Local markets are just doin’ their thang this morning, meandering around break-even since the bell went to lumber into lunchtime at +0.12%.

The market is feeling a little subdued this morning, most likely because the US jobs data that landed last week and knocked just about every ounce of hopium out of Wall Street’s pre-Christmas belief that interest rate cuts are just around the corner has had the same effect here, too.

I’ll get into that shortly, but before I do, there’s news out of the aviation industry that should have aircraft manufacturer Boeing doing a spot of soul-searching this week.

That’s because one of its you-beaut, all bells and whistles 737 MAX-9 planes arrived at its destination with a thumping great big hole in the side, which Boeing’s technicians have confirmed is “not meant to happen”.

Thankfully, the two seats nearest the blow-out didn’t have passengers in them at the time, or they could well have spent a harrowing 2.5 minutes coming to grips with the fact that they are going to be a lot shorter, and several metres wider, when this particular ordeal was over.

This latest incident is part of a jumbo-size serving of ongoing pain, all centred around Boeing’s Latest and Greatest fleet, which has already claimed the lives of 346 people in two separate accidents involving the 737 MAX-8 variant.

fleet, which has already claimed the lives of 346 people in two separate accidents involving the 737 MAX-8 variant.

Add to that the newest feature of the 737 MAX-9 – automatic, if somewhat unpredictable, emergency exits – and it’s pretty clear that something is badly awry.

Which is what makes Boeing’s other recent news all the more alarming, as the company is currently mid-way through petitioning the US Federal Aviation Administration to allow it to simply bypass an evidently important safety protocol on its 737 MAX-7, to get the currently uncertified aircraft flying into the hangars of some increasingly impatient customers.

The issue there is that Boeing’s engine anti-ice system is, by all accounts, a little too enthusiastic about doing its job – the end result being engines that are extremely ice-free, but also very brittle.

Testing has shown that if the anti-ice system is used for longer than about five minutes at a time, parts at the front of the engine start falling off – and anything untethered in front of a jet engine tends to no longer be a thing for very long, as they get sucked into the engine, making lots of stuff go “bang!”.

Which is a suboptimal outcome when you’re 30,000 feet in the air, and lacking enough forward momentum for the bits of the plane that keep it from colliding with the ground to keep working.

TO MARKETS

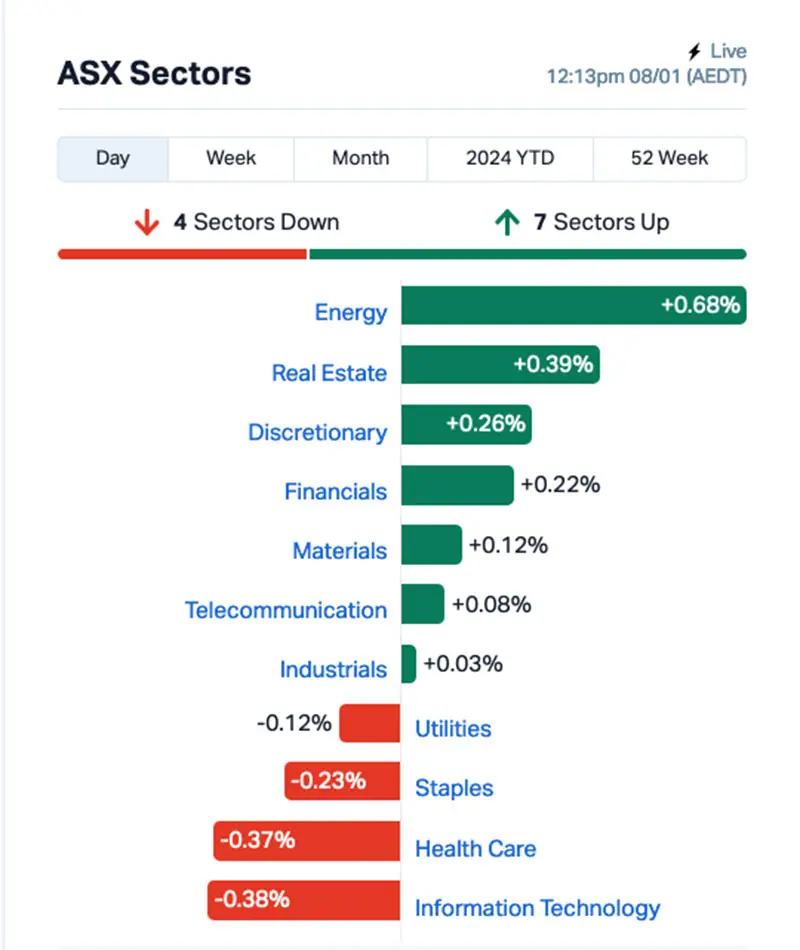

The ASX 200 benchmark has edged higher this morning, led to the dizzying heights of mediocre greatness by a jump in Energy stocks this morning that has that sector out in front of the market to the tune of +0.68%.

