- Gold prices surged 11.55% to a new record month close in September, and analysts think US$4000/oz is on the cards

- Copper and uranium hit new year highs as supply concerns mount

- Clouds gather over coal and iron ore

Up, Up, Down, Down provides a wrap of all the main commodities ASX companies are digging, including winners, losers and key supply-demand news.

WINNERS

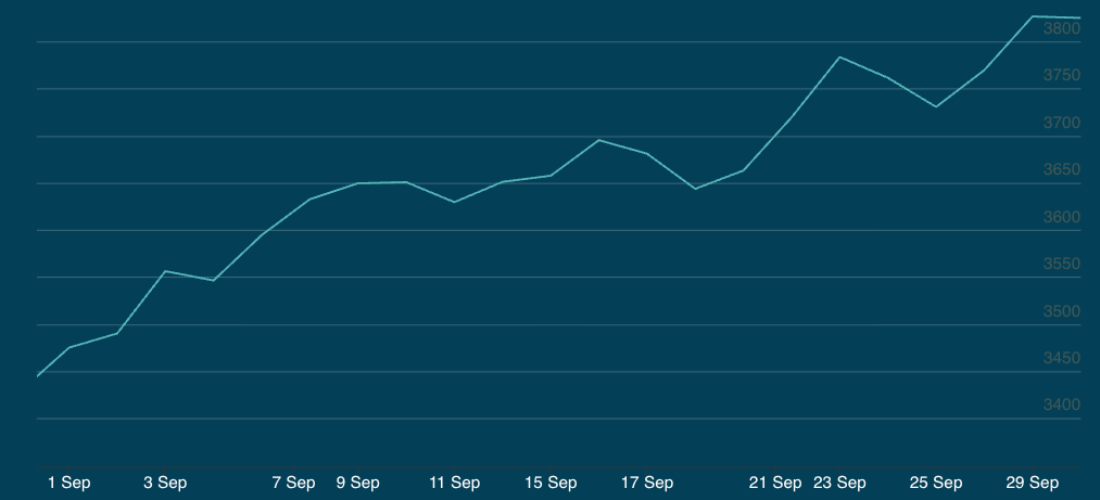

Gold

Price: US$3825.30/oz

% Change: +11.55%

UP

- A rate cut and the US Government shutdown sent prices to record highs of US$3850/oz, as gold surged more than 11% despite already sitting at near record levels amid a climate of uncertainty over the direction of the world’s largest economy. Metals Focus says shutdowns are typically short-lived and have only a temporary impact on gold prices, though this time could be different, with key labor stats withheld. “This could heighten uncertainty, particularly as concerns over the integrity of US economic data have already emerged. Investors are also increasingly worried that the economy may be slowing more than official figures suggest.”

- Analysts have adjusted gold price forecasts even higher. Argonaut is predicting US$4500/oz gold by the end of 2027, while State Street says there’s now a 75% probability of US$4000/oz gold in Q4 2025 or Q1 2026.

DOWN

- Uncertainty is reigning at two of the world’s top gold miners, with both Barrick and Newmont announcing the departures of their CEOs within a day of each other.

- The case for higher gold prices has become extremely consensus, often a sign something could be overbought. But fundamentals remain solid, with other precious metals like silver (near record highs) and platinum on the rise.

READ

Gold Digger: Gold’s heading for US$4500 and the hidden risk to high silver prices

Iron ore

(SGX Futures)

Price: US$105.29/t

% Change: +1.76%

UP

- Restocking ahead of a Chinese public holiday helped support iron ore prices in late September.

DOWN

- China has finally flexed its muscle, with the China Mineral Resources Group reportedly telling state-sponsored mills not to purchase cargoes from BHP’s (ASX:BHP) Pilbara operations.

- With domestic demand for crude steel dropping, it appears to be an attempt from China to take control of iron ore pricing, which has favoured miners’ margins since the shortage caused by the Brumadinho dam disaster in January 2019 began.

