Local markets are trending higher this morning, despite a poor showing on Wall Street on Friday after inflation unexpectedly jumped in the US, hitting +0.3% in January, well above the expected 0.1%, and that – along with a bunch of other stuff – has put me in a mood this morning.

You’ve been warned.

But… on the positive side of things, while Sydney is in the grip of a massive asbestos scare – somehow, a bunch of mulch has been spread allll over town that contains the deadly substance – NSW Premier Chris Minns has delivered the news that the whole nation was breathlessly waiting for.

There are no signs – I repeat, no signs – of any asbestos anywhere near Taylor Swift’s concert venue, so her performances in Sydney at the end of the week are going ahead as scheduled.

“I think it’s important to note that there’s been no positive testing in the [Sydney] Olympic Park precinct, and it’s been pretty comprehensive,” Minns told ABC Radio this morning.

“I understand that maybe crews are going in again just to retest some parts of the precinct but it shouldn’t pose a threat to the impending concerts, in particular, Taylor Swift in the next few days.”

The sense of relief among Sydneysiders, upon hearing that news, has been palpable.

I know that I, personally, have been unable to sleep* at the prospect of having to endure the national outpouring of grief that would follow the postponement of Tay-Tay’s appearance at Stadium Australia.

Meanwhile, at least four schools are closed because kids might have been exposed to asbestos in their playgrounds, and testing continues at a number of public sites including other schools, parks and shopping centres.

But, the show must, and will go on, according to Premier Minns, whose sense of priorities appears to have been tossed into the mulch machine along with whatever illegally-dumped carcinogens have found their way into the mix as well.

* A total lie. I slept like a baby** all weekend.

** By that, I mean I cried incessantly, but I only crapped the bed twice, so there’s that.

TO MARKETS

Aussie markets have thrown off the shackles of Wall Street’s poor Friday, rising slowly this morning to be at +0.27% around lunchtime.

The bulk of the heavy lifting is coming from the resources sector, thanks in no small part to the Federal Government’s tweaking of the nation’s Critical Minerals list, which a charitable viewing suggests that it’s a slew of well-timed changes to help keep operations open and running smoothly, in the face of sinking commodity prices – especially for nickel.

The uncharitable view is that the government has quite egregiously sold the nation down the river, by knocking 50% off the royalties due from the big nickel producers for 18 months – which effectively transfers that rump of wealth away from things like education and healthcare, and into the pockets of shareholders… but that’s not a pleasant narrative at all, is it?

No… so let’s go with “it’s a boon for the miners, and it’ll save heaps of jobs and help Australia reach its position as World Number 1 Supplier of all things Critical Minerals” and leave it at that, because I think I’ve made my point.

The other, far more likely reason for the jump in performance is the rapidly weakening US dollar, which is bad news for America, but great news for our resources stocks, because a slump in the US dollar generally translates to better commodity prices – and that’s looking like it’s happening this time around, too.

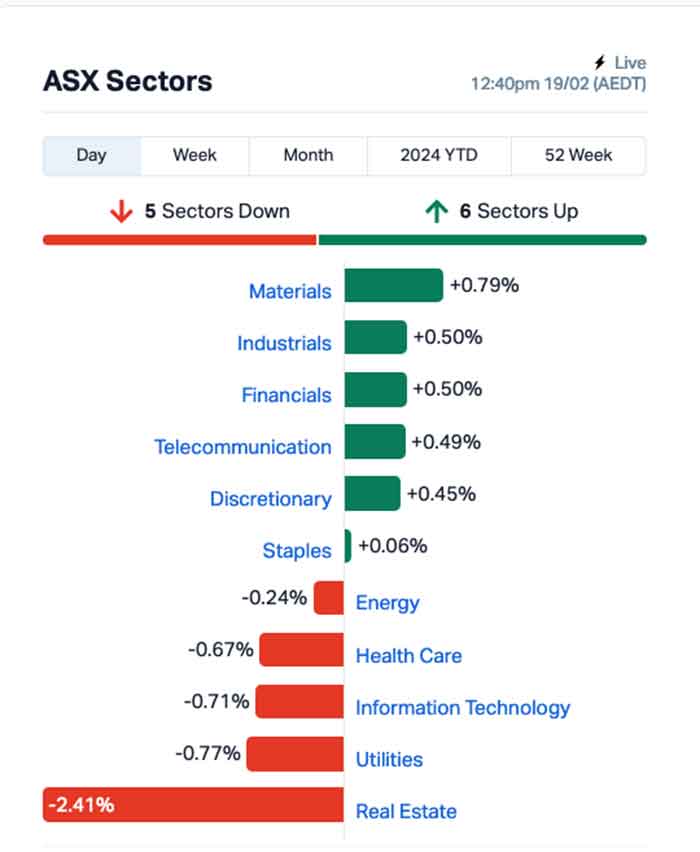

A look at the sectors shows that it’s the two resources-heavy sectors – Materials and Industrials – doing the hard yards to move things forward this morning, as investors throw their weight behind those sectors for the reasons I outlined above.

