- Gold and silver may be dominating the headlines, but precious metals platinum, palladium and rhodium have also enjoyed big moves in 2025

- PGEs are often found in complex deposits with other metals like nickel, copper, gold, titanium and vanadium

- Investments from corporate giants show the big end of town believes in these ASX explorers

While gold and silver have stolen the limelight for precious metals investors, they’re not the only commodities bubbling away in this year’s boom.

Look underneath the hood and platinum and palladium, which had plunged well into the global cost curve in recent years, have also been resurgent.

Palladium futures have run 29% higher year to date to US$1176/oz, while platinum has been even more impressive, rising 49% to US$1373/oz.

The rarer rhodium, another metal used in the catalytic converters that control emissions in internal combustion engine cars and hybrids, has lifted from around US$4500/oz to US$7050/oz, briefly topping US$7500/oz last month.

While prices have been on the up, retail investors have placed less focus on the metals than they did in 2022, when Russia’s invasion of Ukraine sent palladium – of which Russia is the world’s largest producer – to a short-lived all time high of around US$3400/oz.

But there are green shoots. Chalice Mining (ASX:CHN), which owns the Gonneville nickel-copper-PGE discovery near Perth in WA, is up 51% YTD and Mark Creasy’s Galileo Mining (ASX:GAL), while not quite at the levels seen after its Callisto discovery near Norseman in May 2022, is up 42%.

Fellow Australian PGE deposit owners Podium Minerals (ASX:POD) and Future Metals (ASX:FME) and 50% and 70% higher respectively.

But where the action is getting really interesting is on the corporate end. While investors may not be fully alive to the opportunity, major global investors and conglomerates certainly are.

Chalice opened that door when Japanese carmaker Mitsubishi, also one of the world’s biggest PGE traders, came on board as a strategic partner at Gonneville last year.

Japan’s interest in these deposits has accelerated.

