Local markets are up this morning, bouncing back from a sour run of form to be +0.38% as the bells start to ring to announce that it’s lunchtime.

A quick eye over what’s been happening on the bourse and elsewhere gives us a couple of clues as to why things are looking up this morning – and it’s fair to say that a 6.4% spike in iron ore prices has put some wind back in the sails of the Aussie Materials sector.

I’ll get into that a bit further shortly, but first we’re off to Brazil, where an enterprising young woman, identified as Paulo Roberto Braga, has discovered just how hard it is to get a loan this week, after fronting up to a bank to help her 68-year-old, wheelchair bound uncle sign off on a 17,000 reais (roughy AUD$5,000) loan.

Video footage of the attempt by Ms Braga shows that staff were immediately uncomfortable with the situation, with one remarking “I don’t think he’s well. He doesn’t look well at all.”

It was a particularly astute observation, as Ms Braga’s uncle was clearly very, very dead.

Despite that obvious hurdle, Ms Braga continued with her efforts to secure the loan, moving her uncle’s hands around and pretending he was signing the paperwork, all while the old man’s head lolled about like his neck was made from fresh-cooked noodles.

Bank staff started filming when they realised what was happening, and when one employee questioned why the old bloke looked so pale and unwell, Ms Braga replied “That’s just what he’s like” – all the while trying to stuff a pen into his clearly non-functional hand so he could sign the loan agreement.

Obviously, there is video of this kicking around, but in the interests of not upsetting anyone by beaming felonious corpse abuse at them without their consent, I’m not going to share it here.

But it’s out there on the internet, and while some of the versions on major news sites are censored, some are not, and the uncensored ones are kinda difficult to watch.

So if you’re going to go digging around looking for it, that’s on you – and don’t say I didn’t warn you.

But if you’re cool with watching a woman puppeteering an old man’s corpse in an attempt to defraud a bank of a few thousand dollars, then today’s your lucky day.

The woman was arrested pretty quickly after staff alerted the police, and investigating officer Fábio Luiz Souza told local media that the old guy “had been dead for at least two hours” before Ms Braga wheeled him down to the shops.

She’s been charged with violating a corpse and attempted theft through fraud.

TO MARKETS

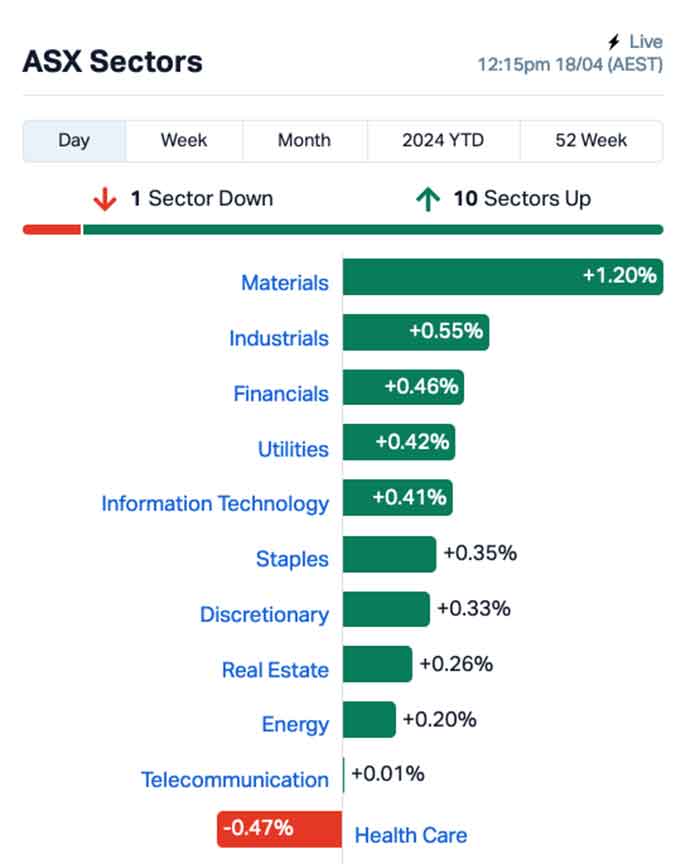

Aussie markets are rising this morning, breaking through +0.5% around lunchtime, thanks to a couple of motivating factors that have helped snap the ASX out of this week’s doldrums.

