- Lithium carbonate lifted close to 10% in October, but rare earths prices failed to live up to the critical minerals hype

- Gold hit a new record before a Trump inspired pullback

- Copper also touched a new record high in late October, while among the minor metals cobalt ran 38% higher

Up, Up, Down, Down provides a wrap of all the main commodities ASX companies are digging, including winners, losers and key supply-demand news.

WINNERS

Lithium

(Lithium Carbonate CIF China, Japan and Korea)

Price: US$11,298.92/t

% Change: +9.71%

UP

- JPMorgan ratcheted up its 2026 and 2027 forecasts for spodumene, predicting that a rise in the energy storage market would tip lithium into a deficit.

- Lithium prices have been creeping upwards, without the exuberance of August and September’s speculative China supply news led rush. Spodumene is now fetching US$944/t – hardly incentive pricing, but not completely unsustainable for the best hard rock mines.

- We’re giving a rare three UPs for lithium this month, with battery giant CATL resorting to external purchases to cover its lithium needs as its Jianxiawo mine remains shut.

DOWN

- We’ve been here before in previous lithium price runs. It’ll take more than a week of gains to convince investors they’re in the clear (short covering aside).

READ

High Voltage: JPMorgan lifts lithium price forecasts as big batteries drive market to deficit

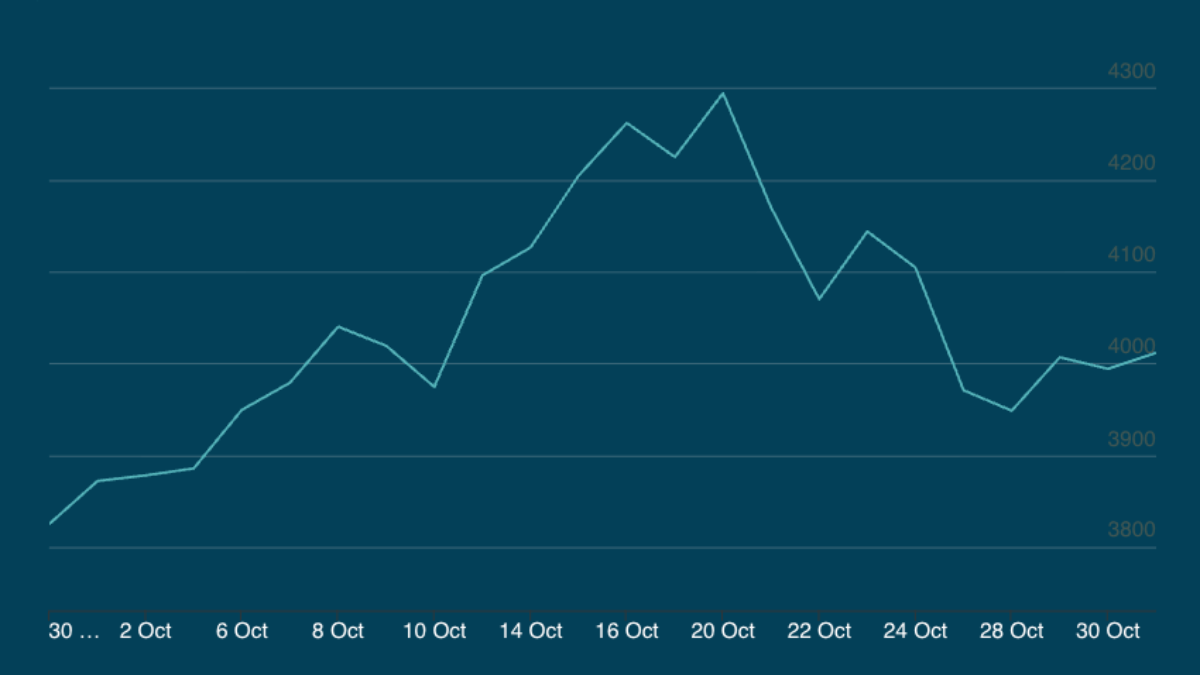

Gold

Price: US$4011.50/oz

% Change: +4.86%

UP

- Morgan Stanley has recommended the shift from a 60-40 portfolio to a 60-20-20, placing gold on an even keel with fixed income (but below equities) in a sign the gold rally could continue. It’s tipping prices of US$4500/oz by mid-2026, and MS is by no means the only bank taking a bullish approach. Bank of America is talking US$5k.

- Gold demand hit its highest level ever in the September quarter, with ETF demand eclipsing central banks. Expectations of continued strong ETF demand as gold investing goes mainstream is propping up support for bullion.

DOWN

- An apparent detente between Donald Trump and Xi Jinping has taken some heat out of the gold price, reaching an apparent deal to reduce tariffs and impediments on the flow of Chinese manufactured goods including rare earths to the US. Gold thrives in chaos, so a normalisation of trade relations reduces its safe haven appeal.

