- S&P/ASX 200 rose 0.8% in February with Large Cap S&P/ASX 50 underperforming Midcap and Small Ordinaries

- Tech sector was the big winner up 19% in February as energy and materials sector slumped

- Nyrada soars after preclinical study shows promise of drug candidate NYR-BI03 in preventing secondary brain injury

Australia’s S&P/ASX 200 inched up 0.8% in February to close at 7968.7 points as January inflation fell to its lowest level since November 2021.

Large-cap S&P/ASX 50 underperformed Midcap 50 and Small Ordinaries, while the S&P/ASX 20 ended the month in negative territory, according to S&P Dow Jones Indices (S&P DJI).

Latest figures from the Australian Bureau of Statistics (ABS) show Australia’s monthly consumer price index (CPI) rose at an annual pace of 3.4% in January, which was unchanged from December and under market forecasts of 3.6%.

Trimmed mean inflation – the preferred measurement of the Reserve Bank of Australia (RBA) because it strips out more extreme price movements – rose an annual 3.8%, which was down from 4% in December.

While still above the RBA’s 2-3% inflation target, economists believe the latest CPI figures should be broadly reassuring to the central bank and reduce the risk of another rate rise in coming months.

In some further good news out of the US the PCE (Personal Consumption Expenditures) Index, came in in-line with expectations.

The PCE, which is the Federals Reserve’s favourite inflation measure, rose by 0.3% in January, while the core PCE price index gained 0.4%.

Tech sector leads winner as materials and energy slump

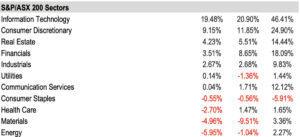

S&P DJI says the S&P/ASX 200 witnessed a large dispersion among sectors in February with Technology, with a relatively smaller index weight the winner up 19%.

Energy was the worst performer despite the strength in oil prices, dropping 6%, while Materials fell another 5% and is down almost 10% YTD.