- China’s steel PMI fell for a second consecutive month in September from 49.8 to 47.7, according to MySteel. Less than 50 indicates a contraction in factory activity.

READ

Bulk Buys: Can Australia really be a green iron powerhouse?

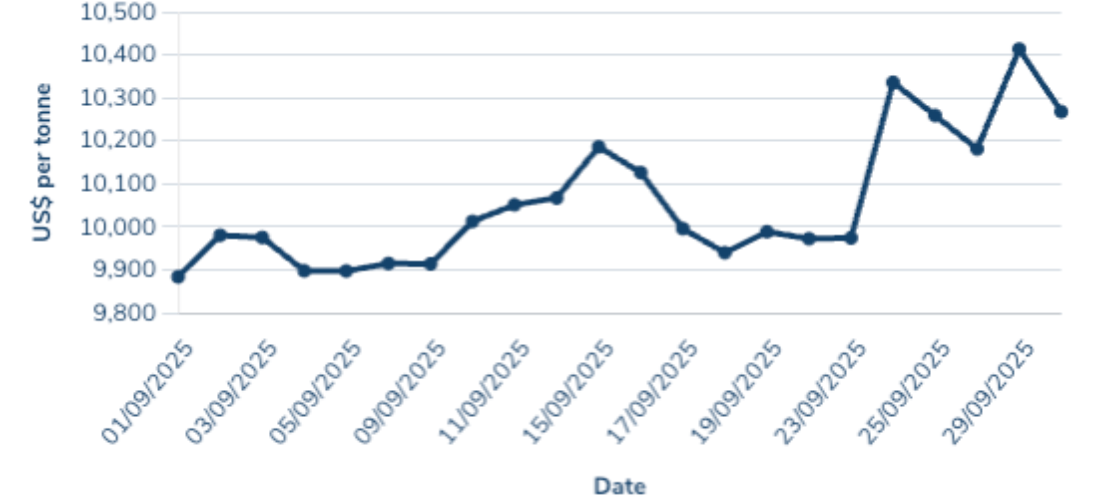

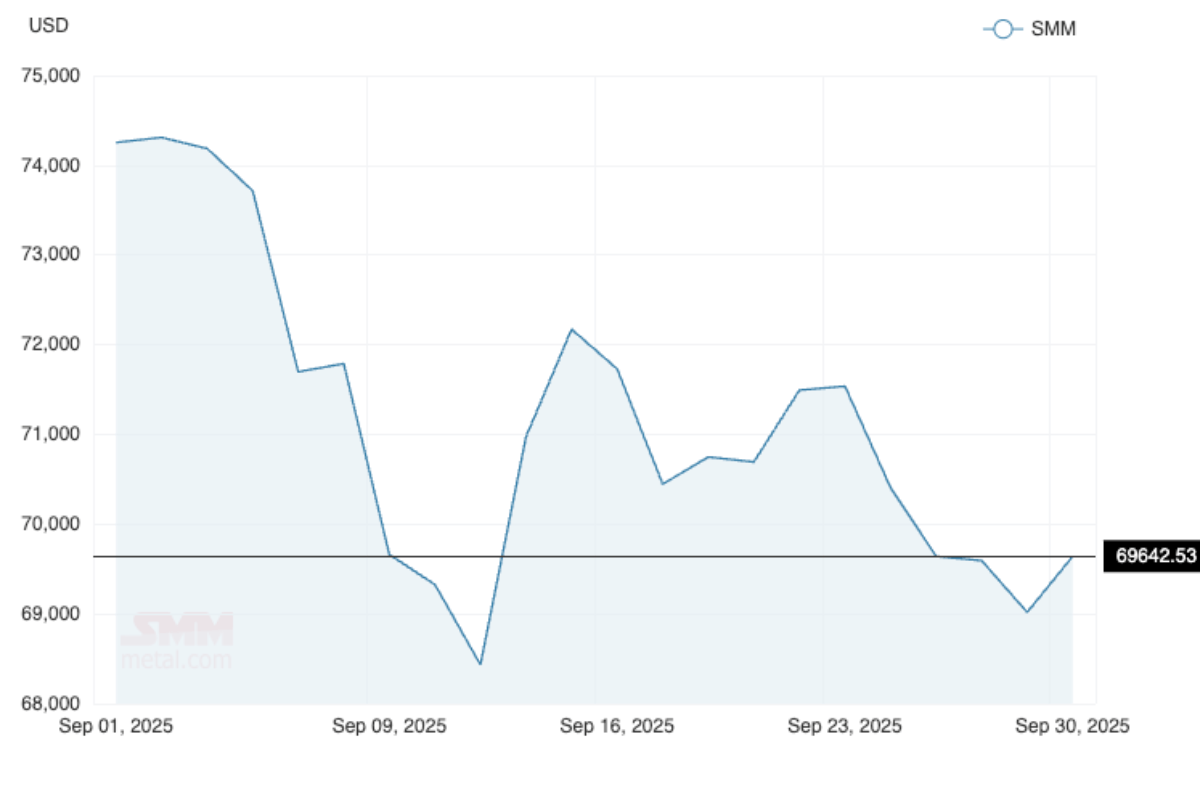

Copper

Price: US$10,268.50/t9902/t

% Change: +3.70%

UP

- A fatal accident and prolonged suspension at Freeport’s Grasberg mine in Indonesia, the world’s second biggest copper operation, could take close to 600,000t of copper supply out of the market next year, leading to a big deficit. Two workers are dead and five remain missing three weeks on from the incident, caused by the sudden ingress of 800,000t of wet material into multiple levels at the mine.

- A number of investment banks have lifted forecast future copper prices, with Bank of America lifting its 2026 number 11% to US$11,313/t and its 2027 estimate to US$15,000/t.

- Copper hit a 15 month-high post-month end of almost US$10,500/t.

DOWN

- BHP has announced $840m of work to enable growth at its South Australian copper business, but has stopped short of greenlighting an expansion of the Olympic Dam smelter amid concerns about energy costs.