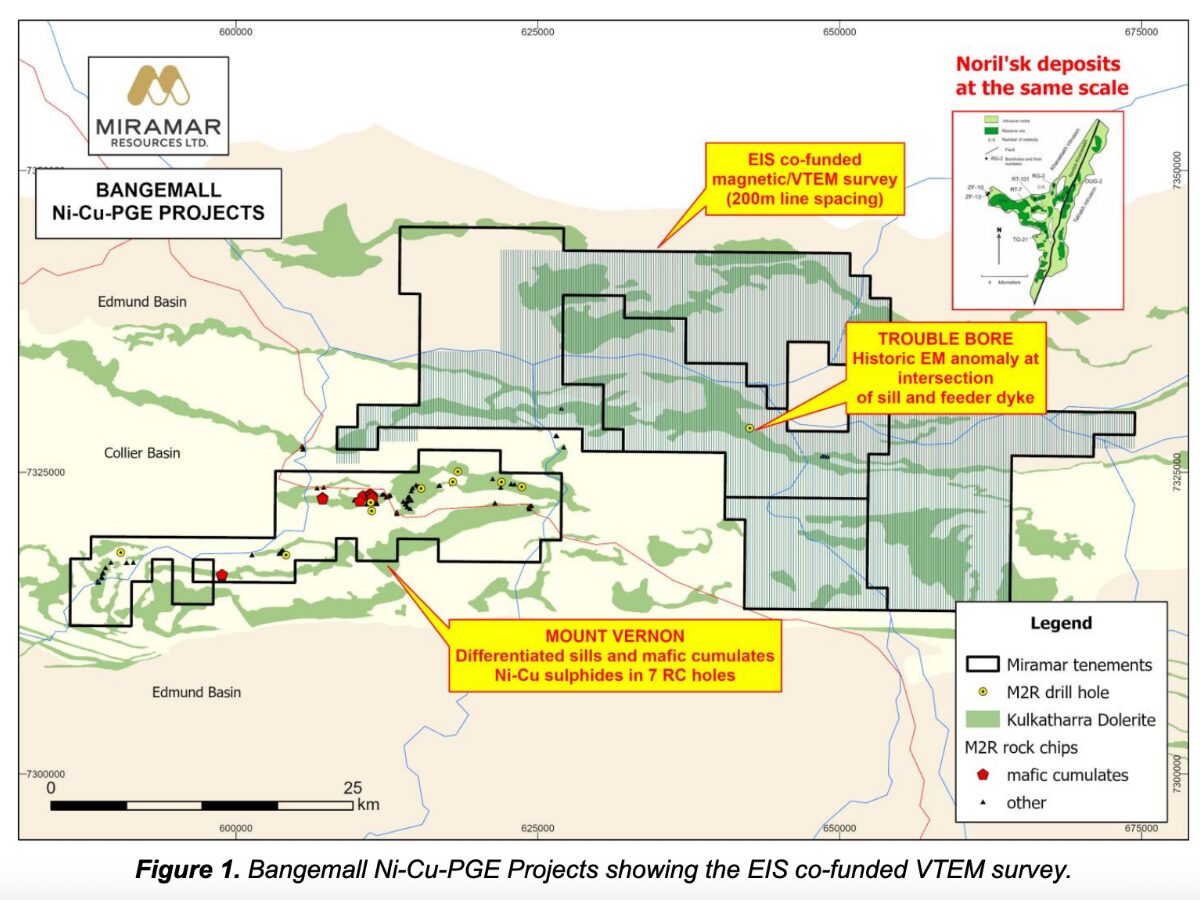

In a bit of blink and you miss it news, Miramar Resources (ASX:M2R) pulled in Sumitomo to farm into its Bangemall Ni-Cu-PGE project in WA’s Gascoyne region late last month.

Value deal

What makes Bangemall so interesting is its geological similarity to the Norilsk nickel deposits in Russia.

It’s often assumed that the cheapest nickel out there is the Indonesian nickel laterites, since those are the source of the oversupply that hobbled Australia’s nickel sector.

Actually, the bottom end of the cost curve is populated solely by Norilsk, which offsets costs from nickel mining against copper and PGE credits and vice versa.

If you were to find one in Australia today, even with the closure of most of the country’s nickel operations, it would make serious money.

“There’s a lot of misunderstanding on a number of levels and the Norilsk deposits are actually, put more correctly even though they’re the biggest nickel deposits in the world, they’re also some of the biggest copper deposits in the world,” Miramar executive chairman Allan Kelly said.

“Steve Beresford gave a talk last week at the AEGC conference and said that the Oktyabrsky deposit, which was the biggest deposit in the Norilsk camp, actually has more copper than Olympic Dam and Escondida put together.

“So he actually calls these things either polymetallic deposits or copper-nickel-PGE deposits with the copper coming first because they’re just huge.

“There’s also negativity because soon as you put nickel in the front people automatically start comparing against the Indonesian laterites and stuff like that and it’s not a fair comparison. If you look at them as nickel deposits, the Norilsk deposits actually have a negative operating cost because there’s so many byproducts from copper and PGEs.”

The Sumitomo deal will see the Japanese major fund a minimum of $600,000 of JV expenditure and potentially claim an 80% JV interest by spending $5.5m over five years – 90% if it completes a feasibility study. So what drew it in?

Having spoken to Sumitomo years ago around its gold projects, Miramar reconnected after taking part in a CSIRO workshop on sharing knowledge around mafic nickel-copper-PGE projects.

“At that point, we had done the drilling and we had done some work with a company called Portable Spectral Service Micro XRF, which is basically mapping rock chip samples at a microscopic scale,” Kelly said.

“That had proved the existence of pentlandite and chalcopyrite in our drilling, and we’d announced that, and people didn’t really understand it, the ASX didn’t really understand that, we got a query about the results.”

Sumitomo was intrigued though. There are a number of dolorite sills in large igneous provinces around the world, Kelly says, but not all are fertile for Ni-Cu-PGE mineralisation. The evidence turned up in drilling of nickel and copper sulphides proved a clincher.

State of the market

At the moment most PGEs are produced out of Russia or, more prominently, South Africa, where mines are now deep, old and expensive to operate.

A discovery in a place like the Bangemall, where Kelly first noticed the polymetallic potential in the mid-1990s while working at Western Mining Corporation, would present a rare new opportunity close to surface in a tier-1 jurisdiction.

“These Norilsk-style deposits, they tend to be zoned and the uppermost part of those tends to be the really highest grade copper and PGEs,” Kelly said.

“I’ve seen some comments about people saying that we’re gonna have to drill deep holes and all this sort of stuff, chasing targets.

“But at Bangemall the projects pretty much outcrop. The dolorite sills that we have drilled up there, we’re doing the EM work on at the moment, they outcrop. We only drilled RC holes last year, so we’re only drilling sort of 120 to 200 metre deep holes.

“If we find copper and PGE mineralisation as part of the discovery up there, it’s going to be pretty shallow, and it’s basically on surface.”

There are no shortage of big players in the region. The Bangemall projects cover a commanding 1230km2 of the Edmund and Collier Basin but neighbours are circling. Chalice just picked up ground in the area and Teck, the zinc and copper giant which recently announced an $85bn mega-merger with Anglo American, is active in the area.