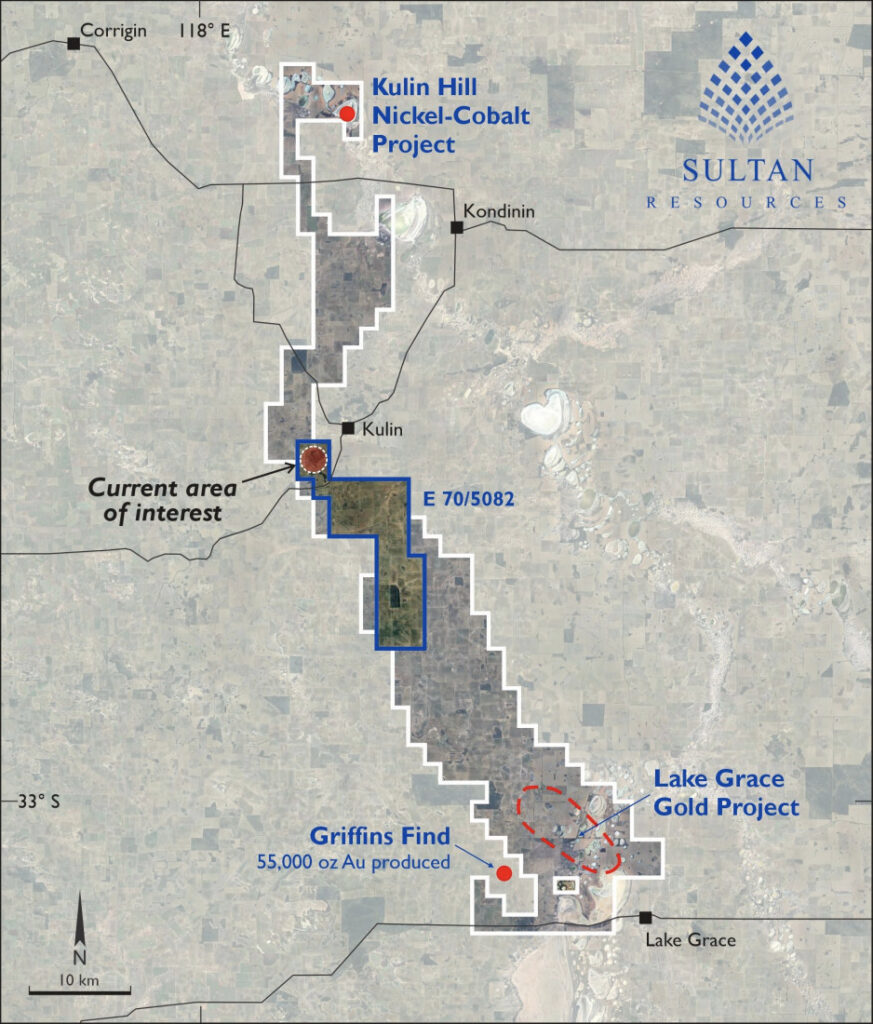

Australia’s resources sector has felt the pinch of falling commodity prices. A slower than projected uptake of EVs has caused a supply glut for battery metals including lithium and nickel.

A deluge of cheap supply of “pig iron” nickel from Indonesia, the world’s largest producer, has further hurt Aussies nickel producers.

Meanwhile, prices for Australia’s most precious commodity iron ore slumped by 11.3%, reaching a four-month low of US$116.5/tonne, according to prices on the Singapore futures exchange.

The falls in iron ore come as pessimism grows about China’s steel production outlook.

Chinese steel sector production fell 6.9% to 77.2Mt in January. S&P Global Market Intelligence expects China’s full-year steel production to fall 0.7% in 2023 due to the slumping property market.

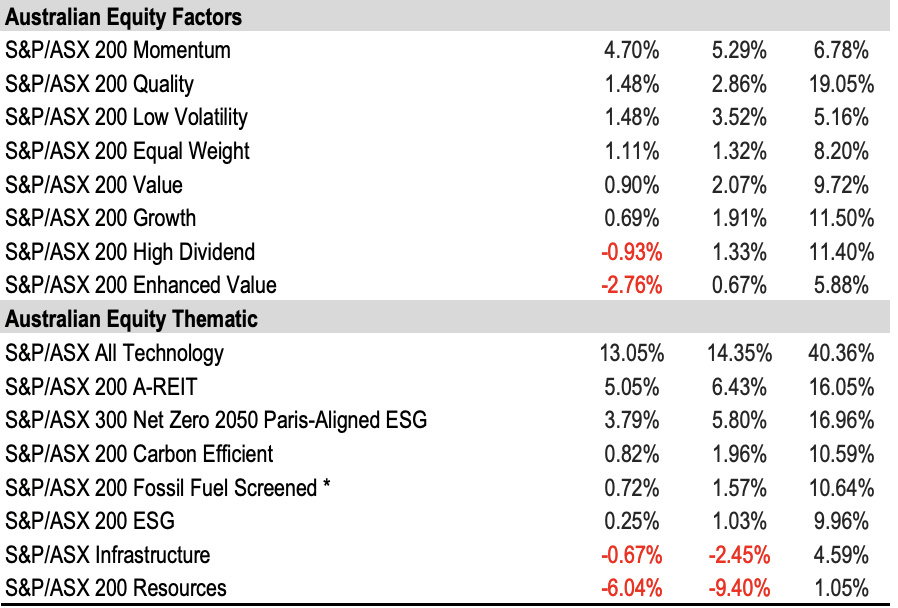

Momentum best performing factor in February

The S&P/ASX 200 Momentum was the best-performing factor in February with a 5% gain. Enhanced value and high dividend factors both closed in the red in February, falling 2.76% and 0.93% respectively.

S&P DJI says equity volatility remained largely suppressed with S&P/ASX 200 VIX hovering at an 11 handle.

