- Lithium made a roaring comeback as China shut numerous large lepidolite mines

- Rare earths prices surged on US Government intervention in critical minerals

- Only coal drops as interest rate hopes propel gold and economic rebound brings hope for copper and iron ore

Up, Up, Down, Down provides a wrap of all the main commodities ASX companies are digging, including winners, losers and key supply-demand news.

WINNERS

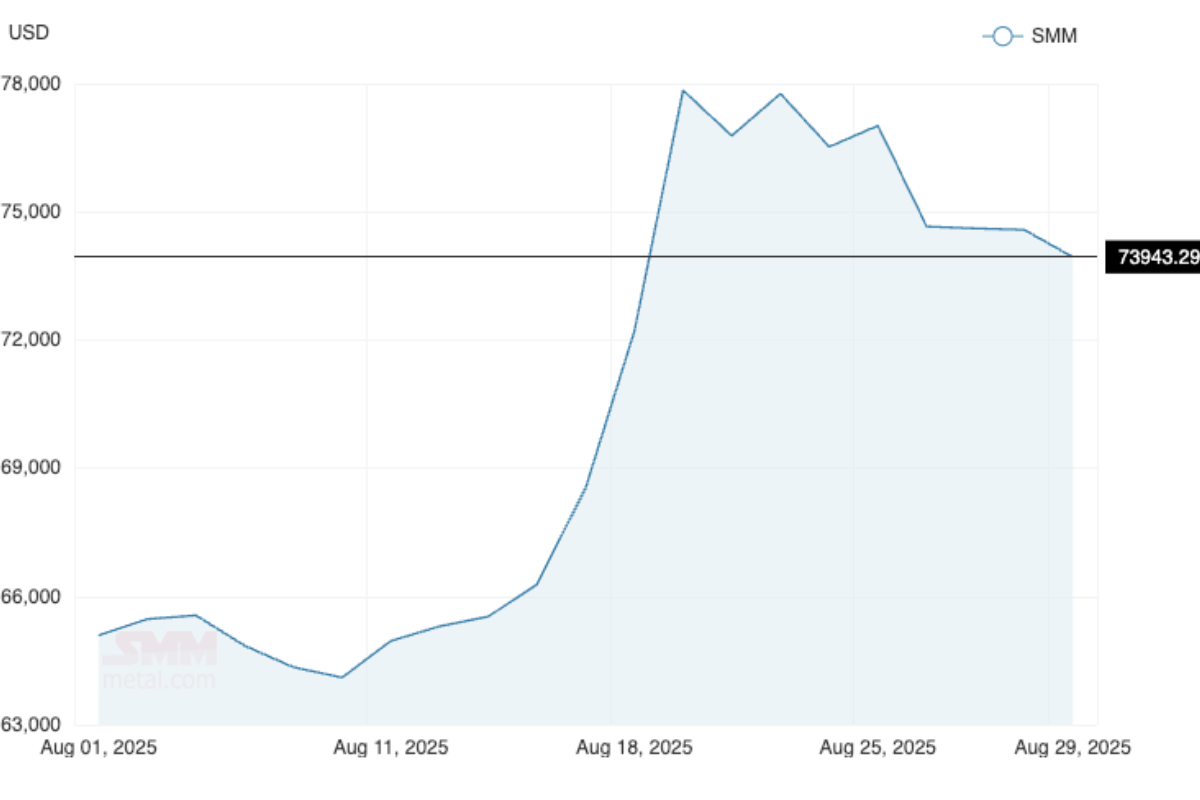

Lithium

(Lithium Carbonate CIF China, Japan and Korea)

Price: US$11,138.46/t

% Change: +22.67%

UP

- The government-enforced suspension of Zijin subsidiary Zangge Mining’s operations in Qinghai and CATL’s Jianxiawo mine (3% of world supply) in Jiangxi sent futures and spot prices for lithium carbonate and spodumene on a tear.

- UBS thinks more Chinese production could be curtailed in the next 6-12 months, lifting its spodumene price forecast for 2026 by 32% to US$1250/t.

DOWN

- Even if prices hit levels more bullish analysts are seeing in 2026, it will take larger and longer lithium price runs to inspire new producers to sign off on mine builds.

- Global EV sales rose by 27% through the first seven months of 2025 to 10.7m units, but that’s been led by Asia and Europe, with North American growth almost flat at just 1m vehicles. July sales of 1.6m were up 21% YoY but down 9% MoM.

