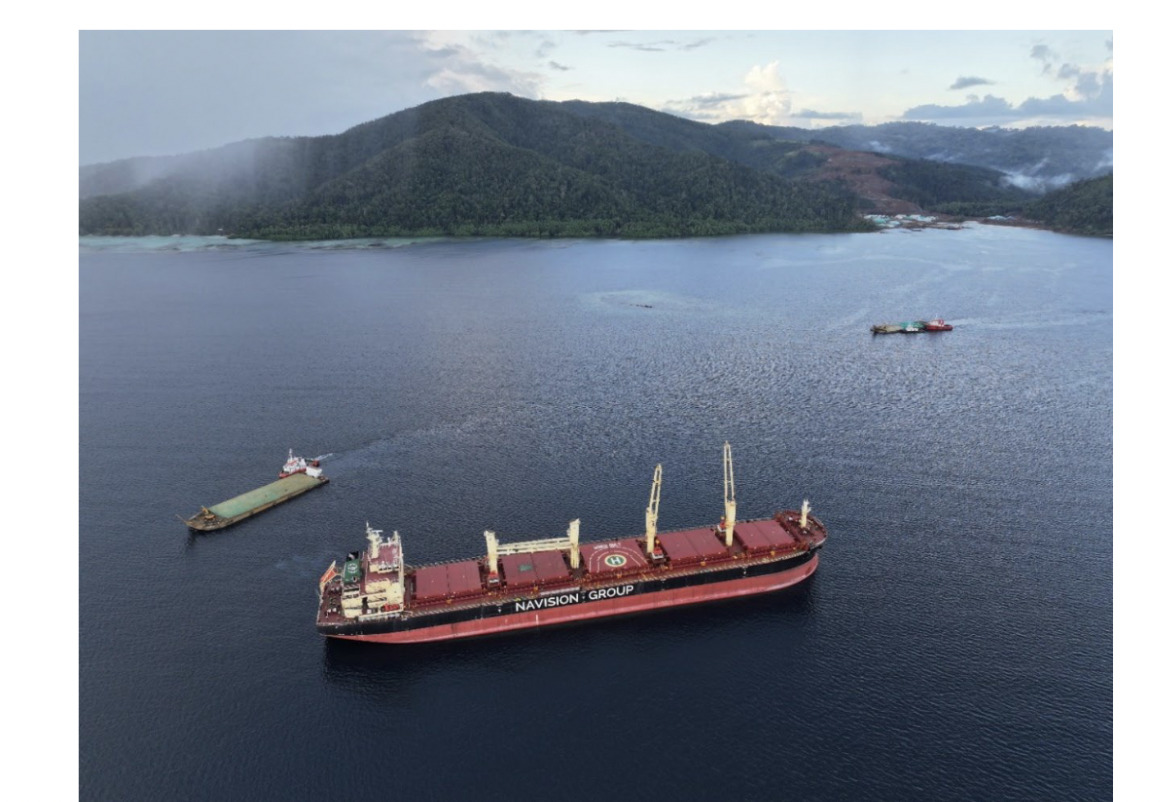

- PNM has ramped up its Solomon Islands nickel production to two nickel ore shipments per month

- MRG Metals is well up on a Heavy Mineral Sands JV in Mozambique

- Tesoro Gold and Castle Minerals also among the gainers

Here are some of the biggest resources winners in early trade, Thursday June 13.

Pacific Nickel Mines (ASX:PNM)

Nickel explorer and developer PNM is focused on advancing its two near term nickel projects, the Jejevo and Kolosori nickel projects located on Isabel Island in the Solomon Islands.

Its share price has made a strong charge today after the company announced a significant production milestone at Kolosori, with two nickel ore shipments now achieved monthly.

It also has plans to ramp that up further soon in the dry season, to what it deems full production of 1.5mtpa, which would be the equivalent of three ore shipments monthly.