The Sumitomo deal will enable Miramar to put its own funds into gold exploration at the Gidji project, just 15km from Kalgoorlie-Boulder. With the Japanese giant now footing the bill, Kelly says it’s clear major players believe in the Norilsk-lookalike analogy.

“It’s not only us and particularly me that believes that Bangemall has potential for the Norilsk style mineralisation,” he said.

“The reason that I targeted it was because the Geological Society of WA said so, CSIRO said so, Geoscience Australia said so, Teck are our next door neighbour, Chalice have just picked up ground to the east of us as well and Sumitomo have done a deal with us.

“So does the market know something that all those people don’t know?“

Big investors search for opportunity

Sumitomo isn’t the only big name launching into Australian PGE and critical minerals opportunities.

Terra Metals (ASX:TM1) has surged 475% in the past six months to a record market cap of $72m after attracting a host of noteworthy institutions to invest in its Dante project in WA’s West Musgrave region, near the State’s border with South Australia.

The area had previously been known as the home of BHP’s proposed West Musgrave nickel and copper mine, scuppered when the Big Australian mothballed its Nickel West division in response to low prices in 2024.

But Dante – which has geological similarities to the reef-hosted platinum mines of South Africa’s Bushveld – is a different proposition altogether.

A maiden resource last month clocked in at 148Mt at 14.8% titanium dioxide, 0.54% vanadium pentoxide, 0.18% copper and 0.33g/t PGE (gold, platinum and palladium).

That amounts to 22Mt TiO2, 800,000t vanadium pentoxide, 270,000t copper, 400,000oz gold, 880,000oz platinum and 330,000oz palladium.

A higher grade indicated resource includes 38Mt at 18.4% TiO2, 0.73% V2O5, 0.23% Cu and 0.72g/t 3PGE (1.87% copper equivalent) for 7Mt of TiO2, 280,000t V2O5, 90,000t Cu, 200,000oz gold, 500,000oz platinum and 180,000oz palladium.

Met testwork has already shown Terra can produce three high grade commercial concentrates – a titanium-ilmenite concentrate, a vanadium-magnetite concentrate and a copper-gold-PGE sulphide product, all of which are in demand from industrial offtakers.

It’s an unusual proposition for the Australian market, familiar with standalone iron ore, gold, lithium and copper developments. But retail interest has followed institutional buy-in.

A decision to focus on investors in the cashed-up Singaporean market has worked wonders, with esteemed fund Tribeca one of Terra’s top holder with 12.57% of its stock and energy and coal investors GEAR and M Resources CEO Matt Latimore entering first in a $4m placement before topping up in a $15m cash call in August.

Shares from that 7c raising are now well in the money, with Terra climbing to 12c last week.

It’s a massive shift in GEAR and Latimore’s Australian investment strategy, which has until now focused largely on producing coal and gold mines.

“These groups that are connected to the Chinese market and commodity traders (like Tribeca), they understand these things a little bit more than even the Australian analysts,” Terra Metals CEO Thomas Line told Stockhead.

“So they understood it and we started doing some work together and reviewing the asset, some due diligence, and eventually that led to GEAR coming in and making a significant investment and they brought Matt Latimore with them.”

Tick of approval

Line said it was a big tick of approval and major validation for the company and the Dante project, where a third phase of drilling has just kicked off.

“Where the polymetallic nature (of the deposit) makes it complicated for the Australian retail market, (that attribute) is actually the value that is seen by these sophisticated groups who build mines and are connected to the commodity trading hubs and the Chinese market.”

The advantage of polymetallic deposits is the optionality they provide. Different metals can be the moneymaker as cycles turn, with products sold into depressed markets still assisting by underwriting production costs.

It’s a natural hedge against the risk of a downturn in any one market.

Currently, Line says Terra is seeing strong interest from vanadium buyers as China builds out vanadium redox flow battery production lines. With prices around record levels, gold and copper would generate the margin in the copper-gold-PGE concentrate if Dante were producing today.

But this year’s platinum and palladium price run shows why it’s handy to be able to feed into multiple commodity investing themes.

With labour and power supply issues in South Africa and the continuation of Russia’s war in Ukraine, the need for new mines is growing.

“There is a big drive and demand for western supply of platinum group metals and we have what could become one of the larger upcoming PGM deposits coming onto the market in the western world,” Line said.

“But it also has these other critical metals with it.”

The post Why global majors are in the corner of these ASX PGE explorers appeared first on Stockhead.