READ: UBS wakes up lithium bulls with price upgrade

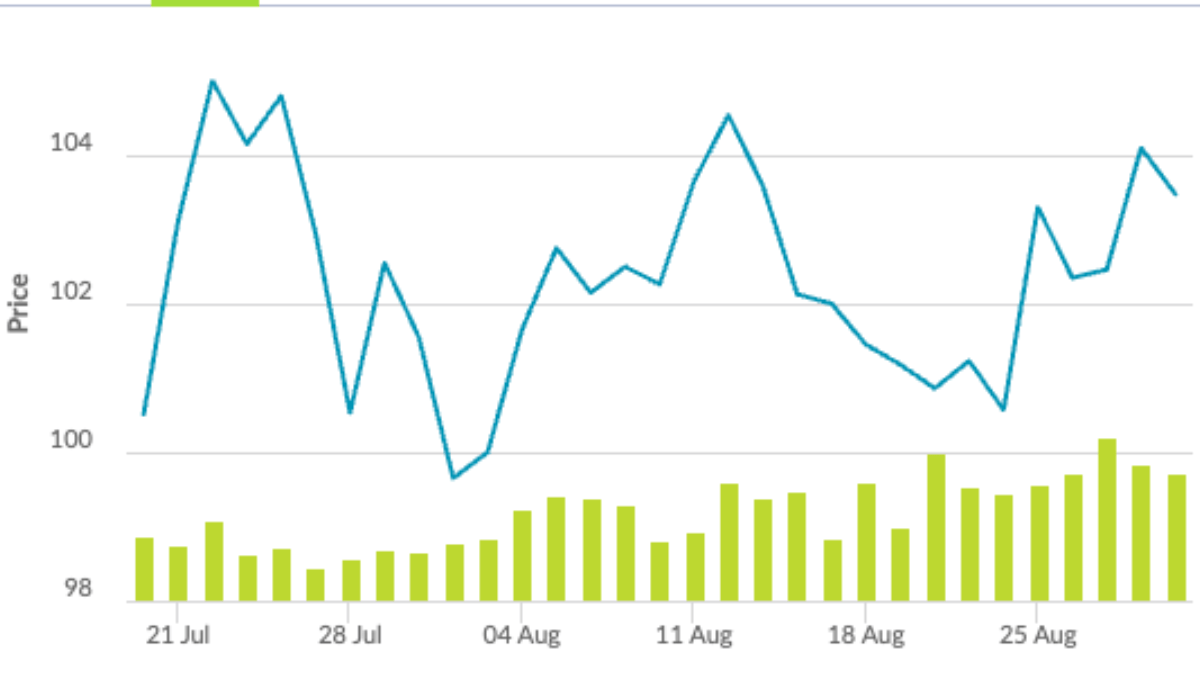

Rare earths

(NdPr Oxide)

Price: US$83.55/kg

% Change: +28.4%

UP

- The US Department of Defense has put a rocket up the rare earths market, with NdPr prices surging to levels not seen since 2023 after it offered a floor price of US$110/kg for the magnet metal as part of its deal to become the largest shareholder of US producer MP Materials.

- Chinese refiners have also been left short with MP no longer shipping material from the Mountain Pass mine in California. Moves appear to be afoot for the Australian Government to enter similar arrangements with local miners and explorers.

DOWN

- China has taken steps to have greater central control over rare earth quotas, including the control of imported ore in its semi-regular planning announcements.

- Gina Rinehart backed Lynas (ASX:LYC) is yet to see the full benefit of higher prices, raising $825m in a placement and share purchase plan to chase expansion plans after cash wound down from over $500m at the end of FY2024 to $166m at June 30, 2025.

READ

A price floor could be just the thing to supercharge the rare earths sector

Iron ore

(SGX Futures)

Price: US$103.47/t

% Change: +3.72%

UP

- Moves to cut steel capacity in China, part of a broader cultural shift to stymie free market competition that has led to large corporate losses, have supported iron ore prices by improving steel mill margins. Crude steel output in China – the market that matters – fell 3.1% in the first seven months of 2025.

- China’s steel exports sat at all-time highs through the first seven months of the year, according to ING, eclipsing 2015’s record levels (which took place in iron ore’s biggest bust, we should add).