- We may not see an interest rate cut in December in the US, if comments from Fed chair Jerome Powell are anything to go by. A delay could precipitate another pullback after gold delivered its largest one-day retreat since Covid in late October.

READ

Gold records biggest daily plunge since Covid – are miners still a buy?

Iron ore

(SGX Futures)

Price: US$105.83/t

% Change: +0.51%

UP

- Mineral Resources (ASX:MIN) hit nameplate at its 35Mtpa Onslow Iron project, in a demonstration that new operations can get up and running at scale without the installation of major rail infrastructure.

- Prices remain relatively stable, with the Trump-Xi talks boosting market sentiment in China.

DOWN

- While unconfirmed, BHP (ASX:BHP) has reportedly agreed to accept payments for some iron ore shipments in RMB, a concession that could shift the balance of power in pricing negotiations to China.

- Mount Gibson Iron (ASX:MGX) will be forced to shut its Koolan Island mine early and forego a year of revenue on its high-grade iron ore after major geotechnical issues emerged. That will take one of the few non-major iron ore options out of the market as it pivots to gold exploration – Fenix Resources (ASX:FEX) and Grange Resources (ASX:GRR) are effectively flying the flag now for junior and mid-cap iron ore producers.

- The first iron ore from Simandou is getting prepared for shipment, with the first trainload from the Rio Tinto (ASX:RIO) led Simfer JV reaching the Port of Morebaya on October 21, MySteel reported.

READ

Bulk Buys: Does China’s iron ore standoff open the door to BHP-Rio merger?

Copper

Price: US$10,887.50/t

% Change: +6.03%

UP

- Demand fundamentals have long been solid, but mine suspensions and guidance cuts at a host of major mines have brought the supply side into line, with LME prices briefly hitting a record of close to US$11,200/t in late October.

- The ICSG has updated its copper balance forecasts, projecting a 178,000t surplus for 2025 but a 150,000t deficit for 2026, expecting constraints to mind copper supply will swing the market from a previously forecast 209,000t surplus.

DOWN

- Codelco continues to believe it will grow output at its Chilean mines in 2025, despite the impact from an outage at its El Teniente mine being worse than expected.

- Majors are looking at the option of expanding production in the US to take advantage of an improved regulatory environment, with Freeport studying the expansion of its Bagdad mine in Arizona and BHP looking at idled mines in the same region.

