- ASX200 ends 0.48% higher, makes it five sessions of gains

- Materials way out in fromt with a 1.5pc gain

- Hats off to small cap leaders Propell and NeuRizer

The benchmark ASX200 has punched a green ticket for a fifth straight session of gains.

At 4.15pm on 25 Jan, the S&P/ASX200 was ahead 36.2 points or 0.48% to 7,555.4

The big name miners lifted in early trade along with the overnight iron ore price after stimulus whispers in China found full voice in Sydney on Thursday.

Also on song was the Marrickville PM Anthony Albanese who’s laid out some promise-breaking tax cuts, telling the 20 or so Australians listening that his government’s new tax plan will probably get the lazier amongst us to go get a job, while also saving the Federal budget some cashola over the long-term.

Just. So. Much excitement on the local bourse with everyone’s favourite two word combo – “China” and “stimulus” on traders’ lips, in their ears and surely clogging up Google’s precious Albo-rhythms.

Among the headlining blue chips with skin in that game – Fortescue (ASX:FMG) and the polyglot-owner billionaire formerly known as Twiggy, (Dr Andrew Forrest) who might be having second thoughts about trying to drag Fortescue up the value chain now even more evil has fallen upon the possibly cursed high-grade ore Iron Bridge project.

The Iron Bridge is looking further and further off after FMG revealed a leaky water pipe could end up smashing magnetite production by 50% over FY24.

That miner aberration (hoho) looks like it could hit FMG some $220nm to fix (it’s actually some 65 kilometres of pipeline which needs replacing) without mentioning the lost shipments.

Still, FMG shipped some 48.5mn tonnes for the December quarter, beating the previous three months by 6% and adding weight to FMG’s 2nd-highest 1H production ever.

The price of iron ore jumped 2.5% overnight to $135.15 per tonne, thanks to those two words previously Googled and that’s left Rio Tinto up 1.7% to $131.95 and BHP (ASX:BHP) plus 1%.

Fortescue (ASX:FMG) gained 1.6%.

Over the road at Mineral Resources (ASX:MIN) investors were liking quarterly spodumene production at MIN’s Mt Marion which is reportedly up 30% vs the previous quarter, and shipments lifted 34 per cent. It told investors it was keeping its volume and cost guidance unchanged for fiscal year 2024. Mineral Resources stock ptice was up 5% after lunch to over $58 dollarbucks.

Resmed stock is up 5% after quarterly revenue beat analyst expectations by half a million USD.

On the sad side of Thursday, somebody took a big slice out of Domino’s Pizza Enterprises (ASX:DMP) with the stock down 30% before lunch after Don Meiji’s company withdrew guidance after revealing overnight that Asia sales were short circa 9% over 1H vs, 1H23.

Meanwhile, Eddy Sunarto reports that the Aussie biotech, Memphasys (ASX:MEM), which specialises in reproductive science has crashed out badly on Thursday (down by more than 35% at lunch), after finding little but disappointment during a recent field trial of its Artificial Insemination (AI)-Port at a partner stud farm in NSW’s Hunter Region.

Memphasys did a tour with four bulls speed dating some 146 cows using Memphasys’ ambient temperature AI-Port system. Unfortunately MEM says that pregnancy rates were achieved at only 60% of the rates observed with conventional cryostorage procedures.

The trial was conducted with four bulls across 146 cows using Memphasys’ ambient temperature AI-Port system.

The aim of the field trial was to increase pregnancy rates and introduce operational improvements over traditional artificial insemination using cryostored semen.

However, an undaunted MEM says it will use these results to improve identifiable areas in order to make operational improvements – and that the bulls, though tired, are ready to give it another crack at the soonest possible convenience.

A miss by Tesla (more on that below) appears to have weighed on the local Tech Sector. Block has lost circa 6%, showing (bad things) can Appen, which is down 3%.