DOWN

- Rising steel inventories prompted a cut in iron ore prices by close to 2.5% on September’s first trading day Monday. The official Chinese PMI, which covers large state owned organisations, showed factory activity contracted for the fifth straight month in August.

- Falling iron ore prices have hit the bottom lines of Australia’s top iron ore miners. Fortescue (ASX:FMG), BHP (ASX:BHP) and Rio Tinto (ASX:RIO) paid a combined dividend of A$10.1bn for the latest reporting period, down from around A$12.75bn this time last year.

READ

Bulk Buys: Can Australia really be a green iron powerhouse?

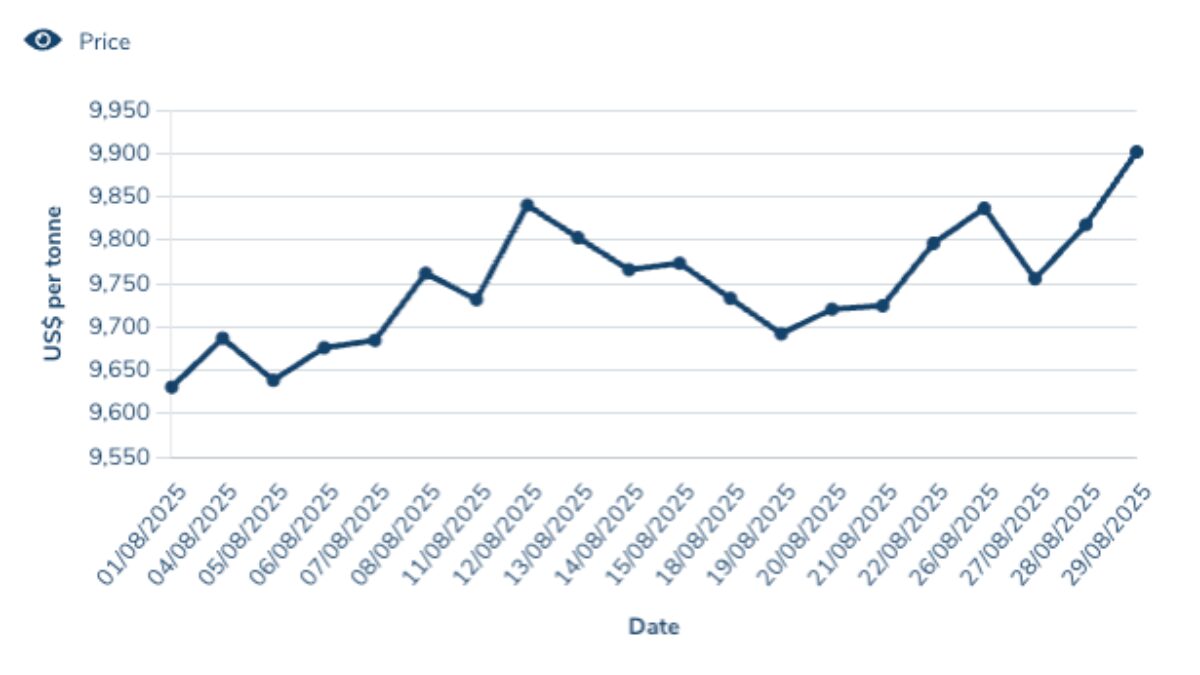

Copper

Price: US$9902/t

% Change: +3.03%

UP

- Copper is now challenging iron ore as the top earner for BHP, the world’s biggest miner, responsible for 45% of its FY25 earnings (iron ore was at 53%).

- Stronger-than-expected US economic data and signs of stabilisation in China have helped push the red metal back to US$10,000/t. The latest ICSG press release showed refined copper production rose 3.6% in the first half, but usage grew 4.8%, with an apparent surplus of 251,000t.

DOWN

- After surging to US$5.68/lb, American copper futures came crashing back to Earth at the start of August when it emerged copper metal would not be tariffed by a 50% rate threatened by President Donald Trump. They’re now fetching US$4.60/lb, roughly in line with LME prices.

- There is drama afoot in Queensland’s copper scene, where Glencore is angling for government support to keep the iconic Mt Isa copper smelter operating. The mining giant, which shut down underground mines at Mt Isa in recent weeks has warned it will not keep shouldering losses at the refinery unless the Queensland and Federal Governments come to the table.