It’s worth noting that local markets are very much going their own way today, ignoring a poor showing from Wall Street overnight – and that’s largely due to a strong boost for a couple of key commodities overnight.

Iron ore prices spiked 6.4% – a remarkable jump backed by a willingness from steel mills to ramp up production, thanks to improving margins and an uptick in downstream demand.

And copper’s bull run is continuing, with prices topping US$9,400/t this morning as talk of tight supply continued. That’s a better than 14% rise since the start of February, when it was changing hands around $8,000/t.

The other helping hand for the market today came from the latest round of employment figures, which landed at 11.30am, courtesy of the Australian Bureau of Counting Stuff.

The headline: Employment is down by 6,600, and unemployment up by 20,600.

On the face of it, not ideal – but a longer term view of the figures, which were wide of analyst expectations, is that they offer more weight to calls for interest rate relief in Australia.

So, taking all that into account, it makes sense that things are going reasonably well for local investors, and that it’s been the Materials sector that’s making the best headway throughout the morning session.

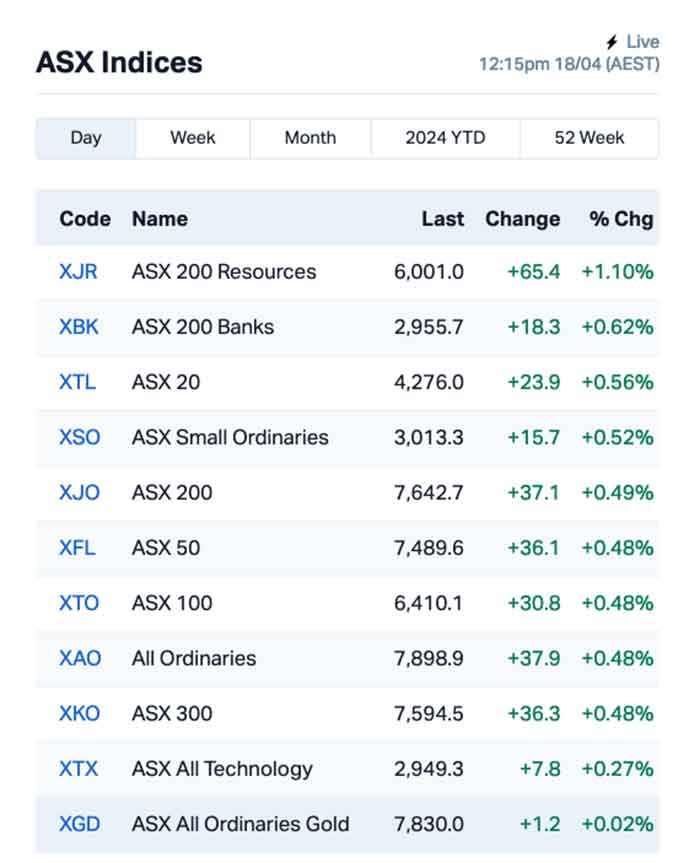

A more granular look at the market shows that it’s definitely the Resources steering the ship this morning, with some help from the banks. It’s worth noting that the goldies aren’t exactly off this morning – but they’re also clearly not 100% on.

There are a couple heavyweights doing well in the Large Caps division, the best of them TELIX Pharmaceuticals which has surged 8.9% this morning off the back of a favourable quarterly delivered to the market just after the closing bell yesterday.

And investment management firm Challenger has also made headway this morning, up close to 6.0% thanks to its third quarter update that hit the market about 90 minutes before the session got started today.

NOT THE ASX

A quick look at the US today shows that Wall Street managed to keep its losing streak running strong overnight, leaving the S&P 500 down by -0.58% – that’s its fourth straight day of declines.

The blue chips Dow Jones index was also down by -0.12%, and the tech-heavy Nasdaq slipped by -1.15%.

The US tech sector took most of the beating overnight, with investors stepping away from market darling chipmakers throughout the session.

Nvidia led the losses in US megacaps, down almost -4%. Rival chipmaker ASML Holding was down -6.7% in Amsterdam.

Earlybird Eddy reports that there was some curious movement on oil prices overnight, which has been blamed on “algo trading”, with “a band of algorithmic money managers trading on chart signals are thought to be behind the rapid selloff”.

I’ve often said that I’m fine with most money managers – but those algorithmic ones… there’s something not quite right about them. They look shifty, with their beady little eyes and twitchy fingers.

I might be thinking of something different, though. It’s getting increasingly hard to tell.