READ

ASX copper plays cash in as supply fears grow

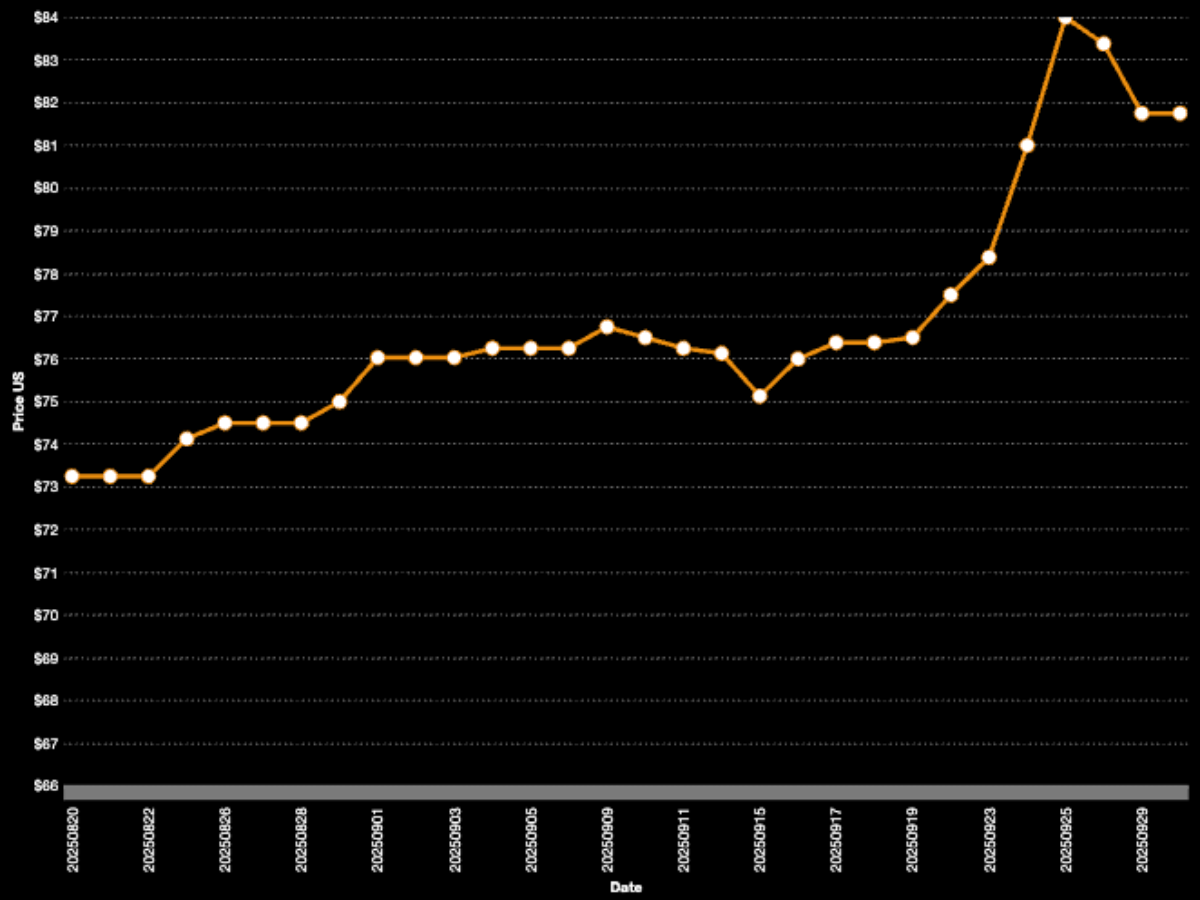

Uranium

(Numerco)

Price: US$81.75/lb

% Change: +9%

Up

- Supply challenges and buying from physical funds helped push spot prices to their highest level in 2025.

- The World Nuclear Association’s latest update of the Nuclear Fuel Report global reactor requirements for uranium in 2025 are estimated at about 68,920t, a figure which is expected to more than double to over 150,000t by 2050, with capacity additions by 2040 up 9% on the last fuel book.

- Increasingly governments are showing support for uranium mining, with US Energy Secretary Chris Wright creating a bullish environment – especially for US focused stocks like American Uranium (ASX:AMU) – by announcing plans to boost the US uranium stockpile. Sweden’s Government also lit up local players with plans to dump a seven year uranium ban under consideration by its legislature.

Down

- A ‘tug of war’ between utilities and miners has seen contracting rates fall well below the levels seen in the past two years. Less than 43.5Mlb has been contracted this year against 116Mlb at the same point in 2024, Canaccord Genuity analysts say.

- That has kept term prices in the US$80/lb rate for 15 months, below the incentive price for most new mines.

READ

Key report shows uranium supply will struggle to keep up with demand

LOSERS

Lithium

(Lithium Carbonate CIF China, Japan and Korea)

Price: US$10,299.10/t

% Change: -7.54%

UP

- The US Government is rumoured to be moving to take a 5% stake in Lithium Americas, the developer of its first new lithium mine in decades at Thacker Pass. That has US-based equities looking up at the potential of being underwritten by the Trump Administration.

- After a 60% gain in spot prices from June to August, a 20% retrace has investors nervous. But Argonaut’s analysts say the recovery was always going to be volatile and the demand backdrop remains bullish with EV and energy storage demand growing. “We expect spot prices to resume a move higher as more supply growth delays are outlined, particularly by larger industry participants,” they said in a note. “We reiterate our positive view on lithium equities, and reiterate our BUY ratings on PLS, IGO and LTR and SPEC BUY ratings on CXO, PMT and WC8.”

DOWN

- The reported reopening of CATL’s Jianxiawo mine after a short hiatus stalled by Chinese regulators has tanked ASX lithium stocks twice in the past month, killing momentum from a wave of supply cuts in China.