READ

Cannindah raising $4mn in bid to ramp up search for giant Queensland copper deposit

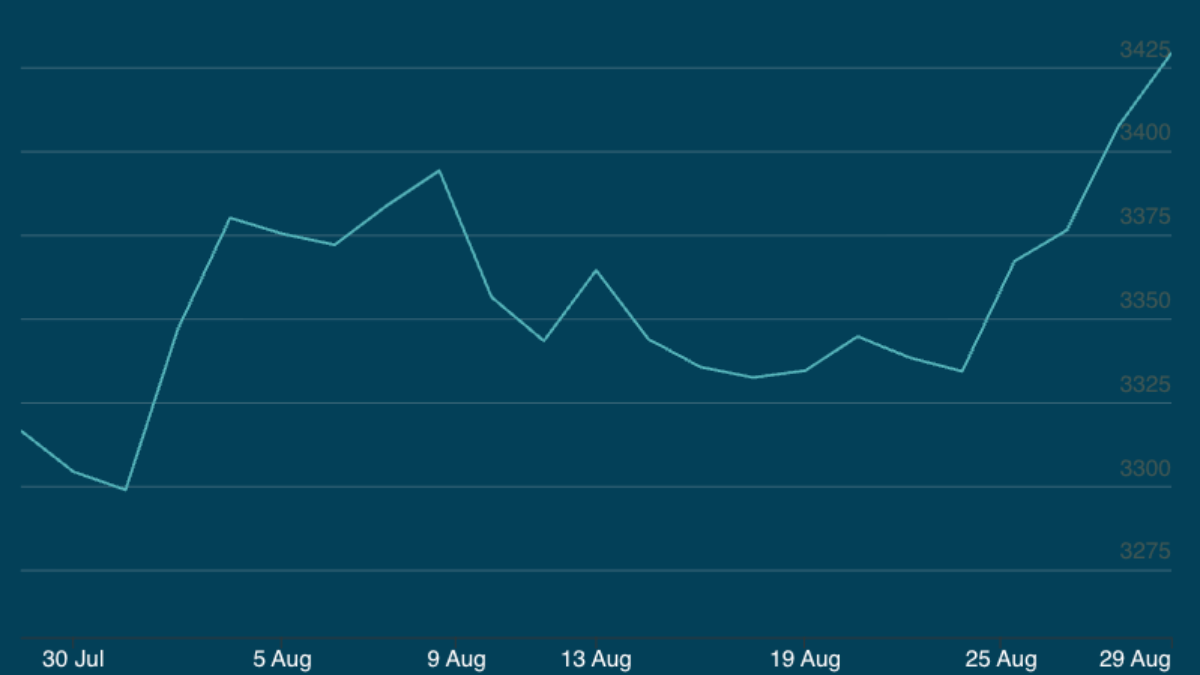

Gold

Price: US$US3429.15/oz

% Change: +3.95%

UP

- Gold returned to growth mode in August and kept sailing through the first day of September, running to close to US$3500/oz as investors lined up waiting for lower interest rates in the US. Gold miners already racing to margins of close to $3000 Aussie dollars an ounce could see even stronger profits as prices rise and hedges roll off.

- Donald Trump’s decision to remove Federal Reserve Governor Lisa Cook could rattle markets and lead to a safe haven flight into gold as the President and his administration interfere with generally non-partisan monetary policy.

DOWN

- Costs are starting to follow gold prices higher, lifting 2.5% on average in Australia and New Zealand in the June quarter. With mine plans accommodating lower quality ounces and labour inflation still sticky, costs are expected to lift sharply for most operators in FY26.

- Gold ETF inflows continued in July, the last month for which we have data. They’re up to a near three-year high of 3639t, but remain someway below the record holdings seen in 2020.

