- High-grade results for MML reinforce potential growth immediately north of the titanium indicated resource

- BOE rebounded on a robust annual report, including $17.4m in operating net cash flow

- MGU moves to leach testing of high-grade samples from the Palmares REE project in Brazil

Your standout small cap resources stocks for Friday, August 29, 2025

McLaren Minerals (ASX:MML)

Results of up to 24.11% heavy minerals outside the indicated resource boundary at its namesake titanium project in WA have seen McLaren Minerals (ASX:MML) race ahead.

While the Formula 1 racing team of the same name has been ahead of the pack for much of the current season, MML has been doing well since closing at 1.8c on June 25 and today raced to 4.5c, a surge of 114.3%.

This saw the company take a podium place among today’s small caps in terms of activity as more than 96m shares changed hands.

The high-grade results in first phase drilling reinforce potential growth immediately north of the indicated resource boundary and include:

- MAC0061 – 14m at 5.7% HM from surface including 2m at 19.45% from 12m with 1m at 14.79% from 12m and 1m at 24.11% from 13m;

- MAC060 – 14m at 3.7% HM from surface including 1m at 7.87% from 12m; and

- MAC059 – 19m at 4.31% HM from surface.

Results from 1,424 samples have been received, representing ~75% of phase 1 drilling, which targeted resource and extension zones and they continue to confirm broad, consistent and high-grade mineralisation.

They will directly support a mineral resource update and the completion of a pre-feasibility study (PFS) for the project, which is in the Eucla Basin, 140km east of Norseman and 40km west of Balladonia.

“It is very pleasing to see these high-grade results in this recent round of assays, giving us more confidence in the strength and potential of the deposit,” managing director Simon Finnis said, adding:

“We continue to see broad, continuous, high-quality intersections of heavy minerals from surface but these higher-grade areas are icing on the McLaren cake.

“The majority of these results are outside the existing indicated resource, so the grades and continuity are very encouraging.

“We are confident the data will underpin a robust resource update and help shape the next phase of development.”

Titanium is considered a critical mineral that is essential for aerospace, defence and energy sectors, with increasing global supply focus.

Boss Energy (ASX:BOE)

It has been a rollercoaster ride over the past few months for Boss Energy (ASX:BOE) but an encouraging annual report, including $17.4m in operating net cash flow, saw shares move ahead 14.61% to a daily high of $2.08.

After rising from $2.10 on April 7 to a peak of $4.67 on June 30, 2025, shares fell 58% before today’s welcome rebound that saw more than 24m shares exchanged valued at more than $48m.

The period was the company’s first full financial year of production at its Honeymoon and Alta Mesa uranium operations in South Australia and Texas, USA.

Apart from the net cash flow, other highlights were:

- strong balance sheet with $224.3m of cash and liquid assets and zero debt;

- uranium inventory of 1.40Mlbs following accumulation of an additional 130,000lbs;

- average realised price of US$78.4/lb, including loan repayments.

BOE reported a $34.17m net loss on its first year of operations at Honeymoon, but attributed most of that to ‘non-cash’ impacts – largely $77.2m attributed to the cost of purchased uranium in its strategic inventory.

“Boss is in a very strong financial position with $224.3 million in cash and liquid assets and no debt,” BOE MD Duncan Craib said.

“The company generated positive free cash flow of $17.4m from the first year of production at Honeymoon.

“This is an outstanding result which reflects Boss’ potential to grow cash as we deliver on our increased production guidance for FY26.”

Commenting on the report, Argonaut’s George Ross said the results were mostly in line with consensus.

“BOE is fortunate to hold significant liquid assets in the form of shares and finished uranium inventory which may come in handy if production becomes a struggle at the East Kalkaroo deposit area and uranium prices were to deteriorate,” he said in a note this morning.

