BHP Group on Tuesday reported its smallest annual underlying profit in five years and its lowest dividend in eight years, hiked its debt target, and flagged a cut in capital and exploration spending towards the end of the decade.

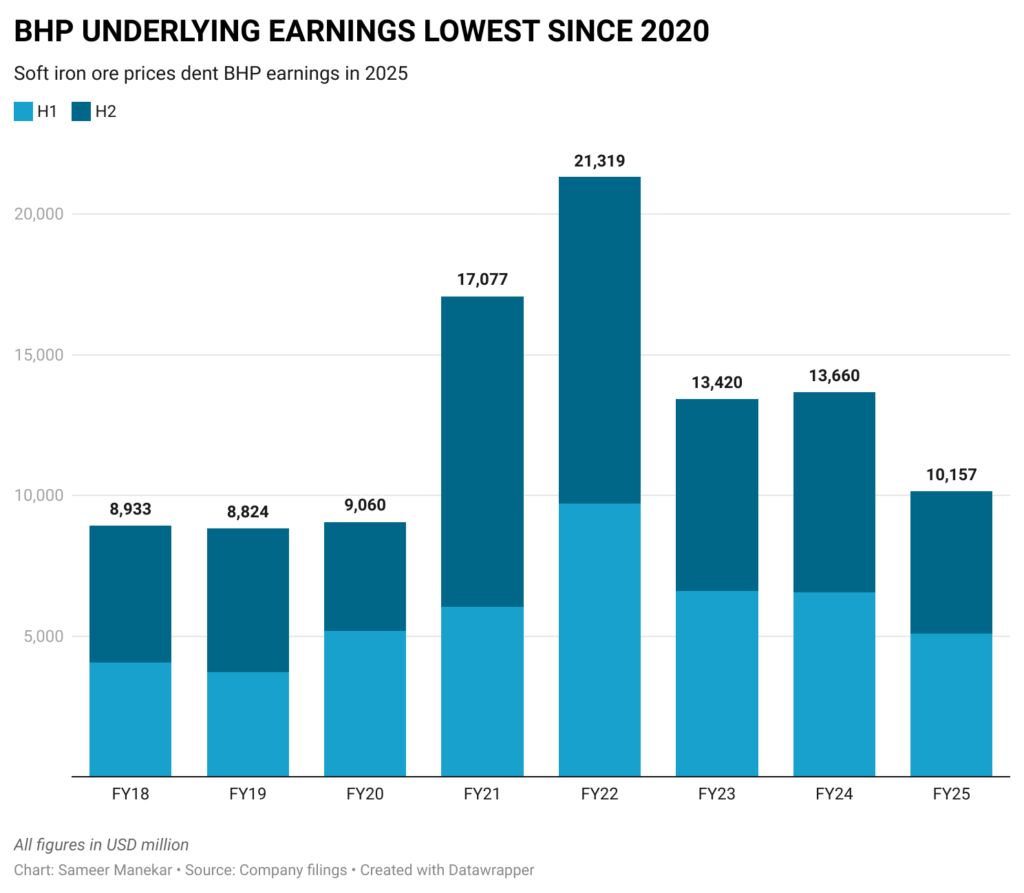

The world’s largest listed miner reported an underlying attributable profit of $10.16 billion for the year ended June 30, down 26% from last year and below the Visible Alpha consensus of $10.22 billion.

This was the miner’s weakest performance since 2020.

It announced a final dividend of $0.60 per share, down from $0.74 a year earlier. The full-year dividend payout of $1.10 beat the Visible Alpha consensus of $1.01 apiece, but was its lowest payout since 2017.

Additional supplies from Australia, Brazil and South Africa, alongside lower steel production in top consumer China, pressured iron ore prices for much of the financial year, affecting earnings for top miners including BHP and Rio Tinto.

BHP’s average realized price for its iron ore fell by 19% during the year, though that was partly offset by stronger prices for copper, its second-biggest profit driver.

Still, the miner expects demand for its commodities to remain resilient even as the global economy faces an uncertain environment due to “shifting trade policies”.

“Policy uncertainty, particularly around tariffs, fiscal policy, monetary easing, and industrial policy, has been elevated and continues to influence investment and trade flows. Despite these dynamics, commodity demand remained resilient,” chief executive Mike Henry said in a statement.

In a sign of its confidence, BHP raised its net debt target range to between $10 billion and $20 billion, from between $5 billion and $15 billion, citing a healthy balance sheet and investment in high-quality growth projects.

“We remain confident in the long-term fundamentals of steelmaking materials, copper and fertilizers, which are critical to global growth, urbanization and the energy transition,” Henry said.

The company said it plans to spend $11 billion on growth projects and exploration over the next two years, up from $9.79 billion in fiscal 2025. However, it said that spending will slow down to an average $10 billion each year between 2028 and 2030.

In July, the mining giant flagged a delay and a cost overrun of up to $1.7 billion at its key Jansen potash project in Canada, and also exited its interest in the $942 million Kabanga nickel project in Tanzania.

On Tuesday, it said it had agreed to sell copper assets in Brazil for up to $465 million.

(By Sameer Manekar and Roushni Nair; Editing by Maju Samuel and Sonali Paul)

I wanted to take a moment to commend you on the outstanding quality of your blog. Your dedication to excellence is evident in every aspect of your writing. Truly impressive!