READ

Investor Guide: Gold & Copper FY2026 featuring Barry FitzGerald

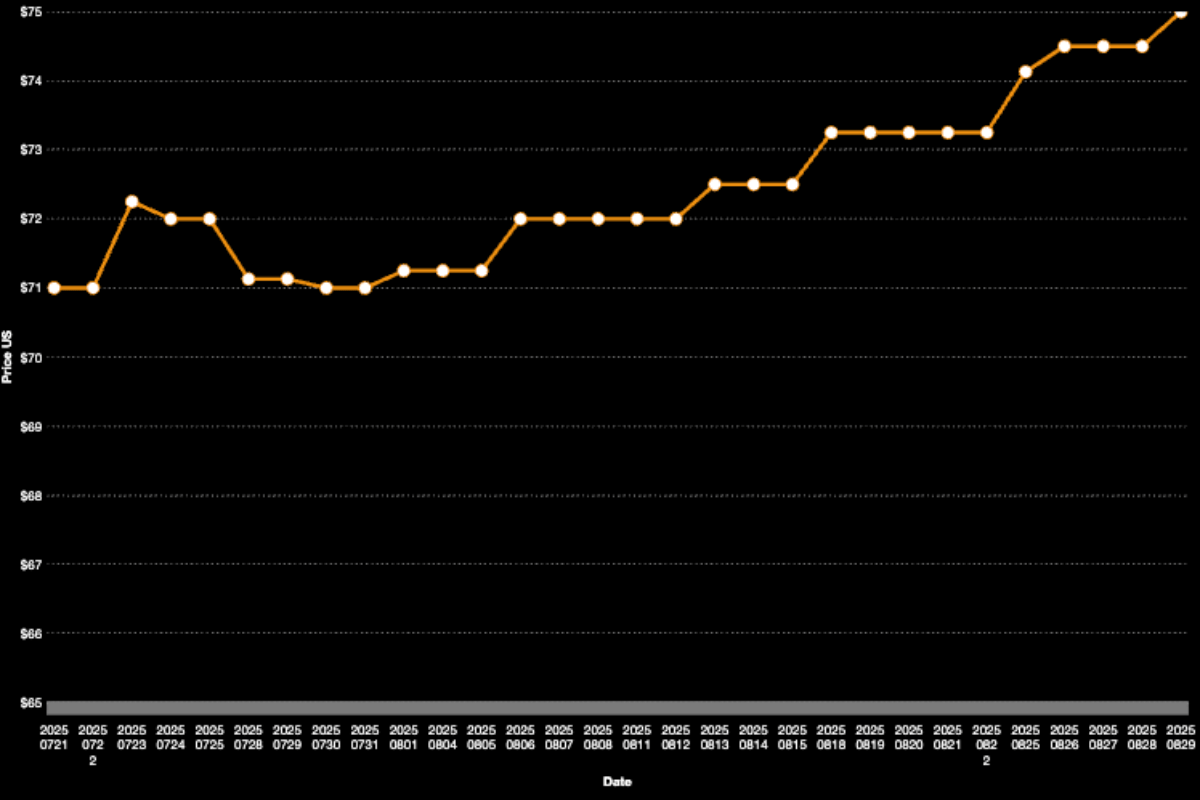

Uranium

(Numerco)

Price: US$75/lb

% Change: +5.63%

Up

- The World Nuclear Symposium starts this week in London, typically viewed as a key catalyst each year for the direction of the contracting market. If dealmaking starts to ramp up, it bodes well for spot prices. The release of the biennial Nuclear Fuel Report on September 5 will also be a major talking point.

- Kazatomprom flagged further delays in securing sulphuric acid supply to ramp up in situ leach production in Kazakhstan, the world’s largest producer. Canaccord’s Alex Bedwany said this means there are doubts about its ability to hit market expectations next year after the miner flagged it would likely exercise its downflex allowance in its sub-surface production rights. “This necessarily implies a wide range, with a lower bound of ~23,750 tU/62 Mlbs, compared to CGe of 25,750 tU/67 Mlbs. We interpret this to be a reflection that the actual production outcome is dependent on (constrained) acid supply and alleviation of other logistical constraints,” Bedwany said. Cameco also dropped production forecasts for its McArthur River mine in Canada from 18Mlb to 14-15Mlb for 2025.

Down

- Operational execution is again haunting investors, with Boss Energy’s long-term guidance worries spooking investors. It did pull buyers back with positive cashflow for its first full year and operations at the Honeymoon mine still forecast to grow production from ~850,000lb in 2025 to 1.6Mlb in 2026.

- Demand for nuclear may be growing, but financing remains a struggle, with many western institutions locking nuclear out of green bonds and Russian plant builders struggling for funding as the war effort in Ukraine and sanctions bite. Security issues have also resulted in the delay of two major plant restarts in Japan to 2029 and 2031.