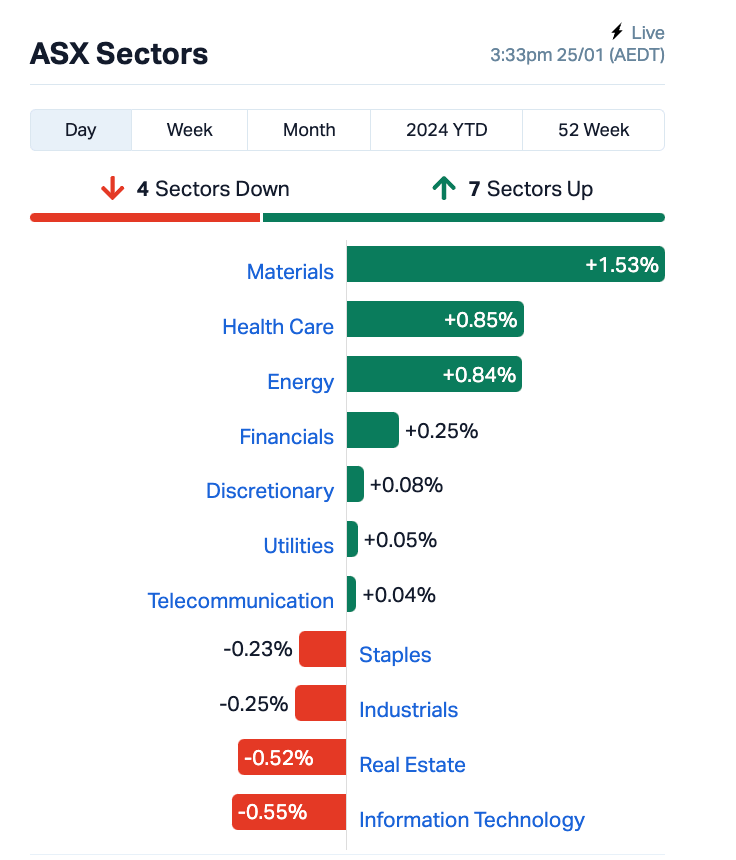

ASX SECTORS at 3.30pm on THURSDAY

Around the ‘hood…

Asian-Pacific equity markets are pretty upbeat, led by a 3rd straight day of gains in Hong Kong.

The Shanghai Composite and Shenzhen Component are both rallying off five year lows on the mainland after the buckets of fresh stimulus talk out of Beijing helped dissolve the pall of paranoia ungulfing Chinese equities this year.

China’s central bank, the People’s Bank of China (PBoC) said on Wednesday that it’ll slash the banks’ reserve ratio by 50 basis points next month in a bid to boost the country’s struggling economy.

The move would free up around 1 trillion yuan in long-term capital to the economy.

Earlier this week, Premier Li Qiang coralled China’s state cabinet and squeezed out an official pledge they’d try to stabilise China’s deteriorating capital markets, reportedly seeking to deploy about 2 trillion yuan as part of a fund to buy mainland shares, as per Blommers.

Unsurprisingly, it’s the Financial Sector calling the shots – aptly named Shanghai China Fortune is up 10% and Capital Securities ahead 8%.

And in the States…

The S&P 500 rose Wednesday as a number of big tech stocks rallied, pushing the broader market to new heights.

Tesla dropped results after the bell with Q4 revenue growth of 3%, missing estimates. Possibly infuriating Elon.

TSLA has lost circa 5% in extended trading, taking the losses YTD to around 20%, after more than doubling last year.

The benchmark S&P 500 eked out a gain of 0.08%, enough to lodge a new all-time closing record with Guinness or whoever does that now.

The Nasdaq Composite rose 0.36% also a fifth straight day of gains.

Netflix surged nearly 10% after the streaming giant killed the video star with a lift in earnings guidance, revenue and a reported total subscriber base of 260.8mn sets of eyes.

Elsewhere, Microsoft and Meta were 1% and 1.4% higher taking the former’s market cap to $3 trillion and the Facebook parent’s market cap to above $1 trillion.

The Dow Jones Industrial Average was 0.25% lower hurt by some retracing of gains by Verizon and 3M a day after each jumped on reported earnings.

AT&T also dragged, down 3% on lower-than-expected earnings.

US stock futures were mixed at 3pm in Sydney.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.014 | 100% | 20,911,108 | $9,645,620 |

| DXN | DXN Limited | 0.0015 | 50% | 705,538 | $2,153,340 |

| EVG | Evion Group NL | 0.032 | 33% | 1,568,543 | $8,303,020 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 1,000,000 | $2,450,593 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 618,116 | $11,677,324 |

| PHL | Propell Holdings Ltd | 0.013 | 30% | 128,576 | $1,203,555 |

| ICR | Intelicare Holdings | 0.018 | 29% | 99,311 | $3,287,543 |

| CST | Castile Resources | 0.09 | 29% | 343,719 | $16,933,170 |

| CUF | Cufe Ltd | 0.019 | 27% | 3,361,573 | $17,191,685 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 500,000 | $5,060,460 |