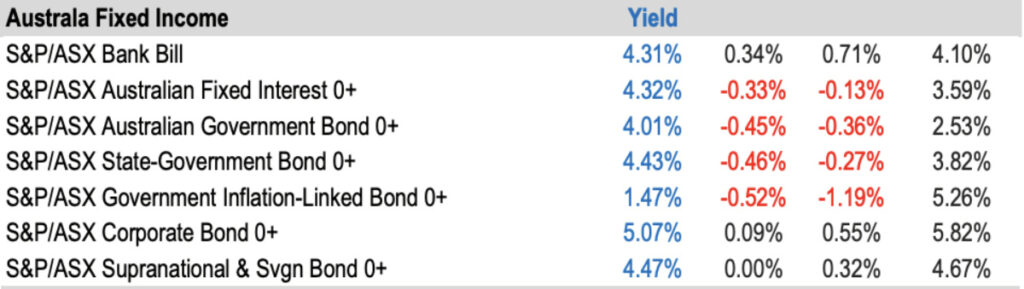

Fixed income mixed performace

Fixed income had a mixed during February, as the RBA held the cash rate steady at 4.35%. Inflation-linked government bonds remained among the worst performers YTD.

Here are the 50 best performing ASX stocks for February:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | JANUARY RETURN % | MARKET CAP |

