve seen the markets continue to change, particularly with respect to lithium pricing, and there’s been other M&A activities in the marketplace that we’ve continued to monitor very closely,” he said at the time.

“And I’m pleased today to be standing in front of you and saying it looks like we’ve found some support for lithium pricing, and it’s been good to see the stock price start to move in a positive direction in the last week or so.”

Markets fall ahead of NYE festivities

After a week of gains prompted by bullish Christmas cheer and surging gold and iron ore prices a breather for the two latter today has the ASX materials sector down almost 0.48%.

The pre-New Years correction has seen few large cap resources stocks win, with only Lynas (ASX:LYC) and Pilbara Minerals (ASX:PLS) cracking the top ten large caps, and then with gains of under 0.5%.

A correction in gold prices overnight — still near all time highs at around US$2068/oz — has that sector in the red. The All Ords Gold Sub-Index should close the year on gains of close to 25%.

Nickel Industries (ASX:NIC) was the top mid-cap miner on the final trading morning of 2023. It came as the Indonesian nickel pig iron producer announced it had paid US$189.8m to up its stake in the Excelsior nickel project from 5.5% to 13.75%, a second step on US$1.265b path to take a 55% share in the project.

NIC will eventually be the majority holder of the HPAL project, which it will develop with major shareholders Shanghai Decent (a subsidiary of stainless steel giant Tsingshan) and PT United Tractors.

It will diversify its offering to become, primarily, a producer of so-called ‘class I nickel’ suitable for use in EV batteries, with the second stage expansion of the site to eventually make NIC a global top 5 nickel metal producer.

Ground Breakers share prices today

The post Ground Breakers: How quickly are we expecting cellar dwelling lithium prices to turn around? appeared first on Stockhead.