Those gains are being driven by fluctuations in the commodities markets, which have seen oil and gas prices rising sharply in recent days. Brent’s currently moving for US$78.24 a barrel, while the cheaper homebrand WTI stuff is at $73.48.

Even coal is improving this morning, up around 0.5% to rub some of the stink off its -10% performance over the past week.

Down the bottom of the table, InfoTech’s bad day has bled over into another dour performance this morning, so it’s down -0.4%, with Health Care stocks also in the red, only marginally better at -0.36%.

The goldies are also performing well today, with the XGD All Ords Gold Index leading the indices on +0.43%, even as the gold price has eased by 0.10% over the course of the morning.

All that has left a number of the ASX’s big diggers on healthy gains for the day thus far, with the likes of Paladin, Boss and RED5 all putting on some value this morning.

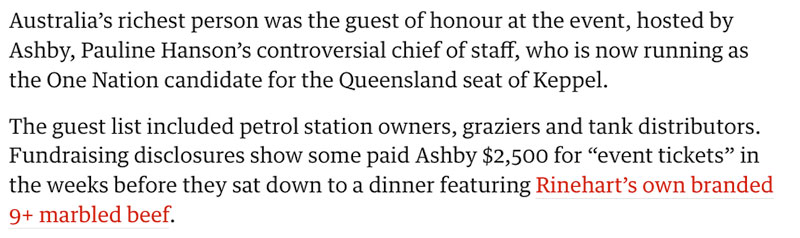

Which is great news, as I’m more than a little concerned about a news report that landed on my desk this morning about one of Australia’s most high-profile mining magnates, Gina Rinehart.

This excerpt from the normally razor-sharp Guardian is severely worrying, especially in its description of the apparent depths a certain Queensland One Nation candidate is willing to sink, to attract punters to what sounds like a horribly morbid fundraiser.

I know I’m not the only person who thinks that forcing political donors to eat portions of Australia’s richest woman is perhaps a step too far – and The Guardian’s hot take on Our Gina’s physical conditioning really does feel like someone over there is really twisting the knife.

(I jest, of course. It’s all in good fun, and – just so we’re clear – I’m not actually asserting that One Nation candidates and supporters are bloodthirsty cannibals… or that The Guardian’s suggestion that Ms Rinehart is constructed out of “9+ marbled beef” is anything other than some hilariously poor phrasing.)

NOT THE ASX

The mood on Wall Street on Friday wasn’t excellent, as it’s become more and more apparent that even the most evangelical US investors that went berserk at the tail end of 2023 at the merest whiff of US Fed rate cuts are now realising that they almost definitely jumped the gun.

By the end of the last session, the S&P 500 rose modestly by +0.18%. The blue chips Dow Jones index was up by +0.07%, and the tech-heavy Nasdaq lifted by +0.1%.

Earlybird Eddy has returned from a well-earned seaside sojourn to report that stronger-than-expected jobs data showed that the US economy added 216,000 jobs last month, which is waaaay more than the 170,000 economists expected.

That’s thrown a massive bucket of freezing water on mid- to long-term guesses at when the US Fed is likely to start cutting interest rates again, which has made Wall Street’s enthusiasm about as convincing as a dental receptionist’s smile.

To US stocks, shipping company Maersk was down -1% after announcing that it will divert its ships from the Red Sea/Gulf of Aden route for the ‘foreseeable future’ following attacks.

Exercise equipment stock Peloton surged almost 10% after announcing a partnership with TikTok where Peloton content will be featured on a dedicated fitness hub on the platform.

Meanwhile in London, gold miner Endeavour Mining PLC fell -7% after CEO Sébastien de Montessus was fired, and accused of misconduct for a breathtakingly brazen ‘irregular payment of $5.9m’ instructed by himself in relation to an asset disposal.

In Asian market news, Japan’s Nikkei is up 0.23%, but both Shanghai and Hong Kong markes have slipped this morning, shedding 0.77% and 0.83% respectively.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.002 | 100% | 2,224,512 | $4,728,824 |