Under the terms of an Offtake Agreement with Glencore, the company receives 85% of the value of the shipment once loaded, with the balance payable upon adjudication at the discharge port.

The company has had to deal with challenges such as unseasonal rainfall, but despite this has managed to improve its mining operations and expects stronger production with the arrival in July and August of new equipment including additional articulated dump trucks to facilitate the ramp-up

The company is targeting an average nickel ore grade of 1.7% over the next nine months, as per its Project Feasibility Study.

MRG Metals (ASX:MRQ)

Gold, base metals and heavy mineral sands explorer MRG Metals is leading the ressie gainers today with a solid burst that’s sent it 66% up, intraday, at the time of writing.

The company has signed a binding joint venture (JV) agreement with Sinowin Lithium subsidiaries, including Sinowin Lithium Cobalt (SLC), to develop its Mozambique Corridor Sands projects and its other Mozambique Heavy Mineral Sands projects.

Under the terms, MRG Metals is to be free carried, including all capital expenditure and operating expenditure, through to 440,000 tonnes of annual concentrate production.

Additionally, MRG shall retain equity of 30% of the JV through mine start-up at 110,000 tonnes of annual concentrate production, reducing during production expansion to a floor equity of 20% when the JV production has grown to 440,000 tonnes of annual

concentrate.

For the JV, SLC will make an initial investment of $3 million and then an additional $3m later, to advance mine approvals.

Tesoro Gold (ASX:TSO)

This $49m market capper goldie is double digits up today after returning grades up to 173g/t gold in first pass drilling at the Drone target, 700m from its 1.3Moz Ternera deposit in Chile.

Drone Hill is one of four high–priority drill targets located within a 1.5 km radius of Ternera, and the new find is considered shallow and “very high grade”, comprising the following highlights:

• 1.8m at 77.15g/t Au from 59.2m, including: 0.8m at 173.00g/t Au from 59.2m

• 3m at 2.48g/t Au from 111.0m including 1.0m at 7.06g/t Au from 111.0m.

A further four diamond drill holes have been completed, two at the Buzzard target and two at Ternera East, with assay results expected in the coming weeks.

Tesoro MD Zeff Reeves said:

“The exceptional results returned from first pass drilling at Drone Hill are highly encouraging and represent some of the highest grades intersected at the El Zorro Gold Project to date.

“Gold discovered in these initial holes is associated with a northwest-trending fault system that also hosts high-grade mineralisation within the Ternera Gold Deposit. This fault system has the potential to link Ternera to Drone Hill over 700 metres of strike.”

Castle Minerals (ASX:CDT)

(Up on Tuesday’s news)

Castle Minerals is gearing up for a major gold hunt at its Kpali gold project in the West African Republic of Ghana.

Eearlier this week, the company revealed plans for a 3500m drilling operation to test for extensions of mineralisation defined from a series of high-grade past intercepts.

First phase holes will test for downdip and strike extensions to previous Castle intercepts which included 22m at 2.85 grams per tonne gold and 17m at 3.4g/t.

A mineral resource of 107,000 oz has already been defined at Kpali, and the company anticipates extending the mineralisation significantly.

The company notes that subsequent drilling will further test Kpali plus several new targets in the immediate Kpali Gold Project area identified in reprocessed geophysics.

Castle MD Stephen Stone said, in a very long sentence:

“With gold prices steadying around recent peak levels, increasing investor interest in the West African gold sector and the Kambale Graphite Project successfully transitioning into the development study phase, it’s appropriate to revisit Castle’s 100% owned Kpali Gold Project and the several virgin, open-ended discoveries it has made in a location central within one of the world’s most well-endowed gold regions with some 70 deposits greater than one million ounces and forty over three million ounces.”

The post Resources Top 4: Pacific Nickel Mines turbo charges production and barges up the bourse appeared first on Stockhead.

Attractive section of content I just stumbled upon your blog and in accession capital to assert that I get actually enjoyed account your blog posts Anyway I will be subscribing to your augment and even I achievement you access consistently fast