- Miners are seeking to redraw contracts in a bid to improve cashflows. Liontown Resources (ASX:LTR) this week moved to switch its deal with Elon Musk’s Tesla from being tied to lithium hydroxide – which now trades at a wide discount to fellow lithium chemical lithium carbonate – to spodumene concentrate, the product produced at the Kathleen Valley mine.

READ: Trump’s angling for a slice of Lithium Americas and that’s a win for ASX critical mineral juniors

Rare earths

(NdPr Oxide)

Price: US$78.70/kg

% Change: -5.80%

UP

- NdPr prices may have cooled in September, but that came off the back of a near 30% rise in August, influenced by the US DoD deal to provide a US$110/kg price floor for NdPr produced by MP Materials.

- Critical minerals stocks, especially those in the US and around the Mountain Pass mine like Dateline Resources (ASX:DTR), Red Mountain Mining (ASX:RMX), Bayan Mining and Minerals (ASX:BMM) and Locksley Resources (ASX:LKY) have seen strong gains despite the NdPr price run stalling.

DOWN

- A Chinese company is reputedly in line to develop a refinery in Malaysia, according a report from Reuters, breaking into a jurisdiction previously dominated by Australia’s Lynas (ASX:LYC).

- Prices have been kept in check by the end of a traditional stockpiling season in China, the main refiner of rare earth oxides into metal.