| EXT | Excite Technology | 0.01 | 25% | 5,692,851 | $10,633,934 |

| NKL | Nickelx Ltd | 0.04 | 25% | 484,545 | $2,810,085 |

| W2V | Way2Vat Ltd | 0.011 | 22% | 333,173 | $5,864,476 |

| ACW | Actinogen Medical | 0.029 | 21% | 11,530,268 | $55,375,442 |

| KNM | Kneomedia Limited | 0.003 | 20% | 102,638 | $3,833,178 |

| M4M | Macro Metals Limited | 0.003 | 20% | 3,708,000 | $6,167,694 |

| CCM | Cadoux Limited | 0.065 | 18% | 65,741 | $20,158,467 |

| BTH | Bigtincan Holdings Ltd | 0.23 | 18% | 2,854,638 | $120,169,353 |

| MOM | Moab Minerals Ltd | 0.007 | 17% | 654,950 | $4,271,781 |

| VAL | Valor Resources Ltd | 0.0035 | 17% | 1,592,095 | $12,520,004 |

| NGX | NGX Limited | 0.15 | 15% | 148,974 | $11,779,539 |

| AHF | Aust Dairy Limited | 0.015 | 15% | 1,335,700 | $8,402,768 |

| FRB | Firebird Metals | 0.115 | 15% | 49,160 | $14,236,140 |

| PMT | Patriot Battery Metals | 0.85 | 15% | 6,547,560 | $372,960,118 |

| SSL | Sietel Limited | 9.2 | 15% | 5,000 | $64,219,982 |

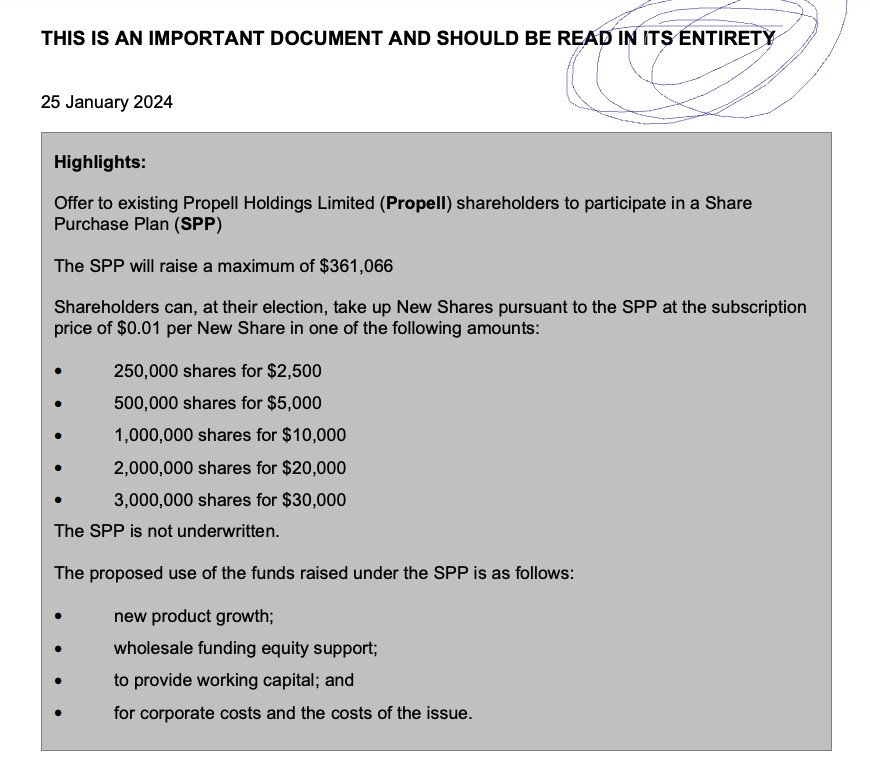

Small biz payments solutions firm Propell (ASX:PHL) is killing it on the release of its share purchase plan.

You should read it in its entirety, apparently – which I’ve clearly gone and circled very clearly below.

Having said that, I’m not going to, so here’s the best bits (stock is up about 25%)…

Also up the pointy end of the Small Caps was NeuRizer (ASX:NRZ), showing a 100% jump after some to-ing and fro-ing with the ASX over disclosures by the company in the lead-up to it releasing its quarterly and Appendix 5B on 18 January.