READ

Pivotal Metals could be ASX copper’s pound for pound champion

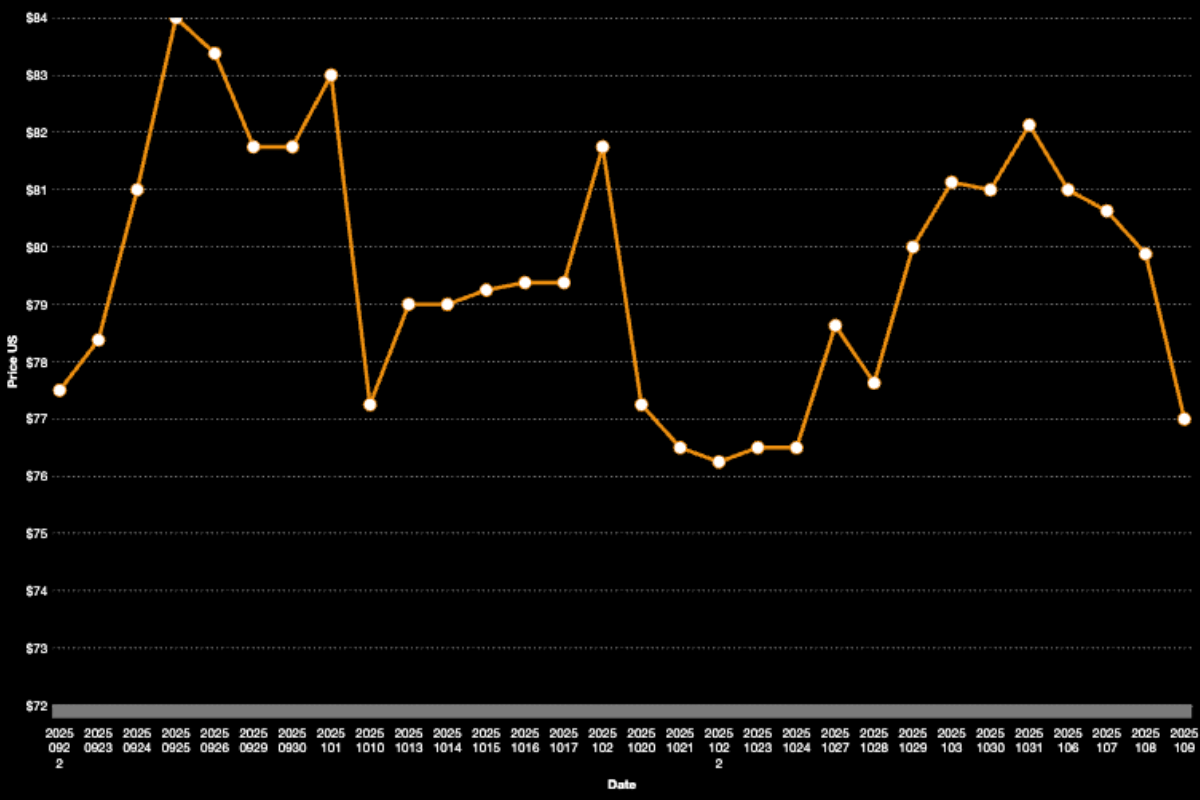

Uranium

(Numerco)

Price: US$77/lb

% Change: +5.81%

Up

- The US Government announced a US$80bn deal to expand nuclear power capacity in an arrangement that could see it take an equity stake in Cameco and Brookfield’s Westinghouse division.

- NextEra Energy and Google became the latest nuclear-tech buddy up as tech giants look to power AI data centres, agreeing to restart a nuclear plant shut five years ago in Iowa.

Down

- A slowdown in buying by the Sprott Physical Uranium Trust put a cap on spot prices, which fell towards the end of the month of October.

- Uranium miner Boss Energy (ASX:BOE) remains the most shorted stock on the ASX, with close to a quarter of its shares held short. Paladin Energy (ASX:PDN) is in fifth, though investors aren’t necessarily tipping a sector meltdown – Deep Yellow (ASX:DYL) has slid to 29th, with Silex Systems (ASX:SLX) 18th and Lotus Resources (ASX:LOT) 26th.

READ

Big Tech’s nuclear pivot: How Amazon, Google and Meta are powering the AI revolution

Coal

(Newcastle 6000 kcal)

Price: US$109.25/t

% Change: +2.87%

UP

- Thermal coal has been range bound for months. But coking coal prices are starting to pick up just a bit of speed, with front-month Singapore futures now over US$200/t. The same contract was under US$180/t in June.

- We remain well into the cost curve, evidence by the announced closure of a string of Queensland operations including BHP’s Saraji.

- BHP has traded land at its Mt Arthur thermal coal mine to New Hope backed Malabar Resources, which could enable the expansion of its Maxwell mine. BHP has been planning to shut the large Mt Arthur mine and exit energy coal in 2030, having previously failed to find a buyer for the asset.

DOWN

- Queensland miners continue to call for a change to the State’s royalty structure. Despite not putting it in place, the LNP Government of David Crisafulli appear steadfast, unless a revolt from members in central Queensland seats upsets the applecart.

- Australian miners are facing competition from domestic sources in China and weaker demand after monsoons in India, according to S&P Global.

READ

Monsters of Rock: PLS warns investment is key to keep Australia on top in lithium race (we promise you, there’s some coal coverage in here)

LOSERS

Rare earths

(NdPr Oxide)

Price: US$74.48/kg

% Change: -5.67%

UP

- Lynas has just started selling dysprosium and terbium to Western clients, with samarium to come in 2026. Its boss Amanda Lacaze says the miner has strong demand and flexibility on prices for these products, currently more than 97% controlled by China.

- The Australian and American critical minerals deal has promised to direct more funding from Canberra and Washington to local developers, potentially getting more early stage projects off the ground. Far more water to travel under the bridge though.

DOWN

- The big outcome from Trump and Xi’s meeting in Korea last month was a mooted relaxation of restrictions on Chinese rare earths sales to US customers. That could take the steam out of geopolitically driven price and stock gains. Lynas (ASX:LYC) shares have fallen 17% in five trading days.

- Donald Trump says in a year we’ll have so many rare earths they’ll be worth US$2/kg. The Pentagon is gearing up to eat a US$108/kg loss on its NdPr from MP Materials. Thank God we have those price floors.

READ

OTHER METALS

Nickel

Price: US$15,226/t

%: -0.06%

Silver

Price: US$48.96/oz

%: +6.02%

Tin

Price: US$36,086/t

%: +1.91%

Zinc

Price: US$3055.50/t

%: +3.23%

Cobalt

Price: $US48,570/t

%: +38.77%

Aluminium

Price: $2884/t

%: +7.56%

Lead

Price: $2017/t

%: +1.43%

The post Up, Up, Down, Down: Gold hit a record but will we look back on October as lithium’s turning point? appeared first on Stockhead.