In Asia this morning, things are looking pretty positive. Shanghai markets are up +0.36%, Hong Kong’s Hang Seng is +0.86% higher and Japan’s Nikkei has inched up +0.18%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 18 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % TODAY | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| NIM | Nimy Resources | 0.071 | 61% | 3,244,389 | $6,178,639 |

| ADG | Adelong Gold Limited | 0.004 | 33% | 10,667 | $2,641,467 |

| NAE | New Age Exploration | 0.004 | 33% | 6,551,360 | $5,381,697 |

| KNB | Koonenberry Gold | 0.026 | 30% | 200,000 | $2,754,229 |

| BUR | Burley Minerals | 0.083 | 28% | 626,981 | $6,779,289 |

| ECT | Env Clean Tech Ltd | 0.005 | 25% | 114,500 | $12,687,242 |

| EEL | Enrg Elements Ltd | 0.005 | 25% | 805,365 | $4,039,860 |

| ODE | Odessa Minerals Ltd | 0.005 | 25% | 683,268 | $4,173,130 |

| TIG | Tigers Realm Coal | 0.005 | 25% | 5,459,594 | $52,266,809 |

| VML | Vital Metals Limited | 0.005 | 25% | 677,761 | $23,580,268 |

| RCL | Readcloud | 0.056 | 24% | 860,871 | $6,579,203 |

| CBY | Canterbury Resources | 0.031 | 24% | 82,259 | $4,293,522 |

| SW1 | Swift Networks Group | 0.018 | 20% | 33,096 | $9,700,866 |

| GTI | Gratifii | 0.006 | 20% | 2,700,000 | $8,060,225 |

| RR1 | Reach Resources Ltd | 0.003 | 20% | 100,000 | $9,225,051 |

| SDV | Scidev Ltd | 0.32 | 19% | 1,108,934 | $51,246,951 |

| RNX | Renegade Exploration | 0.013 | 18% | 2,399,505 | $11,040,367 |

| WMG | Western Mines | 0.31 | 17% | 272,073 | $19,897,043 |

| OSX | Osteopore Limited | 0.14 | 17% | 44,072 | $1,239,443 |

| 1MC | Morella Corporation | 0.0035 | 17% | 63,023 | $18,536,398 |

| AJX | Alexium Int Group | 0.014 | 17% | 527,138 | $7,934,529 |

| CDT | Castle Minerals | 0.007 | 17% | 98,239 | $7,346,958 |

| DUB | Dubber Corp Ltd | 0.07 | 15% | 19,042,484 | $34,859,943 |

| LYN | Lycaon Resources | 0.275 | 15% | 333,844 | $10,573,500 |

| CPN | Caspin Resources | 0.089 | 14% | 113,413 | $7,352,722 |

Thursday morning’s fastest mover was Nimy Resources (ASX:NIM), up more than +100% on news that drilling at Block 3 within the company’s Mons project in WA has returned intersections of elevated copper, gold, silver mineralisation in massive sulphides plus high-grade gallium and rare earth oxide mineralisation.

Block 3 is turning into a massive prospect for Nimy, with the company saying that it has now encountered mineralisation extending 53.5kms along strike of the estimated 80km greenstone length.

New Age Exploration (ASX:NAE) was gaining on reports that the company has defined several Hemi Style intrusive and structural gold targets at its Wagyu gold project in the Pilbara, following a comprehensive review of existing geophysical data by chief geological consultant, Greg Hudson.

Meanwhile, eLearning solutions provider Readcloud (ASX:RCL) was up after delivering its March quarterly, showing a record $5.22 million in cash receipts from customers (up 44% on the March 2023 quarter), and $1.94 million positive net cash from operations, up 52% on the March 2023 quarter.

Reach Resources (ASX:RR1) enjoyed a boost, in the wake of the company dropping an investor presentation about 30 minutes after the market opened outlining how things are progressing across its several projects.