READ

High Voltage: Rare earths reign again with an Aussie junior in the spotlight

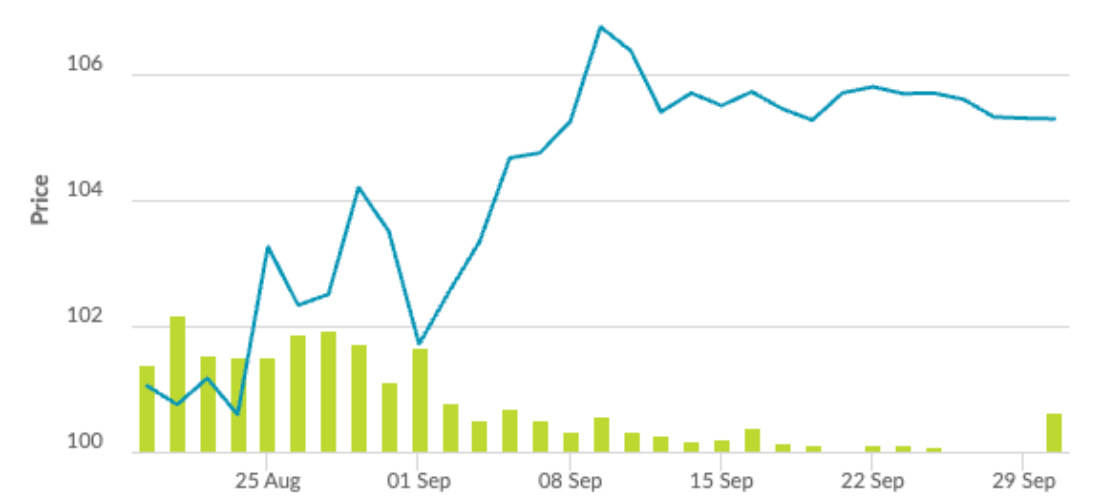

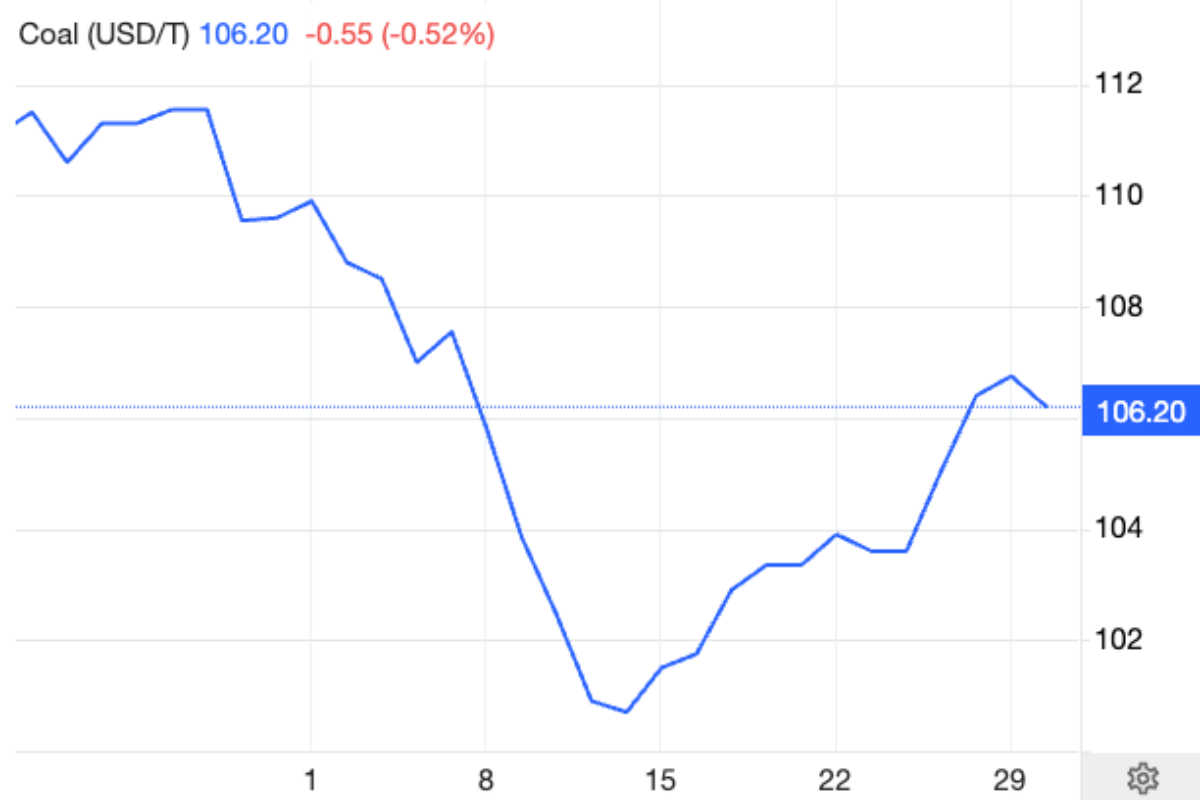

Coal

(Newcastle 6000 kcal)

Price: US$106.20/t

% Change: -3.10%

UP

- Forward prices are in a soft contango, indicating market participants expect prices to rise over time, but with thermal and met coal prices eating into the cost curve, there are few other places to go.

DOWN

- Over 1000 jobs will be chopped across BHP (ASX:BHP), Anglo American and QCoal’s Queensland operations as prolonged mild prices bite and a stoush between the miners and Queensland Government over royalties guests beefier.

- Argonaut’s Jon Scholtz suggests met coal prices will recover to US$250/t by the end of the decade, but has shifted down the broker’s long-term price to US$225/t, prompting downgrades to hold for Whitehaven Coal (ASX:WHC) and Coronado Global Resources (ASX:CRN). Stanmore Coal (ASX:SMR) remains a buy for Scholtz.

- Marginal coal miners who looked like world-beaters during the 2022-23 boom are back in troubled waters, with Queensland producer TerraCom (ASX:TER) announcing a $43.4m loss for FY25. TER delivered a $25m profit just last year.

READ

Lunch Wrap: BHP swings the axe; Droneshield keeps buzzing

OTHER METALS

Nickel

Price: US$15,235/t

%: -1.20%

Silver

Price: US$46.18/oz

%: +19.02%

Tin

Price: US$35,410/t

%: +1.12%

Zinc

Price: US$2960/t

%: +5%

Cobalt

Price: $US35,000/t

%: +4.99%

Aluminium

Price: $2680.50/t

%: +2.49%

Lead

Price: $1988.50/t

%: -0.13%

The post Up, Up, Down, Down: Gold’s bull run got even more spectacular in September appeared first on Stockhead.