| AMD | Arrow Minerals | 0.0075 | 50% | 97,703,950 | $17,368,825 |

| CLE | Cyclone Metals | 0.0015 | 50% | 2,209,999 | $10,471,172 |

| CPO | Culpeominerals | 0.077 | 35% | 27,387,073 | $6,644,055 |

| RGS | Regeneus Ltd | 0.004 | 33% | 239,384 | $919,311 |

| YOJ | Yojee Limited | 0.004 | 33% | 2,163,157 | $3,917,956 |

| YRL | Yandal Resources | 0.12 | 32% | 387,633 | $21,360,080 |

| OAU | Ora Gold Limited | 0.0075 | 25% | 27,905,996 | $34,136,928 |

| DOU | Douugh Limited | 0.005 | 25% | 408,496 | $4,328,276 |

| RIL | Redivium Limited | 0.006 | 20% | 415,157 | $13,654,274 |

| ACR | Acrux Limited | 0.061 | 20% | 601,619 | $14,771,180 |

| EQS | Equitystorygroupltd | 0.038 | 19% | 61,056 | $1,363,673 |

| OEQ | Orion Equities | 0.195 | 18% | 13,078 | $2,582,123 |

| PGD | Peregrine Gold | 0.35 | 17% | 240,052 | $20,098,944 |

| EEL | Enrg Elements Ltd | 0.007 | 17% | 180,453 | $6,059,790 |

| VRC | Volt Resources Ltd | 0.007 | 17% | 27,594 | $24,780,640 |

| GLA | Gladiator Resources | 0.022 | 16% | 1,610,038 | $11,538,640 |

| BIT | Biotron Limited | 0.115 | 15% | 5,094,907 | $90,227,551 |

| EYE | Nova EYE Medical Ltd | 0.31 | 15% | 1,418,966 | $51,469,801 |

| EXT | Excite Technology | 0.008 | 14% | 382,362 | $9,304,692 |

| FDR | Finder | 0.09 | 14% | 106,931 | $5,925,000 |

| OZZ | OZZ Resources | 0.093 | 13% | 103,668 | $7,587,470 |

| GUE | Global Uranium | 0.11 | 13% | 719,022 | $20,584,270 |

| MDR | Medadvisor Limited | 0.255 | 13% | 232,662 | $123,059,210 |

| RNE | Renu Energy Ltd | 0.017 | 13% | 690,024 | $10,124,510 |

Both Melodiol Global Health (ASX:ME1) and Arrow Minerals (ASX:AMD) are off and racing this morning – however, neither of them have deposited any fresh news to the market, so I’m just going to acknowledge that they’re there, and move on.

Hrm… same with Cyclone Metals (ASX:CLE), too – while Culpeo Minerals (ASX:CPO) is continuing its climb on last week’s news of a decent-looking copper-gold porphyry rock-sampling report from its La Florida Prospect, in the Fortuna Project in Chile.

In fact, by the looks of things, almost the entire winners list this morning is made up of companies being driven by external forces such as commodity prices, or their gains are simply carry-overs from newsworthy announcements that hit the market last week.

Nova Eye Medical (ASX:EYE) – which also had happy news out last week – is riding that momentum, with a helpful boost this morning from news that the company has managed to grow its US sales revenue up 65% to US$5.1 million for the six months ended 31 December 2023, compared to the same period last year.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 January [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MRQ | Mrg Metals Limited | 0.002 | -33% | 141,700 | $7,414,023 |

| EOF | Ecofibre Limited | 0.11 | -27% | 13,204 | $56,831,085 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 18,000 | $3,671,126 |

| VAL | Valor Resources Ltd | 0.003 | -25% | 575,072 | $16,693,339 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 7,497,810 | $123,204,013 |

| CHK | Cohiba Min Ltd | 0.002 | -20% | 4,558 | $6,325,575 |

| YAR | Yari Minerals Ltd | 0.009 | -18% | 979,903 | $5,305,936 |

| CXO | Core Lithium | 0.19 | -17% | 40,392,214 | $491,495,175 |

| NPM | Newpeak Metals | 0.019 | -17% | 120,521 | $2,298,890 |

| ECT | Env Clean Tech Ltd. | 0.006 | -14% | 235,527 | $20,050,173 |

| ICN | Icon Energy Limited | 0.006 | -14% | 130,243 | $5,376,096 |

| BKG | Booktopia Group | 0.054 | -14% | 77,527 | $14,376,921 |

| NNG | Nexion Group | 0.013 | -13% | 89,793 | $3,034,618 |

| ENL | Enlitic Inc. | 0.85 | -13% | 5,258 | $70,380,904 |

| DYM | Dynamicmetalslimited | 0.165 | -13% | 20,071 | $6,650,000 |

| DLI | Delta Lithium | 0.365 | -13% | 2,333,595 | $298,803,915 |

| 1AG | Alterra Limited | 0.007 | -13% | 500 | $6,657,177 |

| CRB | Carbine Resources | 0.007 | -13% | 648,493 | $4,413,902 |

| MOM | Moab Minerals Ltd | 0.007 | -13% | 83,198 | $5,695,708 |

| NET | Netlinkz Limited | 0.007 | -13% | 1,936,884 | $30,710,513 |

| TX3 | Trinex Minerals Ltd | 0.007 | -13% | 8,979,753 | $11,896,197 |

| FXG | Felix Gold Limited | 0.043 | -12% | 53,954 | $5,816,614 |

| MTC | Metalstech Ltd | 0.225 | -12% | 169,434 | $48,183,420 |

| REC | Rechargemetals | 0.093 | -11% | 36,998 | $11,691,957 |

| WYX | Western Yilgarn NL | 0.093 | -11% | 1,320 | $5,214,038 |

The post ASX Small Caps Lunch Wrap: Who’s glad they didn’t spring for more leg room on their flight today? appeared first on Stockhead.