But weighing heavily this morning is Real Estate, which has been on a bit of a tear in recent weeks, dropping off sharply in the wake of sector giant Lendlease slashing its outlook and warning of tough times ahead, after posting a $136 million loss for the prior six-month period.

Our dear friends and neighbours at The Australian put it perfectly this morning: “Investors savaged the company’s shares on the disappointing result, and they were down 13.5 per cent in early trading after riding the broader recovery in property stocks over the last several months.”

NOT THE ASX

Friday wasn’t really a great day for US stocks, due largely to a surprise jump in inflation for January that appeared to catch quite a number of investors on the hop.

By the end of Friday’s session, the S&P 500 fell by -0.48%, the Dow Jones index was down by -0.37%, and the tech-heavy Nasdaq had tumbled by -0.82%.

The Bad Guy in Friday’s story was the Producer Price Index, which Earlybird Eddy Sunarto (who knows these things) says is “a key gauge measuring wholesale inflation”.

It jumped 0.3% in January from the prior month. This was much higher than the 0.1% rise expected by economists, and is very much not the news that anyone hoping for US rate relief would have been wanting to hear.

“If we see continued strength in the inflation data, it’s possible that the Fed could push its rate cuts into 2025,” said Clark Bellin of Bellwether Wealth, who is now the new front-runner for least popular market oracle for the month.

It does suggest that the US economy is in a precarious position at the moment, and if you needed any further proof than that, then news from the weekend that a certain presidential hopeful has been spotted trying to flog obviously low-budget sneakers at US$399 a pair at a sneaker convention should be all the indication you need to realise just how badly broken things over there are, politically speaking.

Sure, he’s just been personally handed a US$354 million fine for one of his many, many crimes – I have honestly lost track of which one it’s for, there are so many – but if he’s hopeful enough that he’ll be able to shift 1 million pairs of the ugliest high-tops in the known universe to cover it, then god-speed to him, the daft bastard.

For some reason, though, I doubt it.

You heard it here first: the highly variable “sneaker-obsessed but too young to vote” demographic is obviously crucial to electoral success in 2024.

In US stock news, Coinbase rose +9% after it reported its first quarterly profit since 2021.

Roku, the TV streaming company, plunged -24% after the company slightly missed its quarterly guidance estimates for gross profit, citing more competition from tech giants like Amazon.

AI cloud storage company, Super Micro Computer, slumped by -20% after Wells Fargo said the upside related to AI has already been reflected in its price.

All eyes will now be on Nvidia, which is set to report its quarterly earnings on February 21st

The good-ish news for local stocks is that the US dollar is softening like a pat of butter in the sun – which in turn is driving up commodity prices, which is great news for Aussie miners.

Meanwhile in Asia, Chinese markets are back! The long national holiday is finally over, and Shanghai markets have reopened after Lunar New Year celebrations wound to an end.

At lunchtime today, Shanghai markets are already done blowing out the cobwebs to post a +0.27 gain for the morning so far, Hong Kong’s Hang Seng is pointing -0.70% lower while in Japan, the Nikkei is pretty much flat, sitting on -0.05% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 19 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | 100% | 318,954 | $1,954,116 |

| APM | APM Human Services | 1.265 | 52% | 5,088,951 | $761,261,015 |

| 29M | 29Metalslimited | 0.25 | 35% | 10,385,622 | $129,743,336 |

| HOR | Horseshoe Metals Ltd | 0.008 | 33% | 1,188,571 | $3,878,872 |

| IS3 | I Synergy Group Ltd | 0.008 | 33% | 1,000 | $1,824,482 |

| RDM | Red Metal Limited | 0.22 | 26% | 5,547,483 | $52,281,834 |

| NNG | Nexion Group | 0.015 | 25% | 361,035 | $2,427,694 |

| AL8 | Alderan Resource Ltd | 0.005 | 25% | 200,000 | $4,427,445 |

| PUR | Pursuit Minerals | 0.005 | 25% | 100,000 | $11,775,886 |

| COD | Coda Minerals Ltd | 0.13 | 24% | 31,507 | $14,948,994 |

| CCO | The Calmer Co Int | 0.006 | 20% | 11,100,209 | $5,377,928 |

| CHK | Cohiba Min Ltd | 0.003 | 20% | 966,666 | $6,325,575 |

| IPT | Impact Minerals | 0.012 | 20% | 4,154,444 | $28,647,039 |

| ASO | Aston Minerals Ltd | 0.019 | 19% | 644,475 | $20,721,028 |

| LLI | Loyal Lithium Ltd | 0.32 | 19% | 498,231 | $22,487,576 |

| SHO | Sportshero Ltd | 0.013 | 18% | 100,000 | $6,796,161 |

| AME | Alto Metals Limited | 0.034 | 17% | 1,482,969 | $20,924,172 |

| IMD | Imdex Limited | 1.88 | 17% | 942,330 | $819,427,023 |

| 1MC | Morella Corporation | 0.0035 | 17% | 1,000,000 | $18,536,398 |

| AVE | Avecho Biotech Ltd | 0.0035 | 17% | 100,260 | $9,507,891 |

| A2M | The A2 Milk Company | 5.865 | 16% | 5,937,999 | $3,650,820,780 |

| C7A | Clara Resources | 0.015 | 15% | 32,951 | $2,457,507 |

| AUR | Auris Minerals Ltd | 0.008 | 14% | 230,772 | $3,336,382 |

| RIE | Riedel Resources Ltd | 0.004 | 14% | 1,072,503 | $7,783,425 |

Among the Small Caps on Monday morning, most of the upward swings could be attributed to the increase in investor confidence in commodities, as the bulk of the big percentage movers this morning are making headway without the benefit of their own announcements to pin it on.