READ

Barry FitzGerald: BHP warms to uranium in latest economic outlook report

LOSERS

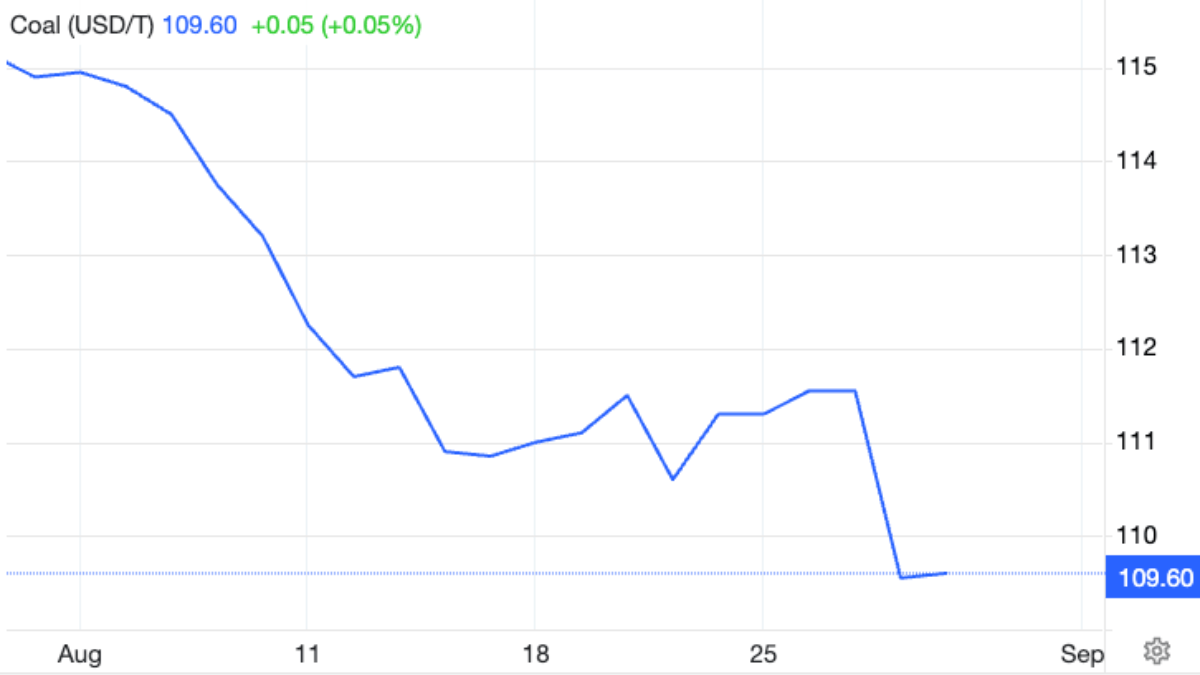

Coal

(Newcastle 6000 kcal)

Price: US$109.60/t

% Change: -4.82%

UP

- Not much to smile about for coal, which has treaded water in the past month. Energy coal prices have trended down, while premium hard coking coal is more robust at US$188/t. The focus is on cost control, with some coal producers – notably Whitehaven Coal (ASX:WHC) and Coronado Global Resources (ASX:CRN) – seeing rebounds in their share prices since their recent April lows.

DOWN

- BHP has threatened the closure of some mines within its BMA operations in Queensland if royalty rates it claims led to an effective tax rate of 67% last year are not dialled back.

- Peabody Energy dumped a $5.7bn deal to buy Anglo American’s Australian coal portfolio after an ignition event at Anglo American’s Moranbah North mine. Anglo American noted the event as being “small and contained”.

- In Indonesia, coal buyers have pressured the government to remove minimum prices on domestic coal sales in a sign of continued oversupply for thermal coal.

READ

Bulk Buys: Like a game of Snake, coal’s tail is getting longer and longer

OTHER METALS

Nickel

Price: US$15,421/t

%: +2.90%

Silver

Price: US$38.80/oz

%: +7.12%

Tin

Price: US$35,018/t

%: +4.91%

Zinc

Price: US$2819/t

%: +3.37%

Cobalt

Price: $US33,335/t

%: +2.92%

Aluminium

Price: $2615.50/t

%: +1.93%

Lead

Price: $1991/t

%: +0.99%

The post Up, Up, Down, Down: Government intervention took rare earths and lithium to the next level in August appeared first on Stockhead.