It’s all very complicated and I don’t have the time to completely unpack it here, but the short version is that there have been some legislative and oversight changes affecting the Neurizer Urea Project, which in turn has had a knock-on effect on investment negotiations for NRZ.

The company has assured the ASX that it is solvent, and working through other potential investment options to keep the project on track

Elsewhere, CuFe (ASX:CUF) jumped 33% this morning despite having nought to report, most likely on the back of renewed enthusiasm for copper among local investors.

Similarly, Castile Resources (ASX:CST) has been all over the joint – up more than 28% after shedding 18% in recent sessions, itself a major step down from the 27% spike the company enjoyed between Friday and COB Monday.

Black Mountain Energy (ASX:BME) has posted a decent gain off the back of a crowd-pleasing quarterly that includes a little tidbit about the company’s divestment of its Half Moon project, which has brought in a pre-tax windfall of US$6,577,810.

Actinogen Medical enjoyed a solid run through the day, off the back of earlier news that a human Positron Emission Tomography (PET) study, confirming high levels of the company’s Xanamem target occupancy in the brain at safe, well tolerated, and biologically active doses, has been published in the Journal of Alzheimer’s Disease.

The company says the study confirms that Xanamem is a brain-penetrant inhibitor of the tissue cortisol synthesis enzyme, 11β-HSD1, with high levels of target occupancy at doses as low as 5mg – which is, I am assured, is a Good Thing.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| AVW | Avira Resources Ltd | 0.001 | -50% | 12,250,000 | $4,267,580 |

| DCX | Discovex Res Ltd | 0.001 | -33% | 200,000 | $4,953,852 |

| NGY | Nuenergy Gas Ltd | 0.027 | -31% | 225,373 | $57,757,264 |

| DMP | Domino Pizza Enterprises | 40.08 | -30% | 2,812,706 | $5,146,337,960 |

| MEM | Memphasys Ltd | 0.01 | -29% | 19,503,304 | $18,814,022 |

| MHC | Manhattan Corp Ltd | 0.003 | -25% | 4,212,812 | $11,747,919 |

| HTA | Hutchison | 0.024 | -23% | 950,881 | $420,747,766 |

| DGR | DGR Global Ltd | 0.014 | -22% | 775,092 | $18,786,483 |

| SUM | Summit Minerals | 0.074 | -20% | 1,528,675 | $4,384,456 |

| ACM | Aus Critical Mineral | 0.098 | -18% | 130,407 | $3,849,150 |

| SGC | Sacgasco Ltd | 0.009 | -18% | 864,496 | $8,576,558 |

| KNB | Koonenberry Gold | 0.0615 | -18% | 626,796 | $8,981,182 |

| ZEO | Zeotech Limited | 0.029 | -17% | 5,460,949 | $60,669,807 |

| AHN | Athena Resources | 0.0025 | -17% | 11,157 | $3,211,403 |

| CRB | Carbine Resources | 0.005 | -17% | 600,000 | $3,310,427 |

| MGU | Magnum Mining & Exp | 0.02 | -17% | 3,991,743 | $19,424,674 |

| NOX | Noxopharm Limited | 0.065 | -17% | 110,846 | $22,794,560 |

| PUA | Peak Minerals Ltd | 0.0025 | -17% | 20,000 | $3,124,130 |

| RMX | Red Mount Min Ltd | 0.0025 | -17% | 3,463,333 | $8,020,728 |

| TREDA | Toubani Resources | 0.13 | -16% | 186,016 | $20,749,178 |

| EME | Energy Metals Ltd | 0.16 | -16% | 167,296 | $39,839,829 |

| BEO | Beonic Ltd | 0.027 | -16% | 266,276 | $13,583,838 |

| ASP | Aspermont Limited | 0.006 | -14% | 1,400,000 | $17,071,346 |

| LNR | Lanthanein Resources | 0.006 | -14% | 1,594,683 | $9,028,683 |

| OSL | Oncosil Medical | 0.006 | -14% | 9,254,036 | $13,821,788 |

TRADING HALTS

Adavale Resources (ASX:ADD) – pending the release of an announcement in relation to a proposed capital raising.

Blue Star Helium (ASX:BNL) – pending the release of an announcement regarding an update on drilling.

The post Closing Bell: Strap on the horns ‘cos it’s five straight on the ASX with Materials a gimme when China talks stimmy appeared first on Stockhead.