Magnum Mining (ASX:MGU)

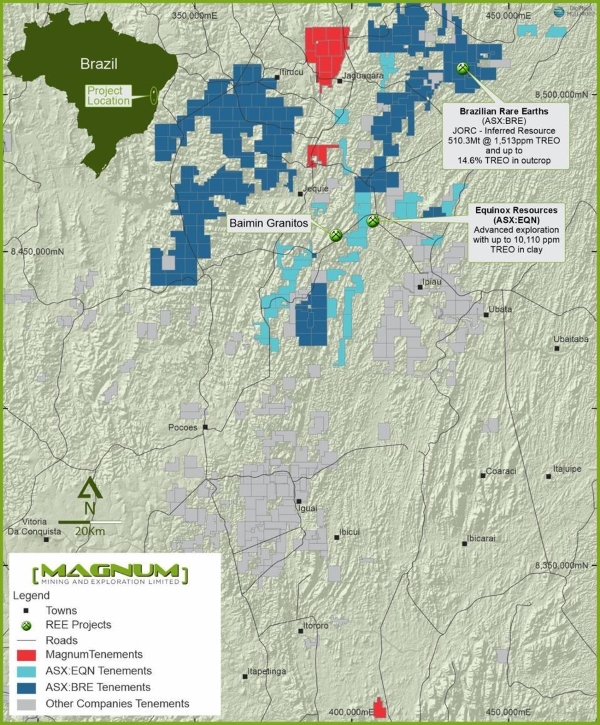

Leach testing on high-grade samples taken from the Palmares rare earth element project in Brazil has started after Magnum Mining & Exploration received trenching and sampling results described as exceptional.

The results confirm Palmares as a very prospective new REE project and MGU increased 71.42% to a daily high of 1.2c.

“The sample results previously taken from the Palmares REE project validate the high-grade continuity of mineralisation on the tenement, specifically on the G2 pegmatites which average 0.40% TREO,” Magnum Mining (ASX:MGU) chairman Michael Davy said.

“Individual grades up to 1.69% TREO, coupled with enrichment in Nd and Pr and high-value heavy rare earths, demonstrate the potential of Palmares.

“Along with the high-grades previously sampled, the estimated 1.3km strike length of the G2 pegmatites make tenement 871332/2020 a viable prospect for drilling.

“Given the general exploration potential for REE across the company’s portfolio in Brazil spanning 1,549km2, we consider it prudent to first undertake a leach testing trial to demonstrate recoveries, before committing to drilling.”

Lotus Resources (ASX:LOT)

Another uranium stock on the improve is Lotus Resources (ASX:LOT) which recently had its Kayelekera uranium mine officially inaugurated by the President of Malawi as the restart enters the final commissioning stage.

A six-month high of 21.5c was reached, an increase of 14.61% on the previous close and a 43.34% lift since the close on August 20.

The inauguration on August 12 by Dr Lazarus McCarthy Chakwera coincided with initial uranium inventory being ready for precipitation, calcining and packaging, a further key milestone in the restart.

Mill performance is demonstrating increasing operating hours and throughput rates, as plant commissioning advances.

“We continue to make terrific progress in commissioning the plant and increasing mill throughput, and we are on track to achieve steady state 200,000lbs per month – 2.4Mlbs per annum – production in early 2026,” MD Greg Bittar said at the time.

Yugo Metals (ASX:YUG)

(Up on no news)

Balkan Peninsula-focused Yugo Metals (ASX:YUG) is ready to hit the ground running as soon as the exploration licence is granted for the Sockovac (Petrovo) project in Bosnia and Herzegovina.

Preparations for upcoming exploration are well advanced and the company is ready to mobilise field teams when the green light is given.

In the meantime, Yugo has continued with community consultations and discussions with the relevant Ministry about the issue of the licence.

Petrovo encompasses an area with significant historical shallow drilling results, including 5.1m at 6.6% nickel from 57.9m and 9.35m at 8.2% zinc+lead from 41.8m.

There is also potential for cobalt while recent rock chip results returned up to 5.7g/t gold and 1,330g/t silver.

Also in Bosnia and Herzegovina, Yugo has the Doboj, Jezero, Sinjakovo and Čajnice projects, which are prospective for battery and precious metals.

All projects are in Europe’s most prospective mining region, the Tethyan metallogenic belt, and near existing core infrastructure and transport routes.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions.

The post Resources Top 5: McLaren races to small-cap podium on high-grade titanium results appeared first on Stockhead.