|---|---|---|---|---|

| NYR | Nyrada Inc. | 0.097 | 322% | $15,132,844 |

| BRN | Brainchip Ltd | 0.385 | 148% | $695,238,654 |

| APM | APM Human Services | 1.64 | 125% | $1,504,178,391 |

| ENV | Enova Mining Limited | 0.046 | 119% | $29,482,750 |

| PAA | PharmAust Limited | 0.35 | 119% | $135,940,618 |

| VMS | Venture Minerals | 0.017 | 113% | $37,683,555 |

| W2V | Way2Vat Limited | 0.019 | 111% | $12,380,560 |

| IRX | Inhalerx Limited | 0.041 | 105% | $7,780,445 |

| GHY | Gold Hydrogen | 1.56 | 103% | $119,594,316 |

| AUA | Audeara | 0.056 | 100% | $8,098,033 |

| BP8 | BPH Global Ltd | 0.002 | 100% | $3,908,232 |

| FTC | Fintech Chain Ltd | 0.02 | 100% | $13,015,392 |

| VPR | Volt Power Group | 0.002 | 100% | $21,432,416 |

| BRX | Belararox | 0.335 | 97% | $23,766,247 |

| ARR | American Rare Earths | 0.255 | 96% | $125,822,941 |

| EOS | Electro Optic Systems | 1.825 | 86% | $312,505,711 |

| WC8 | Wildcat Resources | 0.735 | 86% | $878,941,020 |

| BRE | Brazilian Rare Earth | 2.9 | 75% | $176,808,232 |

| WHK | Whitehawk Limited | 0.031 | 72% | $10,480,192 |

| APX | Appen Limited | 0.565 | 71% | $123,871,657 |

| CTN | Catalina Resources | 0.005 | 67% | $6,192,434 |

| PNX | PNX Metals Limited | 0.005 | 67% | $26,903,124 |

| SHG | Singular Health | 0.14 | 67% | $27,349,428 |

| BOC | Bougainville Copper | 0.595 | 65% | $238,632,188 |

| DRO | Droneshield Limited | 0.69 | 62% | $422,385,992 |

| VBC | Verbrec Limited | 0.115 | 62% | $33,169,190 |

| CCR | Credit Clear | 0.29 | 61% | $121,033,201 |

| AUZ | Australian Mines Ltd | 0.016 | 60% | $18,080,631 |

| RDM | Red Metal Limited | 0.155 | 60% | $46,367,986 |

| AYA | Artrya Limited | 0.365 | 59% | $28,706,882 |

| DEL | Delorean Corporation | 0.055 | 57% | $11,864,650 |

| DUB | Dubber Corp Ltd | 0.22 | 57% | $86,077,262 |

| BIO | Biome Australia Ltd | 0.39 | 56% | $82,684,152 |

| GTE | Great Western Exploration | 0.042 | 56% | $14,616,446 |

| PER | Percheron | 0.087 | 55% | $78,434,412 |

| BVS | Bravura Solution Ltd | 1.24 | 55% | $555,958,962 |

| 4DS | 4DS Memory Limited | 0.105 | 54% | $185,097,666 |

| HIQ | Hitiq Limited | 0.026 | 53% | $9,147,969 |

| ADS | Adslot Ltd | 0.003 | 50% | $9,673,487 |

| ASP | Aspermont Limited | 0.009 | 50% | $22,100,712 |

| C7A | Clara Resources | 0.018 | 50% | $3,402,703 |

| INP | Incentiapay Ltd | 0.006 | 50% | $7,463,580 |

| RBR | RBR Group Ltd | 0.003 | 50% | $4,855,214 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | $4,942,733 |

| 88E | 88 Energy Ltd | 0.006 | 50% | $150,744,375 |

| MMI | Metro Mining Ltd | 0.03 | 50% | $136,691,881 |

| CUE | CUE Energy Resource | 0.1 | 49% | $69,811,972 |

| SLC | Superloop Limited | 1.035 | 49% | $508,365,649 |

| WR1 | Winsome Resources | 0.855 | 49% | $163,121,219 |

| STP | Step One Limited | 1.7 | 48% | $315,078,495 |

Drug discovery and development company Nyrada (ASX:NYR) finished February more well known after seeing its share price jump 322%.

Most of rise came on February 28, the day NYR released positive results from its preclinical study evaluating the efficacy of its brain injury program drug candidate NYR-BI03 in preventing secondary brain injury.

CEO James Bonnar told Stockhead’s Christian Edwards the study results were powerful for three reasons.

“Firstly, the drug candidate is a first-in-class molecule which means it offers a new therapeutic approach to treating brain injury,” Bonnar says.

“Secondly, the pathology behind brain injury is common across both stroke and traumatic brain injuries, such as those caused by a car accident, sports injury or military wound.”

He says this means NYR’s drug candidate has potential for treating patients in two important markets – stroke and traumatic brain injury.

“Lastly, the target our drug candidate hits is novel, making Nyrada pioneers in an area that no other biotech is currently working in, to our knowledge,” he says.

Also on the winners list in February was neuromorphic microchips developer Brainchip (ASX:BRN) as the AI frenzy which gripped markets in 2023 continued into the new year.

The rise came despite BRN plummeting 35% on February 27 after releasing another full year loss – this time US$28.9 million – its sixth straight year of red ink after reporting annual losses since 2018.

READ: Brainchip’s potential in Edge AI is undeniable, but can sales catch up with its cash burn?

Biotech PharmAust (ASX:PAA) rose 119% after a series of positive announcements throughout February including that its lead drug monepantel may be the key to delivering significant improvements in life expectancy for sufferers of MND/ALS with preliminary Phase 1 data showing a 58% reduction in disease progression.

MND/ALS (motor neurone disease/Amyotrophic Lateral Sclerosis) is an invariably fatal nervous system disease that weakens muscles and impacts physical function – affecting more than 350,000 people globally.

Here are the 50 worst performing ASX stocks for February:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | DECEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| KNB | Koonenberry Gold | 0.015 | -75% | $1,796,236 |