And SciDev (ASX:SDV) has delivered a positive quarterly report, showing revenue of $29.1m, up 38% on Q3 FY23 and cash receipts of $31.3 million, while cashflow from operations of $3.8 million has delivered an underlying EBITDA of $3.6 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 18 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RMX | Red Mount Mining | 0.001 | -33% | 177,640 | $4,010,364 |

| SIH | Sihayo Gold Limited | 0.001 | -33% | 52,500 | $18,306,384 |

| LNR | Lanthanein Resources | 0.003 | -25% | 5,059,991 | $7,819,636 |

| ROG | Red Sky Energy | 0.003 | -25% | 220,569 | $21,688,909 |

| BNZ | Benz Mining | 0.175 | -22% | 86,185 | $25,037,544 |

| PKO | Peako Limited | 0.004 | -20% | 596,112 | $2,635,424 |

| TOY | Toys R Us | 0.009 | -18% | 1,878,048 | $11,997,295 |

| BUY | Bounty Oil & Gas NL | 0.005 | -17% | 83 | $8,991,006 |

| EXL | Elixinol Wellness | 0.005 | -17% | 180,888 | $7,806,444 |

| HLX | Helix Resources | 0.005 | -17% | 1,150,000 | $13,938,875 |

| SRH | Saferoads Holdings | 0.055 | -15% | 47,868 | $2,840,851 |

| MEG | Megado Minerals Ltd | 0.011 | -15% | 140,000 | $3,307,922 |

| RPM | RPM Automotive Group | 0.072 | -15% | 1,178,825 | $16,710,286 |

| HMI | Hiremii | 0.04 | -15% | 63,000 | $6,334,624 |

| CAZ | Cazaly Resources | 0.018 | -14% | 617,082 | $9,547,363 |

| H2G | Greenhy2 Limited | 0.006 | -14% | 200,770 | $2,931,291 |

| OSL | Oncosil Medical | 0.006 | -14% | 1,510,557 | $15,788,788 |

| PUA | Peak Minerals Ltd | 0.003 | -14% | 669,319 | $3,644,818 |

| RC1 | Redcastle Resources | 0.012 | -14% | 70,476 | $4,595,978 |

| MNB | Minbos Resources Ltd | 0.06 | -13% | 4,908,234 | $54,595,336 |

| SP3 | Specturltd | 0.02 | -13% | 50,000 | $5,334,181 |

| HOR | Horseshoe Metals Ltd | 0.007 | -13% | 1,240,223 | $5,171,829 |

| LML | Lincoln Minerals | 0.007 | -13% | 642,109 | $13,632,362 |

| DM1 | Desert Metals | 0.022 | -12% | 1,430,328 | $6,635,642 |

| QFE | Quickfee Limited | 0.082 | -12% | 214,693 | $25,581,031 |

ICYMI – AM EDITION

Battery Age Minerals (ASX:BM8) has started summer field work at its Falcon Lake lithium project in Ontario, Canada, to build on successful field campaigns completed last year.

The previous work had confirmed the presence of high-grade spodumene mineralisation across a 5km prospective corridor.

Prospecting teams will focus on mapping and prospecting under-explored tenure at Falcon West, Falcon East and the recently acquired “Falcon Extension” tenure.

Neurotech (ASX:NTI) Phase 2/3 NTIASD2 clinical trial into the use of its NTI164 drug to treat children diagnosed with Autism Spectrum Disorder has reported positive outcomes, demonstrating a statistically significant improvement in severity of illness.

Spartan Resources (ASX:SPR) is raising $80m through a fully underwritten placement and non-renounceable entitlement offer to accelerate exploration and development of its Dalgaranga gold project.

The placement of shares priced at 58c to institutional, professional and sophisticated will raise ~$47m while the 1-for-17 pro rata entitlement offer for existing shareholders will raise a further ~$33m.

Proceeds from the capital raising will be used to underpin a significantly expanded exploration campaign at Dalgaranga in 2024/25.

This will include resource extension drilling at Never Never, Pepper and the broader Gilbey’s Complex including “lookalike” targets, and developing an underground exploration decline from the second half of 2024.

Strickland Metals (ASX:STK) has started diamond drilling to test significant gold mineralisation at its Yandal project in WA.

The diamond rig has started drilling at the Palomino-Clydesdale prospect, where aircore drilling last year intersected up to 39m at 6.1g/t gold from 25m.

It will then move to test Brono-Konik, where drilling last year highlighted the potential for substantial bulk-tonnage mineralisation. Additional RC drilling will also be scheduled to target gold mineralisation along strike at Great Western.

At Stockhead, we tell it like it is. While Battery Age Minerals, Neurotech International, Spartan Resources and Strickland Metals are Stockhead advertisers, the did not sponsor this article.

The post ASX Small Caps Lunch Wrap: Who turned Weekend at Bernie’s into a rapid arrest this week? appeared first on Stockhead.