Impact Minerals (ASX:IPT) did drop some news, announcing that the company has managed to hit a crucial milestone, by achieving better than 99.99% (4N+) High Purity Alumina (Al2O3) from the company’s Lake Hope mud via its proprietary and patented Playa One Sulphate Process.

This is big news for Impact, as the company’s recent Scoping Study demonstrated an NPV of $1.3 billion for the project and an estimated operating cost to produce 4N HPA up to 50% lower than anyone else globally at less than US$4,000 per tonne.

Elsewhere, it’s mid-cap and large caps with news that made the Monday morning winners list, including APM Human Services (ASX:APM) after it confirmed that it’s received a conditional and non-binding indicative proposal pursuant to which funds or investment vehicles advised by CVC would acquire all of the shares in APM by way of a scheme of arrangement, following ongoing discussions between the pair.

And A2 Milk (ASX:A2M) was higher on Monday morning on news of a positive interim result with 3.7% revenue growth and 5.0% EBITDA growth for 1HFY24, off the back of the company managing to grow its infant milk formula revenue despite a large, double-digit decline in the Chinese market overall.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 19 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LSR | Lodestar Minerals | 0.002 | -33% | 17,783,807 | $6,070,192 |

| BXN | Bioxyne Ltd | 0.01 | -23% | 846,714 | $24,721,390 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 20,000 | $3,498,278 |

| CT1 | Constellation Tech | 0.002 | -20% | 9,069,918 | $3,686,834 |

| HCD | Hydrocarbon Dynamic | 0.004 | -20% | 2,250 | $4,042,912 |

| KNM | Kneomedia Limited | 0.002 | -20% | 4,000,000 | $3,833,178 |

| RIL | Redivium Limited | 0.004 | -20% | 250,000 | $13,654,274 |

| TMK | TMK Energy Limited | 0.004 | -20% | 198,441 | $30,612,897 |

| TTI | Traffic Technologies | 0.008 | -20% | 10,000 | $7,576,702 |

| MRC | Mineral Commodities | 0.023 | -18% | 502,134 | $27,565,233 |

| XPN | Xpon Technologies | 0.025 | -17% | 100,000 | $9,108,245 |

| AMD | Arrow Minerals | 0.005 | -17% | 45,948,093 | $20,842,591 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 2,264,807 | $4,145,905 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 679,724 | $7,711,148 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 620,000 | $4,385,992 |

| LLC | Lendlease Group | 6.39 | -15% | 3,840,805 | $5,179,138,175 |

| RHY | Rhythm Biosciences | 0.115 | -15% | 95,526 | $29,854,250 |

| ACW | Actinogen Medical | 0.041 | -15% | 9,591,491 | $111,614,884 |

| A8G | Australasian Metals | 0.09 | -14% | 28,392 | $5,472,652 |

| BFC | Beston Global Ltd | 0.006 | -14% | 3,405,848 | $13,979,328 |

| SHG | Singular Health | 0.125 | -14% | 439,896 | $22,730,897 |

| NUH | Nuheara Limited | 0.076 | -14% | 452,439 | $20,748,267 |

| OD6 | Od6Metalsltd | 0.1 | -13% | 284,572 | $6,326,782 |

| DAF | Discovery Alaska Ltd | 0.02 | -13% | 16,000 | $5,387,398 |

| RTG | RTG Mining Inc. | 0.02 | -13% | 280,000 | $24,966,029 |

ICYMI – AM Edition

Hillgrove Resources (ASX:HGO) has revealed that it has sold the first parcel of copper concentrate from its Kanmantoo underground mine, and – importantly – it’s also received the payment, completing the company’s progression from explorer to cash generative copper producer.

Australian Mines (ASX:AUZ) has announced that it has significantly increased its exploration footprint within the State of Bahia, after it acquired 17 new tenements comprising approximately 51,000ha, taking its total coverage in the region beyond 131,000ha, making it one of the largest tenement holders in the region.

GCX Metals (ASX:GCX) has revealed that it has successfully secured commitments from institutional and sophisticated investors to subscribe for 60,000,000 new ordinary shares of the company at an issue price of $0.035 per share, to raise gross proceeds of $2.1 million.

Tambourah Metals (ASX:TMB) has advised that three exploration licence applications have recently been granted to the company, covering a combined area of 193km2 and located northeast and along strike from the Russian Jack-Haystack Well Lithium Project.

The post ASX Small Caps Lunch Wrap: Which Aussie politician is weirdly obsessed with a certain pop star today? appeared first on Stockhead.