| TTA | TTA Holdings Ltd | 0.003 | -73% | $412,270 |

| CMD | Cassius Mining Ltd | 0.01 | -70% | $5,420,045 |

| ME1 | Melodiol Global Health | 0.007 | -68% | $2,750,973 |

| T3D | 333D Limited | 0.007 | -63% | $836,115 |

| NRZ | Neurizer Ltd | 0.004 | -60% | $5,855,643 |

| ABE | Australian Bond Exchange | 0.021 | -59% | $2,366,030 |

| HCL | Highcom Ltd | 0.145 | -59% | $14,888,987 |

| EE1 | Earths Energy Ltd | 0.018 | -56% | $9,539,356 |

| SSR | SSR Mining Inc. | 6.41 | -56% | $35,643,375 |

| ICL | Iceni Gold | 0.019 | -54% | $4,684,660 |

| BNL | Blue Star Helium Ltd | 0.011 | -54% | $21,364,918 |

| MSG | MCS Services Limited | 0.008 | -53% | $1,584,797 |

| WIN | Widgie Nickel | 0.04 | -53% | $11,917,802 |

| MEG | Megado Minerals Ltd | 0.011 | -52% | $2,799,011 |

| STX | Strike Energy Ltd | 0.215 | -51% | $615,378,560 |

| AVW | Avira Resources Ltd | 0.001 | -50% | $2,133,790 |

| CNJ | Conico Ltd | 0.002 | -50% | $3,140,190 |

| DCX | Discovex Res Ltd | 0.001 | -50% | $3,302,568 |

| NET | Netlinkz Limited | 0.003 | -50% | $11,635,345 |

| RIL | Redivium Limited | 0.003 | -50% | $8,192,564 |

| YAR | Yari Minerals Ltd | 0.005 | -50% | $2,411,789 |

| SLB | Stelar Metals | 0.076 | -49% | $3,983,002 |

| AUG | Augustus Minerals | 0.041 | -49% | $3,500,170 |

| NYM | Narryer Metals | 0.027 | -48% | $1,295,827 |

| JAY | Jayride Group | 0.013 | -48% | $3,072,019 |

| PVW | PVW Res Ltd | 0.03 | -47% | $3,042,143 |

| ECG | Ecargo Holdings | 0.025 | -47% | $15,381,250 |

| KOR | Korab Resources | 0.008 | -47% | $2,936,400 |

| SOC | Soco Corporation | 0.115 | -47% | $15,898,780 |

| NXD | Nexted Group Limited | 0.375 | -46% | $83,068,790 |

| IND | Industrial Minerals | 0.21 | -46% | $14,439,600 |

| BPH | BPH Energy Ltd | 0.022 | -45% | $24,146,060 |

| IBX | Imagion Biosys Ltd | 0.091 | -45% | $2,970,836 |

| VIT | Vitura Health Ltd | 0.14 | -44% | $80,622,330 |

| HHR | Hartshead Resources | 0.012 | -43% | $33,704,186 |

| VAR | Variscan Mines Ltd | 0.008 | -43% | $3,032,003 |

| M24 | Mamba Exploration | 0.032 | -42% | $5,890,633 |

| ZNC | Zenith Minerals Ltd | 0.085 | -41% | $29,952,375 |

| NME | Nex Metals Explorations | 0.013 | -41% | $4,582,923 |

| DAF | Discovery Alaska Ltd | 0.016 | -41% | $3,747,755 |

| OD6 | OD6 Metals | 0.089 | -41% | $4,896,379 |

| APL | Associate Global | 0.095 | -41% | $5,366,780 |

| A8G | Australasian Metals | 0.075 | -40% | $3,909,037 |

| BUR | Burley Minerals | 0.06 | -40% | $6,197,805 |

| PAT | Patriot Lithium | 0.078 | -40% | $5,430,136 |

| ARC | ARC Funds Limited | 0.115 | -39% | $3,458,780 |

| CYM | Cyprium Metals Ltd | 0.014 | -39% | $21,345,973 |

| RBX | Resource B | 0.046 | -39% | $3,803,486 |

| CVB | Curvebeam AI Limited | 0.2 | -38% | $43,715,878 |

Resources companies found themselves heavily featured among the 50 worst performing stocks for February on the back of falling commodity prices.

The ongoing dispute between Cassius Mining (ASX:CMD) and the Government of the Republic of Ghana took a toll on its share price in February.

The company provided an update to the market saying a three-person tribunal rejected Ghana’s request to halt arbitration and it signals its intention to proceed with the proceedings. CMD has filed a claim for US$275 million, citing Ghana’s alleged breaches of contract and statute as the basis.

At Stockhead, we tell it like it is. Although PharmAust is a Stockhead advertisers, they did not sponsor this article.

The post ASX February winners: The best 50 stocks as a ‘super-heroic small cap’ soars 322% appeared first on Stockhead.